December 9, 2024

HARRY’S BI-WEEKLY UPDATE

A Current Look at the Colorado Springs Residential real estate Market

As part of my “Special Brand of Customer Service”, it is my desire to share current Residential real estate issues that will help to make you a more successful and profitable Buyer and Seller.

AS 2024 COMES TO A CLOSE, THERE ARE STILL LOTS OF QUESTIONS IN REGARD TO THE housing market

I keep getting more and more questions.

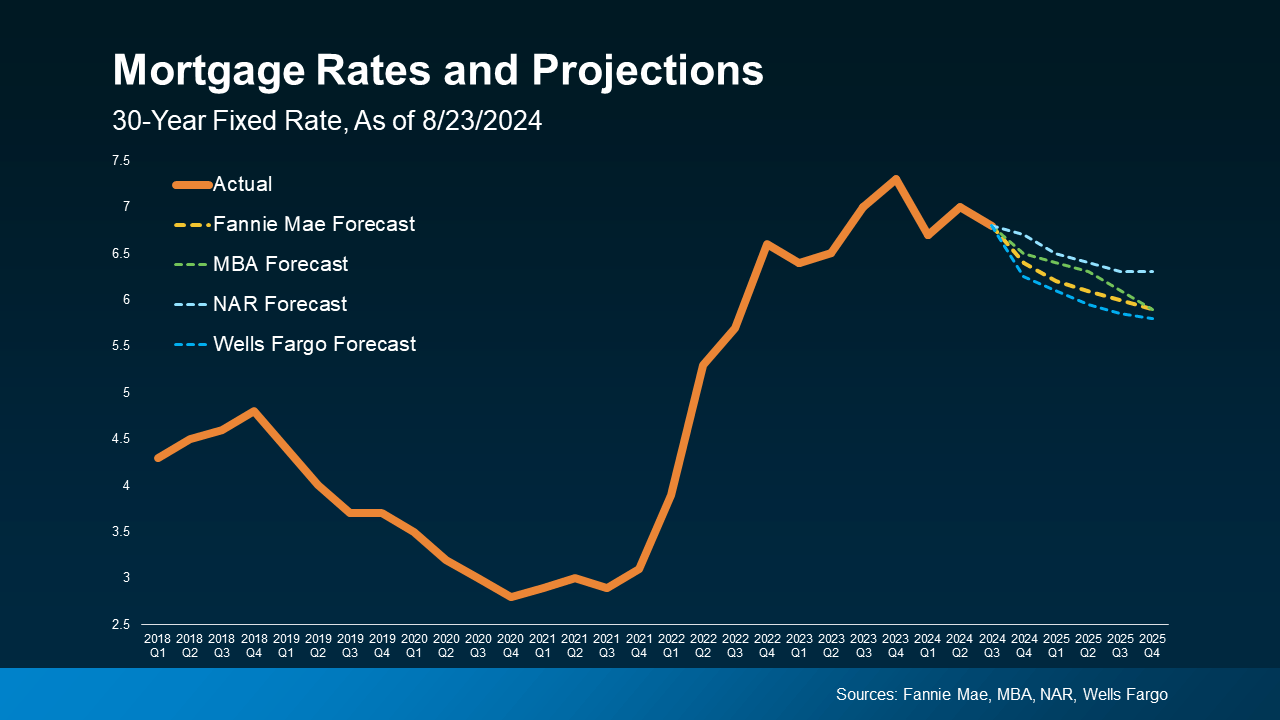

And in wanting to provide answers, I look at what’s happening now and read about the projections for 2025 which seem to be considerably brighter than when we entered 2024.

As you will see from much of the statistics below, homes are still selling, although they are staying on the market a considerably longer time than was the case several years ago. And, more importantly, while home appreciation is up, homes are still selling at very close to list price—a great thing for sellers.

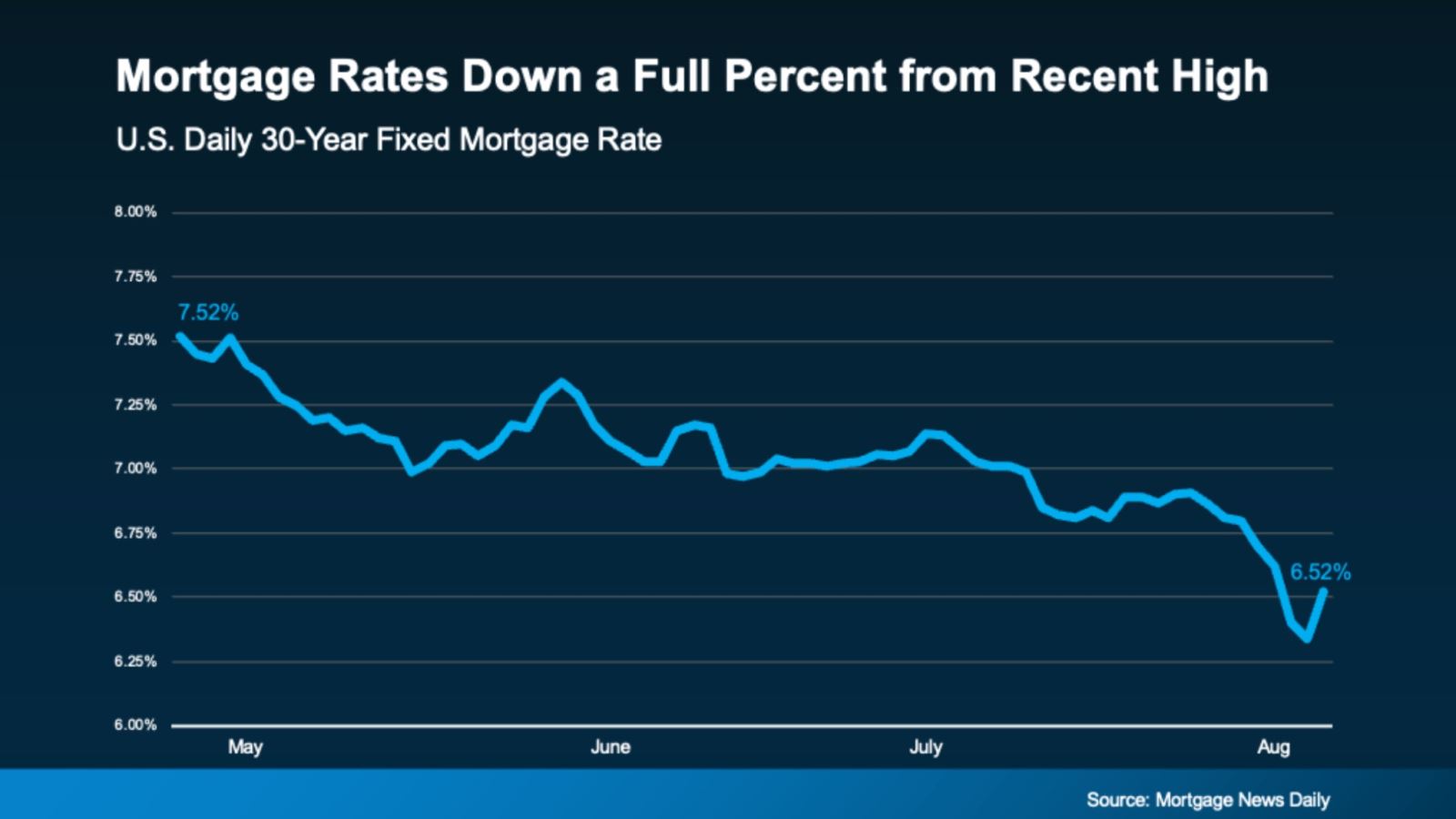

Now that the uncertainty of the presidential election is past, we are starting to see things pick up and I expect the housing market will rebound, although slowly, in 2025.

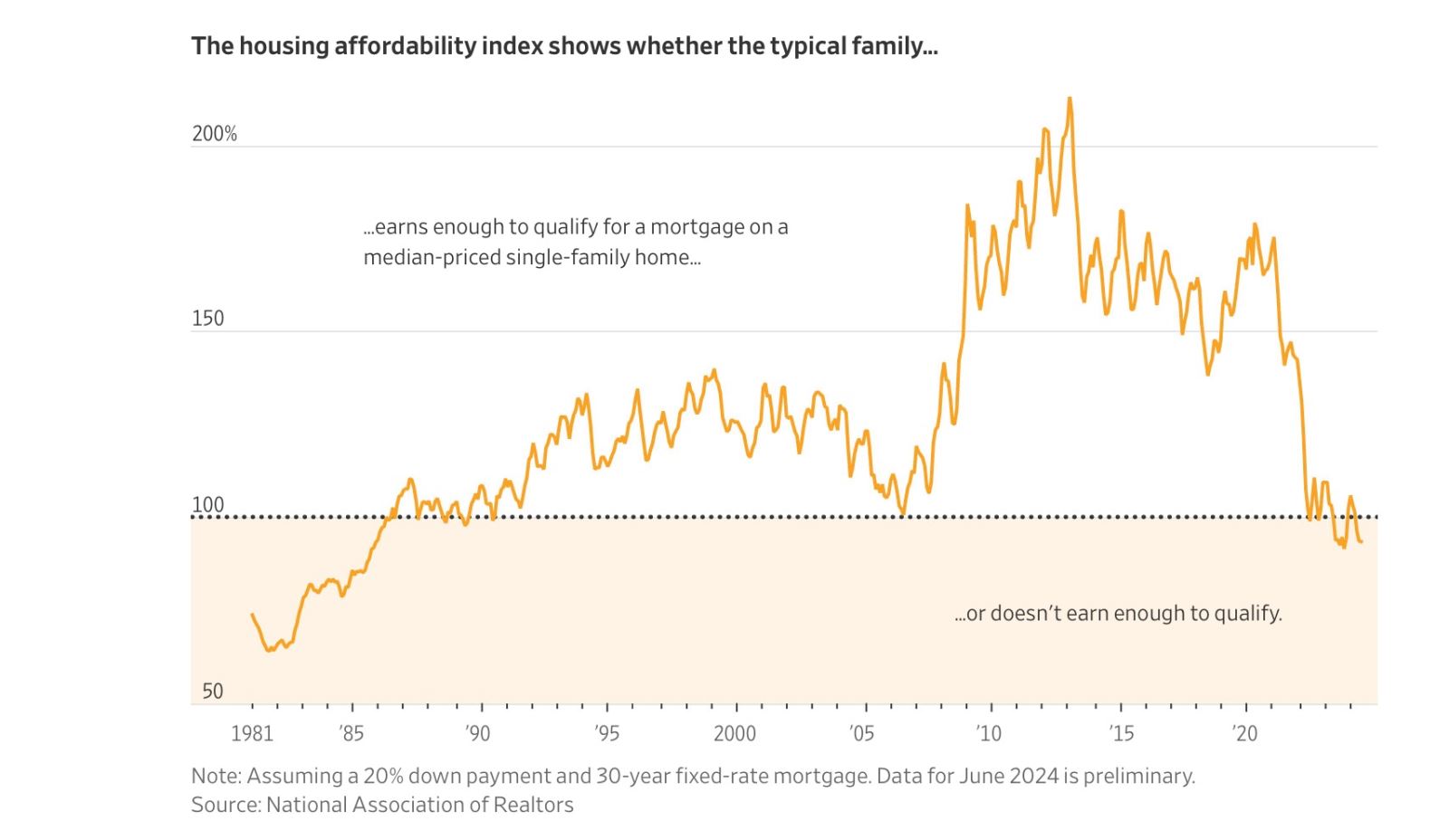

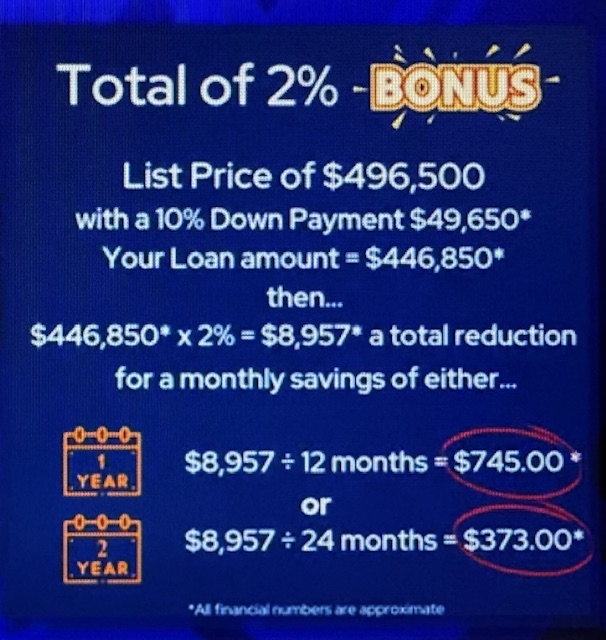

Folks who have been holding back due to the lower interest rates they may have gotten several years ago are realizing that selling to trade up is going to be considerably more expensive. Home prices are NOT going down anytime soon, if ever. And interest rates are not going back to the 2%-3% of the recent past either.

While new homes will cost more, it’s likely there is considerable equity in your present home that you can use for a downpayment and possibly keep your monthly output similar or close to what it is now.

But, of course, you can’t know any of this without sitting down with me to figure it all out. Together, you and I can look at your individual wants, needs and budget requirements and come up with a plan that can work just right for you and your family.

As most of you know, my motto has always been, “Where there’s a will, there’s Harry!” I’ve been fortunate in my 51 plus years in the local Residential real estate arena to have helped so many families find their dream home.

When you couple that experience with my background in investment banking, you can better understand why I’m not only able to find the best home for each individual situation, but most often the best mortgage options for my clients as well.

I’m so fortunate to still be working with so many of my original clients as well as their children and even grandchildren and it’s a privilege I never take for granted.

When you read further on you will see why I’m so optimistic about 2025 and why I strongly advise you to start early if buying or selling is in your near future.

Simply email me at Harry@HarrySalzman.com or call me at 719.593.1000 and let’s get started today.

You’ll find this eNewsletter a big longer than usual…. but it’s the last regular one for 2024 and I thought you might like to see statistically why I’m so optimistic about the future of the Colorado Springs area housing market.

And, if you’ve got two minutes and 36 seconds, check out my new and improved video podcast. Click on the link below and you will be directed to my personal YouTube channel.

While you’re at it you might want to subscribe to my channel, so you won’t miss future broadcasts. It won’t cost you anything…well, it could cost you… if you miss some of my informative musings!)

And now for statistics…

NOVEMBER 2024

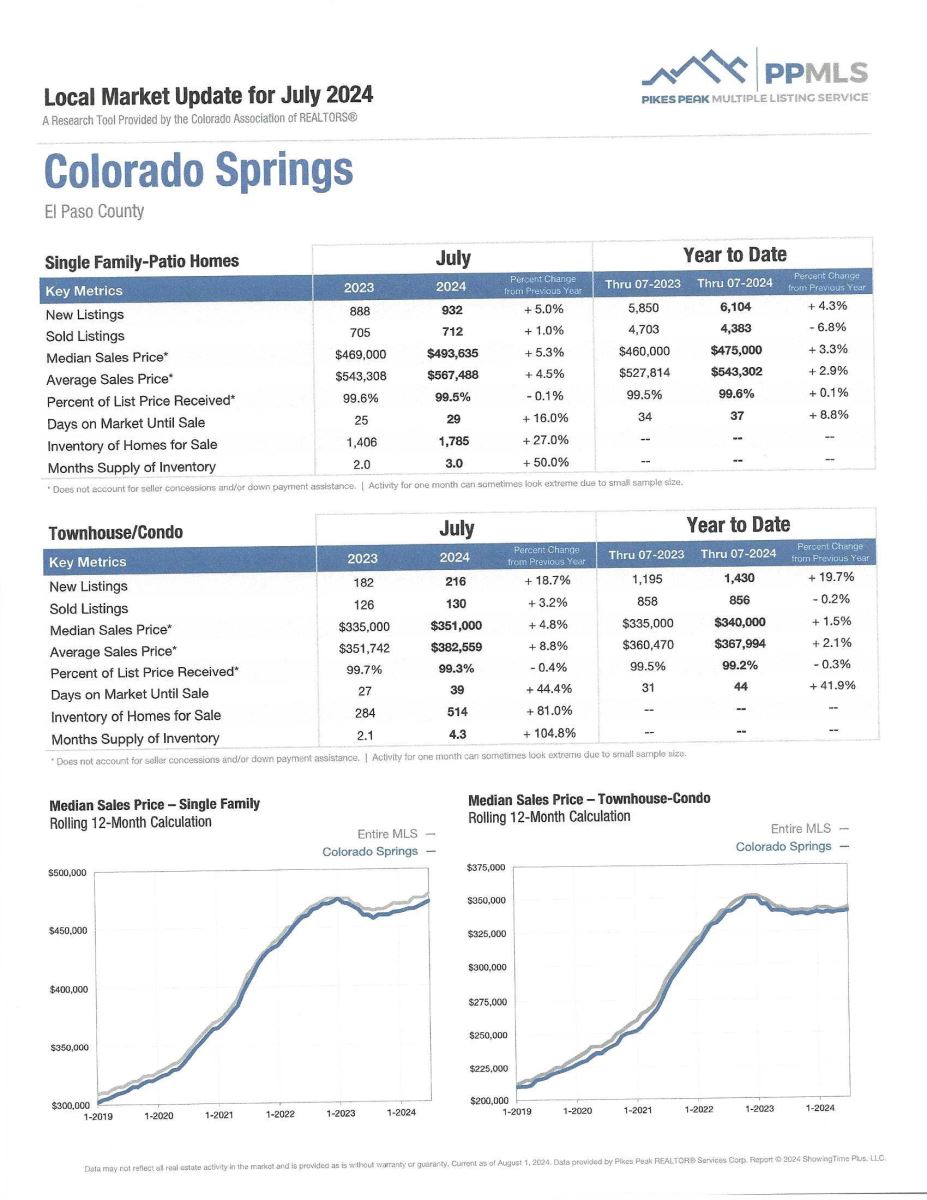

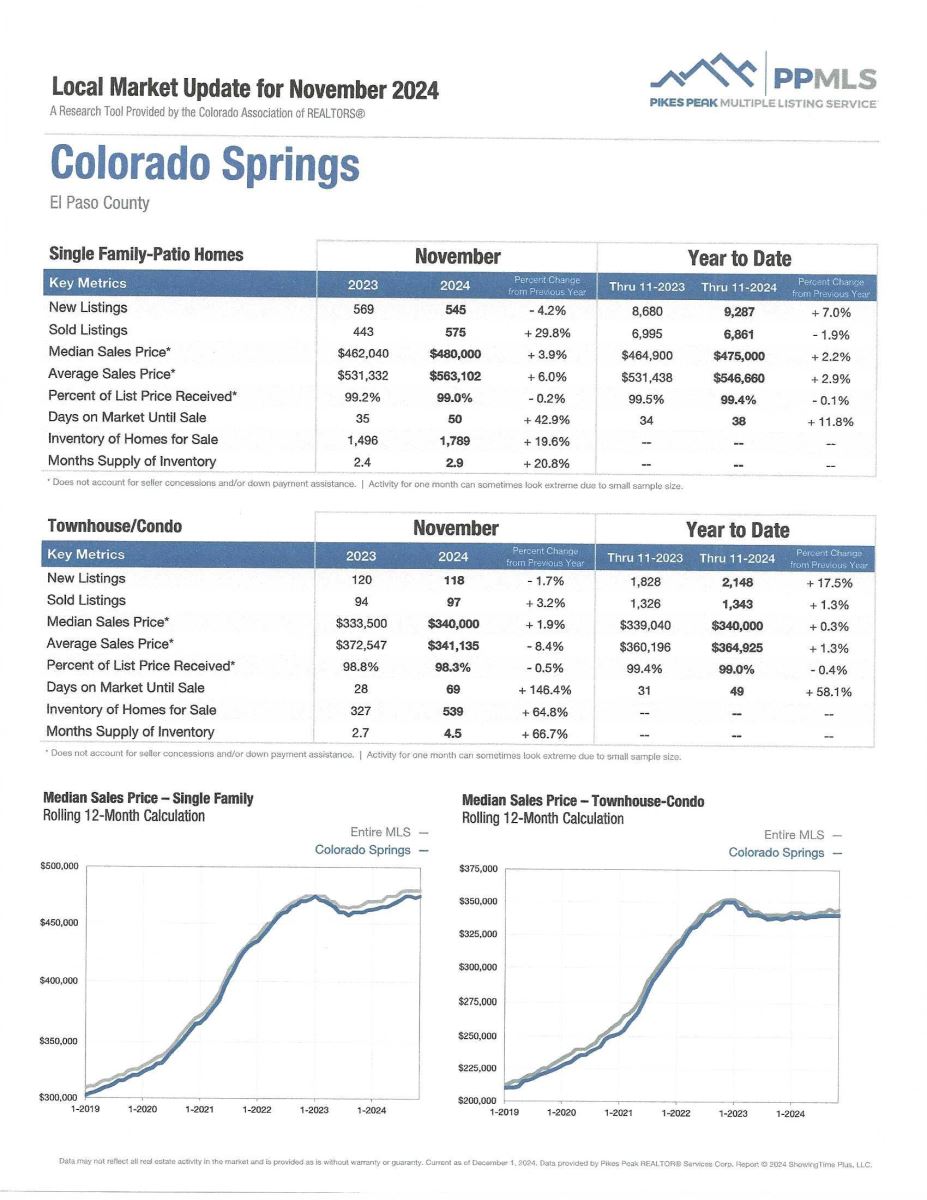

Statistics provided by the Pikes Peak REALTORS Service Corp., or it’s PPMLS

Here are some highlights from the November 2024 PPAR report. You might note that while homes are selling at close to asking price as in the past several months, the days on the market are longer. I expect that to change if interest rates go down more.

In El Paso County, the average days on the market for single family/patio homes was 51. For condo/townhomes it was 70.

Also in El Paso County, the sales price/list price for single family/patio homes was 98.9% and for condo/townhomes it was 98.3%.

In Teller County, the average days on the market for single family/patio homes was 76 and the sales/list price was 97.9%.

Please click here to view the detailed 10-page report, including charts. If you have any questions about the report or to find out how it relates to your individual situation, just give me a call.

In comparing November 2024 to November 2023 for All Homes in PPAR:

Single Family/Patio Homes:

· New Listings were 893, Down 0.2%

· Number of Sales were 894, Up 25%

· Average Sales Price was $553,014, Down 0.3%

· Median Sales Price was $485,000, Up 4.0%

· Total Active Listings are 3,092, Up 29.0%

· Months Supply is 3.5, Up 1.2%

Condo/Townhomes:

· New Listings were 134, Down 9.5%

· Number of Sales were 110, Up 1.9%

· Average Sales Price was $342,556, Down 8.9%

· Median Sales Price was $344,500, Up 2.6 %

· Total Active Listings are 591, Up 58.4%

· Months Supply is 5.4, Up 31.6%

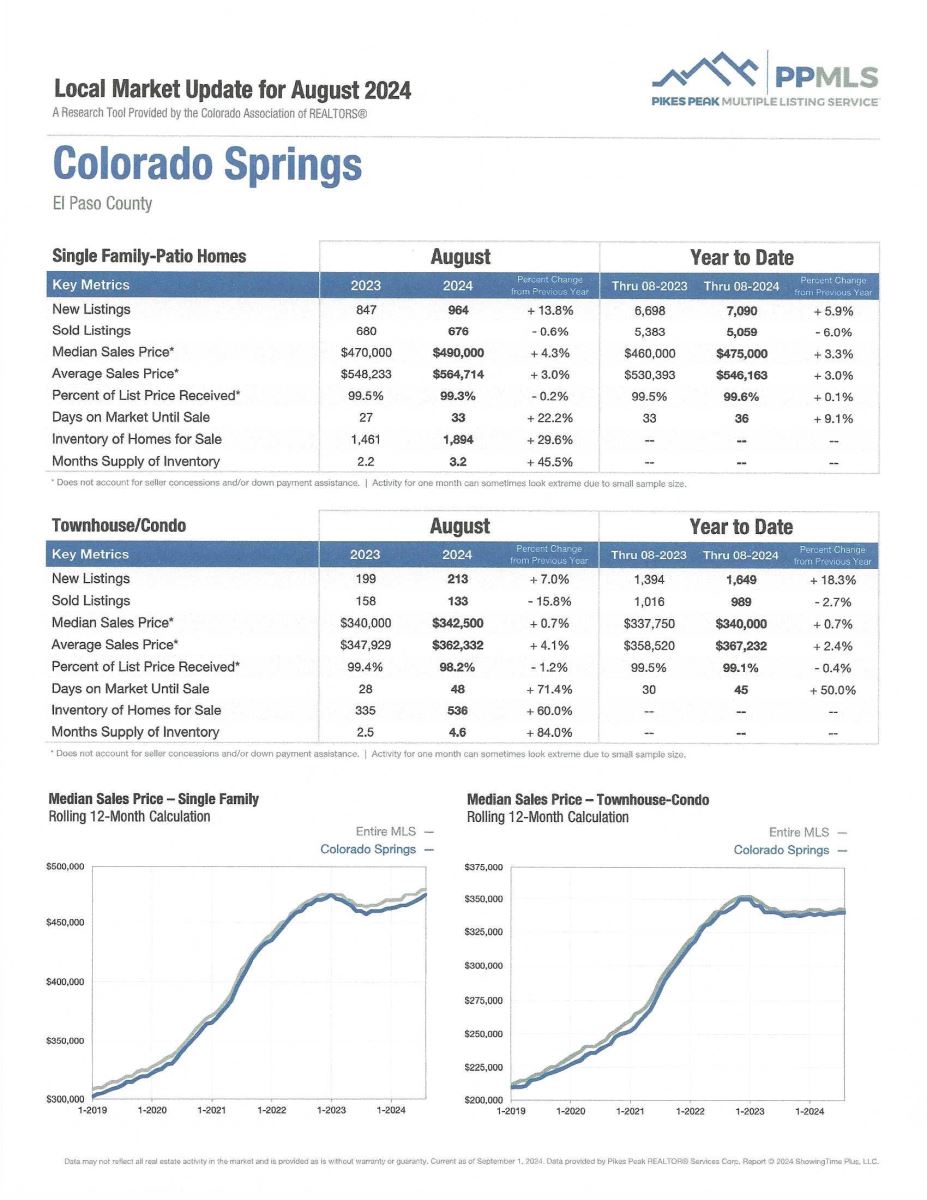

NOVEMBER 2024 MONTHLY INDICATORS AND LOCAL MARKET UPDATE ILLUSTRATE OUR LOCAL TRENDS IN DETAIL

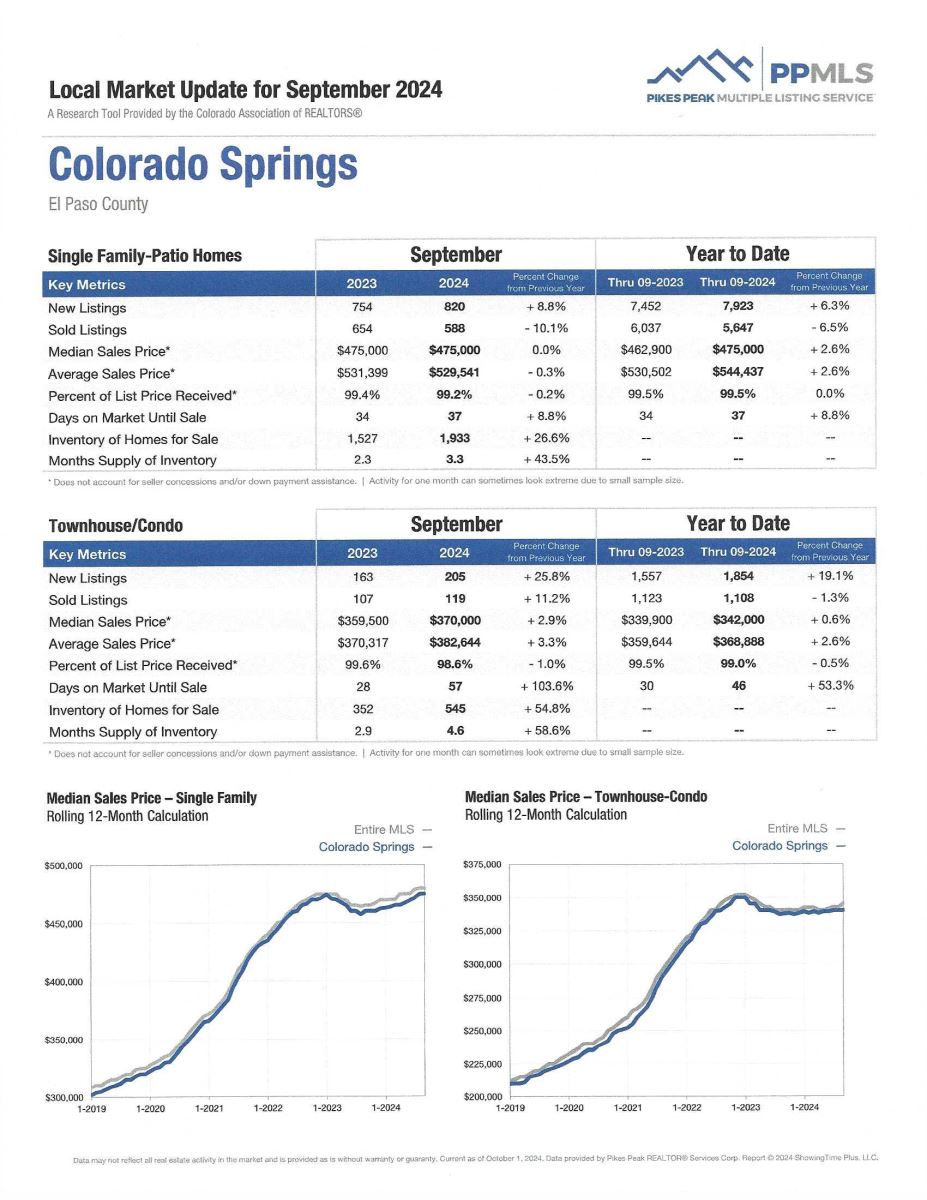

Colorado Association of REALTORS® , Pikes Peak REALTORS Service Corp, or it’s PPMLS

Providing greater detail than the above report, this contains information on both El Paso and Teller counties for Residential real estate.

The “Activity Snapshot” for all residential properties in El Paso and Teller counties shows the Year-to-Date one-year change:

- Sold Listings for All Properties were Up 23.5%

- Median Sales Price for All Properties was Up 3.3%

- Active Listings on All Properties were Up 26.2%

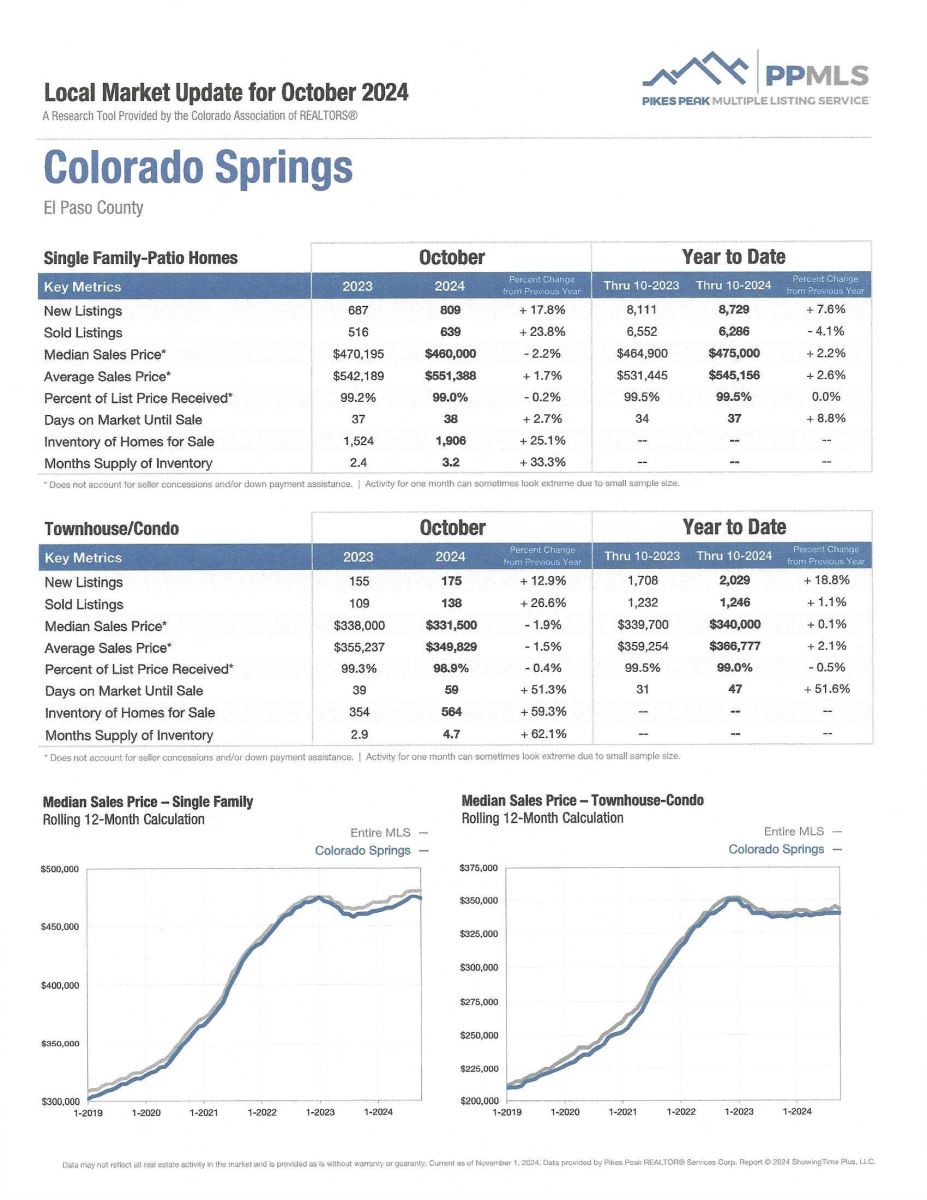

You can click here to read the 16-page Monthly Indicators or click here to get specific information on the geographical are of your choice from the 18-page Local Market Update. It’s a good idea to check out your own area or one that you might be considering in order to get a good idea of the local pulse. As an example, here is a detailed report on the Colorado Springs area:

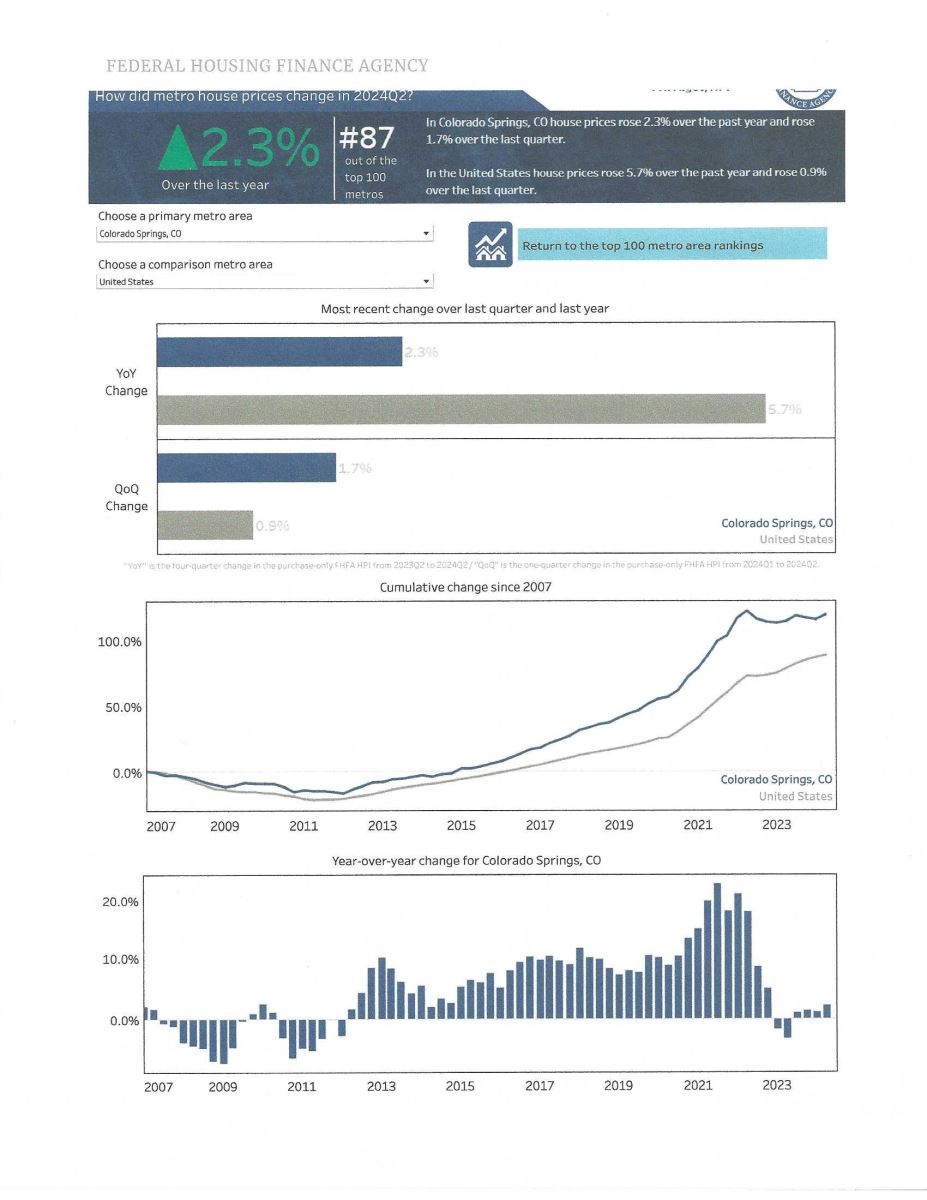

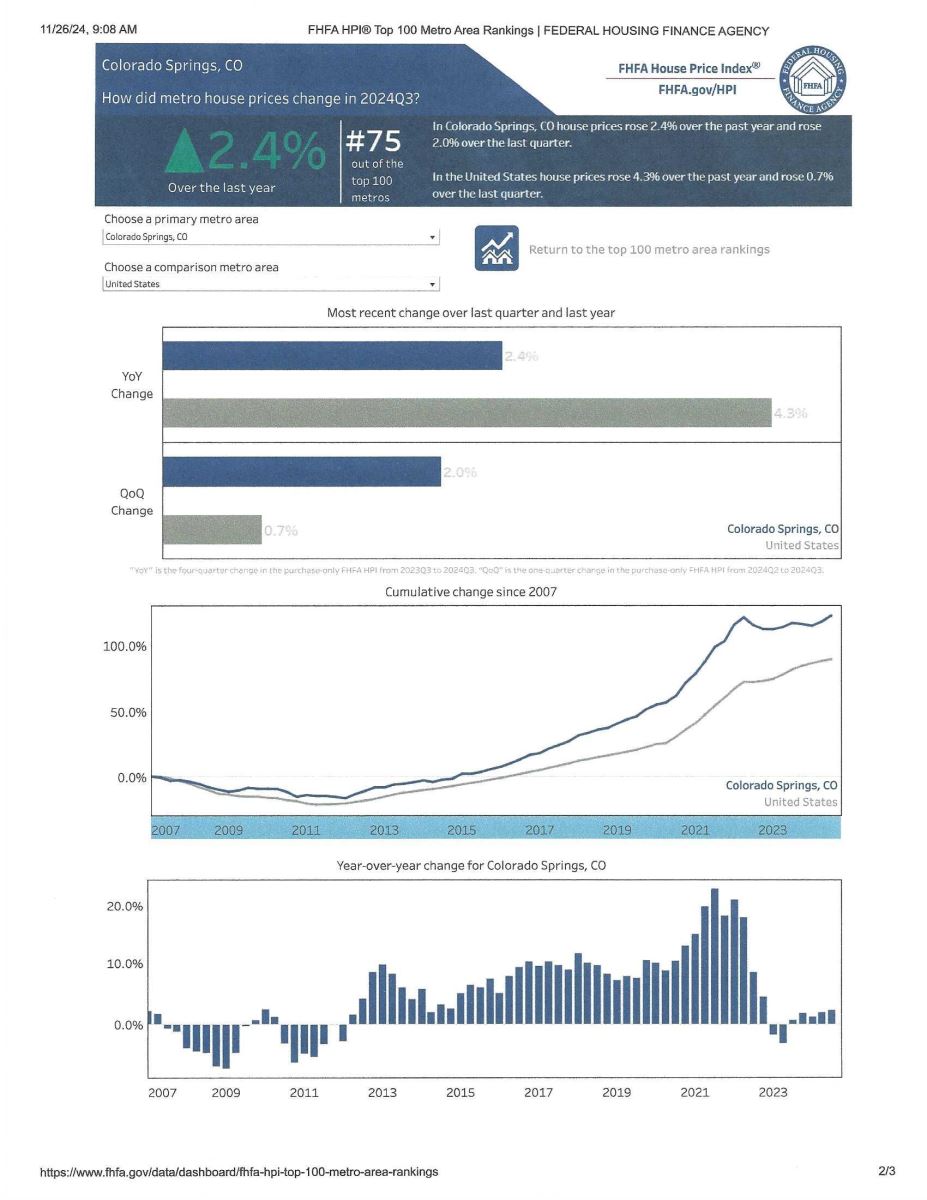

COLORADO SPRINGS RANKS #75 IN THE Q3 2024 FHFA HOUSE PRICE INDEX

Federal Housing Finance Agency, November 2024

The recently published FHFA House Price Index for third quarter 2024 lists Colorado Springs as #75 out of the top 100 in house price changes during that quarter.

Nationally, home prices were up 4.3% year-over-year according to the Federal Housing Finance Agency (FHFA) and up 0.7% compared to Q2 2024.

According to Dr. Anju Vajja, Deputy Director for FHFA’s Division of Research and Statistics, “U.S. house price growth slowed in the third quarter, continuing a trend that started in the fourth quarter of the previous year. While house prices continued to increase because housing demand outpaced the locked-in housing supply, elevated house prices and mortgage rates likely contributed to the slowdown in price growth”.

Colorado Springs is still in the top 100 and moved up from #87 in the Second Quarter 2024 indicating our housing market strength. Our lack of available homes for sale has kept us from ranking considerably higher and I am hopeful that things will begin to turn around in the first quarter of 2025.

And, we are above Denver which ranked #92, which is a fabulous news.

Below are copies of the entire list as well as of the Colorado Springs changes. Any questions? You know where to reach me.

.jpg)

FANNIE MAE AND FREDDIE MAC WILL SOON BACK MORTGAGES UP TO ALMOST $1 MILLION

USA TODAY 11.26.24

Starting in 2025, the federal government’s support for homeownership will expand as home prices continue to surge and borrowers struggle to buy.

Fannie and Freddie, the mortgage guarantors linked to the federal government will back mortgages up to $806,500, their regulator said several weeks ago.

Assuming a down payment of roughly 20%, the most expensive homes financed by those mortgages will cost nearly $1 million. This is another milestone in a market that already feels sharply divided between Americans who own homes and those hoping to do so.

While Fannie and Freddie don’t lend directly, their role is to buy the mortgages that financial institutions like banks offer borrowers. That makes it possible for lenders to offer more loans by providing a sure way to offload them.

This is great news as home prices are certainly not going down and borrowers are looking for the best deal for their individual needs and budgets. The raised limits will help a lot more people and will help some avoid having to seek so-called “jumbo mortgages” which can be a harder process.

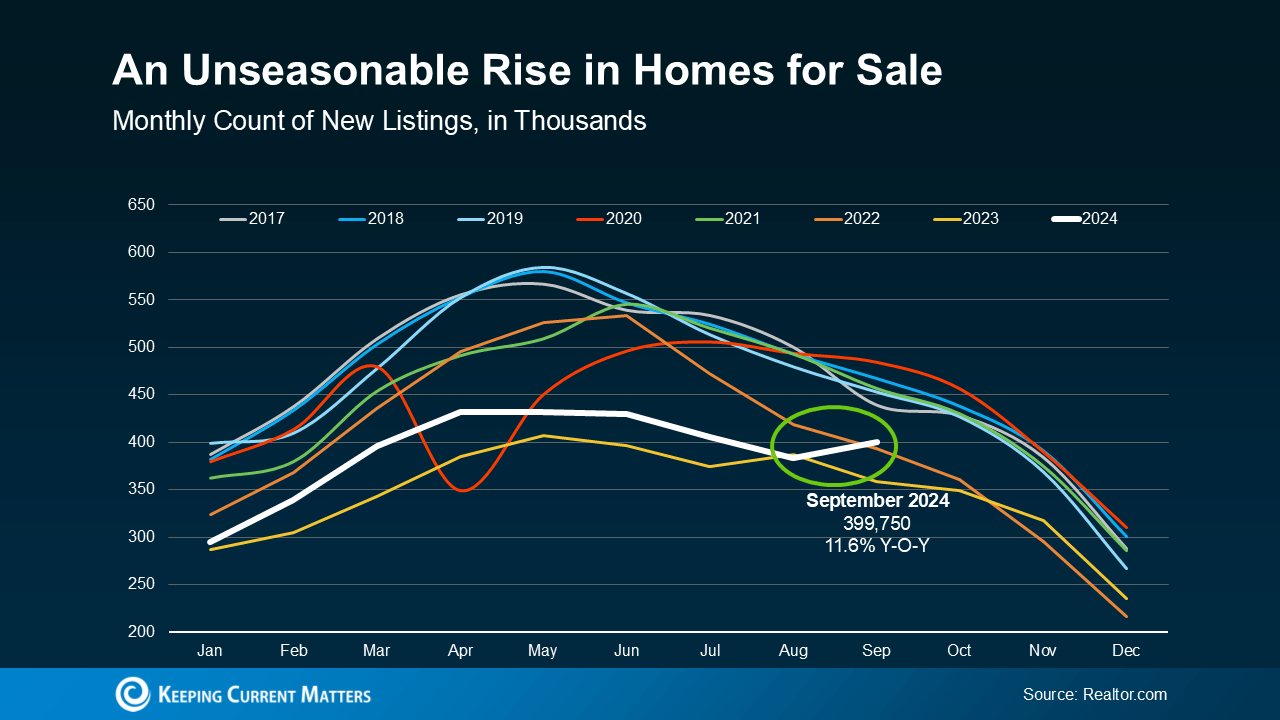

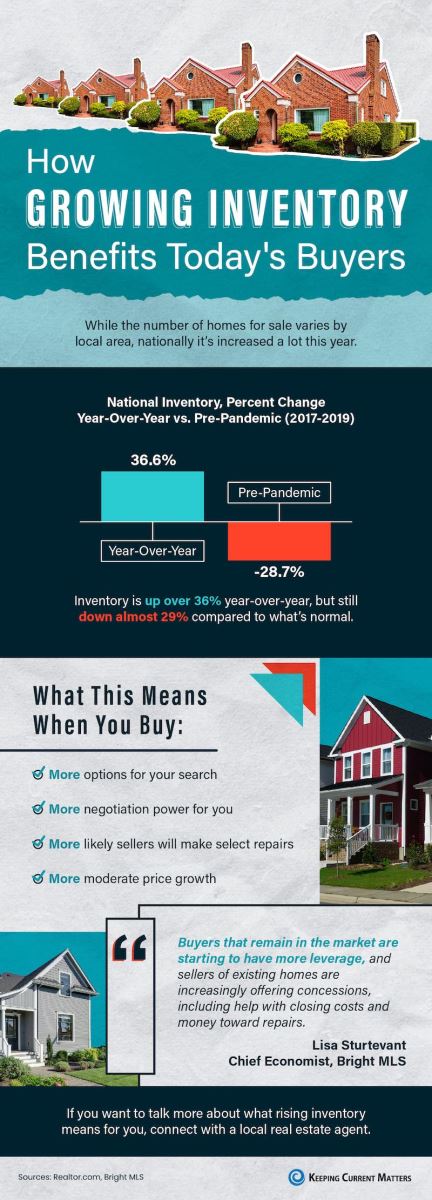

WHY THIS WINTER IS A SWEET SPOT FOR SELLING…an Infographic

KeepingCurrentMatters, 12.6.24

Some Highlights:

- If you are thinking about selling your house, these are a few of the reasons why you may want to do it this season.

- Buyers looking right now are serious about moving and the number of homes for sale is typically lower this time of year which will help your home stand out.

- While inventory is higher this year than it’s been in the past few winters, you’ll still be in this year’s sweet spot before the upcoming traditional spring selling season.

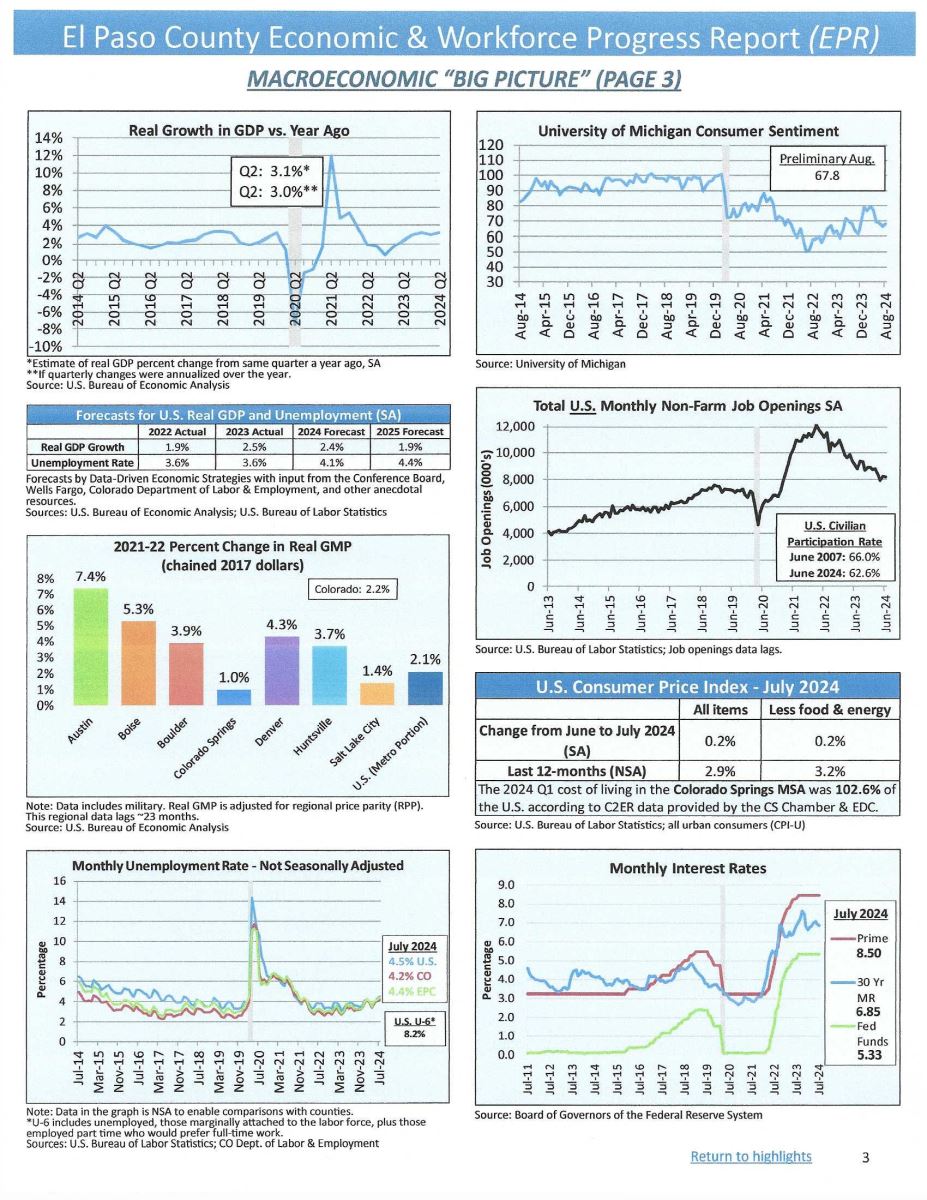

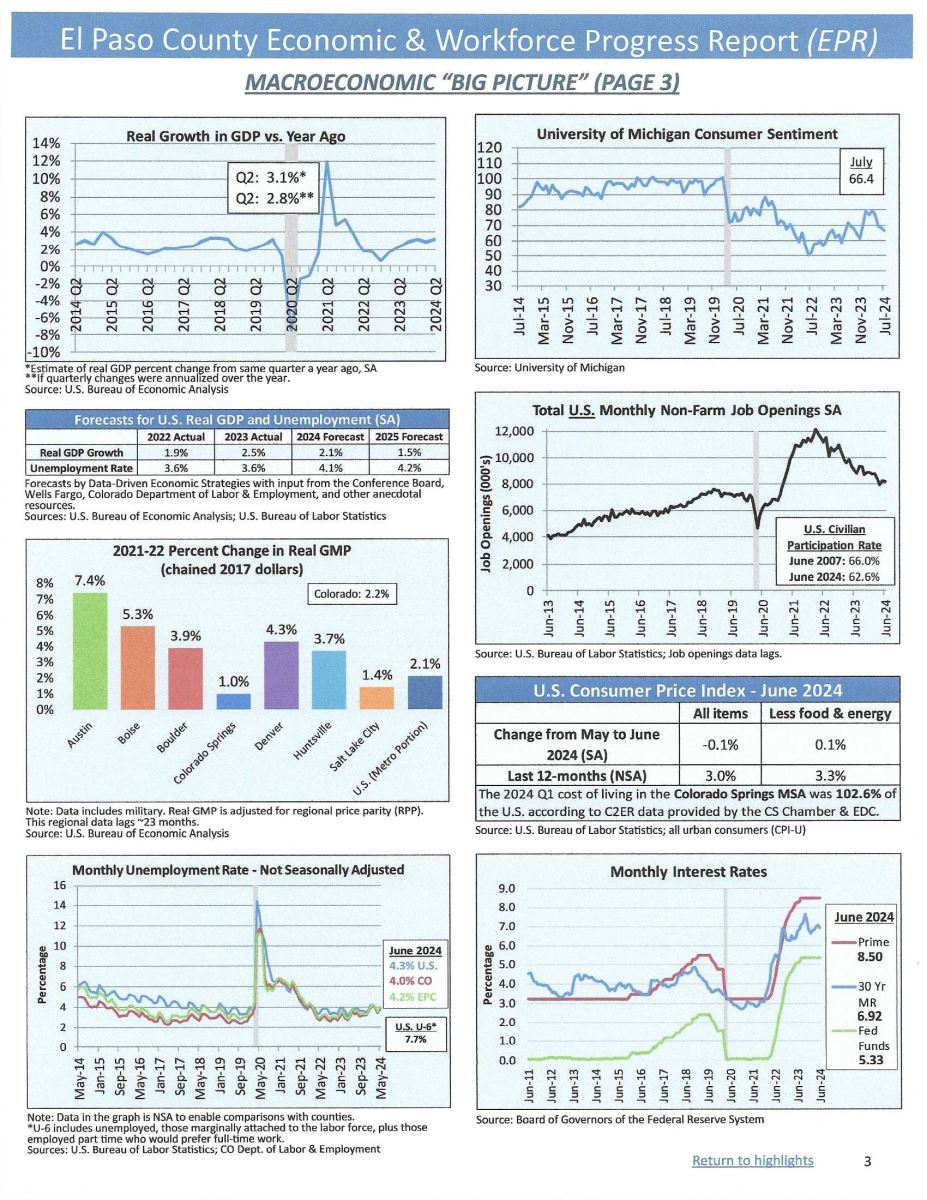

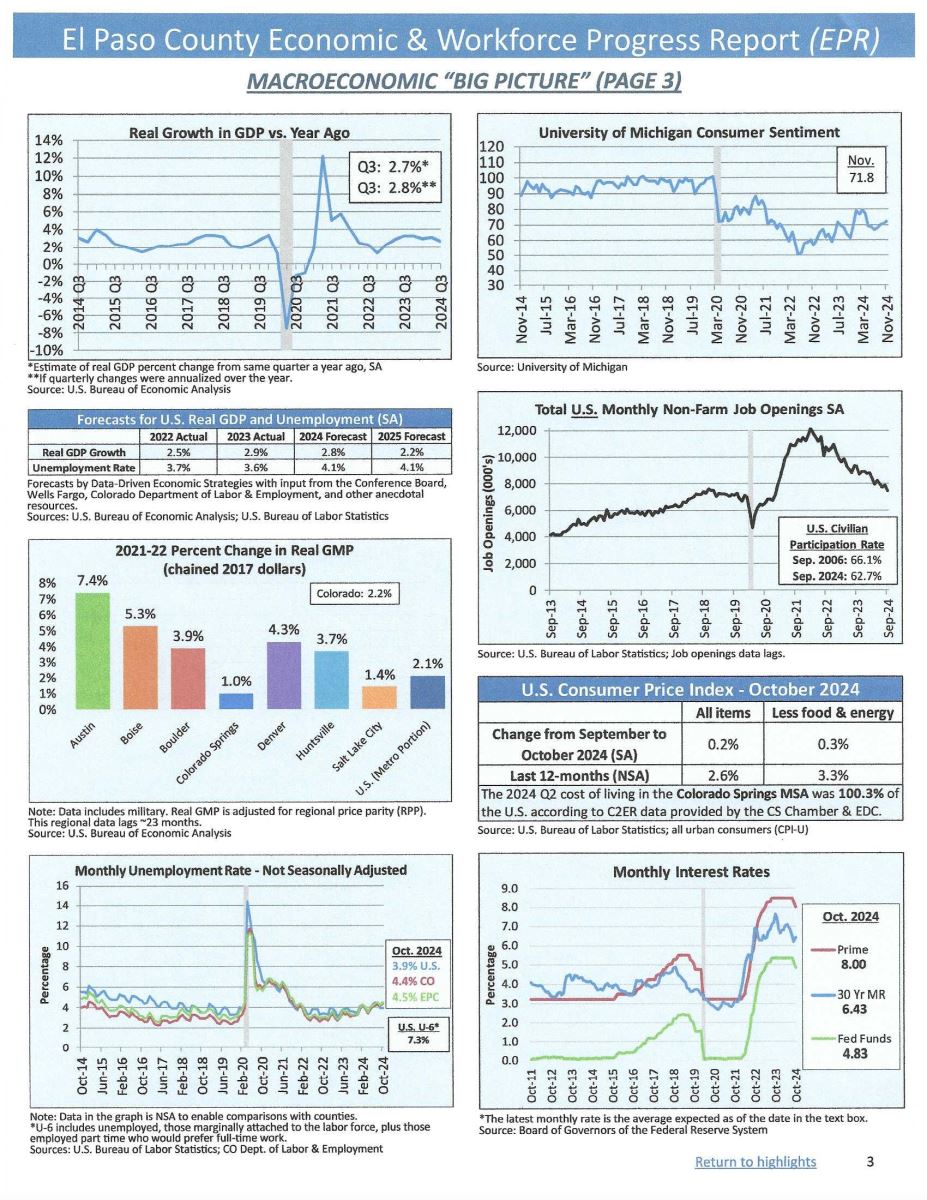

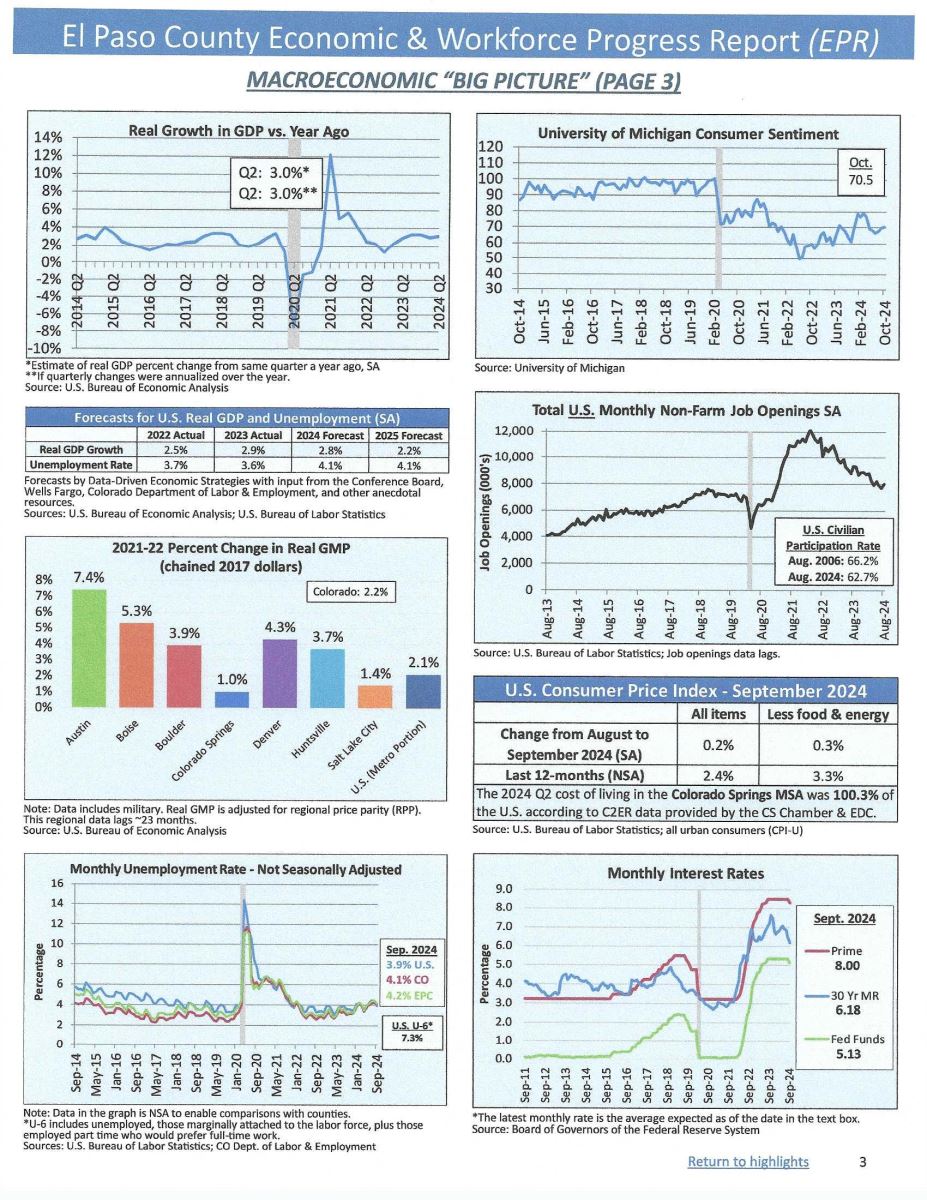

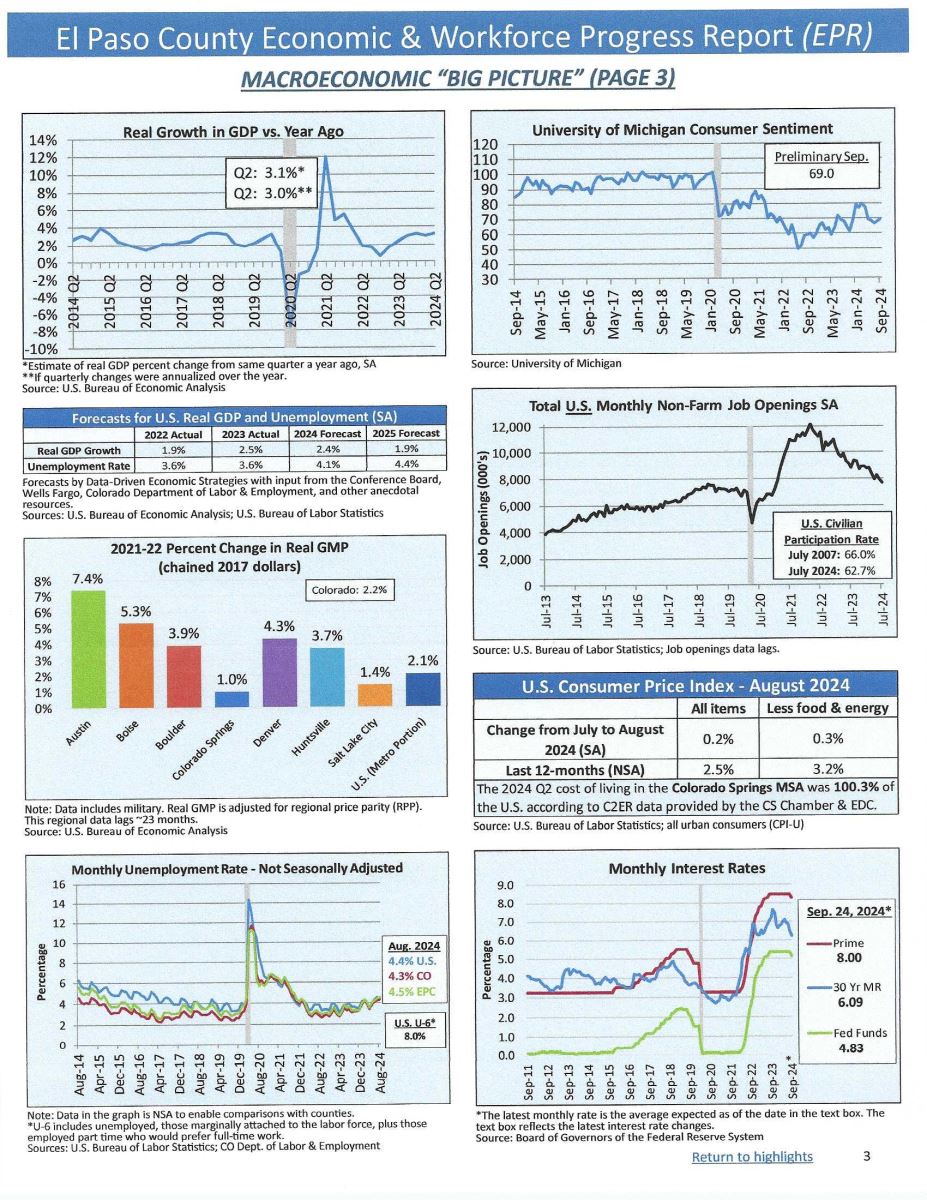

ECONOMIC & WORKFORCE DEVELOPMENT REPORT

Data-Driven Economic Strategies, November 2024

As always, I like to share the useful data I receive from our “local economist”, Tatiana Bailey. You will see in these charts what’s happening locally in terms of the economy as well as the most recent Workforce Progress Report.

This information is especially invaluable to business owners; however, I know you all will all find it worthwhile reading.

Below is a reproduction of the first page of graphics. To access the full report, please click here. And if you have any questions, give me a call.

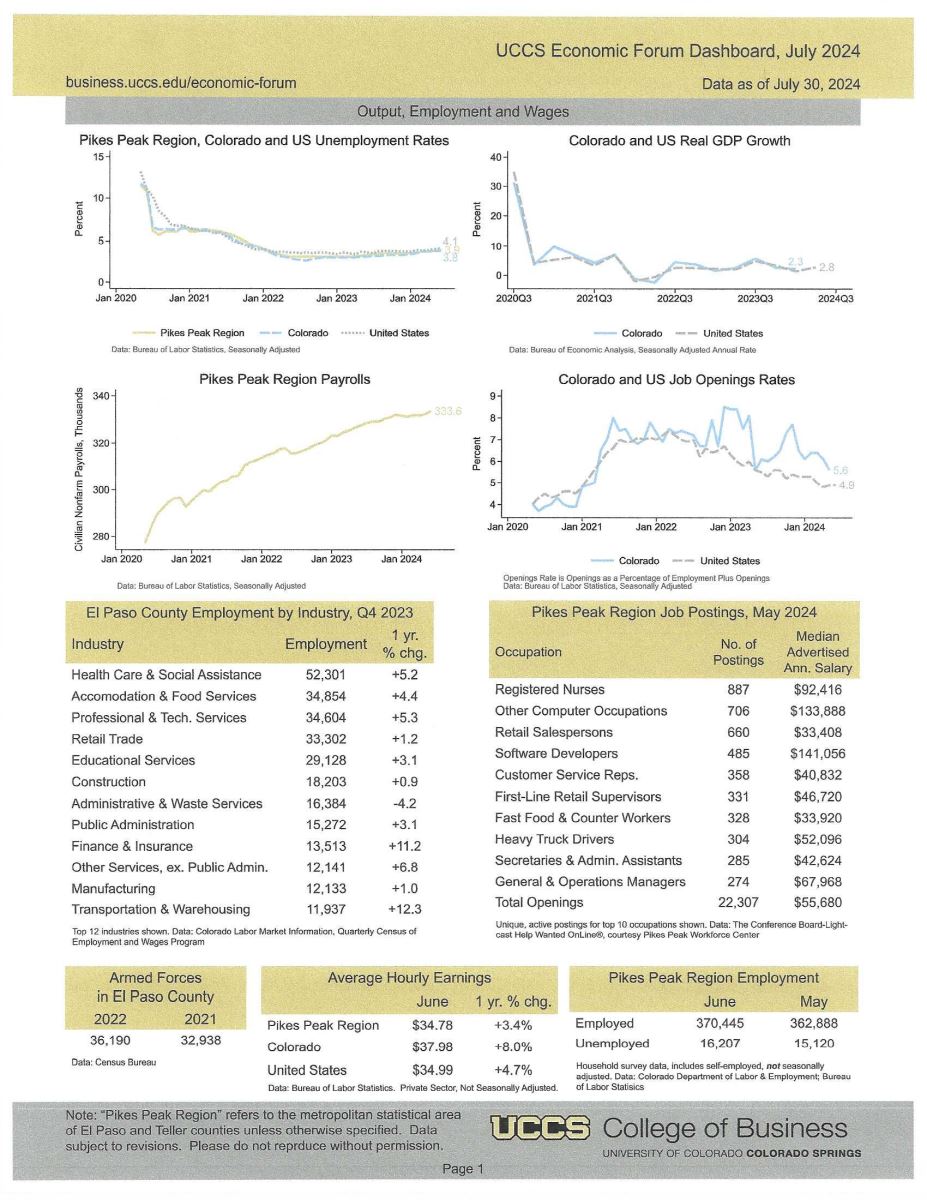

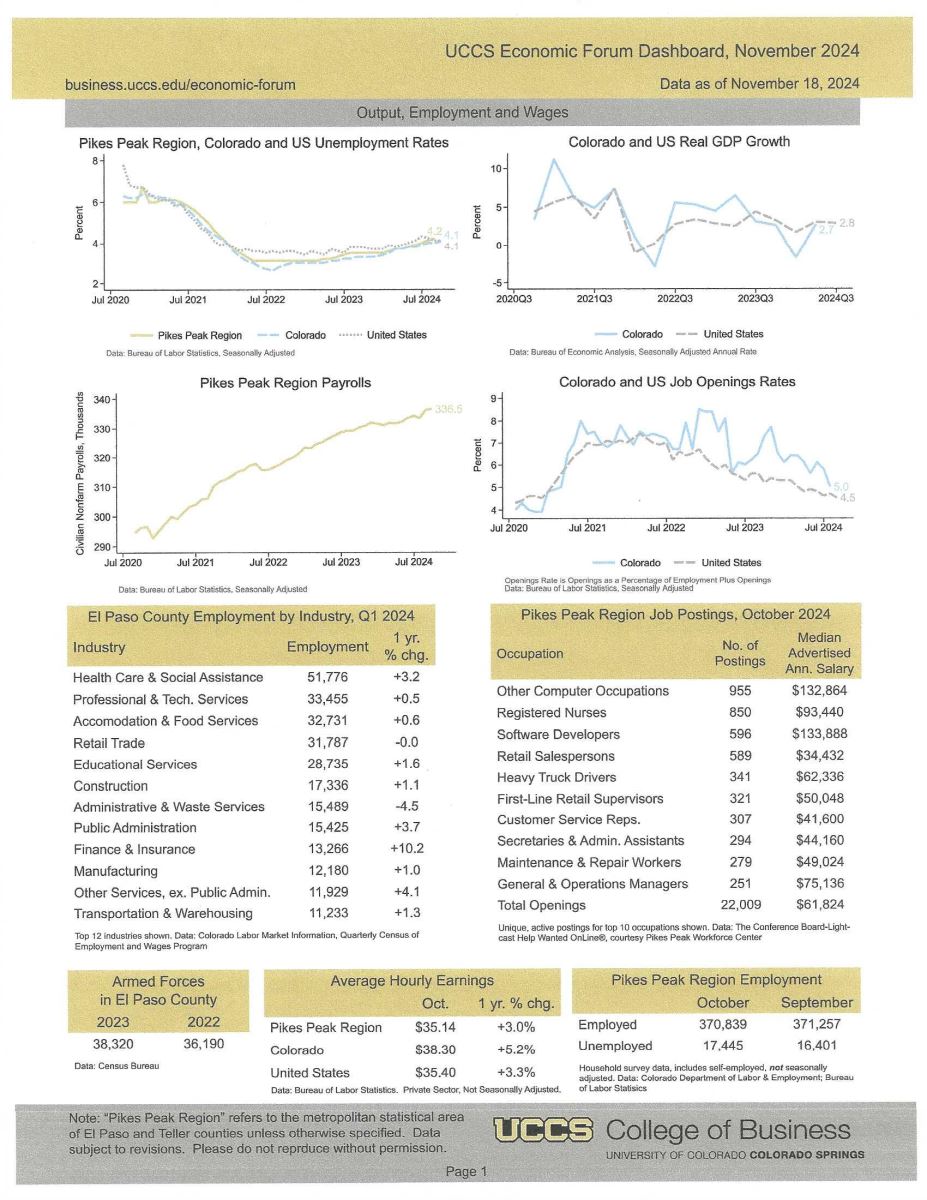

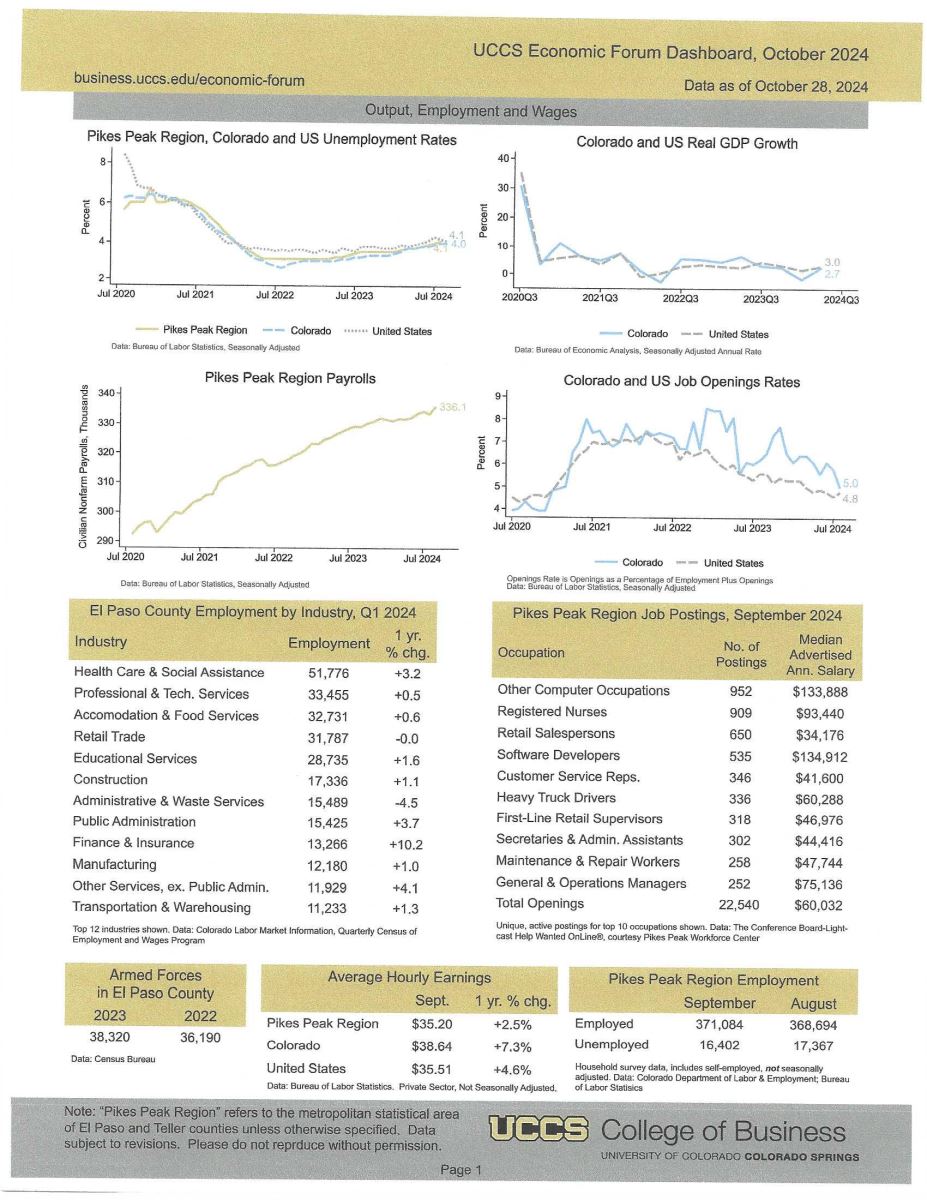

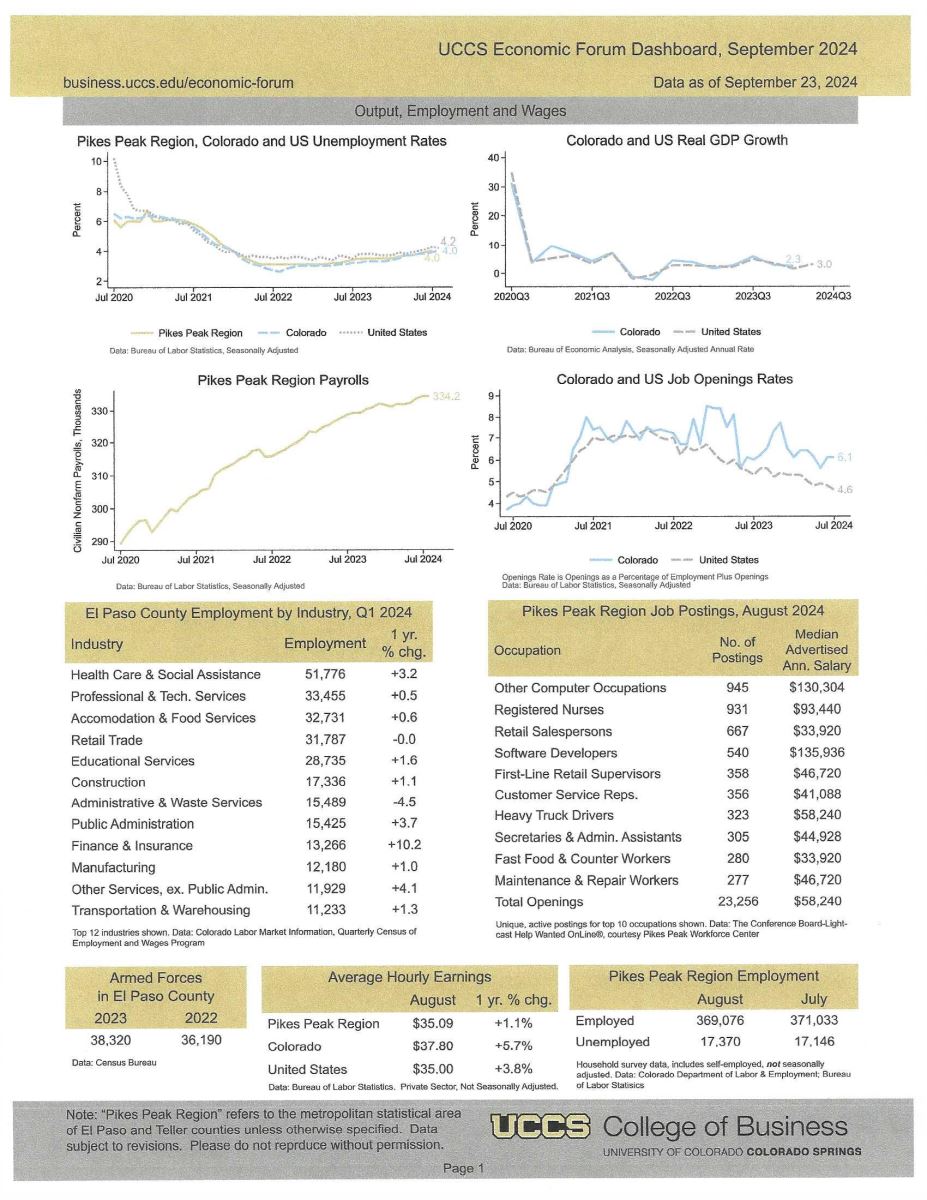

UCCS ECONOMIC FORUM MONTHLY DASHBOARD

Updated November 2024, UCCS College of Business/Economic Forum

Here is the monthly report from the UCCS College of Business Economic Forum. It is created by professor Dr. Bill Craighead, who is the Forum Director. He also publishes an on-line “Weekly Economic Snapshot” you might enjoy.

I know several of you who like statistics and use this information in your daily business life, and I will share it with you when I receive it each month.

I’ve reproduced the first page of the charts below. To access the report in its entirety, please click here.

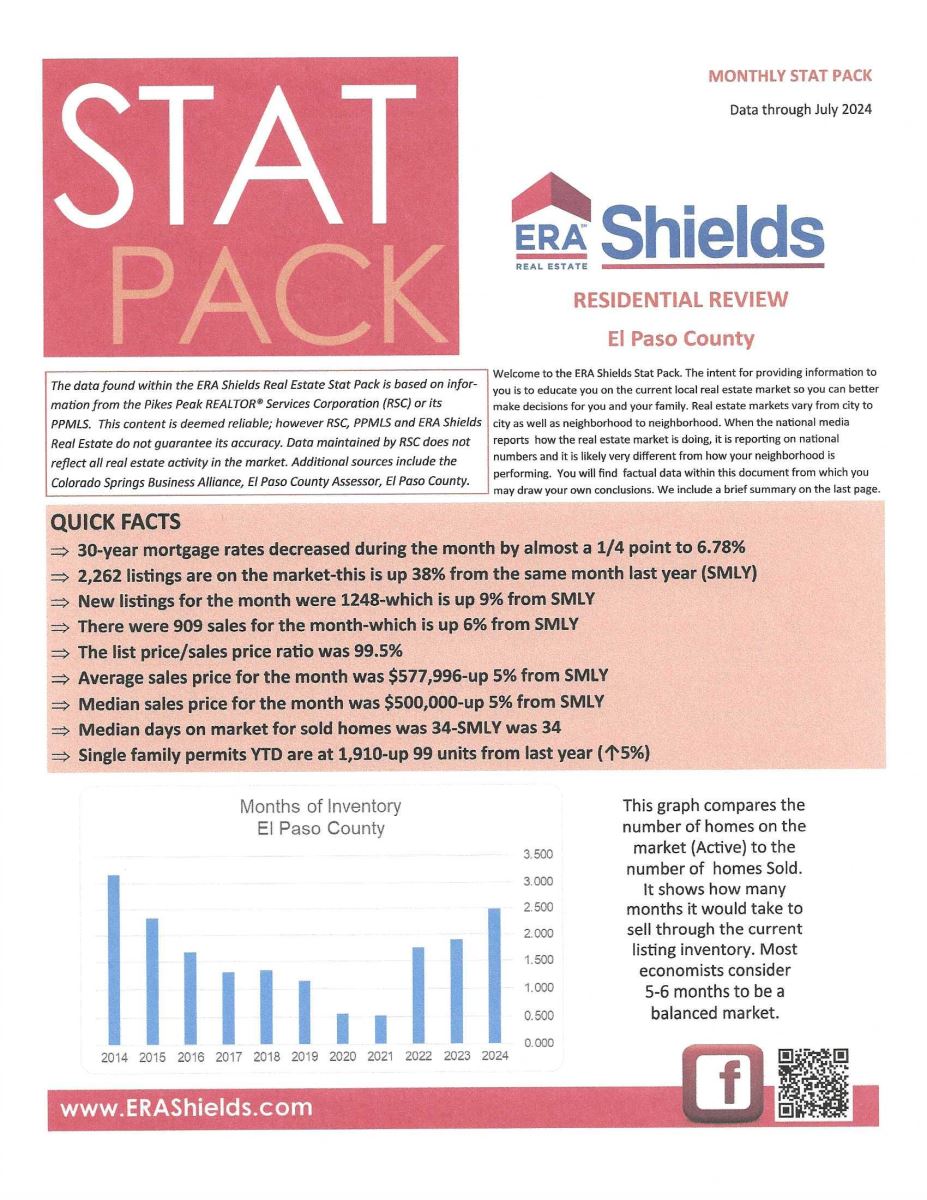

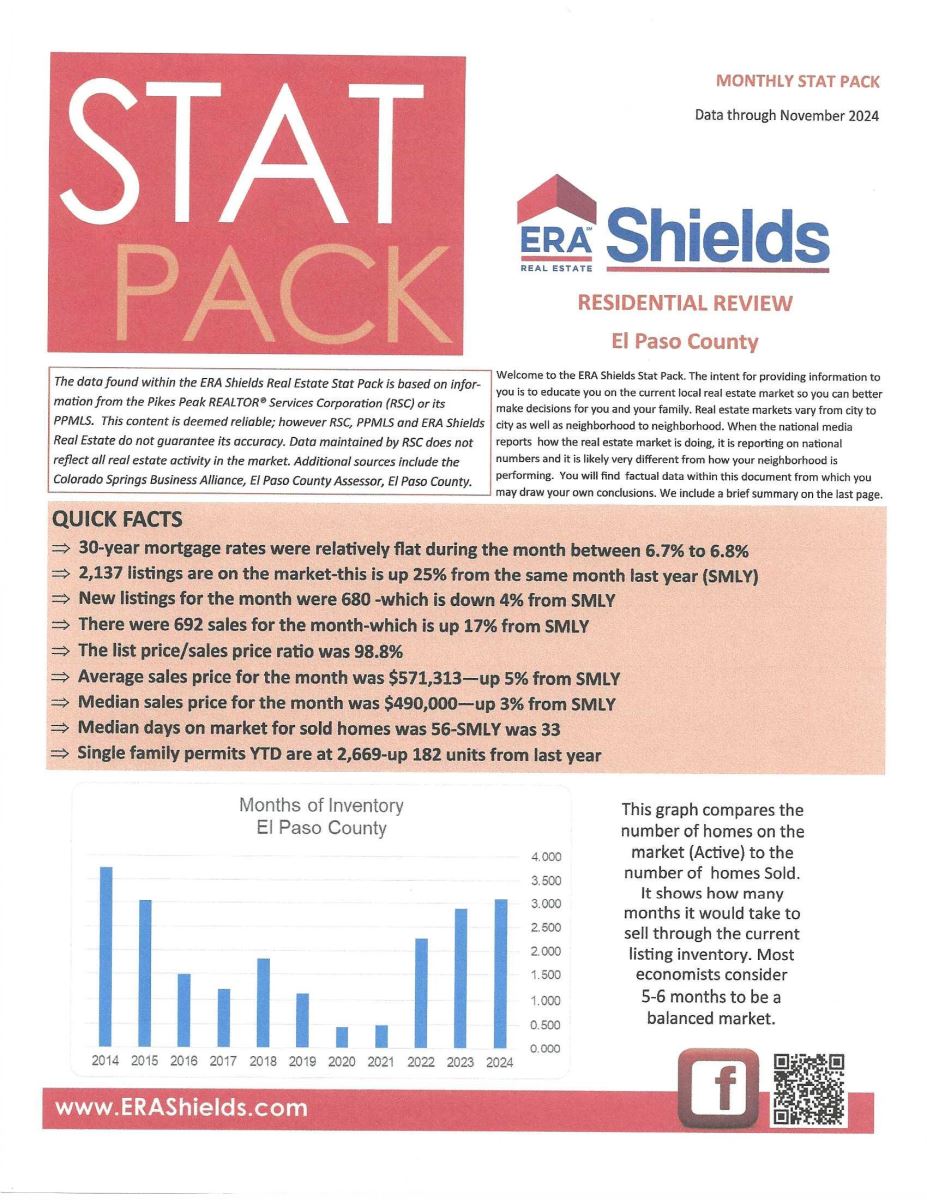

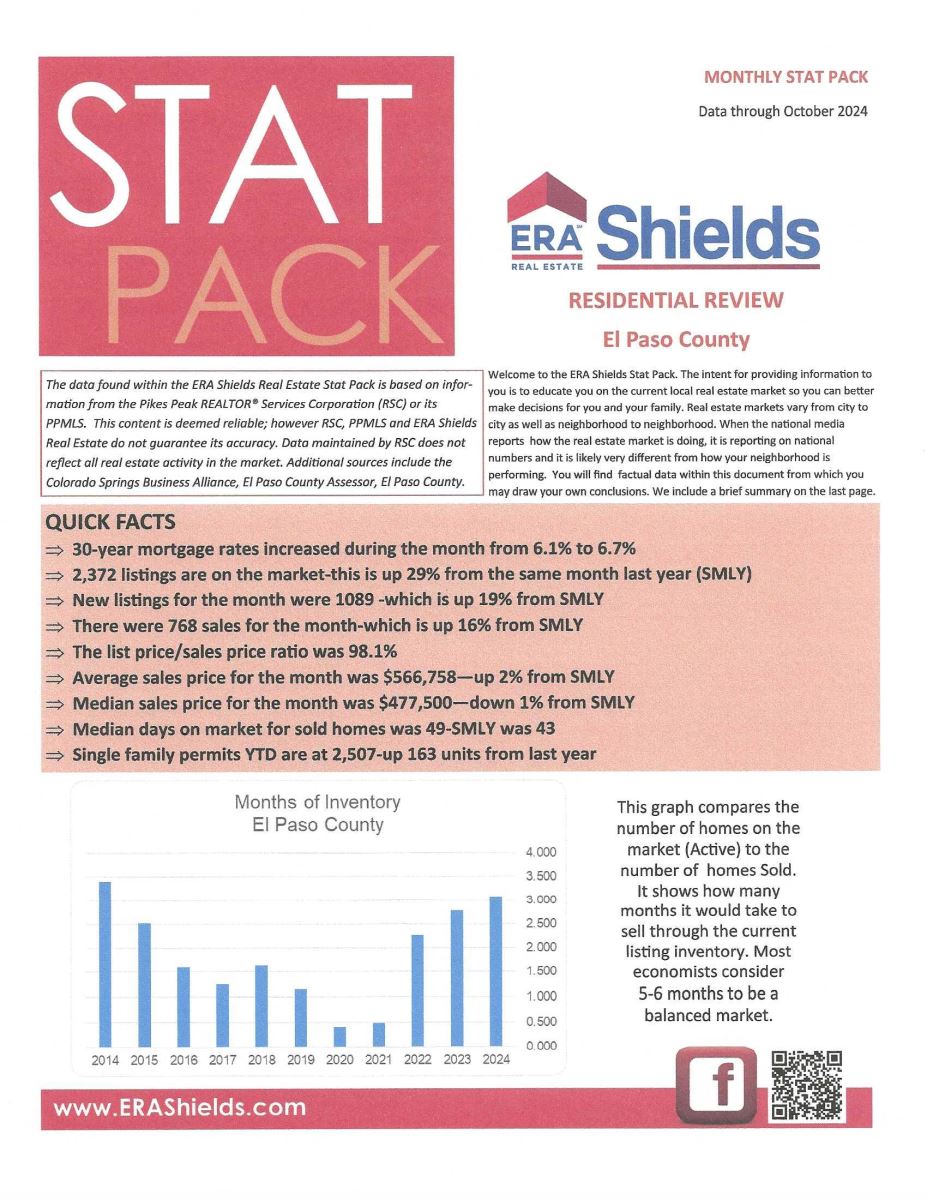

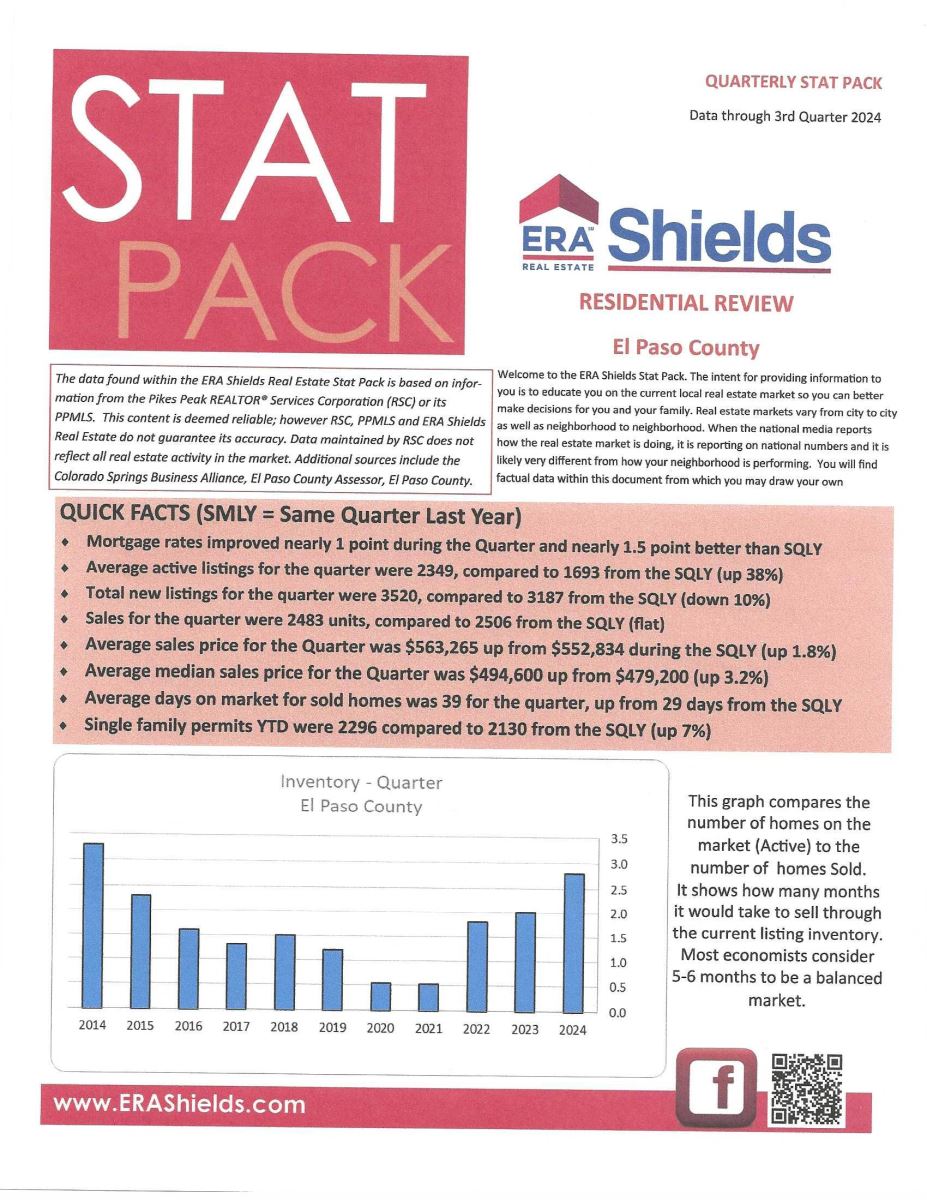

ERA SHIELDS STAT PACK

Data through November 2024, ERA Shields

Here is data from my company’s monthly “Stat Pack” that can better help you understand the local buying and selling reality. I have reproduced the first page, and you can click here to get the 5-page report in its entirety.

.png)

.jpg)