HARRY'S BI-WEEKLY UPDATE 9.10.2024

September 10, 2024

HARRY’S BI-WEEKLY UPDATE

A Current Look at the Colorado Springs Residential real estate Market

As part of my “Special Brand of Customer Service”, it is my desire to share current Residential real estate issues that will help to make you a more successful and profitable Buyer and Seller.

LOTS OF INFORMATION HERE SO I’LL LET IT SPEAK FOR ITSELF…

The good news is that it looks like the Fed will lower rates a bit, which should start a downward trend for 2025. I’ve included a lot of good info on 2025 predictions and more below, including a link to my podcast where I talk about some new lower rates that are currently available.

And, of course, as always, if you’ve even been thinking of making a move, it’s never too early for us to get together and see how together we can begin to get a better picture of how to take your wants, needs and budget requirements and use them for the best outcome for you and your family.

Simply email me at Harry@HarrySalzman.com or call me at 719.593.1000 and let’s get started today.

And, if you’ve got one minute and 53 seconds, check out some of the current mortgage interest rates that are looking oh, so good that I refer to on my new and improved video podcast. Simply click on the link below and you will be directed to my personal YouTube channel.

To watch, click here:

While you’re at it you might want to subscribe to my channel, so you won’t miss future broadcasts. It won’t cost you anything…well, it could cost you… if you miss some of my informative musings!

And now for statistics…

AUGUST 2024

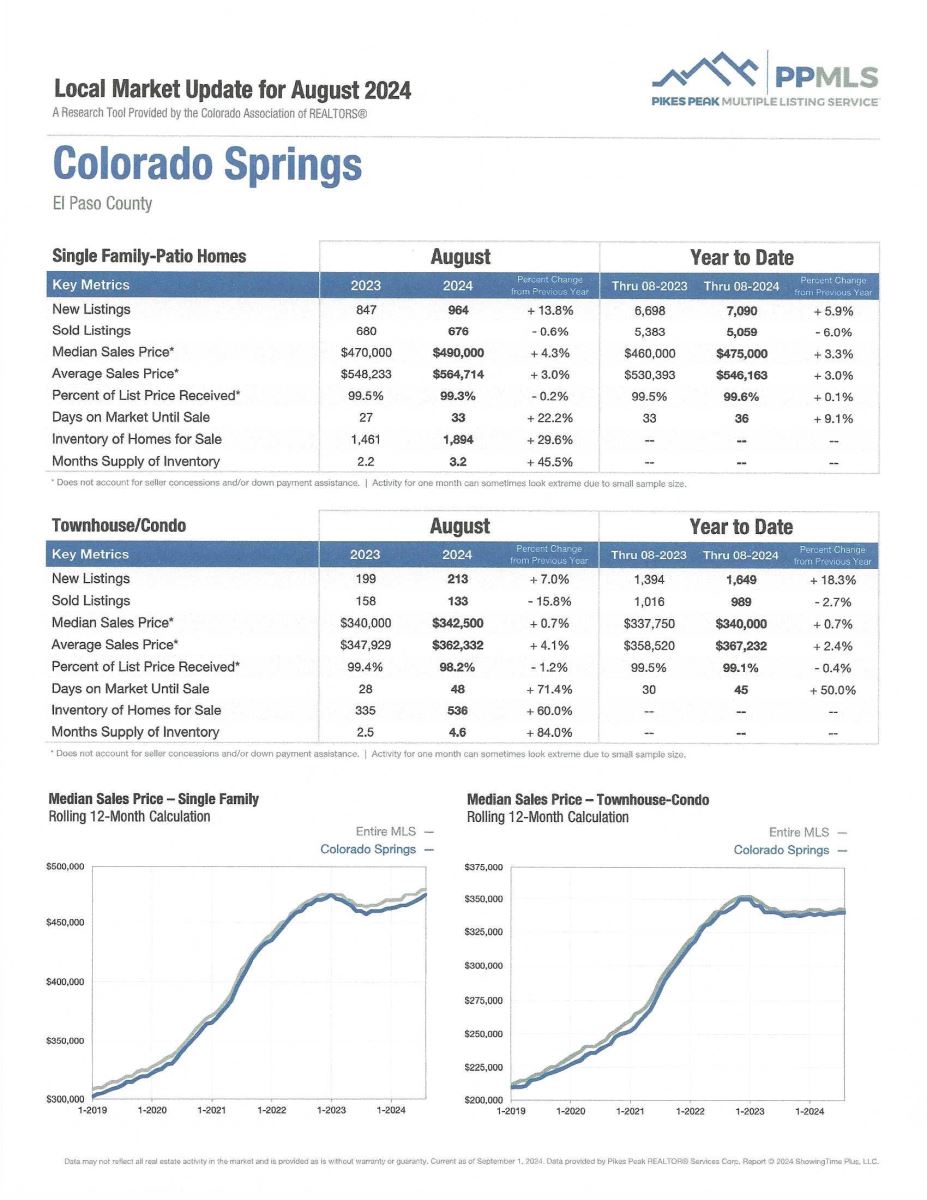

Statistics provided by the Pikes Peak REALTORS Service Corp., or it’s PPMLS

Here are some highlights from the August 2024 PPAR report. You might note that while homes are selling at close to asking price as in the past several months, the days on the market are a bit longer. I expect both to change once the interest rates go down more.

In El Paso County, the average days on the market for single family/patio homes was 34. For condo/townhomes it was 47.

Also in El Paso County, the sales price/list price for single family/patio homes was 99.3% and for condo/townhomes it was 98.3%.

In Teller County, the average days on the market for single family/patio homes was 61 and the sales/list price was 98.4%.

Please click here to view the detailed 10-page report, including charts. If you have any questions about the report or to find out how it relates to your individual situation, just give me a call.

In comparing August 2024 to August 2023 for All Homes in PPAR:

Single Family/Patio Homes:

· New Listings were 1,605, Up 14.1%

· Number of Sales were 1,064, Down 0.3%

· Average Sales Price was $558,409, Up 0.8%

· Median Sales Price was $490,000, Up 2.1%

· Total Active Listings are 3,320, Up 37.2%

· Months Supply is 3.1, Down 132.3%

Condo/Townhomes:

· New Listings were 249, Up 8.3%

· Number of Sales were 157, Down 16.9%

· Average Sales Price was $364,968, Up 1.1%

· Median Sales Price was $347,200, Down 0.1%

· Total Active Listings are 597, Up 69.6%

· Months Supply is 3.8, Down 4.1%

AUGUST 2024 MONTHLY INDICATORS AND LOCAL MARKET UPDATE ILLUSTRATE OUR LOCAL TRENDS IN DETAIL

Colorado Association of REALTORS® , Pikes Peak REALTORS Service Corp, or it’s PPMLS

Providing greater detail than the above report, this contains information on both El Paso and Teller counties for Residential real estate.

The “Activity Snapshot” for all residential properties in El Paso and Teller counties shows the Year-to-Date one-year change:

- Sold Listings for All Properties were Down 2.1%

- Median Sales Price for All Properties was Up 3.7%

- Active Listings on All Properties were Up 33.1%

You cant click here o read the 16-page Monthly Indicators or click here to get specific information on the geographical are of your choice from the 18-page Local Market Update. It’s a good idea to check out your own area or one that you might be considering in order to get a good idea of the local pulse. As an example, here is a detailed report on the Colorado Springs area:

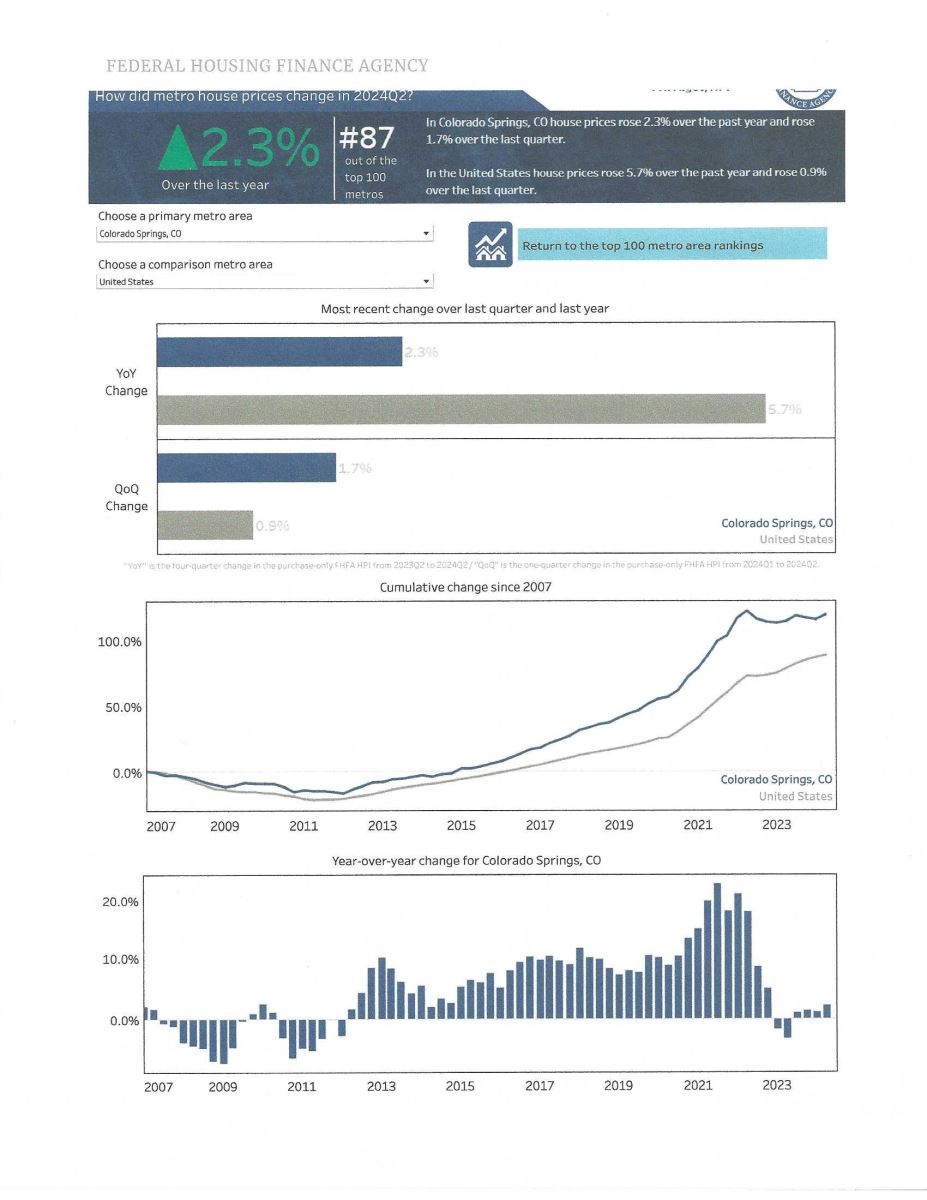

COLORADO SPRINGS RANKS #87 IN THE Q2 2024 FHFA HOUSE PRICE INDEX

Federal Housing Finance Agency, August 2024

The recently published FHFA House Price Index for second quarter 2024 lists Colorado Springs as #87 out of the top 100 in house price changes during that quarter.

We are still in the top 100 and moved up two spots from Second Quarter 2023. Our lack of available homes for sale has kept us from ranking considerably higher and I am hopeful that things will soon begin to turn around.

We are ranked just slightly below Denver which ranked number 81.

Below are copies of the entire list as well as of the Colorado Springs changes. Any questions? You know where to reach me.

HOW THE FEDERAL RESERVE’S NEXT MOVE COULD IMPACT THE housing market

Keeping Current Matters, 9.4.24

With a lot of eyes on the Federal Reserve (the Fed) now that it’s September, the overwhelming expectation is that they will cut the Federal Funds Rate at their upcoming meeting due to recent signs of inflation cooling and the job market slowing down.

Mark Zandi, chief economist at Moody’s Analytics, said; “They’re ready to cut, just as long as we don’t get an inflation surprise between now and September, which we won’t.”

What does this mean for the housing market, and most especially to you as a potential home buyer or seller?

Why a Federal Funds Rate Cut Matters

The Federal Funds Rate is one of the key factors that influences mortgage rates—things like the economy, geopolitical uncertainty, and more also have an impact.

When the Fed cuts the Federal Funds Rate, it is a signal of what’s happening in the broader economy, and mortgage rates tend to respond. A single rate cut may not lead to a dramatic drop in mortgage rates, but it could contribute to the gradual decline that’s already happening.

As Mike Fratantoni, chief economist at the Mortgage Bankers Association (MBA) points out, “Once the Fed kicks off a rate-cutting cycle, we do expect that mortgage rates will move somewhat lower.”

And any upcoming Federal Funds Rate cut likely won’t be a one-time event. Lawrence Yun, chief economist of the National Association of Realtors (NAR) says, “Generally the rate-cutting cycle is not one-and-done. Six to eight rounds of rate cuts all through 2025 look likely.”

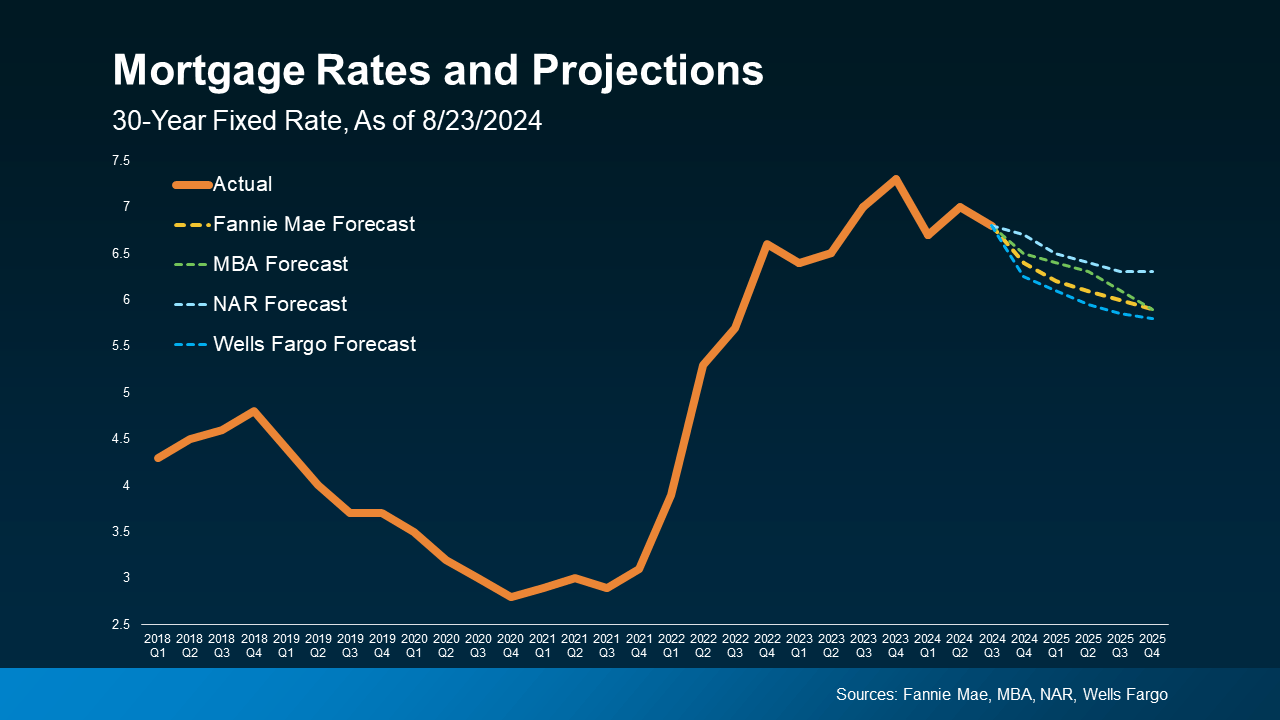

The Projected Impact on Mortgage Rates

Here’s what experts in the industry project for mortgage rates through 2025. One contributing factor to this ongoing gradual decline is the anticipated cuts from the Fed. The graph below shows the latest forecasts from Fannie Mae, MBA, NAR and Wells Fargo.

So, with the recent improvements in inflation and a cooling job market, a Federal Funds Rate cut is likely to lead to a moderate decline in mortgage rates (shown in the dotted lines).

Two big reasons why that’s good news for both buyers and sellers:

It Helps Alleviate the Lock-in Effect

For current homeowners, lower mortgage rates could help ease the lock-in effect. That’s when people feel stuck in their present home because today’s rates are higher than what they locked in when they bought that house.

If the fear of losing your low-rate mortgage and facing higher costs has kept you out of the market, a slight reduction in rates could make selling a bit more attractive again. However, this isn’t expected to bring a flood of sellers to the market as many homeowners may still be cautious about giving up their existing mortgage rate.

It Should Boost Buyer Activity

For potential homebuyers, any drop in mortgage rates will provide a more inviting housing market. Lower mortgage rates can reduce the overall cost of homeownership, making it more feasible for you, if you’ve been waiting to make a move.

What Should You Do?

While the probable upcoming Federal Funds Rate cut is not expected to drastically lower mortgage rates, it will likely contribute to the gradual decrease that’s already happening.

And while the anticipated rate cut represents a positive shift for the future of the housing market, it’s important to consider your options right now.

Jacob Channel, senior economist at LendingTree, sums it up well:

“Timing the market is basically impossible. If you’re always waiting for perfect market conditions, you’re going to be waiting forever. Buy now only if it’s a good idea for you.”

If you have any questions as to whether it’s a good time for YOU, please give me a call and we can look at your individual situation and help determine if it’s the right time for you.

EARLY FORECASTS FOR THE 2025 housing market…an Infographic

Keeping Current Matters, 9.6.24

Some Highlights:

If you’ve been thinking about making a move in 2025 and have been wondering what to expect, here’s what expert forecasts say lies ahead.

- Mortgage rates will come down slightly.

- More homes will sell.

- And prices will rise more moderately.

It’s never too early to start thinking about how the 2025 market will affect you if you have been considering a move.

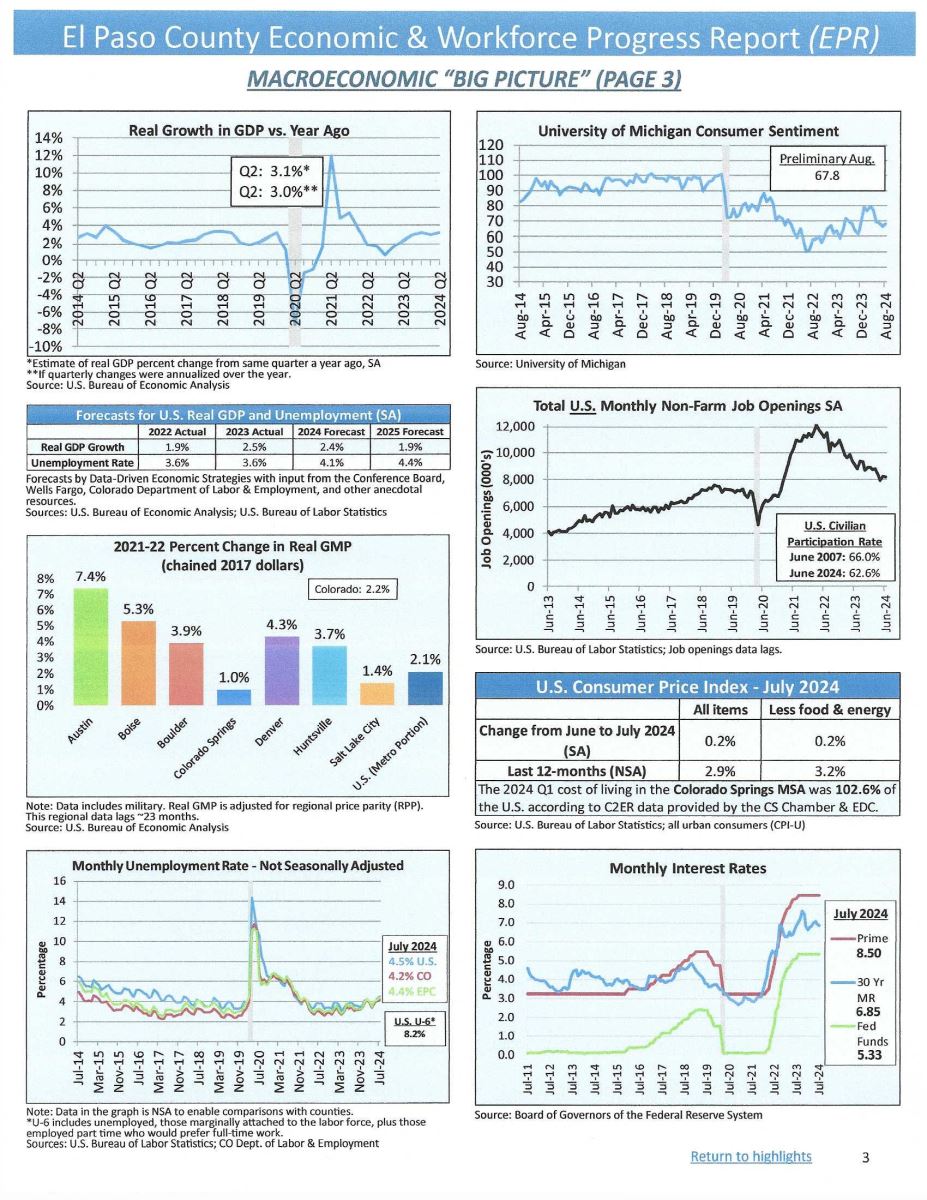

ECONOMIC & WORKFORCE DEVELOPMENT REPORT

Data-Driven Economic Strategies, August 2024

As always, I like to share the useful data I receive from our “local economist”, Tatiana Bailey. You will see in these charts what’s happening locally in terms of the economy as well as the most recent Workforce Progress Report.

This information is especially invaluable to business owners; however, I know you all will all find it worthwhile reading.

Below is a reproduction of the first page of graphics. To access the full report, please click here. And if you have any questions, give me a call.

UCCS ECONOMIC FORUM

Registration is open for the annual UCCS Economic Forum on September 26th at the Ent Center for The Arts.

Get ready for a day filled with insightful economic trends, valuable connections, and plenty of opportunities to learn and grow.

Doors open at noon.

To register and for more information, click on the link below:

I hope to see you there.