HARRY'S BI-WEEKLY UPDATE 10.23.24

October 23, 2024

HARRY’S BI-WEEKLY UPDATE

A Current Look at the Colorado Springs Residential real estate Market

As part of my “Special Brand of Customer Service”, it is my desire to share current Residential real estate issues that will help to make you a more successful and profitable Buyer and Seller.

.png)

THE QUESTIONS KEEP ON COMING…… My Answers Remain the Same.

Is now a good time to buy or sell?

What’s going to happen with mortgage rates?

Should I wait until next year?

Well, I don’t have a crystal ball, but I can give answers based on my 51 plus years in the local Residential real estate arena coupled with my background in Investment Banking.

It’s always a good time to buy and sell depending on your individual situation. As I’ve said time and again, there are always those who want or need to buy and those who want or need to sell. That’s been true for my entire career and will likely hold true for years to come.

What also has held true, most especially in the Colorado Springs area is that home prices are not likely to go down and ARE likely to continue to rise. Each month you don’t buy you are likely losing equity and thus losing greater wealth for you and your family.

As you will see later in this eNewsletter, more folks here and nationally are entering the market at a time that is normally slower than in the spring and summer months.

Why is that? I’ve explained it below but suffice it to say that many folks have been waiting the last few years to either buy for the first time, sell and trade up or downsize. Whatever the reason, more homes are entering the market at present and that’s a plus for buyers.

The pickings have been sparce during the last year or so when mortgage interest rates were rising. Now that they are on their way down, although fluctuating, folks who have been sitting on the fence are ready to jump in.

Yes, interest rates are still somewhat high but as I’ve said before…shopping around for rates can result in some happy surprises. Lenders are chomping at the bit to lend and are doing everything possible to work with buyers.

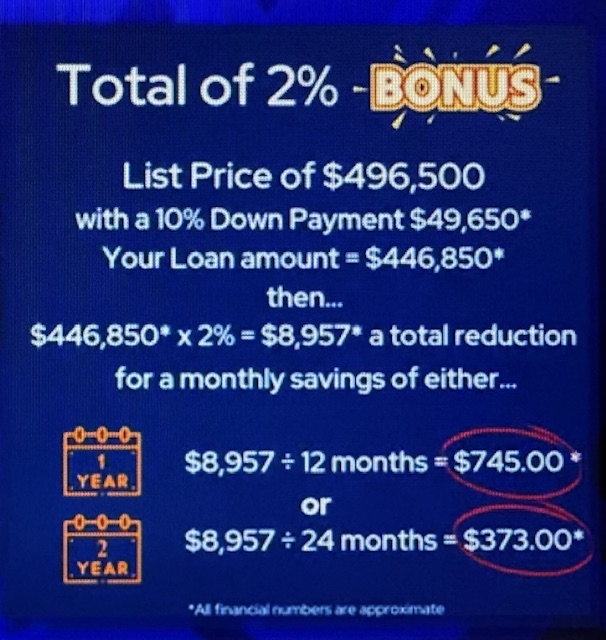

You can also find some sellers, as well as home builders, who are offering a “buy down”—essentially help with lowering the interest rate for a set period of time until you are able to refinance and lower the interest rate yourself. (see my YouTube video link below)

Some of these options can sound confusing but that’s why you’ve got me. I’ve been around for most every cycle imaginable and know the in’s and out’s of it all so you don’t have to. I can work with your needs, wants and budget requirements to help you find something that is just the right fit for you and your family.

Perhaps you’ve waited until after election day to buy or sell? Well, that day will soon be here.

Perhaps you want to wait until next year to buy or sell? That day will soon be here as well.

It’s not too early to start implementing a plan for your 2025 buying or selling needs and the sooner we start talking, the sooner you will have that plan ready and you’ll be that much further ahead of those who wait.

I look forward to meeting with you sooner than later because as you’ll see as you read further down…Time is of the Essence…. or “the early bird gets the worm” as they say. In this case, the early bird gets the opportunity to grow their personal assets first. I like to see my clients get a jump on the rest as I know the excellent opportunities of which they can avail themselves.

Give me a call today at 719.593.1000 or email me at Harry@HarrySalzman.com and together let’s see how your Residential real estate dreams can become reality in the best time frame for you.

And, if you’ve got two minutes, check out my new and improved video podcast and discover how you can purchase a fabulous home at a “buy down” on the mortgage which essentially means a lower monthly payment for the first year or two. Here’s a picture of a chart I featured in the video. If you have any questions, just ask.

(*all financial numbers are approximate)

Click on the link below and you will be directed to my personal YouTube channel.

While you’re at it you might want to subscribe to my channel, so you won’t miss future broadcasts. It won’t cost you anything…well, it could cost you… if you miss some of my informative musings!)

MORE PEOPLE ARE LISTING THEIR HOMES RECENTLY…WHY?

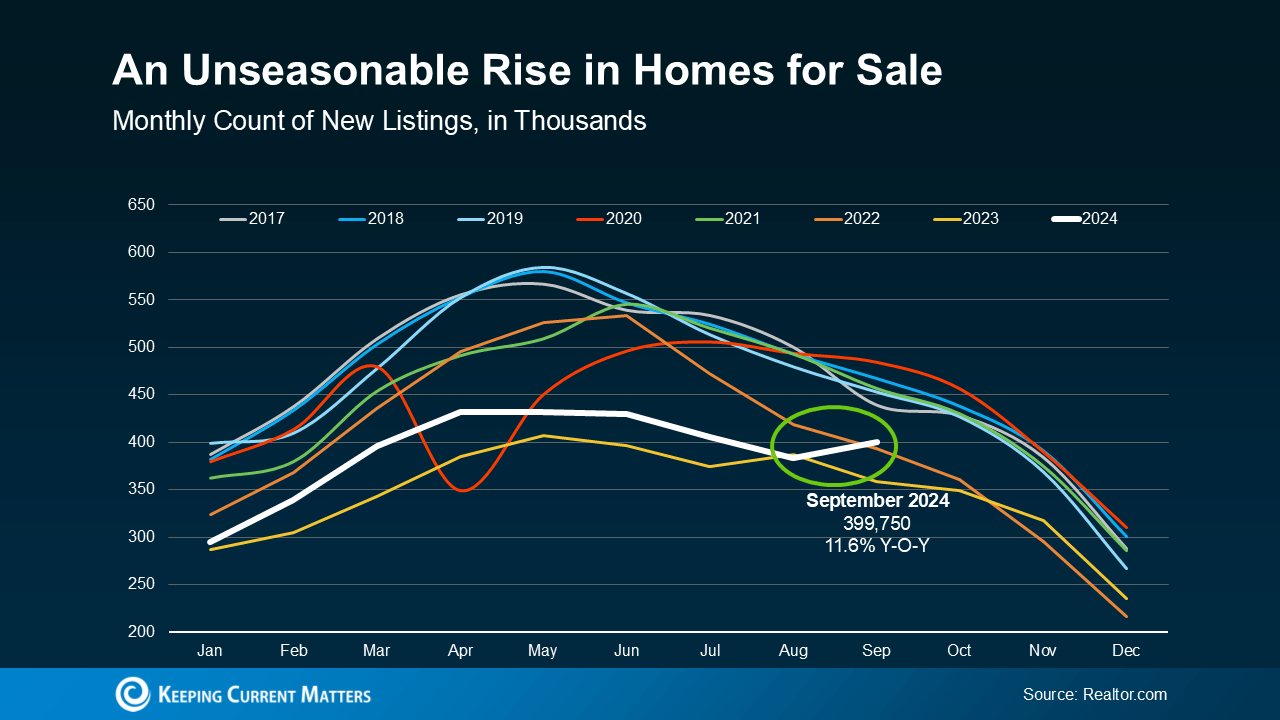

Keeping Current Matters, 10.17.24

As I mentioned earlier, most “normal” or “traditional” housing cycles see around 40% of the buying and selling take place between April and June each year.

Well, there’s been nothing quite “normal” in the Residential real estate market for some time now. This year we saw mortgage interest rates come down at the same time the number of homes on the market usually starts to decline. So, what happened? More homeowners decided to sell, so more homes came on the market. This is true here in Colorado Springs as well as nationally.

The most recent data from Realtor.com reveals that in September the number of homes put up for sale increased by 11.6% nationally compared to this time last year. Locally, we saw an increase in listings of 7.1% in single-family/patio homes and 34.4% for condo/townhomes.

As the green circle in the graph below shows, the typical September decline nationally in homes coming to the market did not happen—the number actually went up. See below:

Ralph McLaughlin, senior economist at Realtor.com explains why there was an unseasonable rise: “This sharp increase is largely due to the decline in mortgage rates in mid-August, enticing homeowners to sell.”

So, What Does This Mean If You’re Looking to Buy a Home?

It means more fresh options to choose from than you have had for a while—not the ones that have simply been sitting around unsold.

However, keep in mind that mortgage rates have been ticking up a bit slightly in recent weeks, which could limit the number of folks who feel comfortable with the idea of selling in the months ahead. And in the recent market, it’s mortgage rates that are largely driving homeowner decisions.

Why Buy Now, Rather Than Wait?

As I mentioned earlier, whether you are looking for a starter home, an upgrade or hoping to downsize, you have more homes from which to choose right now. And if you can find what you are looking for, remember that these new fresh options won’t be on the market forever.

One month does not make a trend. So, what does that mean going forward? Whether more homeowners continue to put their homes on the market will largely depend on what happens with the mortgage rates and the economic factors that impact them, like inflation, employment and the reactions by the Federal Reserve.

With that in mind—if you are ready, willing and able, now might be the best moment while more homes are available.

Lawrence Yun, chief economist at the National Association of Realtors (NAR) explains:

“The rise in inventory—and, more technically, the accompanying months’ supply—implies home buyers are in a much-improved position to find the right home and at more affordable prices.”

Bottom Line?

Once again—if you are ready, willing and able—NOW is the time for us to get together and see how we can make all the above work for your individual situation. Just give me a call and we can get the ball rolling.

AND IN THE SAME VEIN….an Infographic

Keeping Current Matters, 10.18.24

A Few Highlights:

- You may be torn between buying a home now or waiting. But don’t forget to factor in the equity you’ll gain as prices rise as well as the greater choices you have now.

- Experts forecast prices will climb over the next 5 years—and based on those forecasts you could gain about $90k in equity in that time.

- You could wait, but you’ll miss out on a lot of equity if you do. So why not start growing your wealth now in a home that fits your present and future life.

- Once again…. let’s talk and see if this is the right time for you. Call me at 719.593.1000 today.

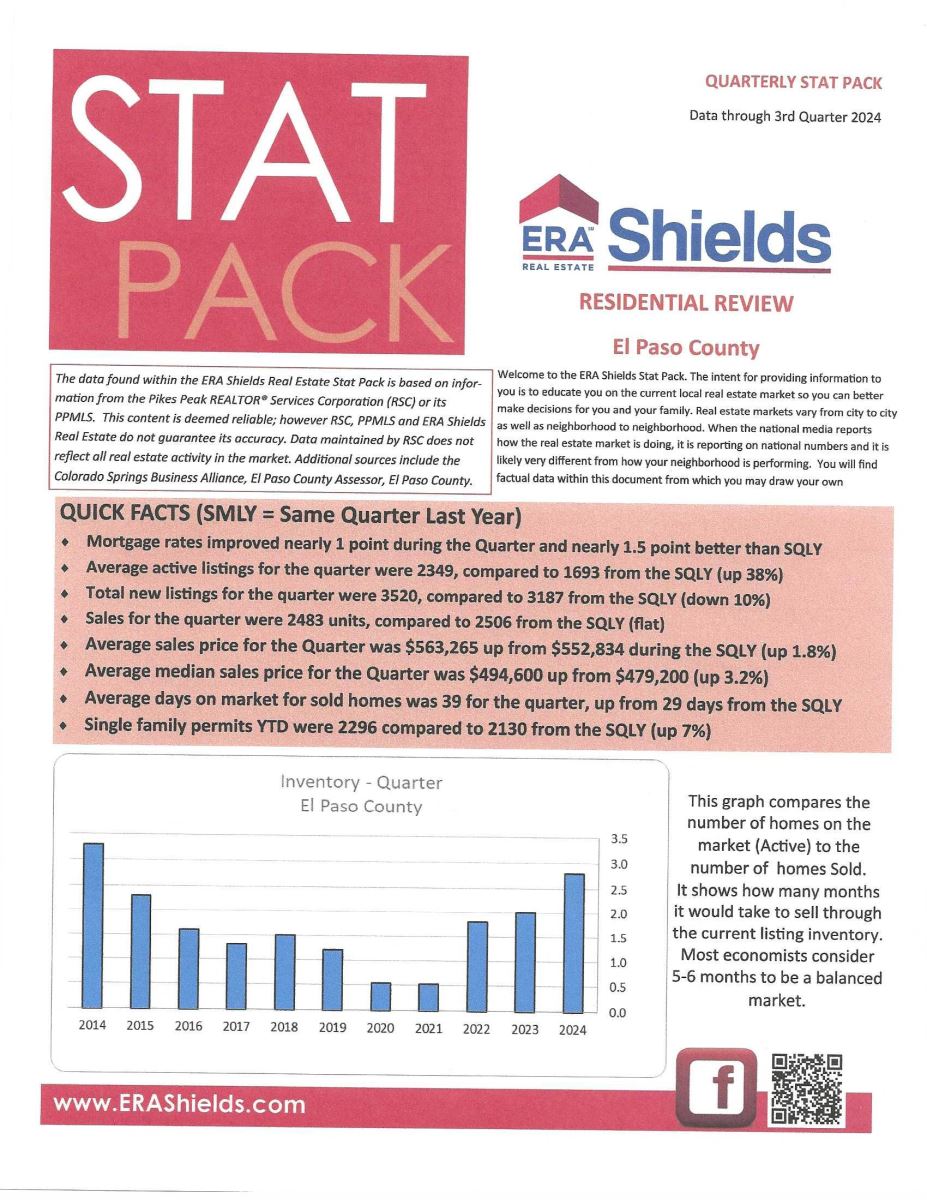

ERA SHIELDS QUARTERLY STAT PACK

Data through September 2024, ERA Shields

Here is data from my company’s quarterly “Stat Pack” that can better help you understand the local buying and selling reality. I have reproduced the first page, and you can click here to get the report in its entirety.

FEATURED LISTING:

It’s the one I featured in my YouTube video link above with the “buy down” offer.

Be sure to check it out. I don’t expect it to last long.