HARRY'S BI-WEEKLY UPDATE 8.21.24

August 21, 2024

HARRY’S BI-WEEKLY UPDATE

A Current Look at the Colorado Springs Residential real estate Market

As part of my “Special Brand of Customer Service”, it is my desire to share current Residential real estate issues that will help to make you a more successful and profitable Buyer and Seller.

FIRST UP…A WORD FROM ME…

I’ve briefly explained some important news in my latest podcast, so if you’ve got 2 minutes and 28 seconds, you will get a brief idea of the new changes that affect all Residential real estate transactions nationwide effective last Saturday. These are explained in greater detail in the article below.

Click on this link to watch my podcast: https://youtu.be/4u15MWmxnaU

WHAT TO KNOW ABOUT RESIDENTIAL real estate COMMISSION CHANGES

The Wall Street Journal 8.15.24

As I mentioned above, change is in the air, and these are some of the biggest changes in decades to the way real estate agents get paid. The National Association of Realtors (NAR) reached a landmark settlement earlier this year over commissions, and as of last Saturday, August 17, most of its 1.5 million members will be subject to the new rules.

Here is a synopsis of some things home buyers and sellers need to know.

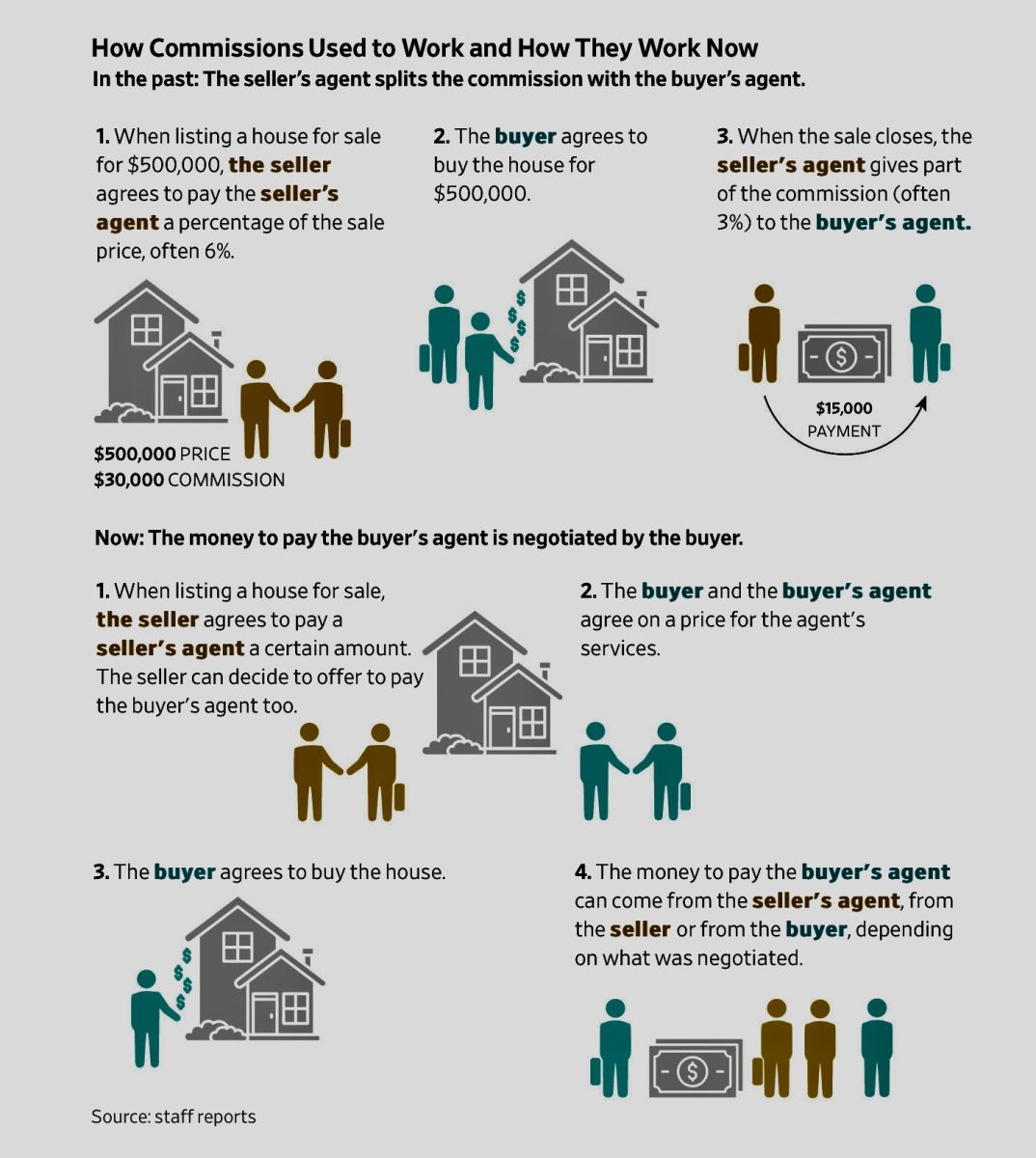

How did the system work up until last Saturday and how is it changing:

For the last 30 or more years the seller has typically paid the agents on both sides of a home sale transaction and decided how much both agents get paid. Usually, sellers agreed to pay their agent a certain amount—often 5% or 6% of the sale price—and the seller’s agent split this with the buyer’s agent. When a home was listed for sale, the listing says how much the buyer’s agent can expect to be paid.

Two main changes are now happening. First, listings in local multiple-listing services (MLS) will no longer show whether a seller is offering to pay a buyer’s agent, or how much. Second, buyers will be required to sign agreements specifying how much their agent will be paid. Buyers will do this before they start looking at homes with agents.

This means that buyers should negotiate directly with their agents instead of letting the seller decide how much the buyer’s representative earns.

These changes are taking effect across most of the U.S., but not everywhere. They ARE taking effect in Colorado.

Is this going to bring home prices down?

This does NOT mean that real estate agents’ commissions will go down. That will be up to buyers and what fees they negotiate with their agents.

If commissions do fall, buyers could benefit by paying lower home prices or sellers could benefit by keeping more profit, depending on how competitive and fast-moving the market is.

Am I eligible to receive money as part of the NAR settlement?

If you sold a home in the U.S. in the past decade or so you might be one of some 50 million sellers who are eligible for a modest payout.

I’m planning to buy a home soon. Do I need to use a real estate agent?

This depends on how much time you want to spend overseeing the home search and on your confidence as a skilled negotiator. Almost 90% of buyers used an agent in the year ended in June 2023, according to NAR.

However, like home sellers, home buyers can choose to skip the agent and go it alone or use an attorney instead.

If I do want to use an agent, how much will that cost?

You and your agent will agree on compensation upfront. Buyers’ agents today are usually paid a percentage of the sale price, often 2.5% or 3% but it differs from agent to agent.

You can also sign a non-exclusive agreement, so you can work with other agents too. However, most reputable agents such I will only work on an exclusive buyer relationship.

What if I want to just tour a home or go to an open house without committing to an agent?

The new rules require buyers to sign agreements with agents BEFORE touring homes. The agreement can be limited to just one home. But if you aren’t ready to commit, you can go to an open house without an agent. Open houses are hosted by the seller’s agent.

You can also ask sellers’ agents to give you tours. In that case, the seller’s agent isn’t working for you, unless you both agree otherwise.

Do I have to pay my agent myself?

No. As a buyer, you will be responsible for coming to an agreement with your agent about how much the agent will get paid. But you can always ask the seller to cover that cost so you don’t have to.

If the seller says no, you can sweeten your offer by raising the price. You can also walk away.

What if the seller is offering a different amount than what I have agreed to with my agent?

You have a couple of options to consider. Let’s say you have agreed to pay your agent $10,000, but then you find a home to buy and the seller has offered to pay a buyer’s agent $20,000. In that case, it is up to the seller what to do with the extra money. You can ask the seller to give that extra money back to you, either by lowering the purchase price or by giving you a concession.

Or let’s say you have agreed to pay your agent $10,000 but the seller is offering $5,000. You can still ask the seller to pay the full $10,000 when you make an offer to buy the home. You could also go back to your agent and try to renegotiate the fee.

I’m planning to sell my home soon. Should I offer to pay the buyer’s agent?

Sellers now have the flexibility to decide whether to offer a commission to a buyer’s agent. It is unethical for your agent to tell you that you must pay a commission or that if you don’t, agents won’t bring buyers to see your home.

Here are a few options:

- You can tell buyers’ agents upfront what you are planning to pay them. You can do this by offering to pay the buyer’s agent directly or by agreeing to pay both commissions to your agent to split with the buyer’s agent.

- You can offer a concession that buyers can use to compensate their agents or for other expenses, such as repairs and closing costs.

- You can offer nothing upfront. When buyers submit offers, they might ask you to compensate their agents.

What happens if a buyer’s agent already agreed to get paid less?

Your contract with your agent should specify whether you want to hold on to any surplus, or have it go to the buyer or to your agent.

What happens if the buyer for my home doesn’t have an agent?

In the past, when a buyer didn’t have an agent, the seller’s representative often kept the commission offered to a buyer’s agent. But you should negotiate upfront with your agent what would happen in that scenario. Your agent may want additional compensation because it may be more work to close the deal. You should also discuss whether your agent can agree to represent both sides, if it is allowed.

What do I do if I think my agent is breaking the rules?

If you believe your agent is breaking any of the rules explained above, you have a few options. You can find another agent. You can report the agent to your state’s real estate commission, to a local Realtor association or to an MLS which sets the rules for home listings. You can also speak to plaintiff attorneys involved in the settlements or consumer advocates.

Below is a chart published in The Wall Street Journal that gives you the changes in a nutshell:

Yes, it’s a lot to take in, even for folks like me and I’ve been working in this industry for 51+ years and have a background in Investment Banking. We’ve had numerous meetings with our local Pikes Peak Realtors Association (PPAR) and others over the summer and I’m more than happy to explain these changes to you in greater detail.

Just give me a call at 719.593.1000 or email me at Harry@HarrySalzman.com and we can discuss any questions you might have in regard to these changes or anything else.

I hope to be speaking with you soon.

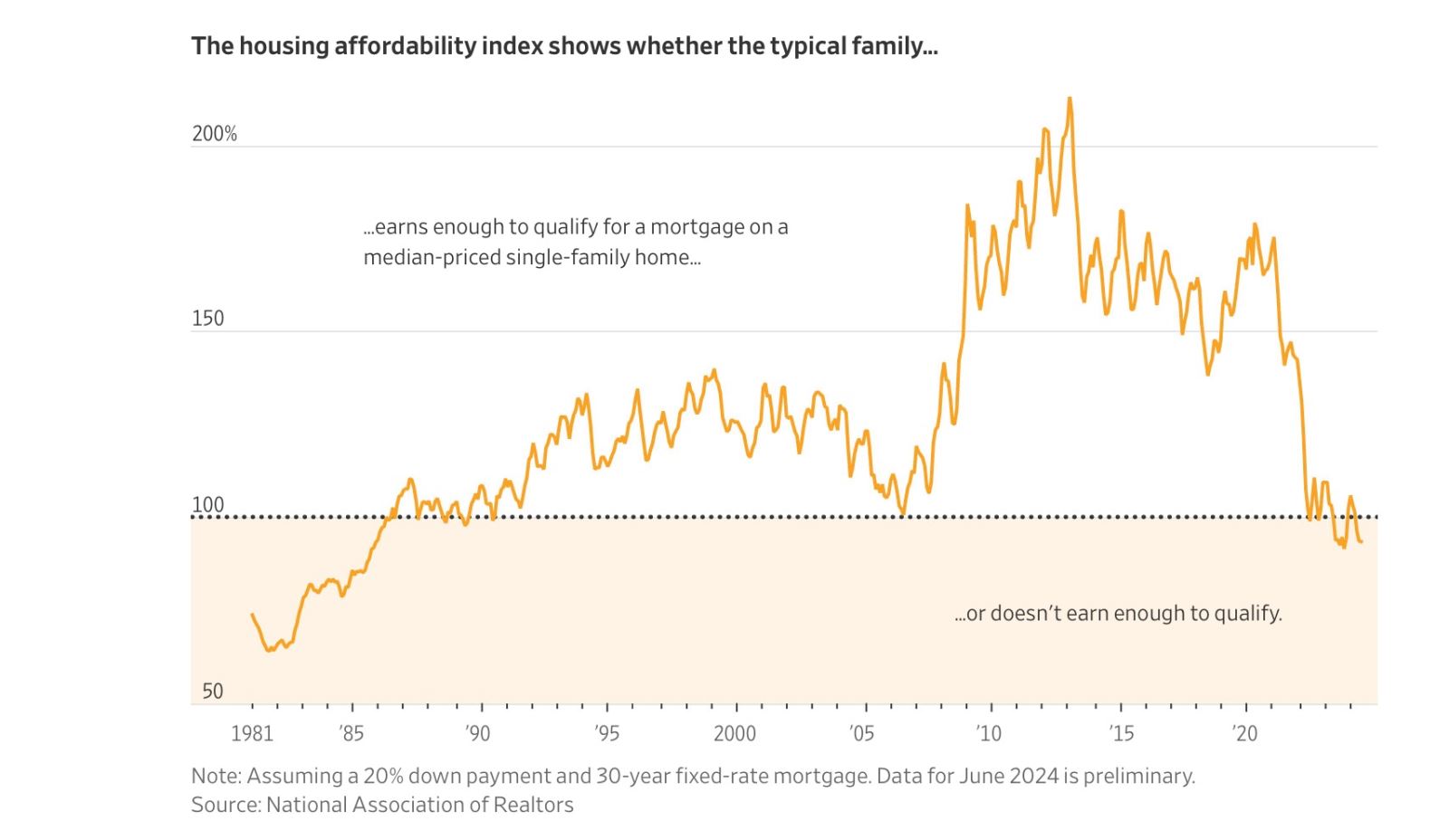

HOUSING SUPPLY, OR RATHER, LACK OF IT…IS MAKING THE HOME BUYING MARKET THE TOUGHEST SINCE THE ‘80s…

The Wall Street Journal, 8.12.24

Yes, mortgage rates are better now than they were in the 1980’s but greater supply back then led to better affordability.

Last fall home buying affordability dropped to the lowest level since September 1985, and it fell near that level again in June.

In 1985, millions of Americans were in their late 20’s and early 30’s, the prime first-time buying years. They also found themselves priced out of the market. However, because buyers in the mid-80’s had much more housing supply, homes became more affordable as mortgage rates fell in subsequent years.

First-time buyers today have it much harder. While affordability is likely to improve by year end if borrowing rates ease and inventory continues to grow, it won’t get significantly better without more home building, economists say.

The chart below shows the housing affordability index:

The chart above is based on national statistics and as I’ve always said, “real estate is local”—meaning that the affordability of folks here is considerably better than nationally. However, that said, we are still suffering from a low supply of existing homes for sale and that is keeping a number of folks from becoming homeowners.

Recent local stats are looking better in terms of people listing homes for sale and I’m hopeful that as interest rates ease more we will see more of those who have been sitting on the fence making their moves (literally) and the supply of available homes for sale will grow.

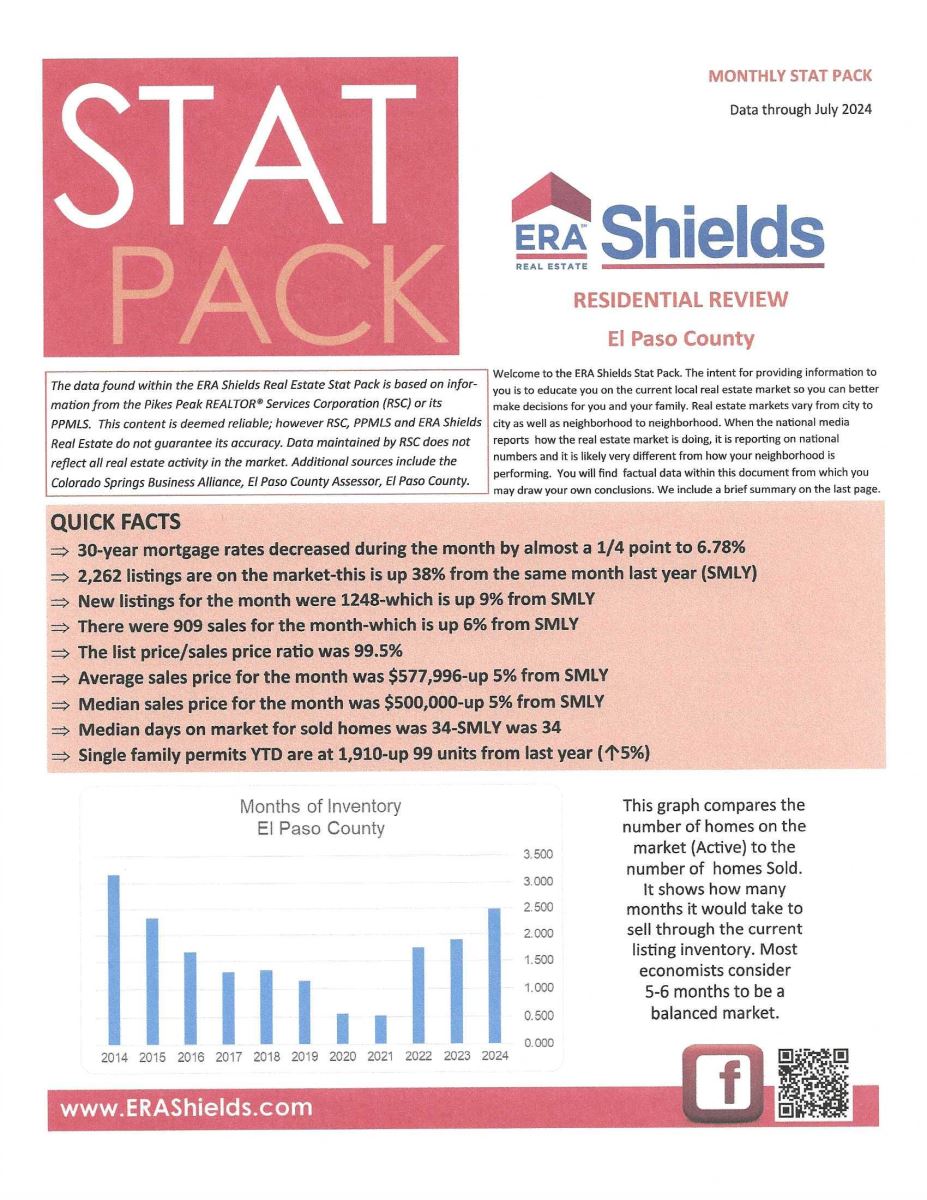

ERA SHIELDS STAT PACK

Data through July 2024, ERA Shields

Here is data from my company’s monthly “Stat Pack” that can better help you understand the local buying and selling reality. I have reproduced the first page, and you can click here to get the report in its entirety.