HARRY'S BI-WEEKLY UPDATE 10.10.24

October 10, 2024

HARRY’S BI-WEEKLY UPDATE

A Current Look at the Colorado Springs Residential real estate Market

As part of my “Special Brand of Customer Service”, it is my desire to share current Residential real estate issues that will help to make you a more successful and profitable Buyer and Seller.

MORTGAGE RATES HAVE FALLEN TO THEIR LOWEST LEVEL IN TWO YEARS… BUT BUYERS AND SELLERS ARE STILL MOVING SLOWLY

Last week the average 30-year mortgage rate dropped to 6.08% from 7.31% one year ago. The last time the average rate was lower was on September 15, 2022, when it was 6.02%. And rates for 15-year fixed rate mortgages rose a bit from 5.15% to 5.16% last week, according to Freddie Mac.

While these rates are certainly better, they don’t appear to be incentive enough to convince those who have been waiting to sell to enter the market. And why is that?

Well, several reasons come to my mind. To begin with there are those who refinanced when rates were historically low several years ago and they don’t want to give up those low rates.

Then there are those who are waiting for the Federal Reserve to lower the Fed Fund rate even more in hope that mortgage interest rates will follow.

And lastly, there are those who are waiting for the outcome of the Presidential election before committing to a move.

All of these reasons are understandable and when you look at the new statistics below you can see how they are affected by the above reasons.

Compared to a year ago in single-family/patio homes, sales are down, new listings are holding steady, and home values are holding their own. The median sales price is up 2.1%.

For condos/town homes most everything is up compared to last year.

The biggest take from all of this is that home values are not going down and are continuing to rise.

What does that mean if you have been sitting on the fence when it comes to making a move? Well, you’re going to pay more for your new home than you might today. So, the possibility of a lower interest rate might not make a lot of difference if your new home costs more than it would today.

I don’t have a crystal ball and can’t predict what will happen to rates or what will happen in the Presidential election. But I can say with conviction that home prices are not going to be going down anytime soon, if ever.

As I’ve always said and will repeat again—there are always those who need or want to buy and those who need or want to sell.

What that means is that there are always going to be potential buyers for your home if you are thinking of making a move. Homes are not going to sell in record time with multiple offers over list price, but if your home is priced right, you are likely to find a buyer.

Listings are slowly going up as I mentioned and as that continues there will be much more competition for your home than if you put it on the market now. With fewer available homes for sale, your home is likely to get more attention today.

How does this affect you? If you’ve even been thinking of making a move, NOW is a great time. It’s never too early for us to get together and see how we can begin to get a better picture of how to take your wants, needs and budget requirements and use them for the best outcome for you and your family.

With 51+ years in the local Residential real estate arena couple with my investment banking background, I’m your guy when it comes to helping you put all the pieces of the buying and selling process together.

Simply email me at Harry@HarrySalzman.com or call me at 719.593.1000 and let’s get started today.

And, if you’ve got one minute and 59 seconds, check out my new and improved video podcast. Click on the link below and you will be directed to my personal YouTube channel.

While you’re at it you might want to subscribe to my channel, so you won’t miss future broadcasts. It won’t cost you anything…well, it could cost you… if you miss some of my informative musings!)

To my Jewish friends and clients, I’d like to wish you a very healthy, happy New Year.

Now for statistics…

SEPTEMBER 2024

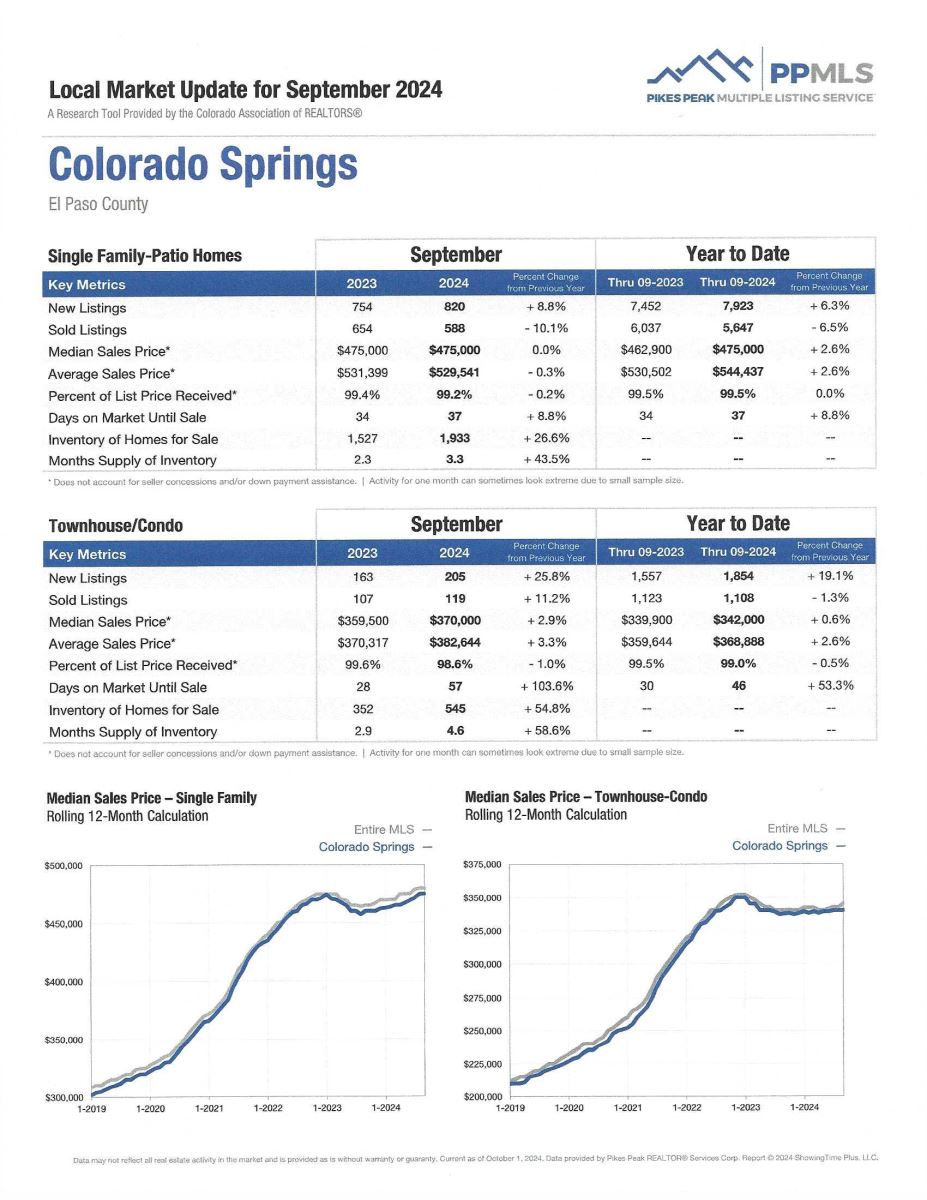

Statistics provided by the Pikes Peak REALTORS Service Corp., or it’s PPMLS

Here are some highlights from the September 2024 PPAR report. You might note that while homes are selling at close to asking price as in the past several months, the days on the market are a bit longer. I expect both to change if interest rates go down more.

In El Paso County, the average days on the market for single family/patio homes was 40. For condo/townhomes it was 55.

Also in El Paso County, the sales price/list price for single family/patio homes was 99.2% and for condo/townhomes it was 98.7%.

In Teller County, the average days on the market for single family/patio homes was 63 and the sales/list price was 97.7%.

Please click here to view the detailed 10-page report, including charts. If you have any questions about the report or to find out how it relates to your individual situation, just give me a call.

In comparing September 2024 to September 2023 for All Homes in PPAR:

Single Family/Patio Homes:

· New Listings were 1,331, Up 7.1%

· Number of Sales were 933, Down 7.4%

· Average Sales Price was $535,023, Down 1.1%

· Median Sales Price was $485,000, Up 2.1%

· Total Active Listings are 3,392, Up 36.6%

· Months Supply is 3.65, Down 4.9%

Condo/Townhomes:

· New Listings were 250, Up 34.4%

· Number of Sales were 140, Up 6.9%

· Average Sales Price was $385,706, Up 4.4%

· Median Sales Price was $370,000, Up 5.7 %

· Total Active Listings are 627, Up 71.3%

· Months Supply is 4.5, Up 10.4%

SEPTEMBER 2024 MONTHLY INDICATORS AND LOCAL MARKET UPDATE ILLUSTRATE OUR LOCAL TRENDS IN DETAIL

Colorado Association of REALTORS® , Pikes Peak REALTORS Service Corp, or it’s PPMLS

Providing greater detail than the above report, this contains information on both El Paso and Teller counties for Residential real estate.

The “Activity Snapshot” for all residential properties in El Paso and Teller counties shows the Year-to-Date one-year change:

- Sold Listings for All Properties were Down 7.2%

- Median Sales Price for All Properties was Up 0.1%

- Active Listings on All Properties were Up 29.6%

You can click here to read the 16-page Monthly Indicators or click here to get specific information on the geographical are of your choice from the 18-page Local Market Update. It’s a good idea to check out your own area or one that you might be considering in order to get a good idea of the local pulse. As an example, here is a detailed report on the Colorado Springs area:

THE TOP THREE REASONS AFFORDABILITY IS IMPROVING

Keeping Current Matters, 10.4.24

Some Highlights:

- Affordability is based on three key factors: mortgage rates, home prices and wages.

- Today, it’s improving quickly as rates come down, prices level off, and wages climb.

- If you’ve put your search on pause, now is the perfect time to get ready to jump back in. Give me a call today and let’s see how all three factors can work for you.

AND ONE OF THE QUESTIONS I’M ASKED THE MOST…” BUY NOW OR WAIT UNTIL AFTER THE PRESIDENTIAL ELECTION?”

Keeping Current Matters, 9.27.24

Bottom Line:

- If you, like many others, are wondering if you should wait until after the election or buy now here’s what you might want to know:

- If you wait for rates to drop more, you’ll likely have to deal with more competition and higher prices when additional buyers jump back in the market. But if you buy now, you’ll be getting ahead of that and have the chance to start building equity now.

- I can help you look at all the options and see what could work best for your individual situation.

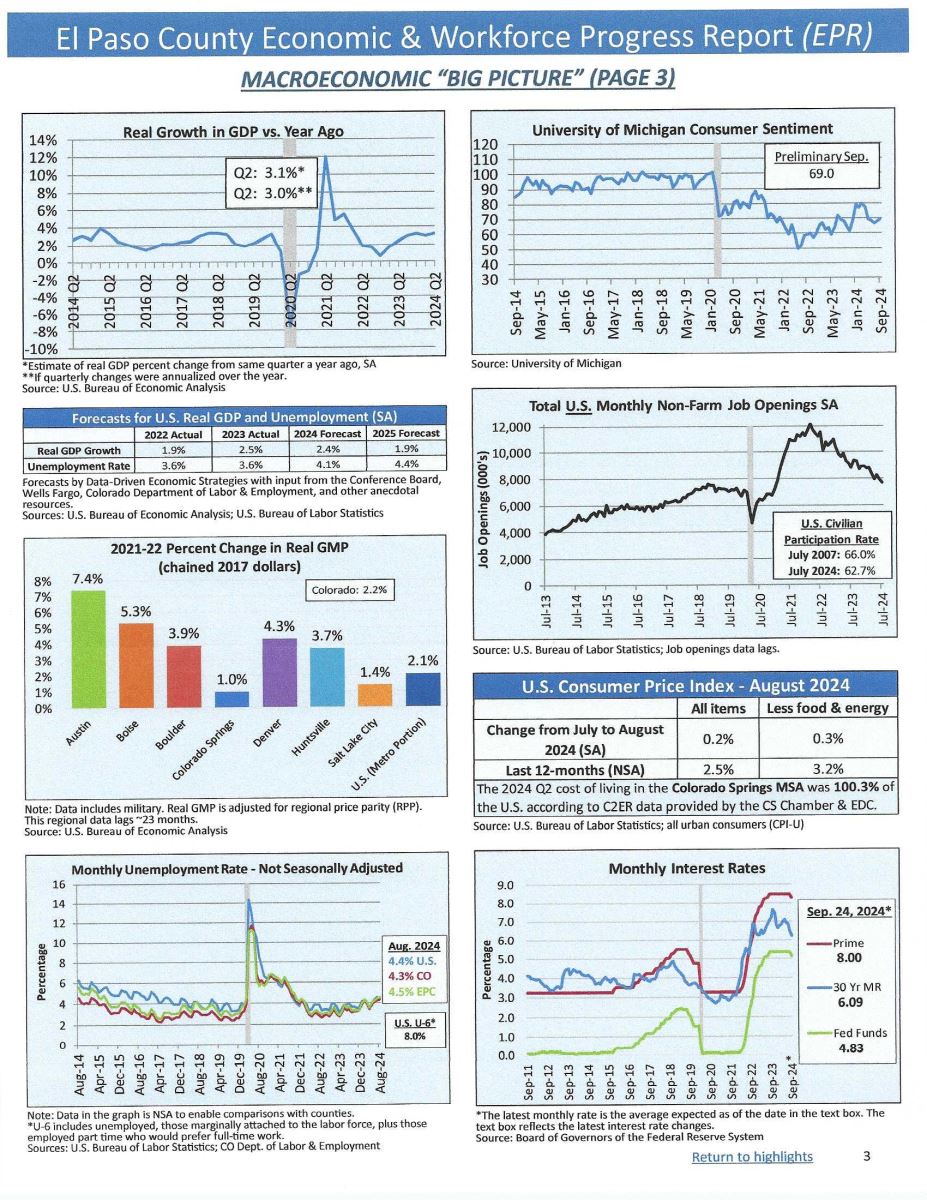

ECONOMIC & WORKFORCE DEVELOPMENT REPORT

Data-Driven Economic Strategies, September 2024

As always, I like to share the useful data I receive from our “local economist”, Tatiana Bailey. You will see in these charts what’s happening locally in terms of the economy as well as the most recent Workforce Progress Report.

This information is especially invaluable to business owners; however, I know you all will all find it worthwhile reading.

Below is a reproduction of the first page of graphics. To access the full report, please click here. And if you have any questions, give me a call.

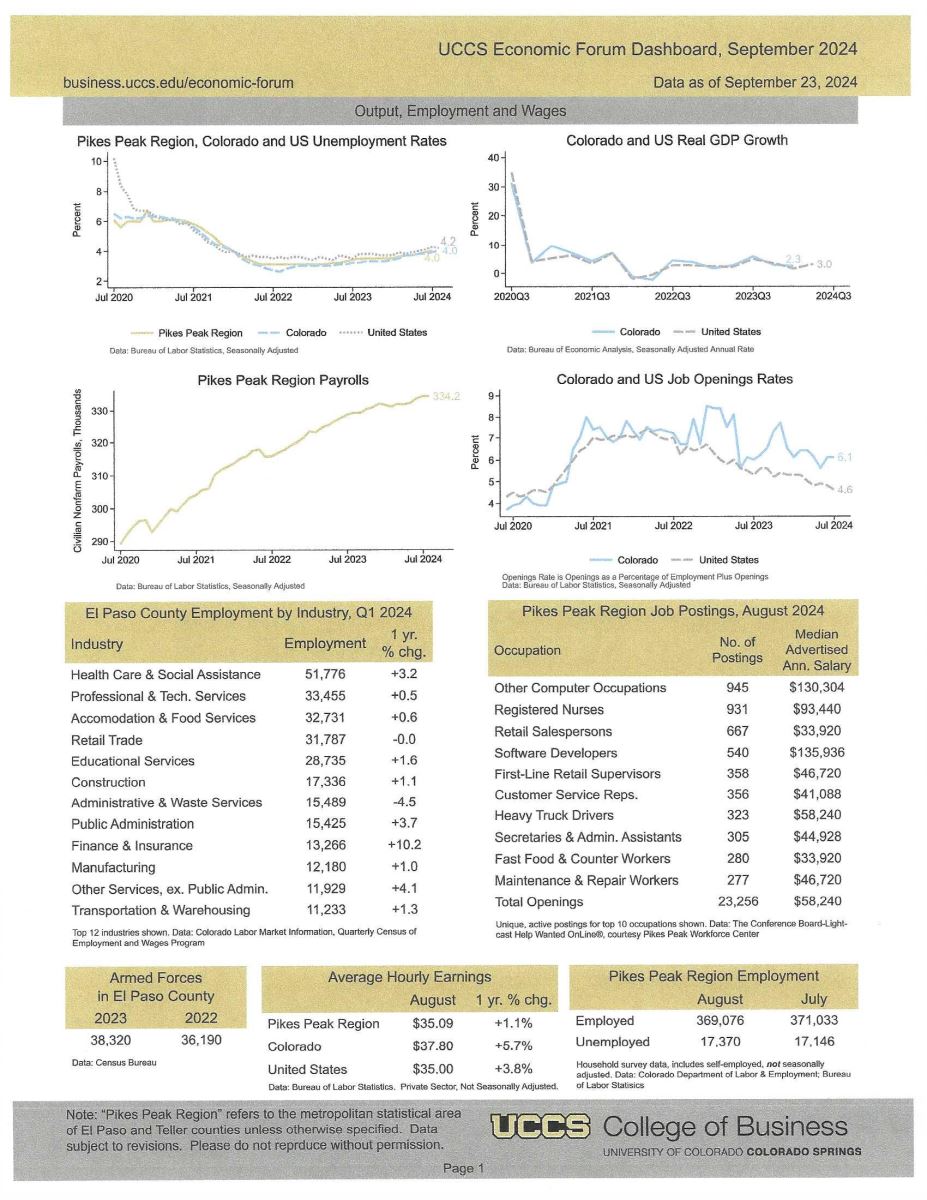

UCCS ECONOMIC FORUM MONTHLY DASHBOARD

Updated September 2024, UCCS College of Business/Economic Forum

Here is the monthly report from the UCCS College of Business Economic Forum. It is created by professor Dr.Bill Craighead, who is the Forum Director. He also publishes an on-line “Weekly Economic Snapshot” you might enjoy.

I know several of you who like statistics and use this information in your daily business life, and I will share it with you when I receive it each month.

I’ve reproduced the first page of the charts below. To access the report in its entirety, please click here.