HARRY'S BI-WEEKLY UPDATE 4.9.25

April 9, 2025

HARRY’S BI-WEEKLY UPDATE

A Current Look at the Colorado Springs Residential real estate Market

As part of my “Special Brand of Customer Service”, it is my desire to share current Residential real estate issues that will help to make you a more successful and profitable Buyer and Seller.

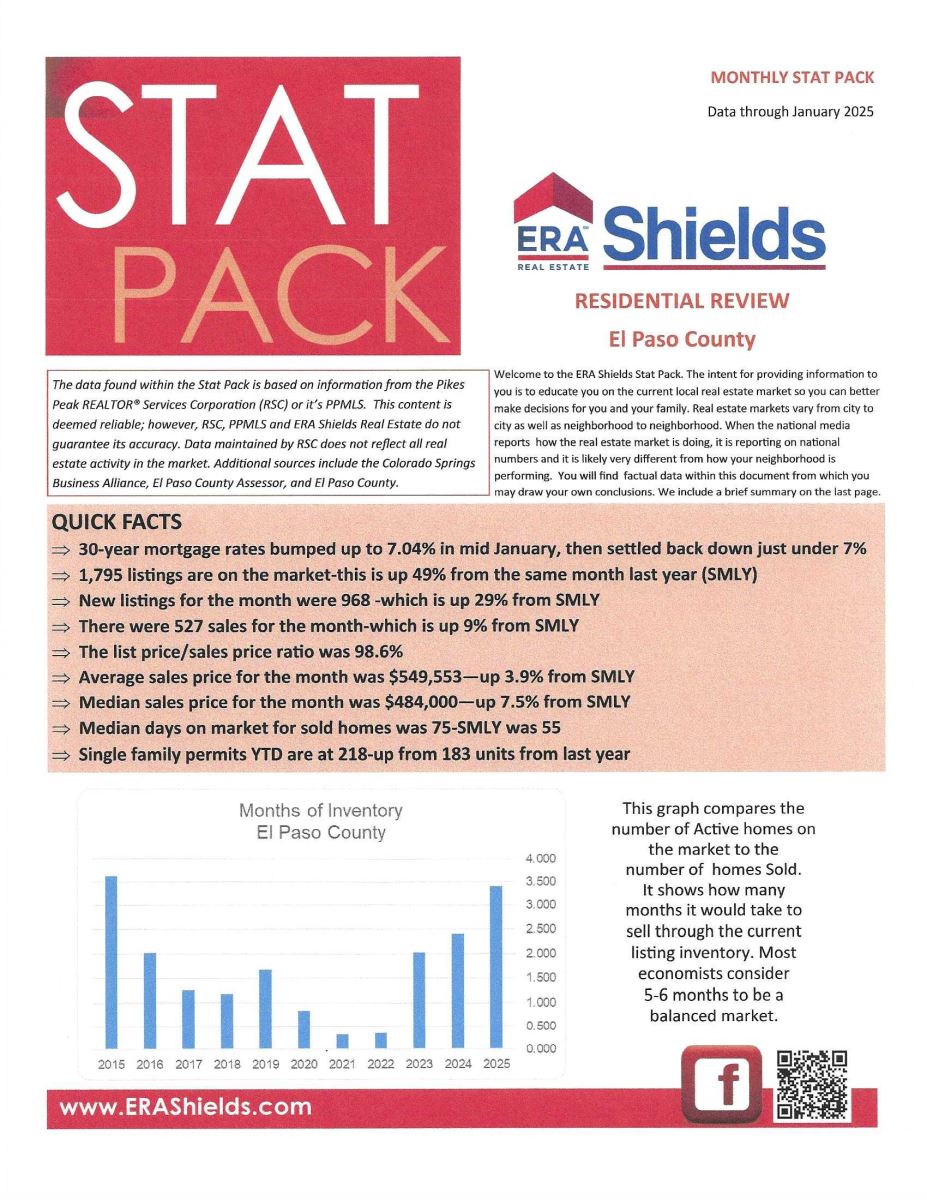

TRUER WORDS HAVE NEVER BEEN WRITTEN…. ABOUT MANY THINGS IN LIFE…BUT ESPECIALLY WHEN IT COMES TO RESIDENTIAL real estate

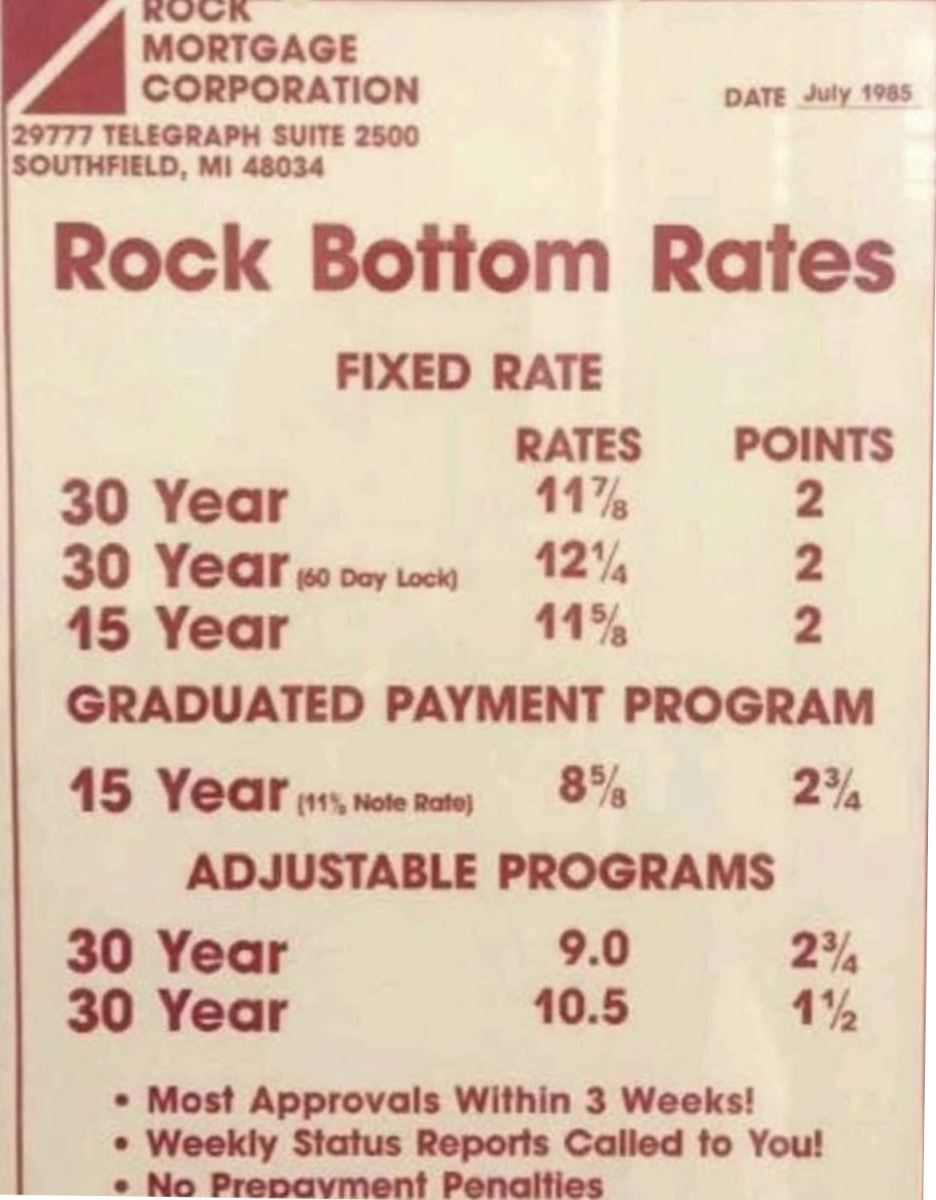

Having been in the local Residential real estate arena for 52 years this month, I can attest to the above. I’ve heard from many folks that they are “waiting for the right time” and when the “right time” gets here the homes often cost more and the interest rates are not as favorable.

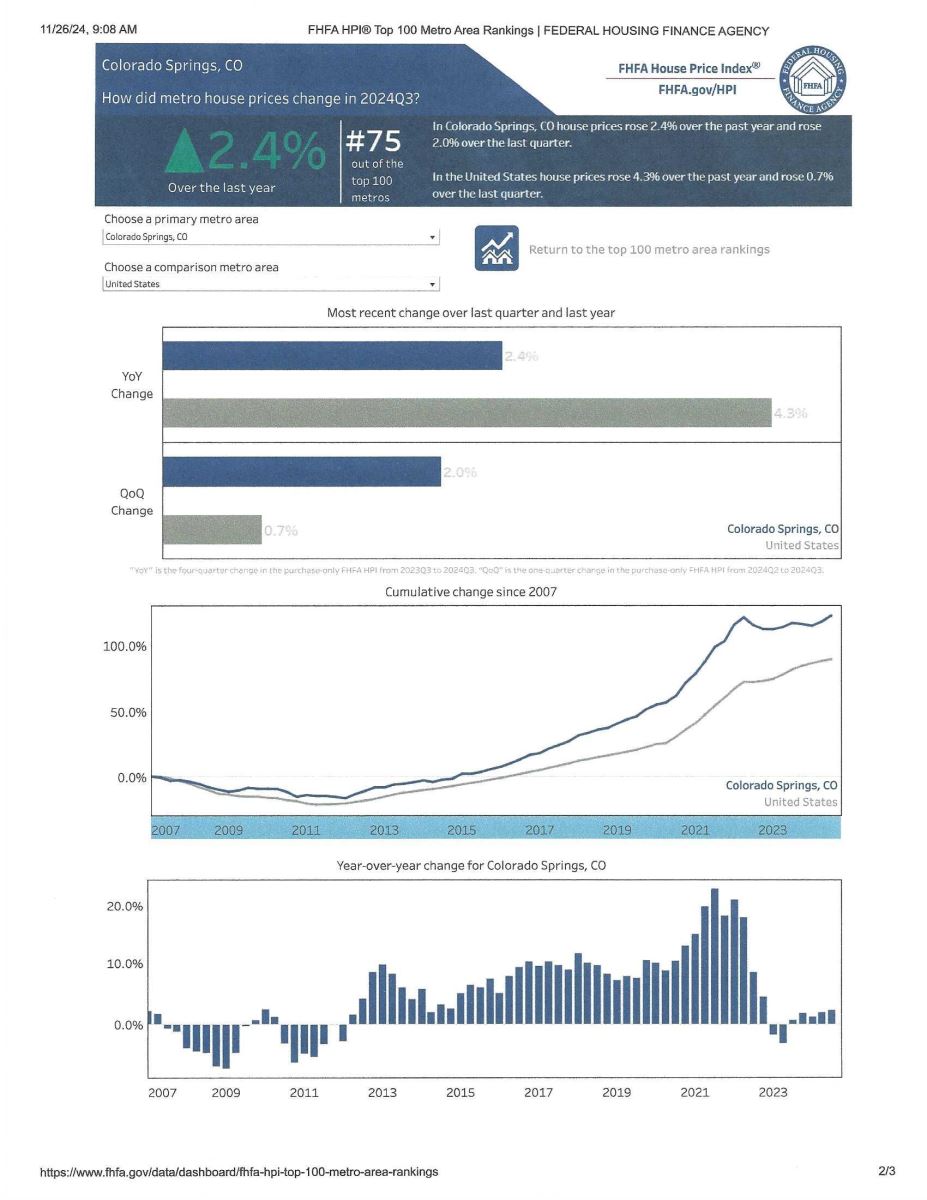

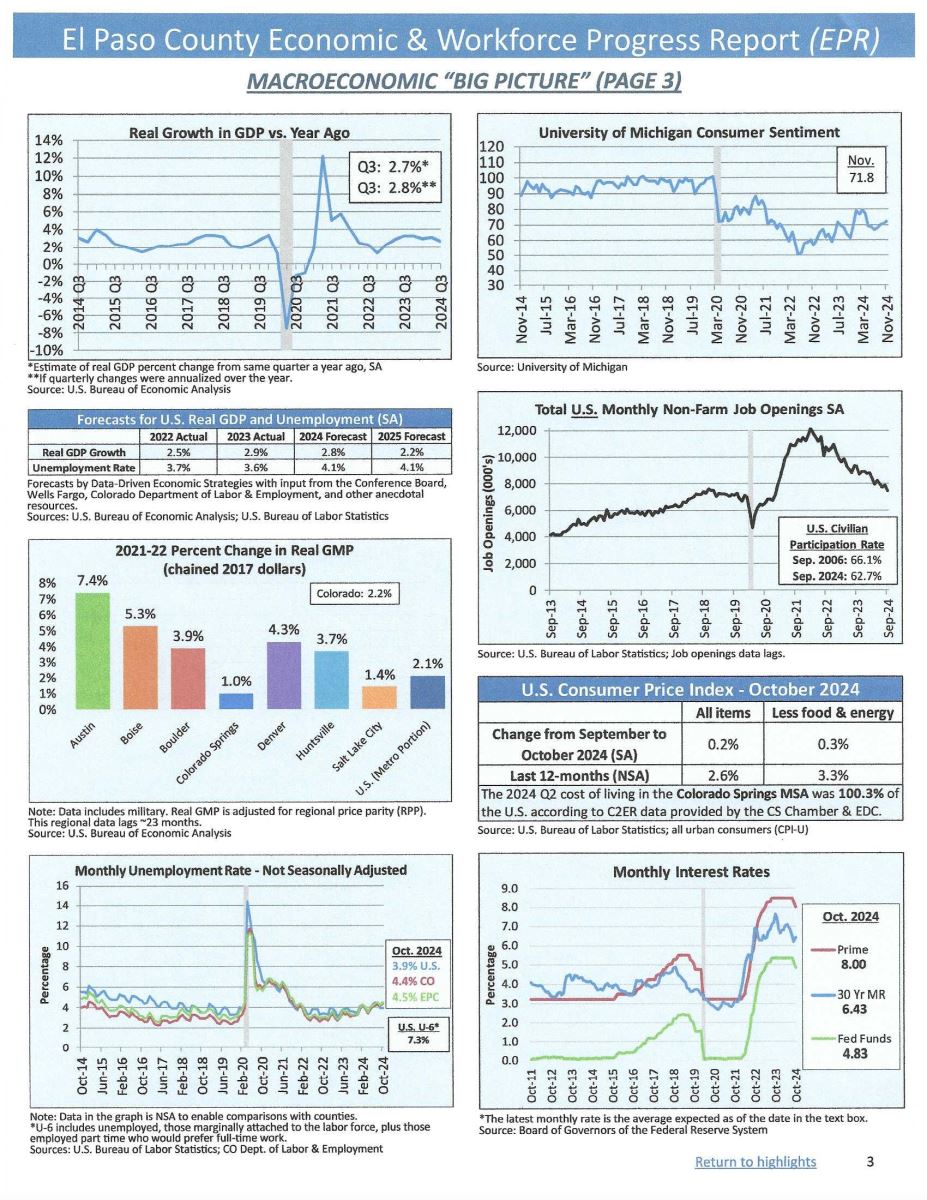

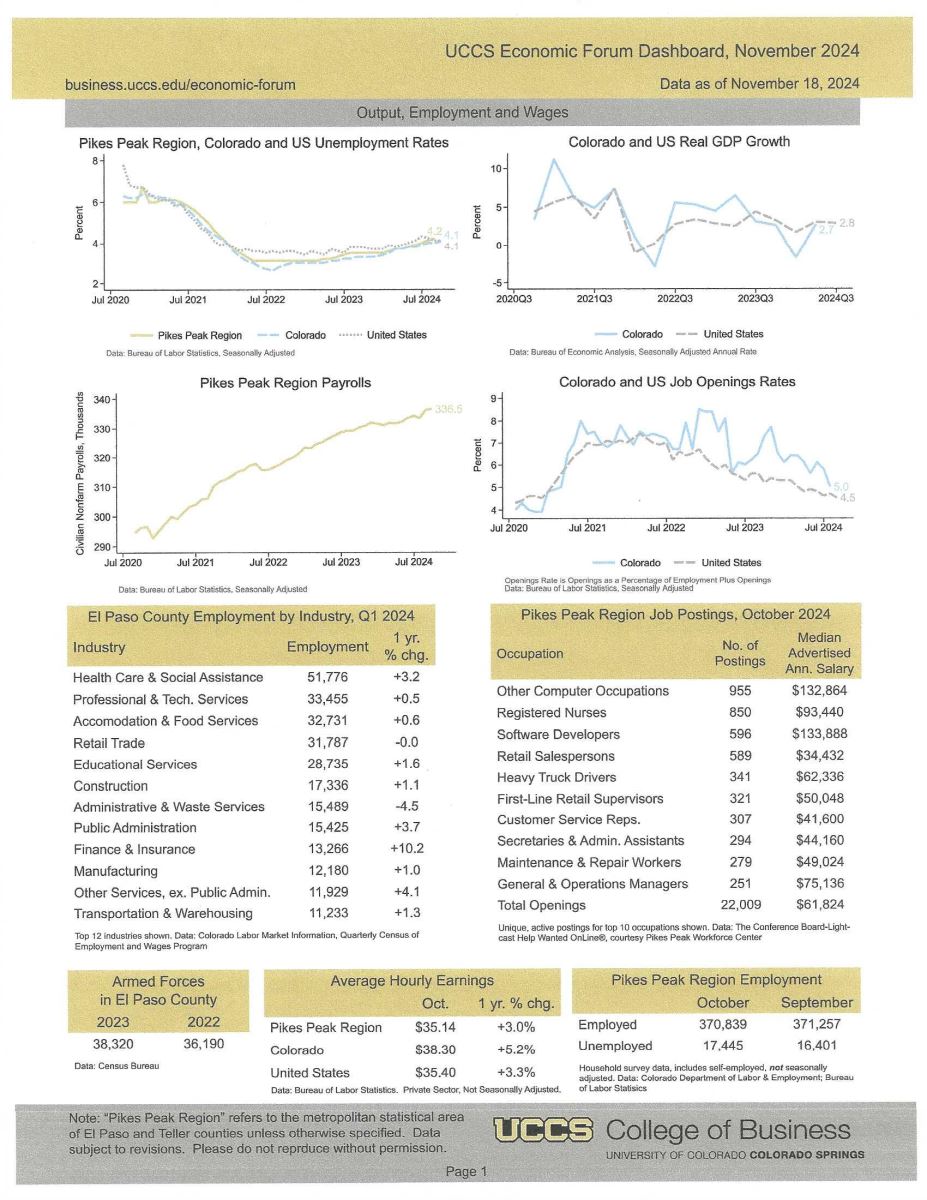

I CAN tell you this. Home prices in the Colorado Springs are not going down anytime soon and while interest rates have been fluctuating in recent times, they have been trending lower since reaching over 7% in January.

Speaking of interest rates, those are often negotiable depending on your individual situation. Banks are making some concessions and so are new home builders.

Folks who were waiting to see if homes would be more affordable are finding that those homes just keep appreciating and the longer they wait the more they will be paying or they might be priced out of the home they really want.

But more importantly, with home prices only getting higher, homes purchased at today’s rate can likely be refinanced at a later date if and when rates decline. And all the while your new home is appreciating in value.

And let’s talk about that value for a moment. As many of you are aware, I started my career as an Investment Banker, and I still follow the financial and commodities markets daily. Even if you never follow the markets, you can’t help but hear about the recent stock market swings that are happening now.

Good news for homeowners:

Time and again it’s been a fact that real estate has outperformed the stock and bond markets over the long haul.

That’s not just me speaking. Most economists have stated the same thing. And, for most families, home ownership is their most important financial investment.

So where is this going?

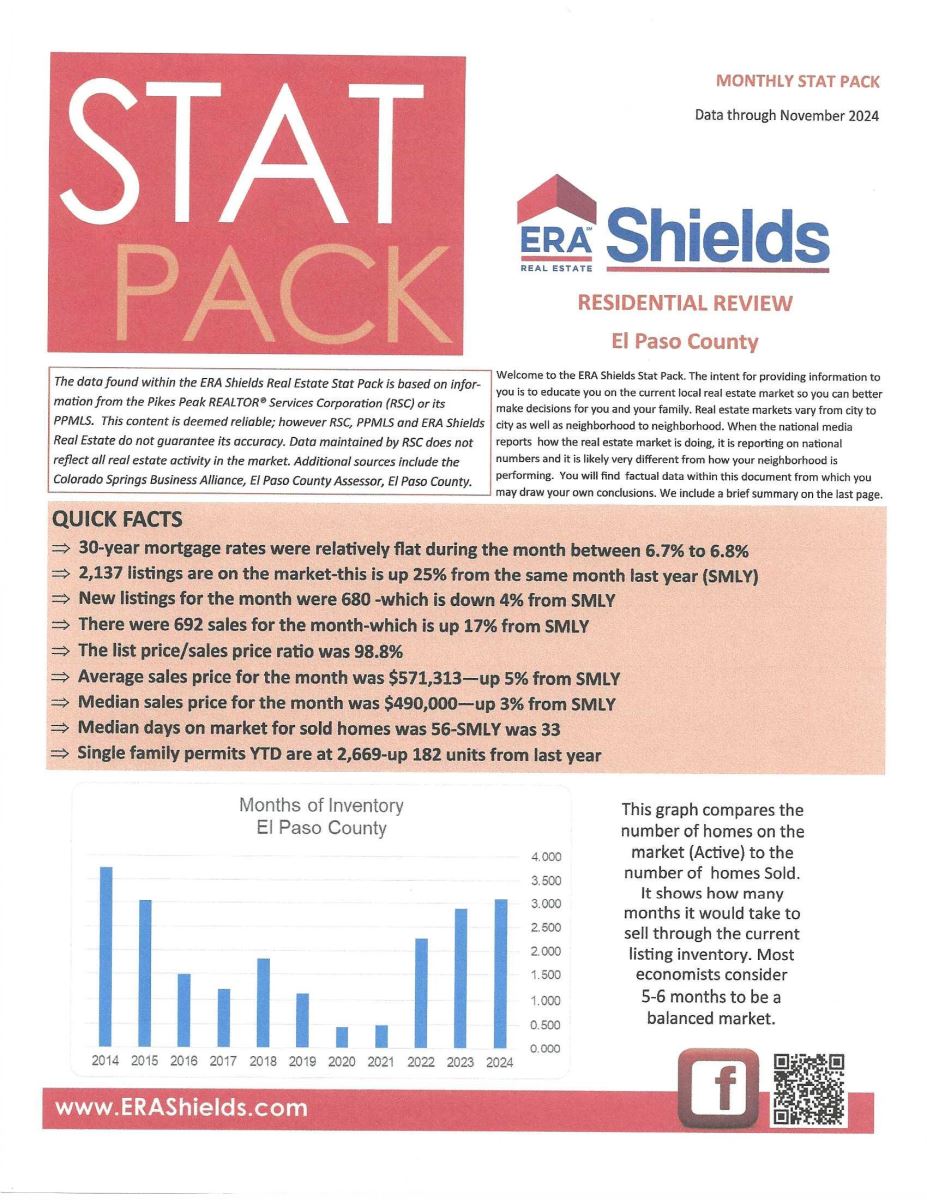

If you look at the monthly local statistics below you will see that home appreciation locally just keeps on moving up and with the spring buying and selling season now underway, you can see we are getting more listings and more sales.

Yes, it is still taking a bit longer to sell a home, but there are buyers out there for most every type of property and if you are looking to sell and trade up or move to another neighborhood or state, that extra time can also give you time to look for your new home without having rush as much as in the market frenzy of several years ago.

With the spring buying and selling season now upon us, if you’re even thinking about making a move, now’s the time to talk about all things Residential real estate. With listings on the rise, and interest rates slowly dropping, the time to get a hold of me is “as soon as possible” so you’ll be ahead of those just tiptoeing in.

Together we can look at your individual wants, needs and budget requirements and find out what can work best for you and your family.

You can reach me at 719.593.1000 or by email at Harry@HarrySalzman.com and I’ve got the answers to your questions.

And now for statistics…

MARCH 2025

Statistics provided by the Pikes Peak REALTORS Service Corp., or it’s PPMLS

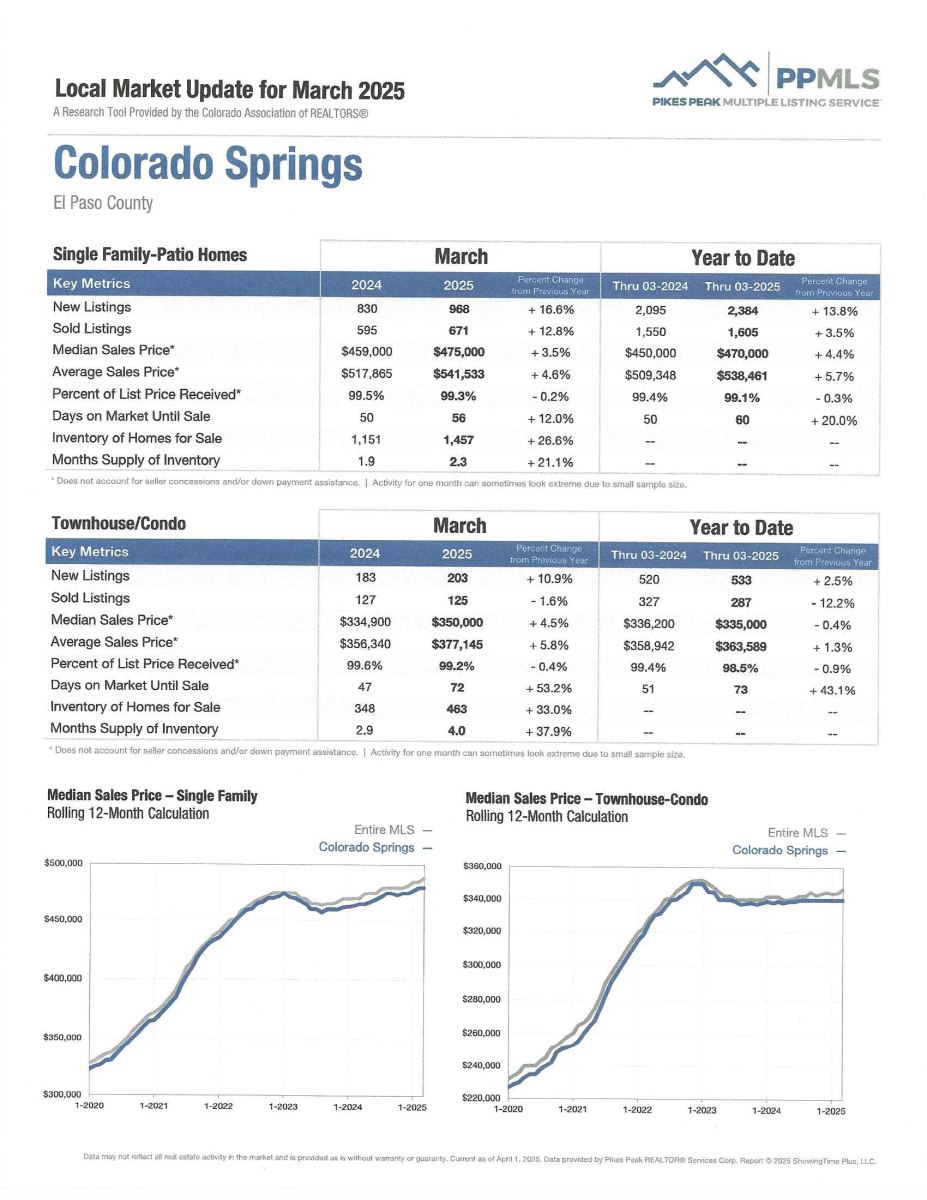

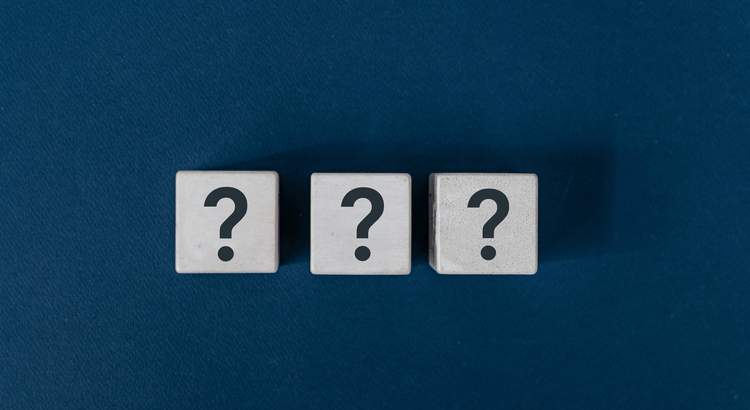

Here are some highlights from the March 2025 PPAR report.

In El Paso County, the average days on the market for single family/patio homes was 58. For condo/townhomes it was 73.

Also in El Paso County, the sales price/list price for single family/patio homes was 99.4% and for condo/townhomes it was 99.2%.

In Teller County, the average days on the market for single family/patio homes was 76 and the sales/list price was 97.5%.

Please click here to view the detailed 10-page report, including charts. If you have any questions about the report or to find out how it relates to your individual situation, just give me a call.

In comparing March 2025 to March 2024 for All Homes in PPAR:

Single Family/Patio Homes:

- New Listings were 1,677, Up 25.4%

- Number of Sales were 1,059, Up 12.5%

- Average Sales Price was $562,548, Up 6.6%

- Median Sales Price was $495,000, Up 5.3%

- Total Active Listings are 2,629, Up 40.7%

- Months Supply is 2.5

Condo/Townhomes:

- New Listings were 256, Up 16.4%

- Number of Sales were 142, Down 6.6%

- Average Sales Price was $377,140, Up 3.0%

- Median Sales Price was $364,975, Up 8.9 %

- Total Active Listings are 535, Up 47.0%

- Months Supply is 3.8

MARCH 2025 MONTHLY INDICATORS AND LOCAL MARKET UPDATE ILLUSTRATE OUR LOCAL TRENDS IN DETAIL

Colorado Association of REALTORS® , Pikes Peak REALTORS Service Corp, or it’s PPMLS

Providing greater detail than the above report, this contains information on both El Paso and Teller counties for Residential real estate.

The “Activity Snapshot” for all residential properties in El Paso and Teller counties shows the Year-to-Date one-year change:

- Sold Listings for All Properties were Up 10.0%

- Median Sales Price for All Properties was Up 4.2%

- Active Listings on All Properties were Up 27.9%

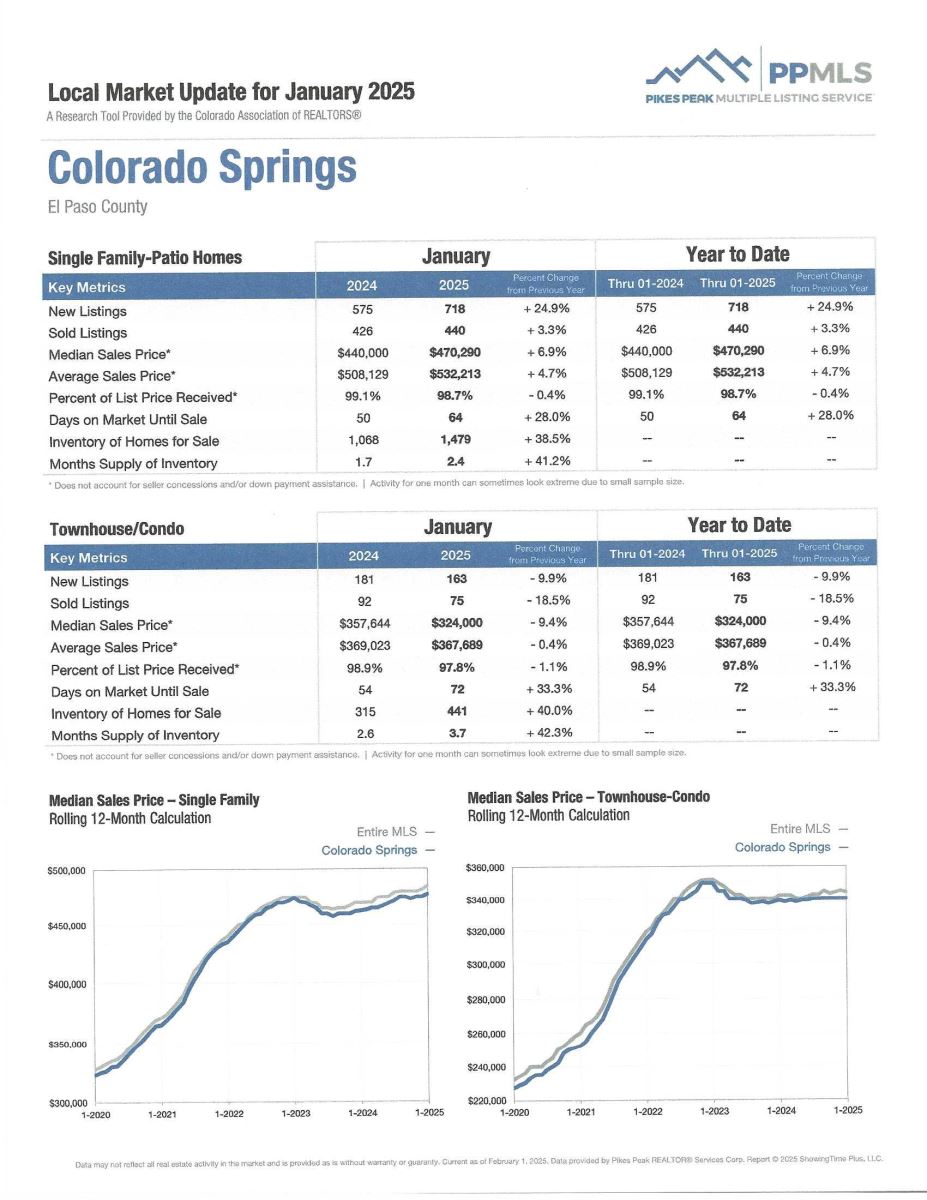

You can click here to read the 16-page Monthly Indicators or click here to get specific information on the geographical are of your choice from the 18-page Local Market Update. It’s a good idea to check out your own area or one that you might be considering in order to get a good idea of the local pulse. As an example, here is a detailed report on the Colorado Springs area:

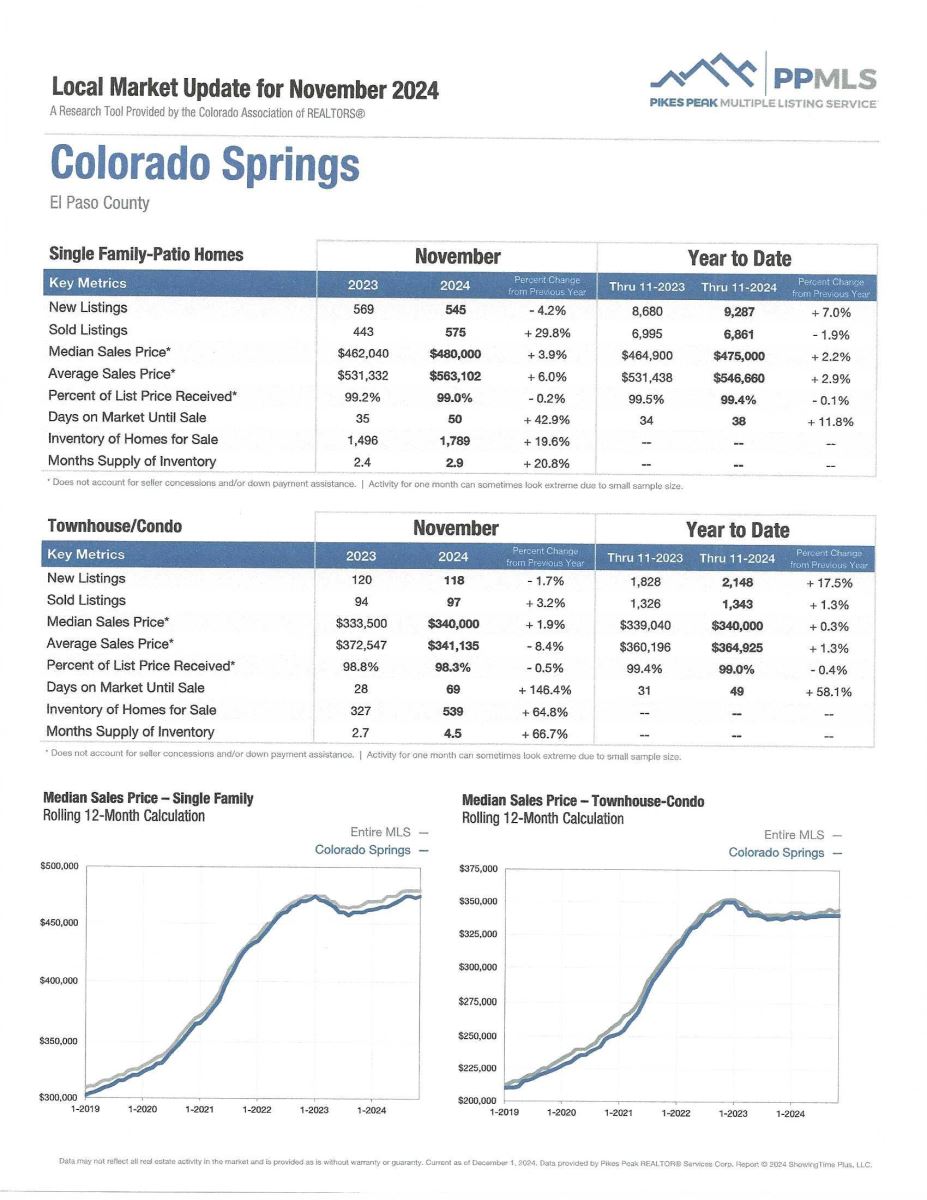

NATIONAL HOUSING TRENDS TO WATCH…an infographic

KeepingCurrentMatters, 3.28.25

SOME HIGHLIGHTS:

- At the national level, things have shifted in the past year. And, as you saw from the local statistics above, things have shifted here as well.

- There are more homes for sale, price growth has moderated a bit and homes are taking longer to sell.

- Any questions? Just give me a call.

SIGNS OF MORE BUYER-FRIENDLY housing market EMERGE

Associated Press, 4.8.25

For those that can afford to buy, this spring buying and selling season is starting out more favorable for home shoppers than it’s been in recent years.

Home prices, while still rising, are not appreciating quite as fast as several years ago—I call that “normalizing” ---so that’s a plus for today’s buyers.

More importantly though, the number of homes on the market both nationally and locally is up substantially from a year ago. And while inventory is still low by historical standards, active listings nationally surged last month by 28.5% on all homes for sale from one year ago. Locally our listings are up 27.9% over last year at this time—so about the same.

With homes taking longer to sell, prices have been dropping a bit which gives prospective buyers more leverage as they negotiate with sellers this spring.

Some sellers are even offering discounts to the listing price to get the deal “done”.

However, for the number of folks still priced out of the market, this isn’t likely to be a game-changer for them.

What it does mean is that if you have been looking to buy, this could be just the right market for you. But you won’t know unless you call me, and we can look at the whole picture to determine the best move for you and your family.

So, once again, if buying a new home is in your immediate future, the time to begin is now.

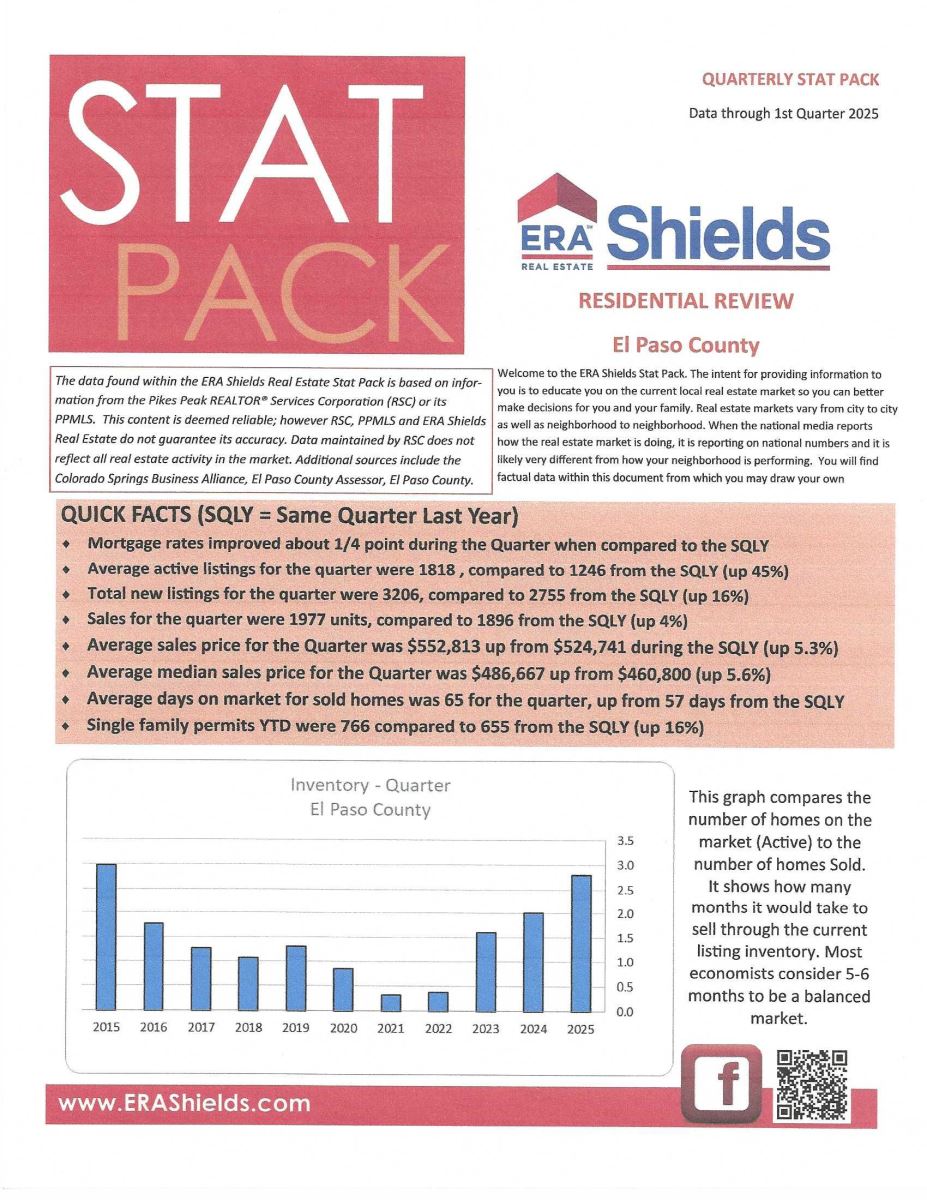

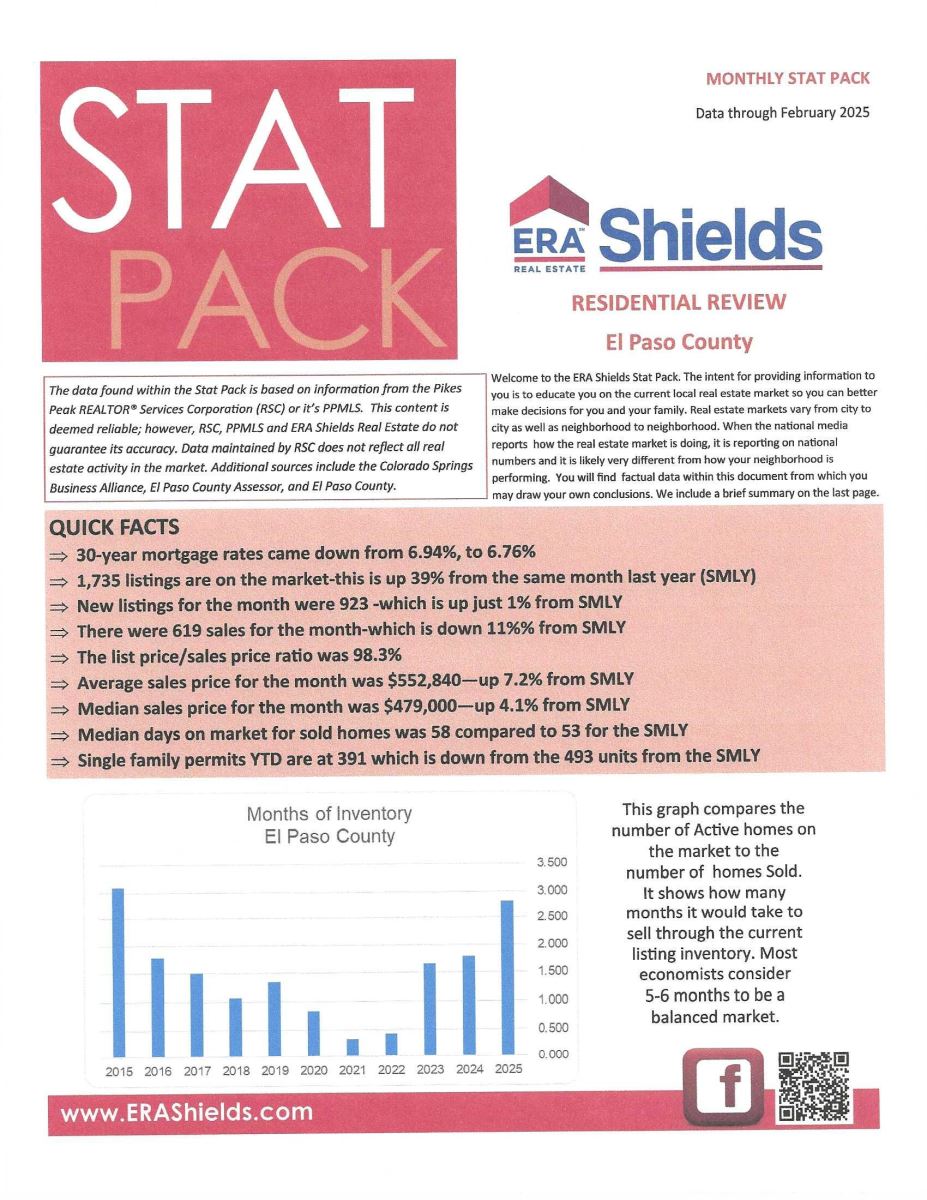

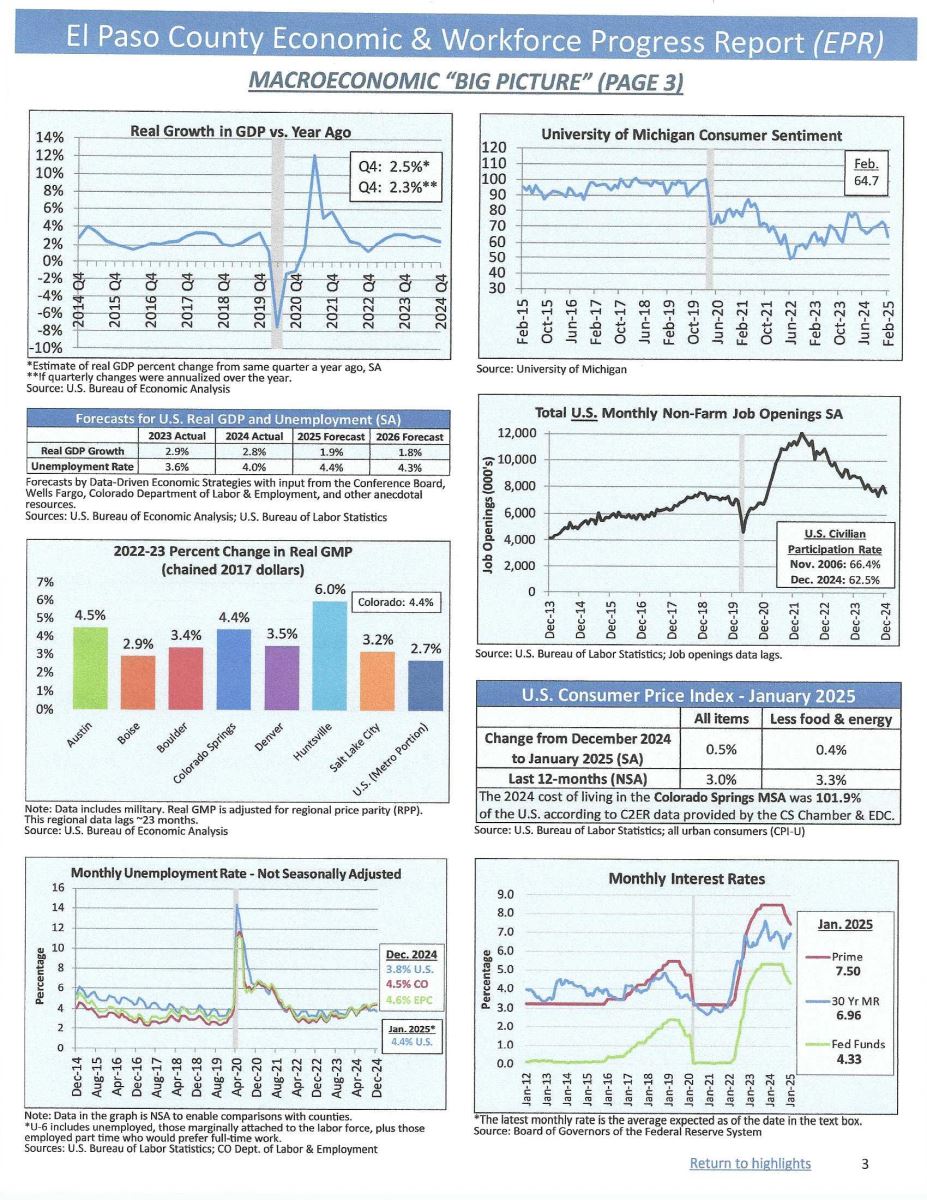

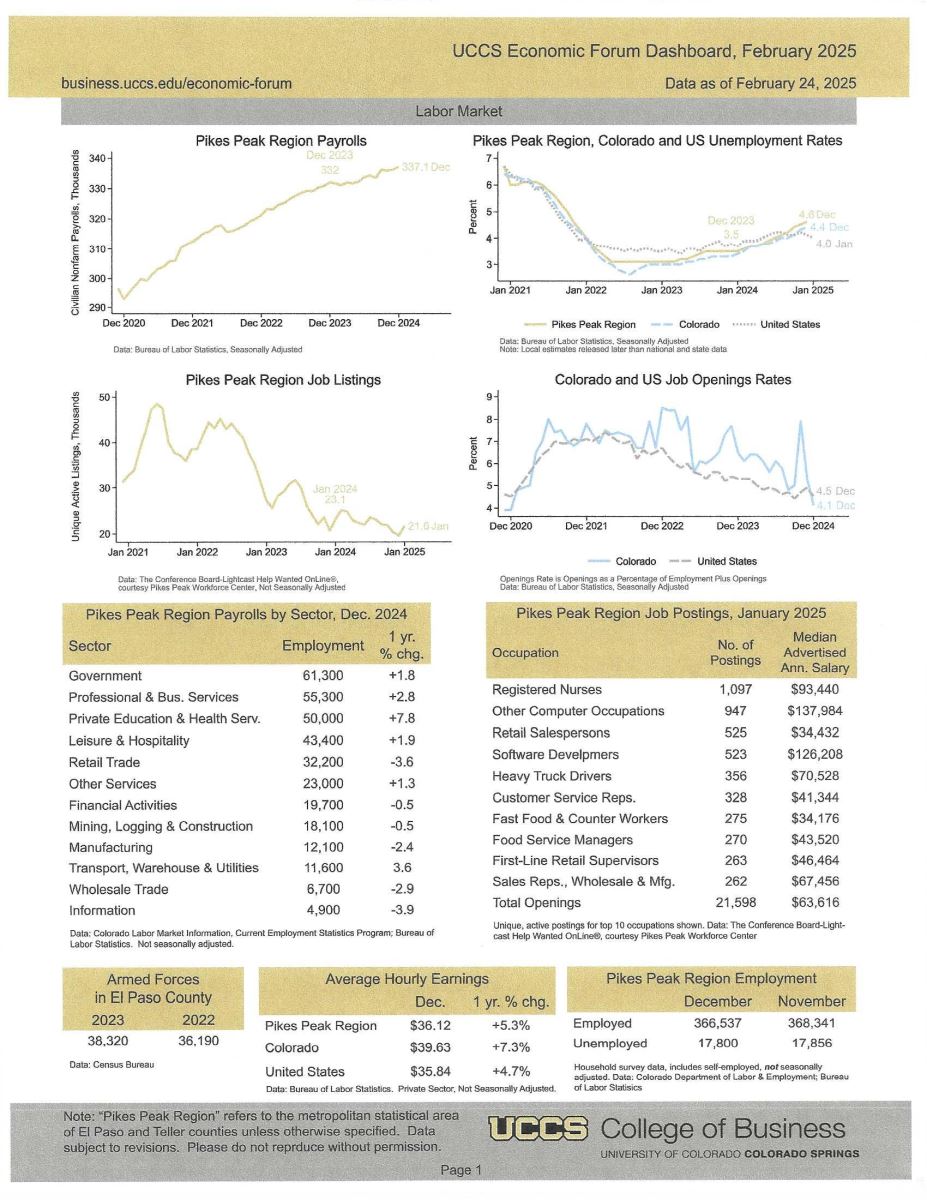

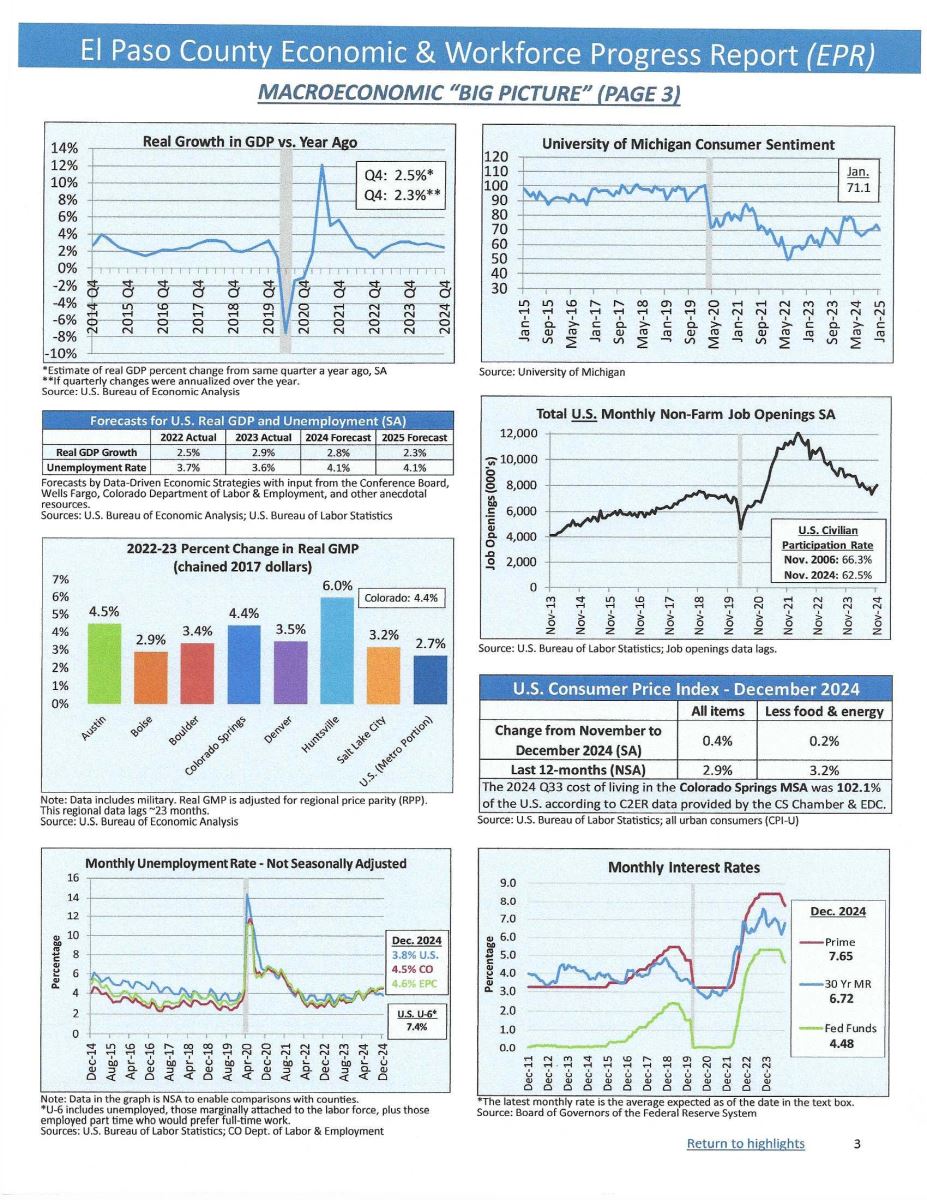

ERA SHIELDS QUARTERLY STAT PACK

Data through Quarter 1, 2025, ERA Shields

Here is data from my company’s quarterly “Stat Pack” that can better help you understand the local buying and selling reality. I have reproduced the first page, and you can click here to get the report in its entirety.

.jpg)

.png)

.jpg)

.jpg)

.jpg)

.jpg)