HARRY'S BI-WEEKLY UPDATE 9.24.24

September 24, 2024

HARRY’S BI-WEEKLY UPDATE

A Current Look at the Colorado Springs Residential real estate Market

As part of my “Special Brand of Customer Service”, it is my desire to share current Residential real estate issues that will help to make you a more successful and profitable Buyer and Seller.

RATES, RATES, AND MORE (LOWER) RATES…

As you’ve probably heard, the Federal Reserve finally lowered the short-term federal funds rate last week by ½ a percentage point. Some say too little too late, but for those who have been waiting for a drop in the home mortgage lending rates, some relief will likely soon be coming.

While mortgage rates are not directly tied to the federal funds rate, the lowering of that rate usually is followed by a reduction in the home lending rates as well. And, as you probably know, mortgage rates have been slowing going down in recent days,

This will certainly help those who have been waiting for rates to drop but for those who are nostalgic for the historic rates of several years ago…sorry…I doubt we will ever see rates that low again.

The current conventional rates of around 5.875 for a 30-year fixed-rate mortgage (FHA/VA are around 5.375 for same terms) are quite normalized and should be dropping a bit more before year’s end. Having been in this business for 51+ years, I’ve seen rates as high as 18% so today’s rates don’t look too bad.

But let’s talk more about rates for a moment, shall we? High interest rates can keep some, and most especially first-time buyers, out of the market. However, it’s very good to remember a couple of very important things.

As you’ve probably seen from our local Residential real estate statistics that I publish the first eNewsletter of each month…our home values are continuing to appreciate which means that home equity is growing for most all local homeowners.

What that means is if you are delaying a move due to the interest rates you are likely going to be paying more for your next home. And your present home is probably worth more than you might think which could provide you with additional dollars to put down on the next home.

Together those two facts can make it easier to understand exactly what a new home will cost you. On top of that, if the rate drops, you can always refinance down the line, all the while earning equity on your new home which you’d likely pay more for later.

Make sense?

Essentially, it’s important to know what your wants, needs and budget requirements are before beginning the search and that will make everything much easier.

Just give me a call today at 719.593.1000 or email me at Harry@HarrySalzman.com and together let’s see how your Residential real estate dreams can become reality.

THEY DON’T CALL ME “MR. NEGOTIATOR” FOR NOTHING

With my background in Investment Banking and 51+ years working for clients in the local Residential real estate arena, my expertise in negotiation is legendary. That is a big plus for my clients and one that has saved them a lot of time and money over the years.

I just came across a quote attributed to President John F. Kennedy and I could totally relate so wanted to share it with you. I’m fairly certain he wasn’t thinking of Residential real estate when he said it, but it’s applicable none the less:

“Let us never negotiate out of fear but let us never fear to negotiate.”

AND NOW MORE ON THE NEW CHANGES TO COMMISSIONS ON RESIDENTIAL real estate

The Wall Street Journal

I wanted to share this link to a podcast from The Wall Street Journal. Simply scan the QR Code below for information on the settlement that was reached and find out how this has changed the way real estate agents collect commissions. You can refer to my last several eNewsletters for additional information or simply give me a call and I’ll do my best to explain it further.

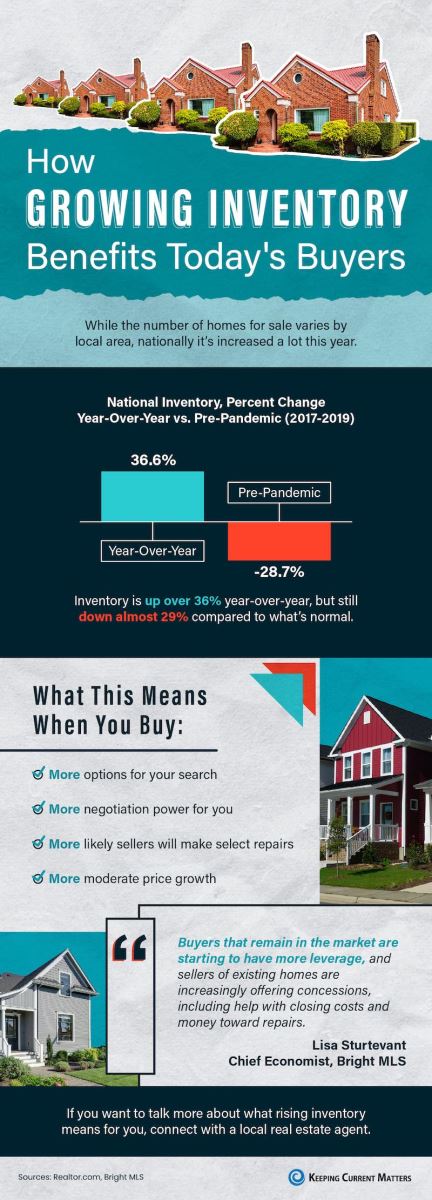

HOW GROWING INVENTORY BENEFITS TODAY’S BUYERS…an Infographic

Keeping Current Matters, 8.23.24

Some Thoughts:

- Our total active listings on single family/patio homes in El Paso County are up 37.2% year-over-year and new listings are up 14.1% year-over-year as of the end of August 2024.

- What that means to you is that when you buy you have more negotiation power (that’s where I come in!).

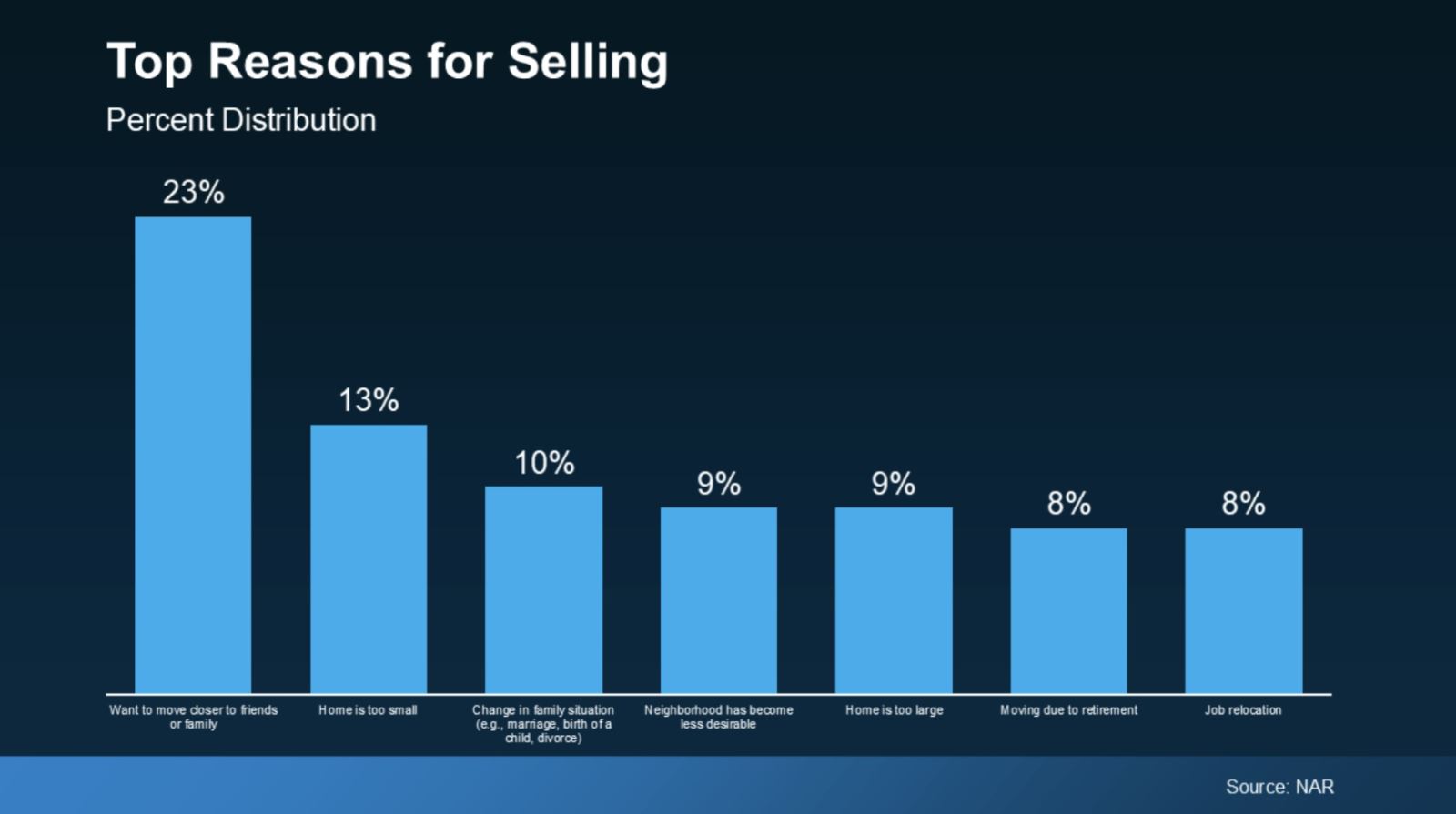

SHOULD YOU SELL NOW? LIFESTYLE FACTORS THAT COULD TIP THE SCALE

Keeping Current Matters, 9.3.24

If you are on the fence about whether to sell now or hold off, you’re not alone. It’s a common dilemma, but a key point is that your lifestyle might be the biggest factor in your decision. While financial aspects are important, at times the personal motivations for moving are reason enough to make the move now rather than wait.

An annual report from the National Association of Realtors (NAR) offers some insight into why homeowners might choose to sell. All of the top reasons are related to life changes, as the graph below highlights:

The biggest motivators were the desire to be closer to friends or family, outgrowing their current house, or experiencing a significant life change like getting married or having a baby. The need to downsize or relocate for work also made the list as you can see.

As Danielle Hale, chief economist at Realtor.com explains:

“A consideration today’s homeowners should review is what their home equity picture looks like. With the typical home listing price up 40% from just five years ago, many home sellers are sitting on a healthy equity cushion. This means they are likely to walk away from a home sale with proceeds that they can use to offset the amount of borrowing needed for their next purchase.”

If any of these factors are important to you at present, just give me a call and let’s discuss how I can help make your move an easier one, and one based on informed, confident facts that fit your individual situation.

After all, no two houses are exactly alike, and no two families are either. That’s why I find it so important when we’re discussing what is likely your most expensive investment to make sure all the pieces of the puzzle fit perfectly for you and your family.

ERA SHIELDS STAT PACK

Data through August 2024, ERA Shields

Here is data from my company’s monthly “Stat Pack” that can better help you understand the local buying and selling reality. I have reproduced the first page, and you can click here to get the report in its entirety.

.jpg)