HARRY'S BI-WEEKLY UPDATE 12.8.2023

December 8, 2023

HARRY’S BI-WEEKLY UPDATE

A Current Look at the Colorado Springs Residential real estate Market

As part of my “Special Brand of Customer Service”, it is my desire to share current Residential real estate issues that will help to make you a more successful and profitable Buyer and Seller.

MY MOST RECENT YOUTUBE VIDEO…UP FRONT AND PERSONAL…

If you’ve got one minute and 55 seconds, I wanted to give you a couple of statistics and to thank you for your business and referrals during this past year.

In fact, while you’re at it, you might want to subscribe to my channel, so you won’t miss future broadcasts. It won’t cost you anything…well, it could cost you… if you miss some of my informative musings!

You will see below that local home sales this year are at an 8-year low. For me personally, my sales have been great, but I know that’s because of your confidence in me and I never take that for granted.

As I’ve said time and again, there are always those who need or want to sell and those who need or want to buy. In today’s market, it takes a Realtor with a lot of finesse, coupled with years of experience and knowledge to make that happen.

I pride myself on looking at each individual situation and my job is to find the right fit for the client’s wants, needs and budget requirements when it comes to buyers. This is as tough a market as I’ve seen, due to the lack of available homes for sales and the current mortgage interest rates.

And for sellers, I’ve been seeing that potential buyers are even pickier than usual, also often due to the high interest rates.

My job is to find the best fit possible and to make certain my clients don’t suffer undo stress. Not always easy, but another slogan of mine has been “where there’s a will…there’s Harry”. I’ll get the job done “one way or another” if it’s at all possible and in the best interest of my clients.

So once again, thank you for your support. It means everything to me, and I will continue to work hard to earn it.

And…to repeat from my video…Happy First Day of Chanukah to all my friends and clients who celebrate.

On that note, as always, if Residential real estate is among your current hopes and dreams for 2024 or beyond, please give me a call at 719.593.1000 or email me at Harry@HarrySalzman.com and let me help make them come true.

And now for statistics…

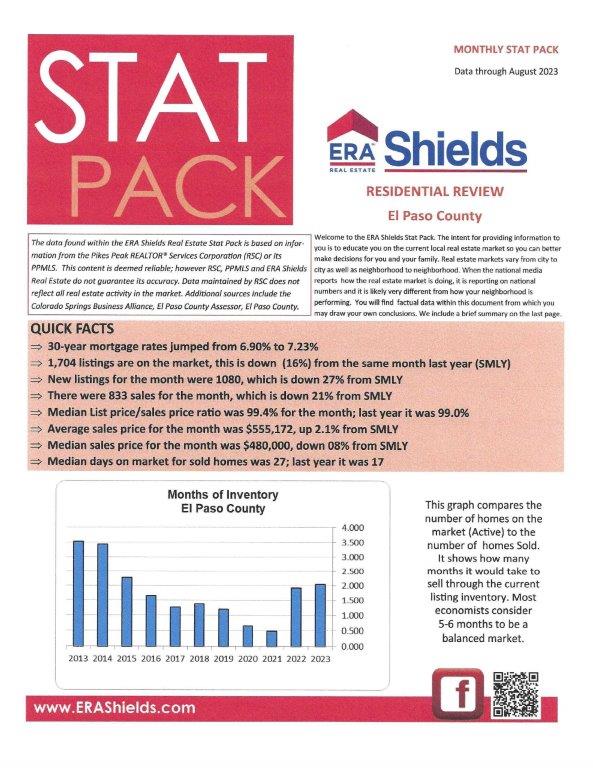

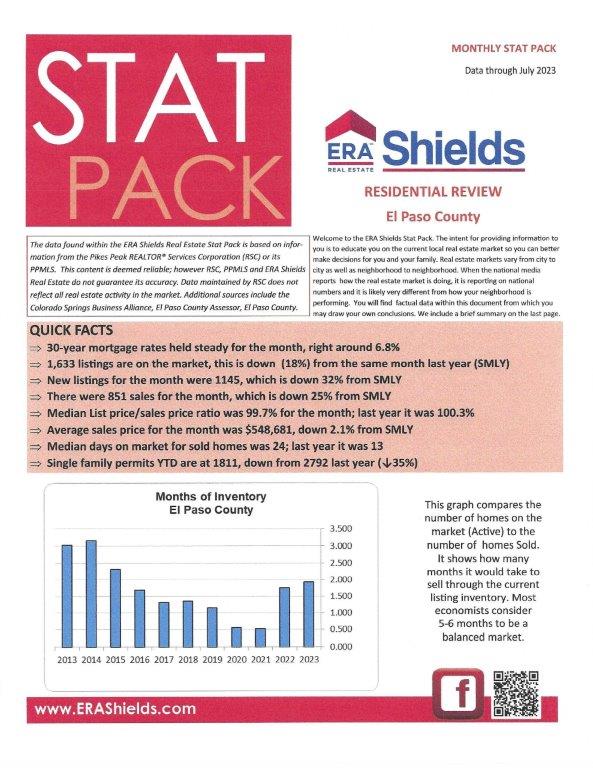

NOVEMBER 2023

Statistics provided by the Pikes Peak REALTORS Service Corp., or it’s PPMLS

Here are some highlights from the November 2023 PPAR report.

In El Paso County, the average days on the market for single family/patio homes was 37. For condo/townhomes it was 28.

Also in El Paso County, the sales price/list price for single family/patio homes was 99.0% and for condo/townhomes it was 98.8%.

In Teller County, the average days on the market for single family/patio homes was 48 and the sales/list price was 132.0%.

Please click here to view the detailed 10-page report, including charts. If you have any questions about the report or to find out how it relates to your individual situation, just give me a call.

In comparing November 2023 to November 2022 for All Homes in PPAR:

Single Family/Patio Homes:

- New Listings were 895, Down 6.1%

- Number of Sales were 715, Down 23.6%

- Average Sales Price was $554,784, Up 5.5%

- Median Sales Price was $466,535, Up 3.0%

- Total Active Listings are 2,397, Down 1.4%

- Months Supply is 3.4, Up 0.1

Condo/Townhomes:

- New Listings were 148, Up 3.5%

- Number of Sales were 108, Down 20.6%

- Average Sales Price was $375,948, Up 2.0%

- Median Sales Price was $335,800, Down 4.1%

- Total Active Listings are 373, Up 42.4%

- Months Supply is 3.5, Down 2.1

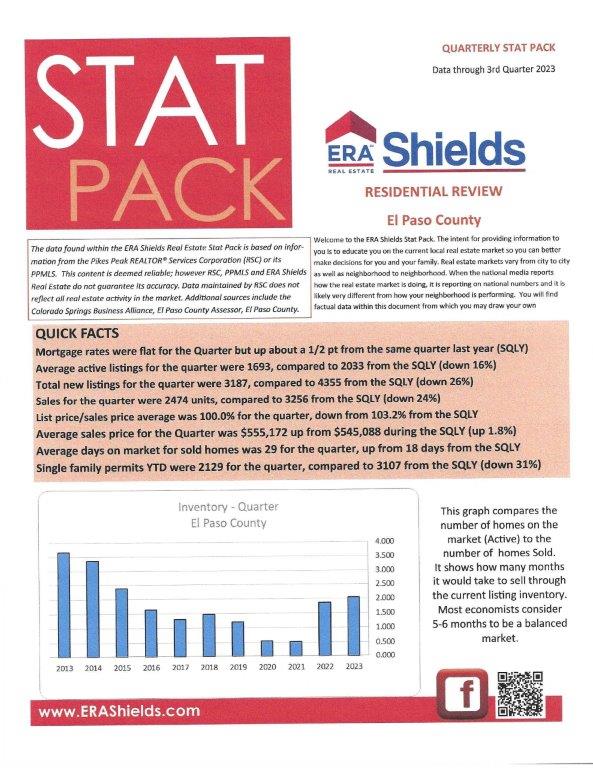

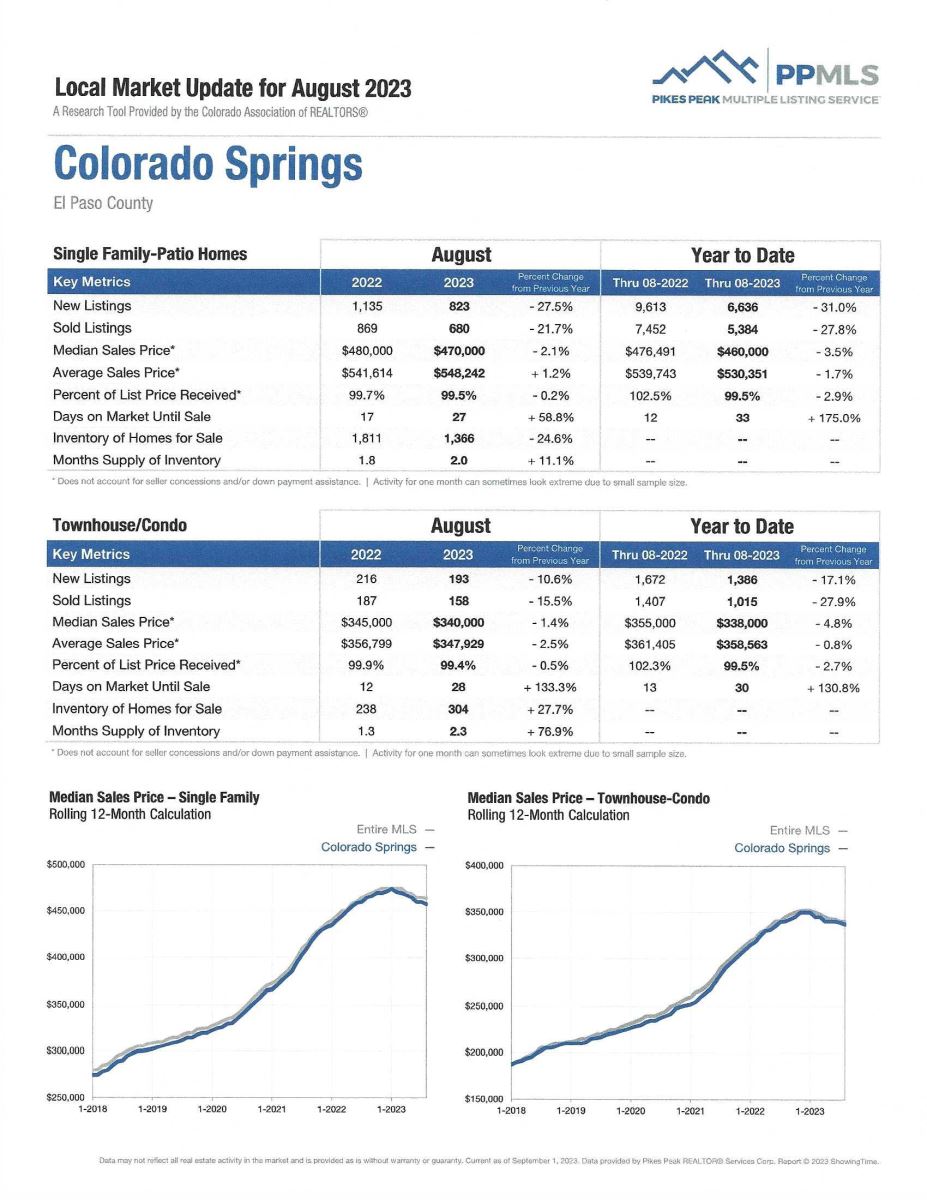

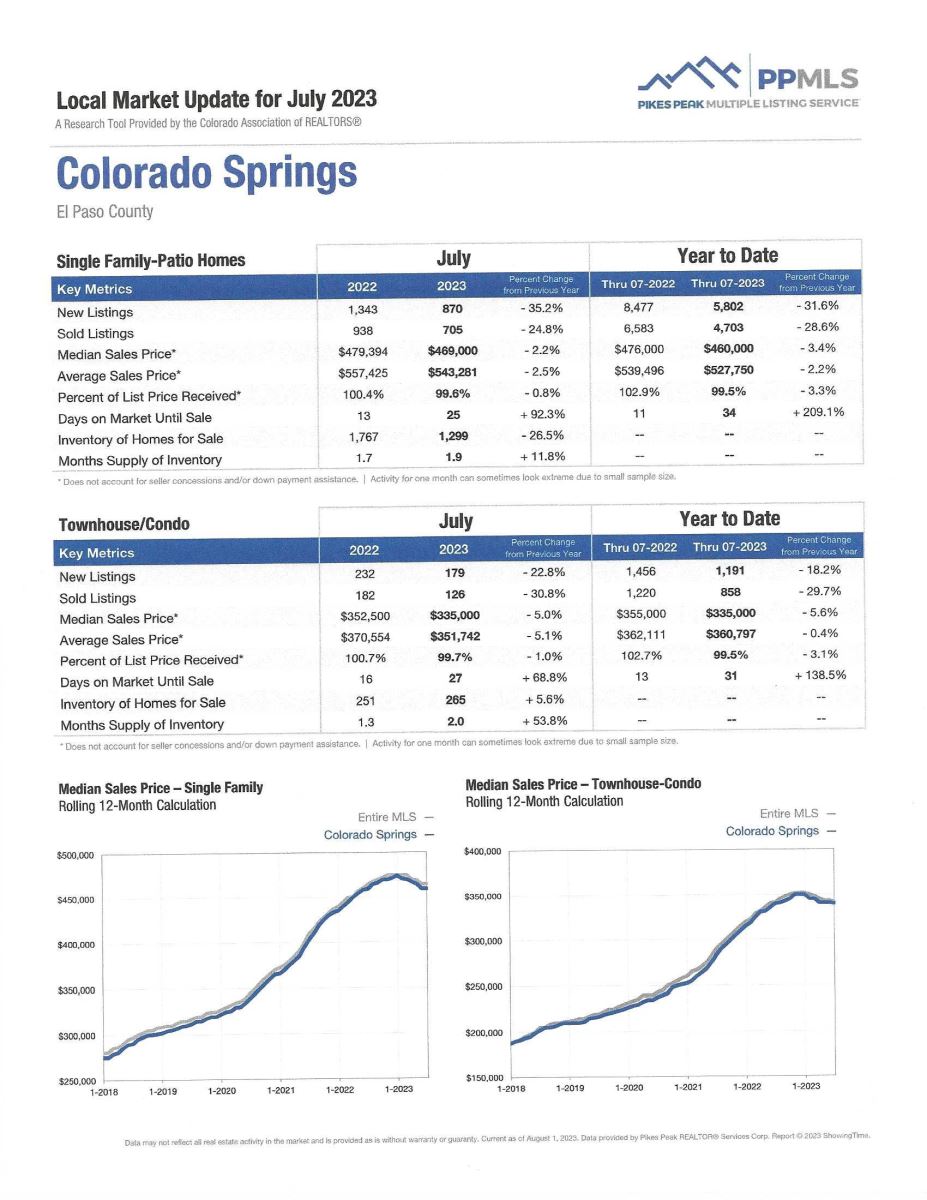

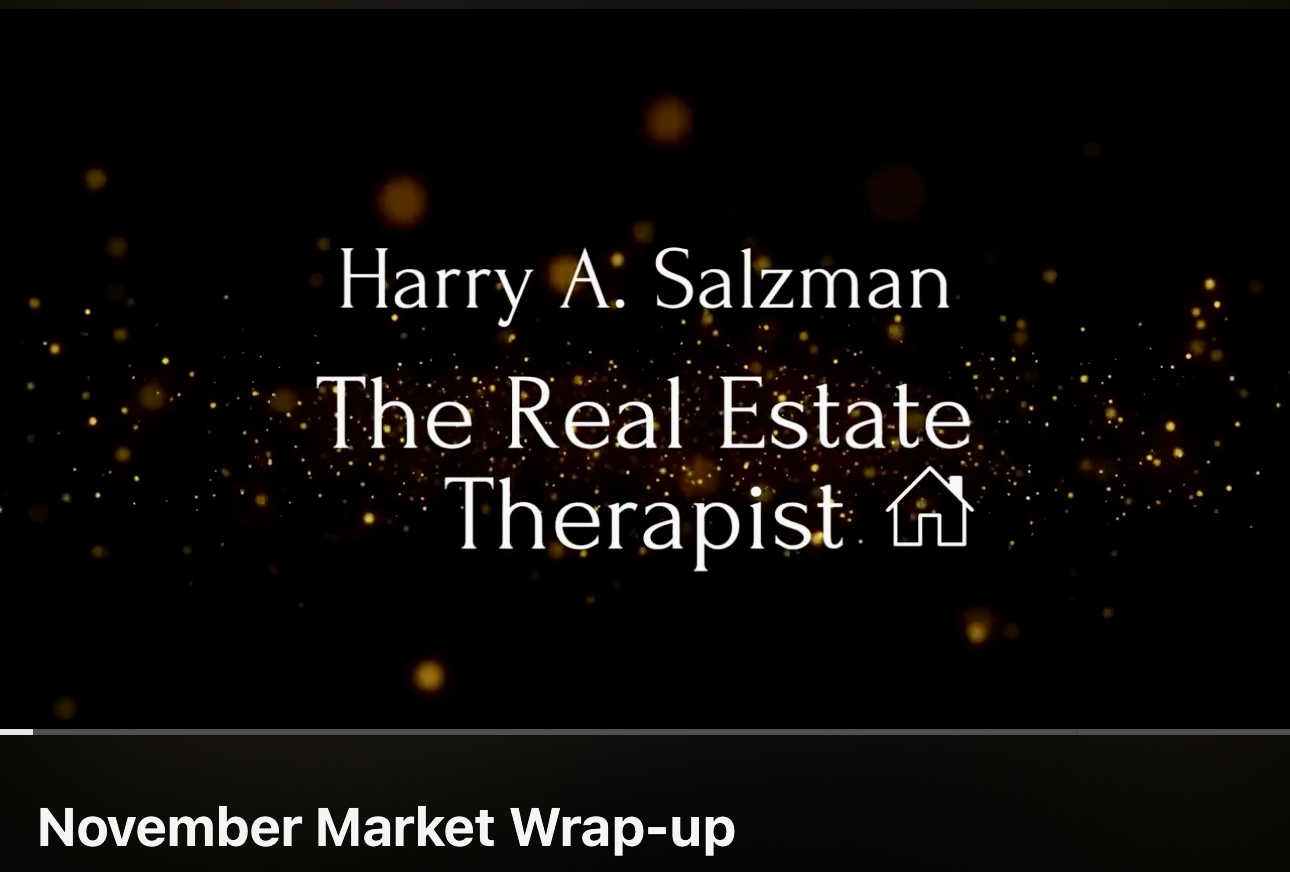

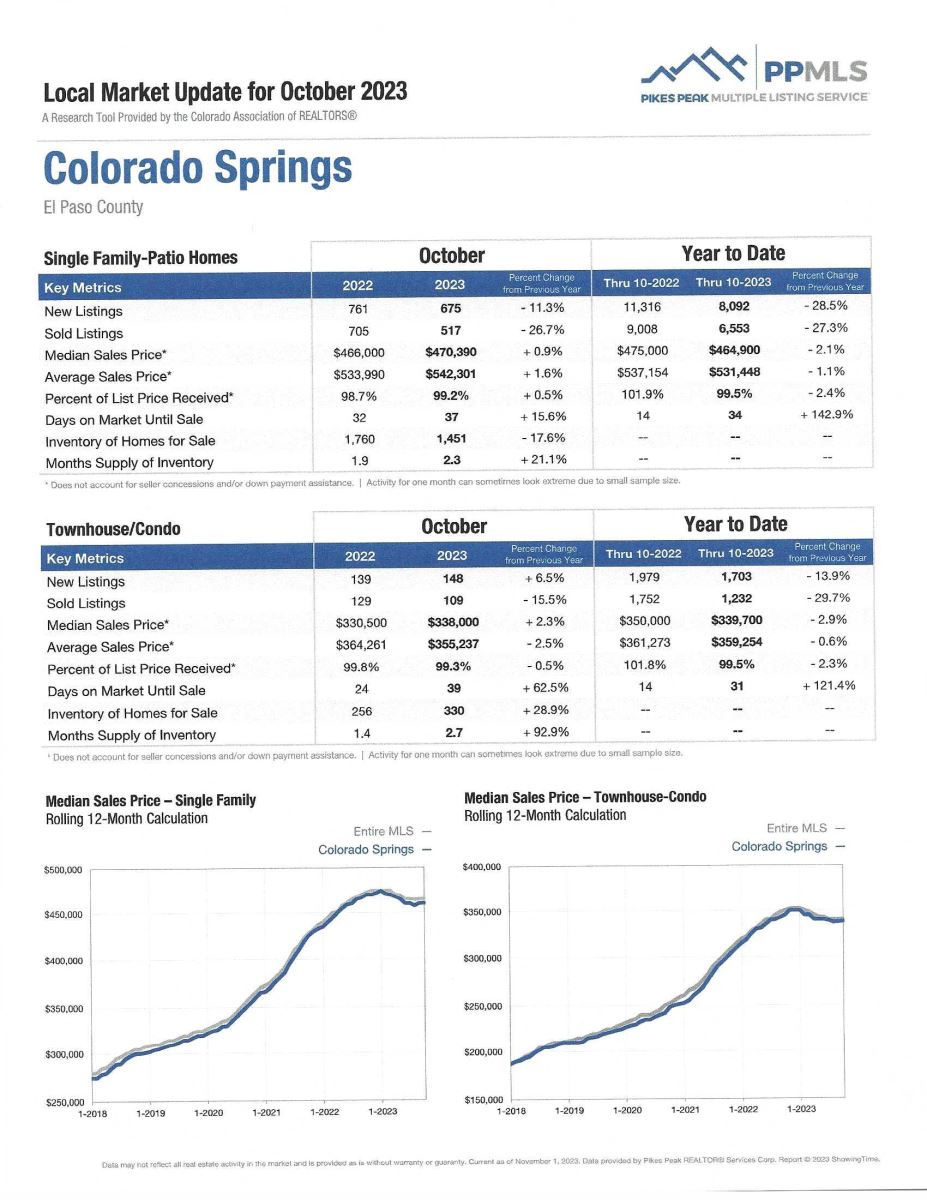

NOVEMBER 2023 MONTHLY INDICATORS AND LOCAL MARKET UPDATE ILLUSTRATE OUR LOCAL TRENDS IN DETAIL

Colorado Association of REALTORS® , Pikes Peak REALTORS Service Corp, or it’s PPMLS

Providing greater detail than the above report, this contains information on both El Paso and Teller counties for Residential real estate.

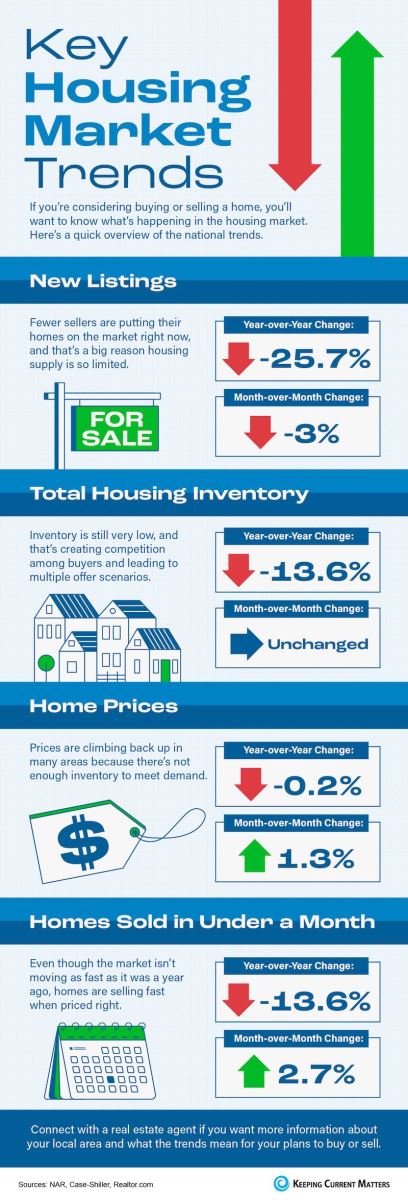

The “Activity Snapshot” for all residential properties in El Paso and Teller counties shows the Year-to-Date one-year change:

- Sold Listings for All Properties were Down 25.4%

- Median Sales Price for All Properties was Up 2.5%

- Active Listings on All Properties were Down 5.2%

You can click here to read the 16-page Monthly Indicators or click here to get specific information on the geographical are of your choice from the 18-page Local Market Update. It’s a good idea to check out your own area or one that you might be considering in order to get a good idea of the local pulse. As an example, here is a detailed report on the Colorado Springs area:

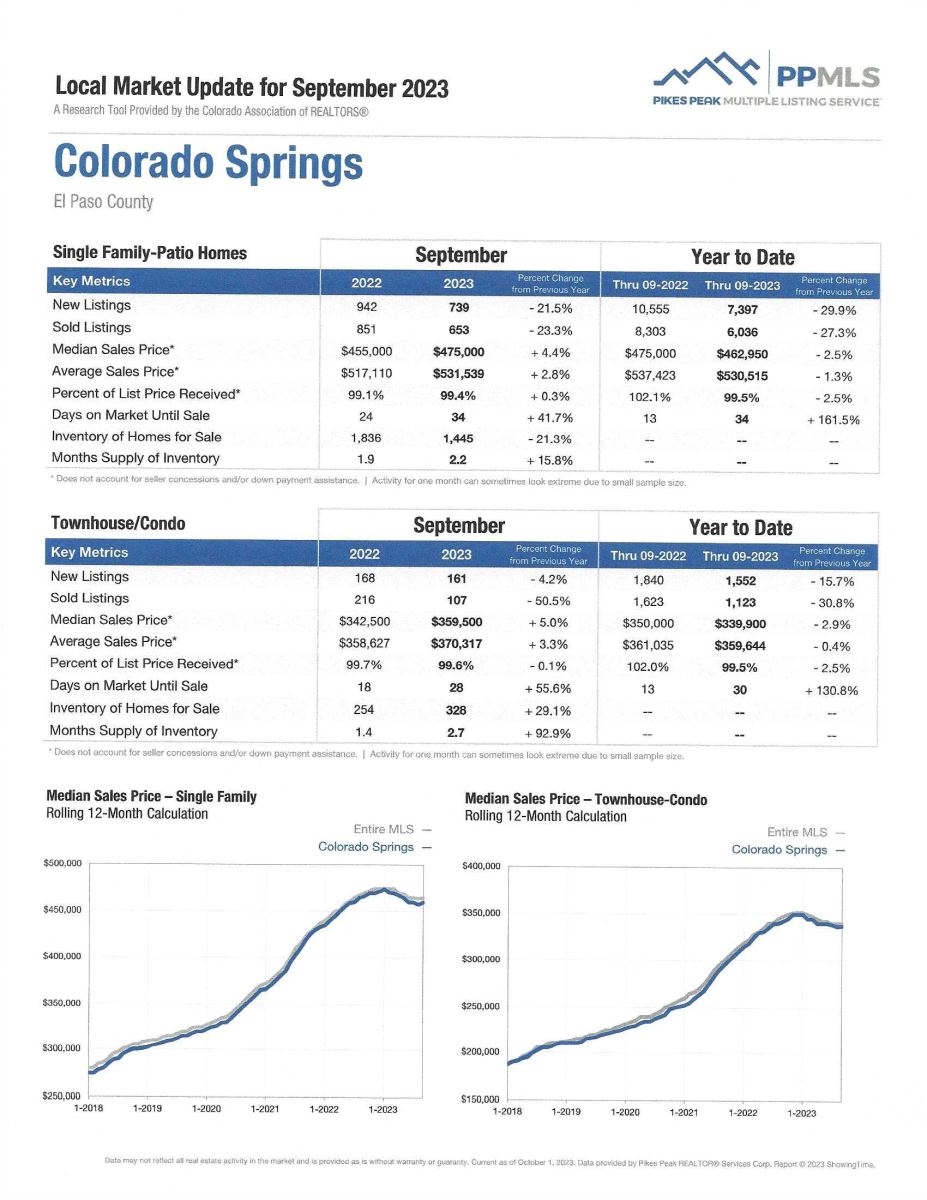

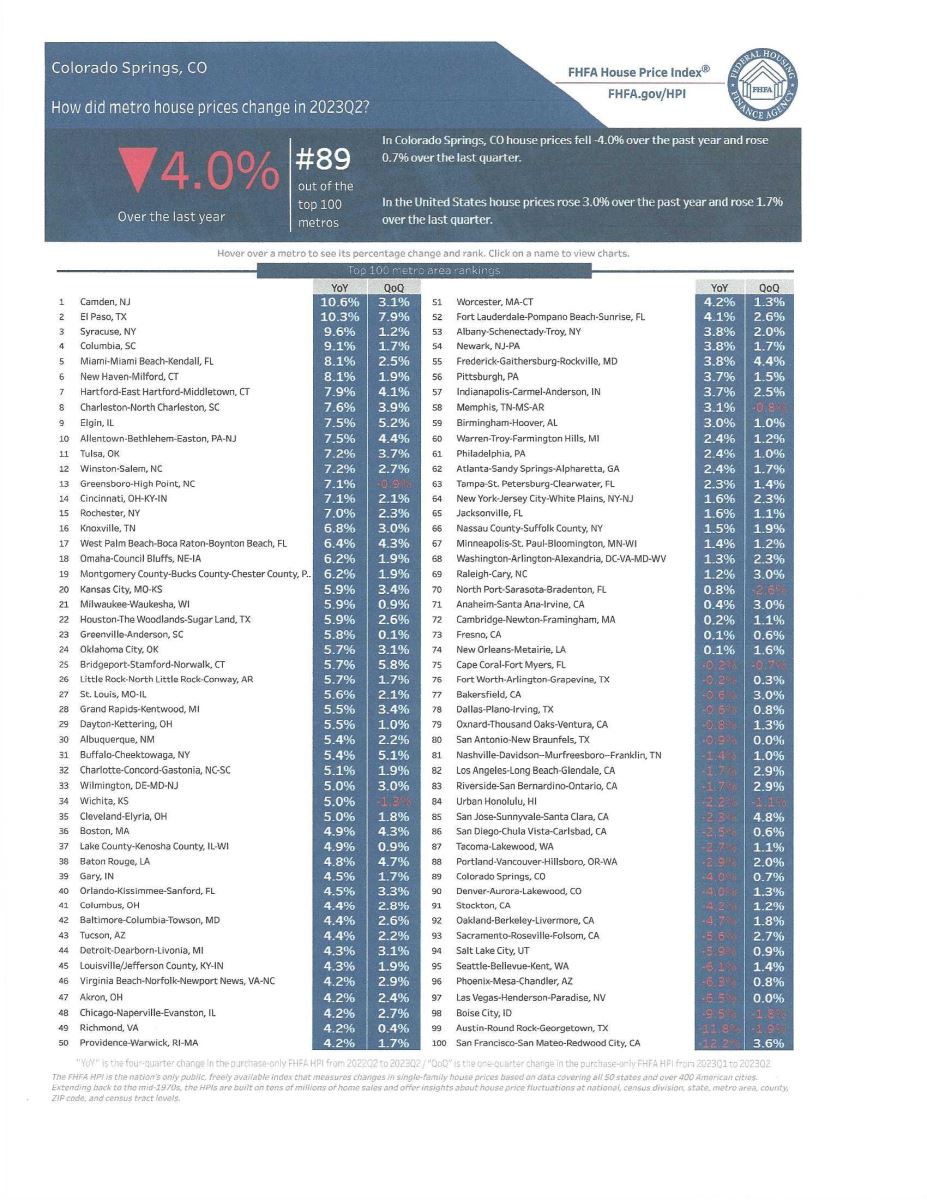

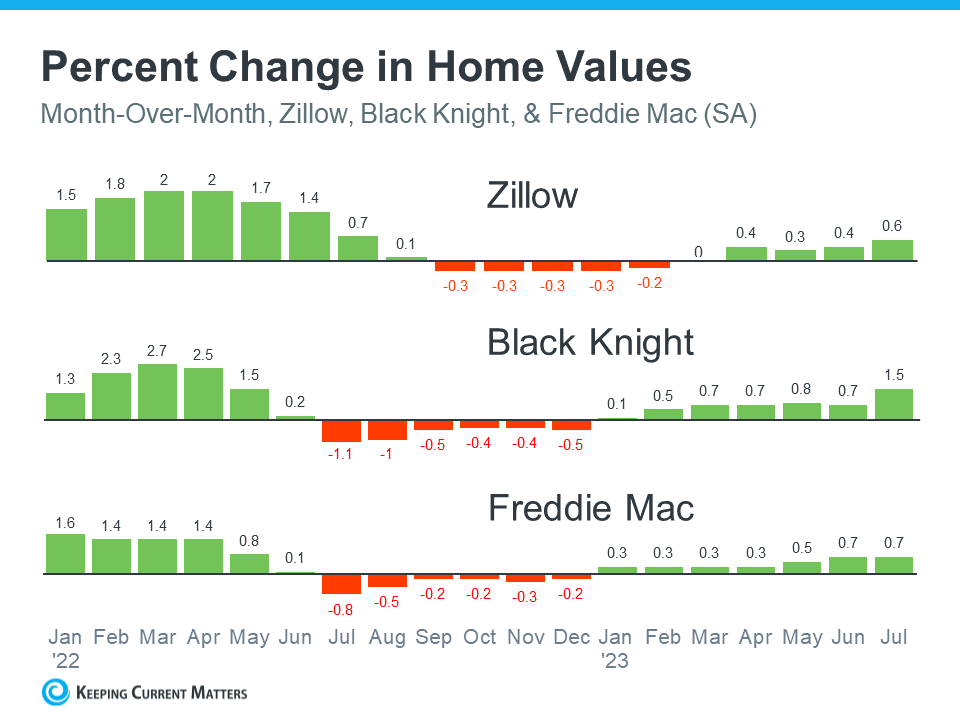

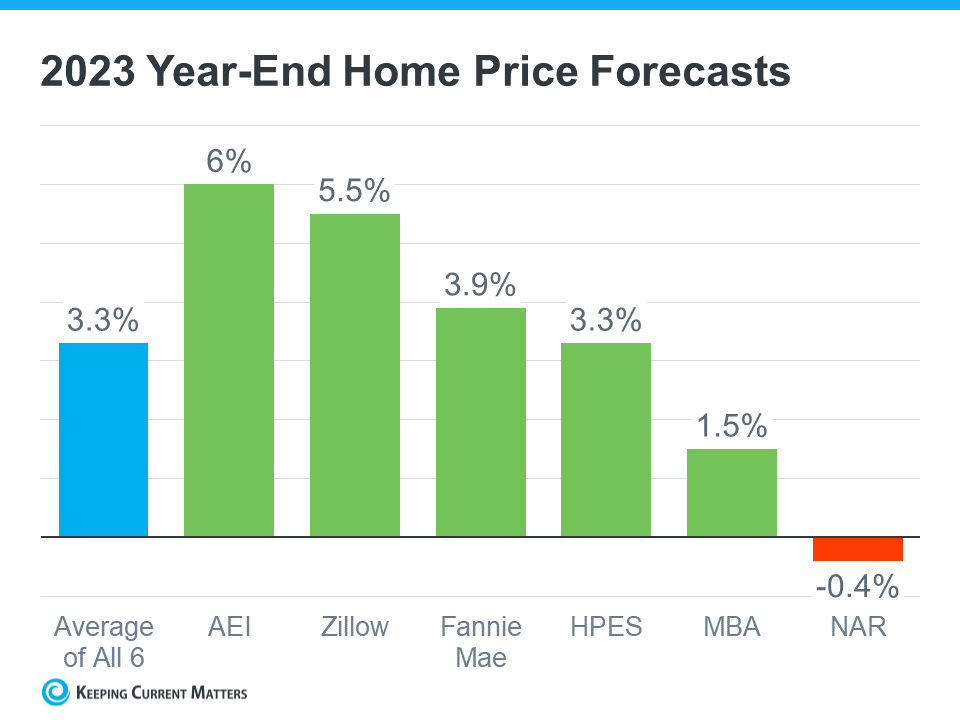

HOME PRICE INDEX RISES AS SUPPLY FALLS SHORT

The Wall Street Journal, 11.29.23

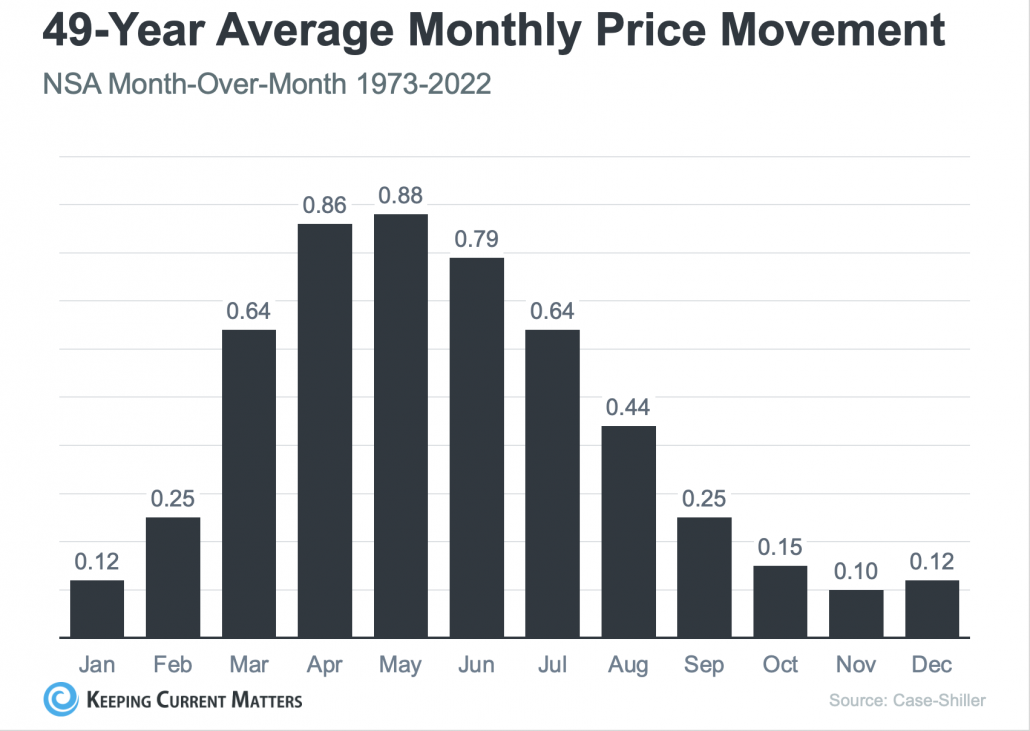

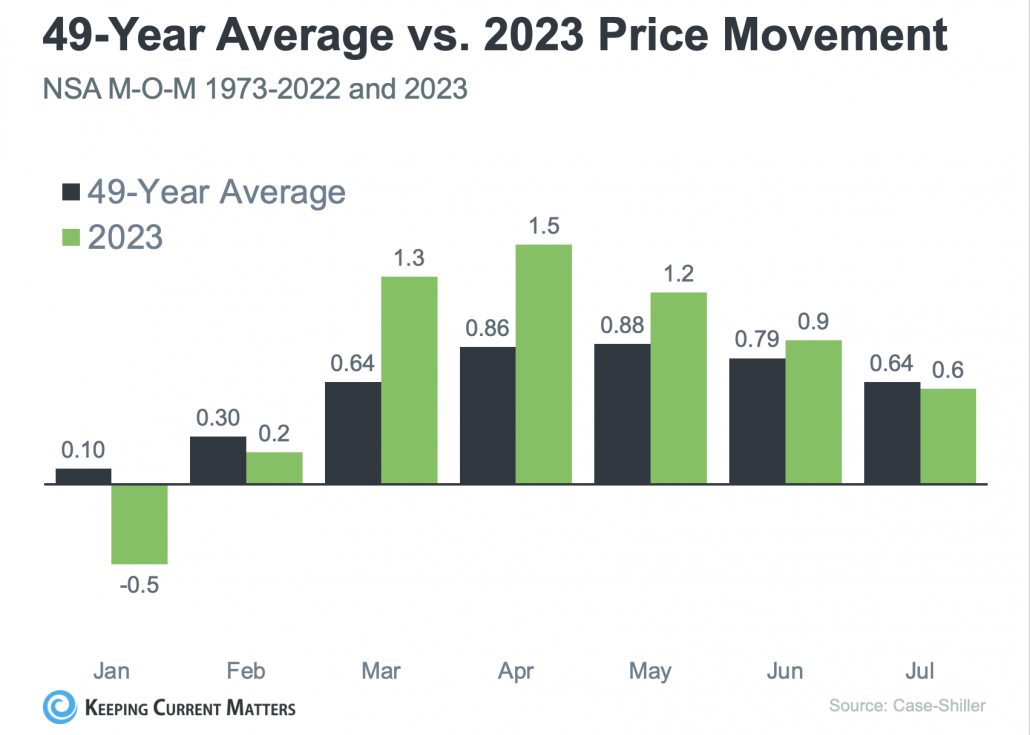

Home prices hit a record high in September because of a shortage of homes for sale, even as rising interest rates made home purchases less affordable.

The S&P CoreLogic Case-Shiller National Price Index, which measures home prices across the nation, rose 3.9% from a year earlier in September, compared with a 2.5% annual increase the prior month. The September level was the highest since the Index began in 1987.

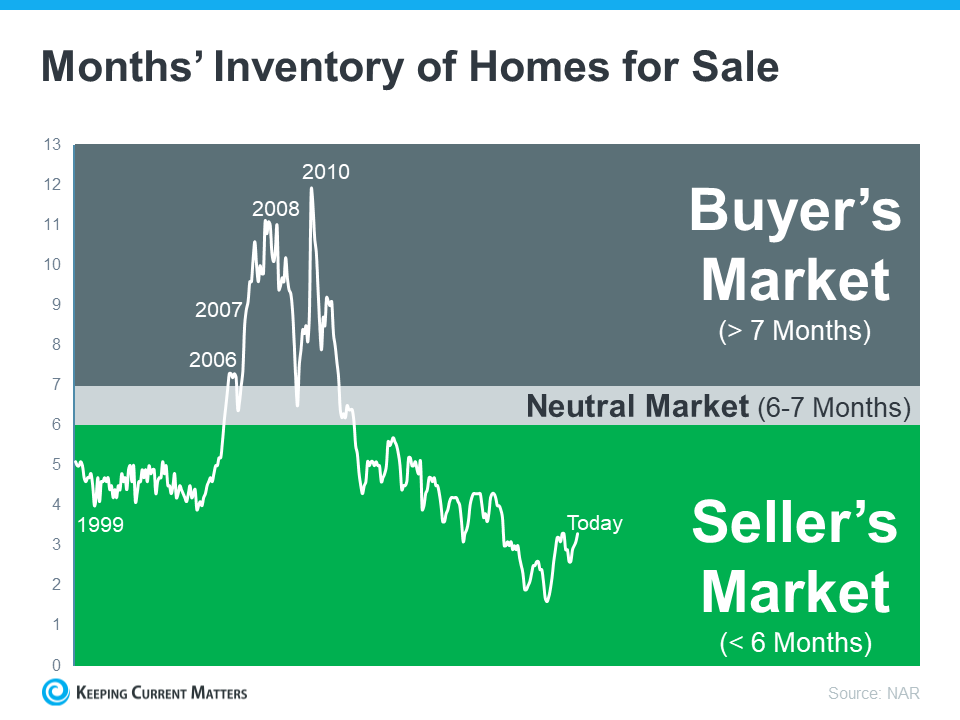

Home sales have slumped from a year ago because higher interest rates pushed buyers out of the market, but the decline in demand isn’t causing prices to fall, because inventory of homes on the market is unusually low.

Higher rates have prompted potential sellers to stay rather than give up their existing low mortgage interest rates.

The Case-Shiller Index, which measures repeat sales data, reports on a two-month delay and reflects a three-month moving average. Homes usually go under contract a month or two before they close, so the September data is based on purchase decisions made earlier this year.

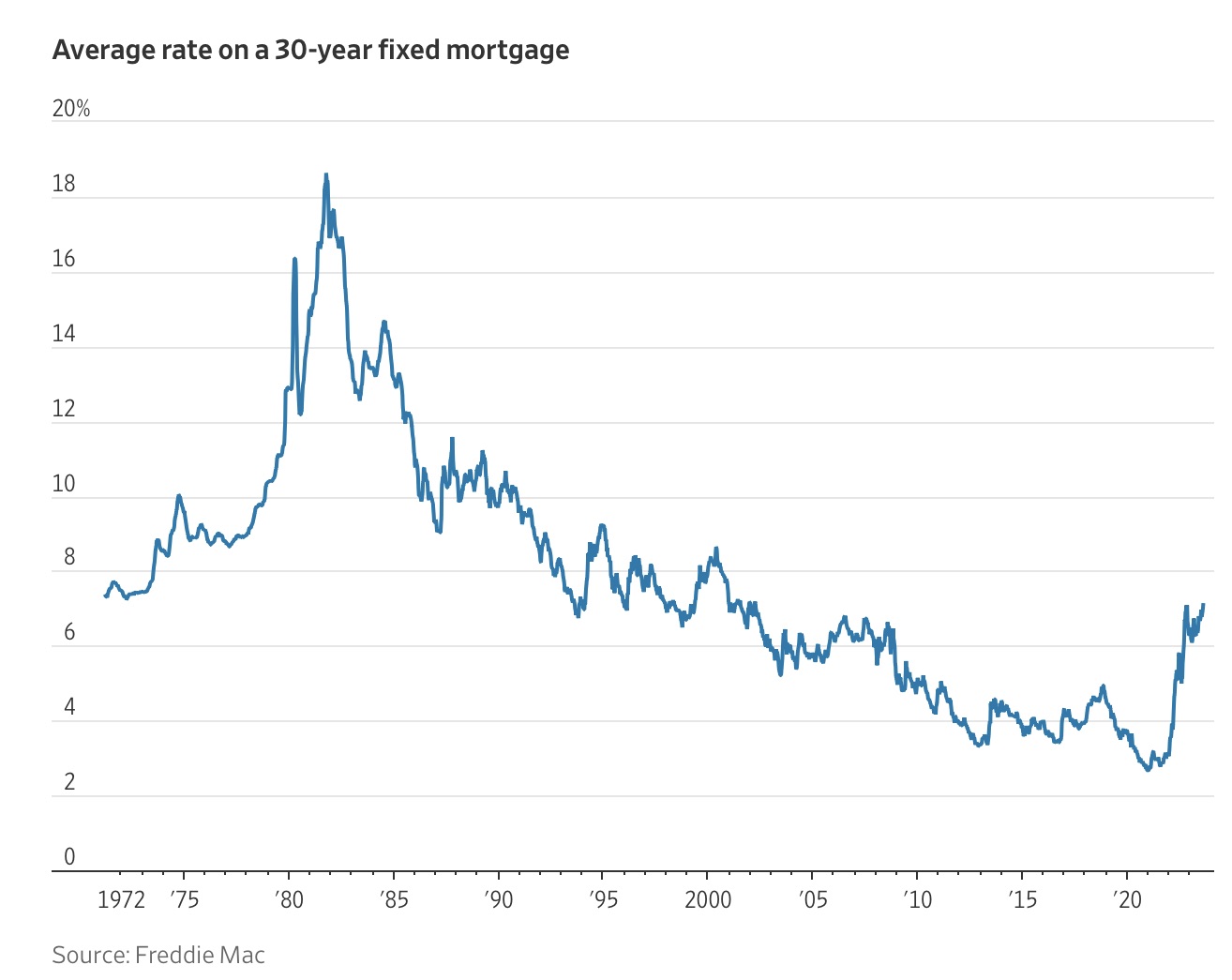

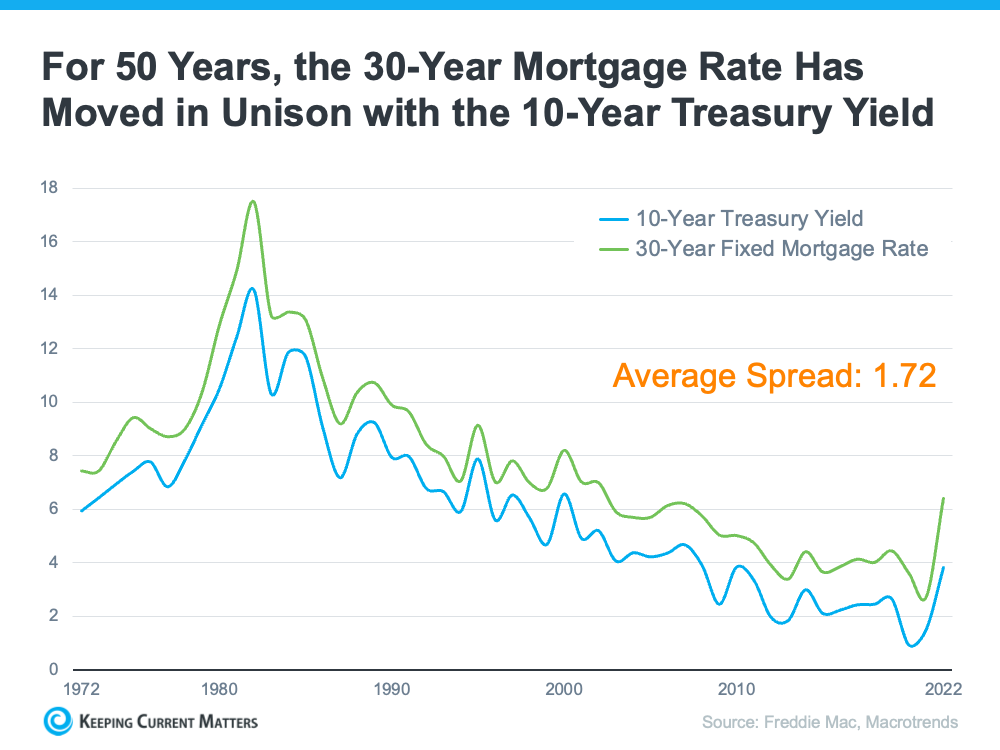

Mortgage rates have declined in recent weeks after hitting two-decades high in October.

NEW MAXIMUM LOAN LIMITS FOR 2024

The Federal Housing Finance Agency (FHFA) raised their conforming loan limit by 5.56% to a maximum amount of $766,550 in 2024. In some geographical areas the limit is even higher.

These limits will take effect in January 2024.

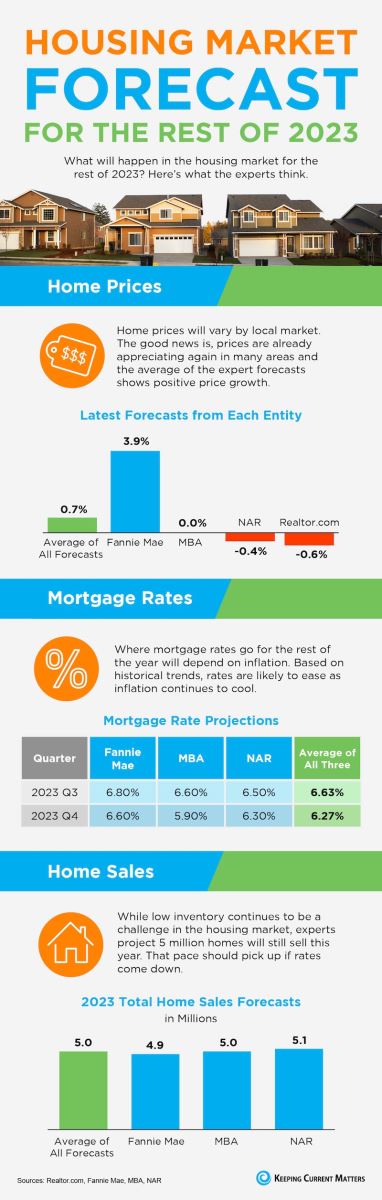

REALTOR.COM 2024 HOUSING FORECAST

PR Newswire, 12.2.23

Lower mortgage rates and easing prices will help spark the beginning of an affordability turnaround in 2024 according to the recently released Realtor.com 2024 Housing Forecast.

However, the supply of existing homes for sale will still be tight and renting remains a competitive option in most U.S. markets.

This year’s forecast also includes price and sales predictions for the top 100 U.S. metro areas.

Overall in 2024, Realtor.com forecasts that buyers and sellers can expect:

- Average mortgage rates of 6.8% with rates edging down over the year to reach 6.5% by the end of the year.

- Home prices to ease slightly and drop by 1.7% after generally increasing since 2012.

- Rents to drop by 0.2%, making renting a more budget-friendly option than buying in most markets.

- A -14% year-over-year drop in inventory, as existing homeowners with low mortgage rates stay put.

- Home sales to hold steady, rising 0.1% year-over-year to 4.07 million.

Some key housing trends and wildcards:

- Affordability will officially turn around in 2024. This will give a foothold for some buyers trying to break into the market.

- Even more sellers hang back, but they could get motivated if rates drop faster than forecasted.

- Sellers should be ready to compete with new construction and should look at that market in order to make sure prices and marketing of their home are competitive.

- Home sales will likely be driven by moves of necessity in 2024.

- Geopolitics and inflation are among the wildcards in 2024.

Note that all surveys are based on national figures and when it comes to Residential real estate things need to be localized.

Colorado Springs is in an enviable position in that we have so many folks who want to relocate here and we have several new employers moving into the area. That’s not to say the above forecast isn’t meaningful to us because it is…it’s just that we often fare considerably better than the U.S. at large in terms of sales and pricing because of the desirability of our area.

Please call me if you have any questions.

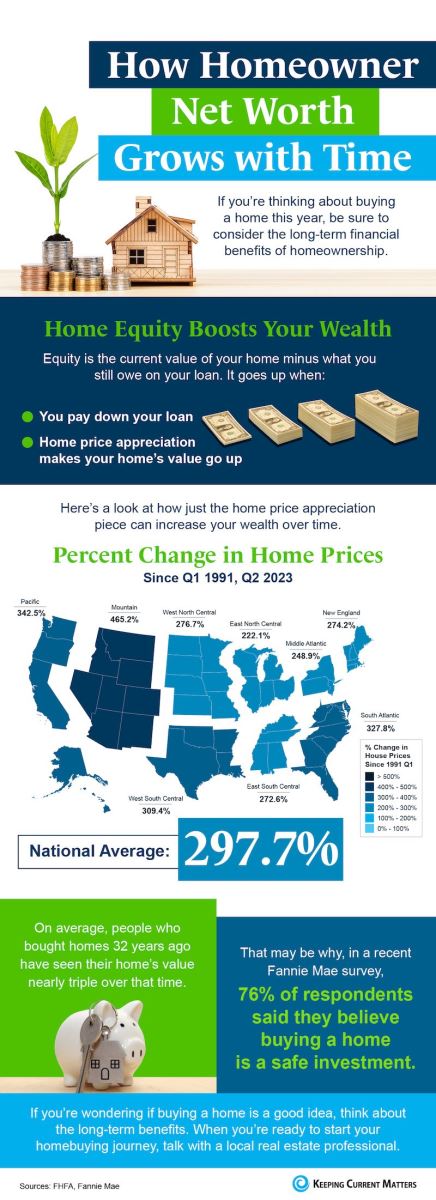

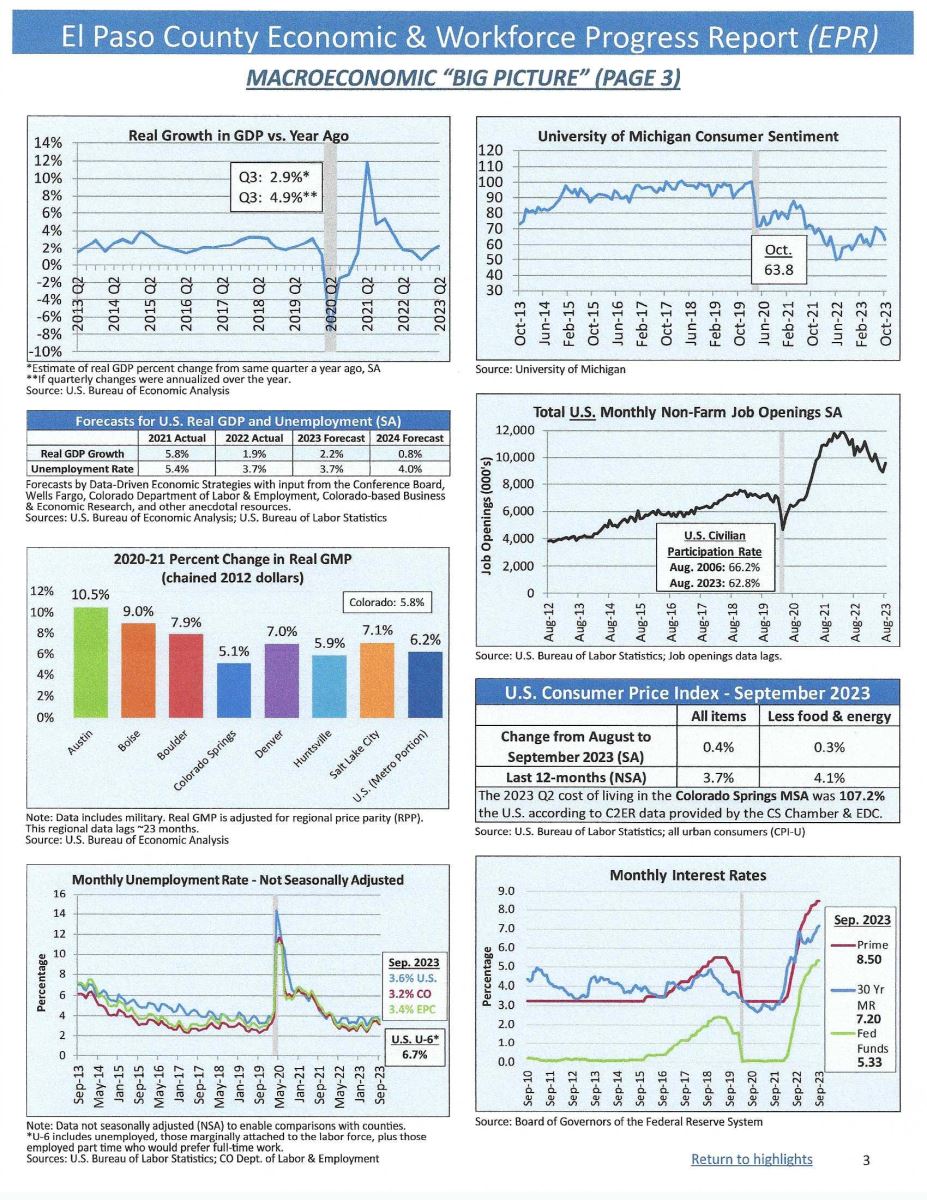

ECONOMIC & WORKFORCE DEVELOPMENT REPORT

Data-Driven Economic Strategies, November 2023

As always, I like to share the useful economic data I receive from our “local economist”, Tatiana Bailey. You will see in these charts what’s happening locally in terms of the economy as well as the most recent Workforce Progress Report.

This information is especially invaluable to business owners; however, I think you all will all find it worthwhile reading.

Below is a reproduction of the first page of statistics that I know you will find interesting and

to access the report in its entirety, click here. If you have any questions, please give me a holler.

.jpg)

UCCS ECONOMIC FORUM MONTHLY DASHBOARD

Updated November 28, 2023, UCCS College of Business/Economic Forum

Here is the monthly report (with a new look!) from the UCCS College of Business Economic Forum. I know several of you who enjoy statistics and use this information in your daily business life and I will share it as always.

Below I have reproduced a copy of the first page and to read the entire report, please click here.

.jpeg)

I just same across this…it has hung on the file cabinet in my office for the last 40 plus years and seemed appropriate for this time of year:

.png)

.jpg)