HARRY'S BI-WEEKLY UPDATE 5.21.24

May 21, 2024

HARRY’S BI-WEEKLY UPDATE

A Current Look at the Colorado Springs Residential real estate Market

As part of my “Special Brand of Customer Service”, it is my desire to share current Residential real estate issues that will help to make you a more successful and profitable Buyer and Seller.

IT’S PEAK BUYING AND SELLING TIME AND HERE ARE THE STATS TO PROVE IT

Well, folks, if you’ve even been considering a move, now is the time to put those thoughts into motion.

If you don’t believe that’s so you might become a believer when you see the data below.

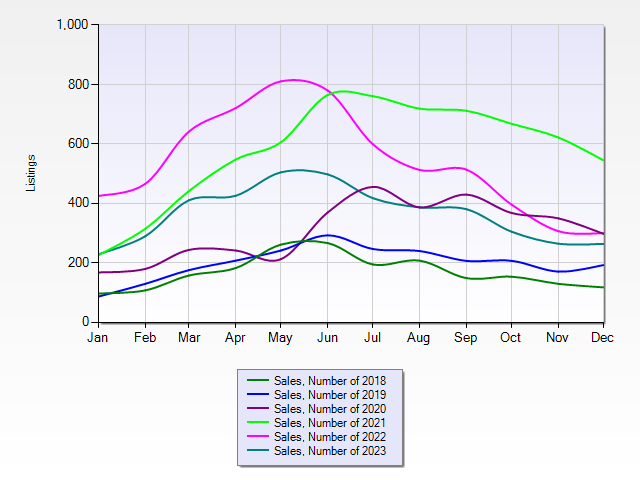

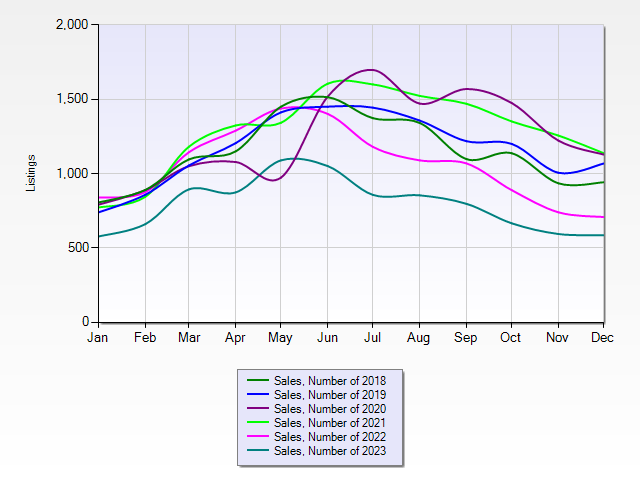

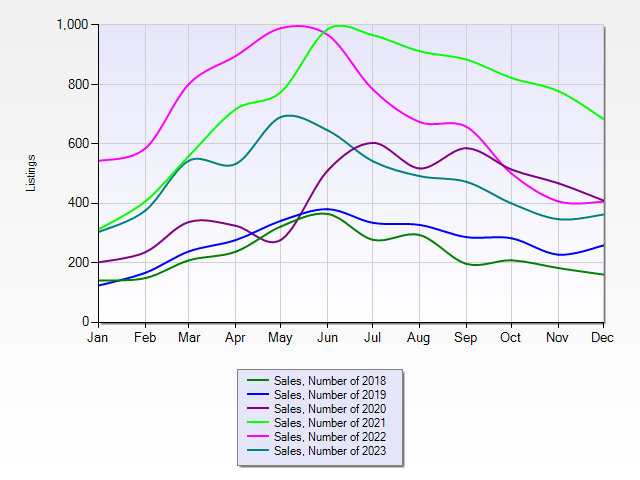

Here are three charts that show historic yearly sales from 2018 to 2023 that will back me up.

The first one shows all sales of single-family homes in Colorado Springs in the price range of $400,000 to $700,000:

This one shows all sales of single-family homes in El Paso County in all price ranges:

And, finally, this one shows all sales of single-family homes in El Paso County in the price range of $400,000 to $700,000:

As you can see, I back up my words with true data and put it to use in helping my clients get the best results, whether they are buying or selling or both. And the time to do that is NOW as you can see that peak sales are during the spring and summer months.

If you’ve got two minutes and seven seconds, look at my newest podcast on this very subject. Simply click on the link below and you will be directed to my personal YouTube channel.

To watch, click here:

While you’re at it you might want to subscribe to my channel so you won’t miss future broadcasts. It won’t cost you anything. Well, it could cost you… if you miss some of my informative musings!

April 1st I began 52 years in local Residential real estate. That, coupled with my Investment Banking background, give me an edge that my clients have found to be crucial in helping them and their families realize their personal real estate visions.

If Residential real estate is among your hopes and dreams for 2024, please give me a call at 719.593.1000 or email me at Harry@HarrySalzman.com and let me help make them come true.

And now for the statistics that were not available at press time for the 5.6.24 eNewsletter…

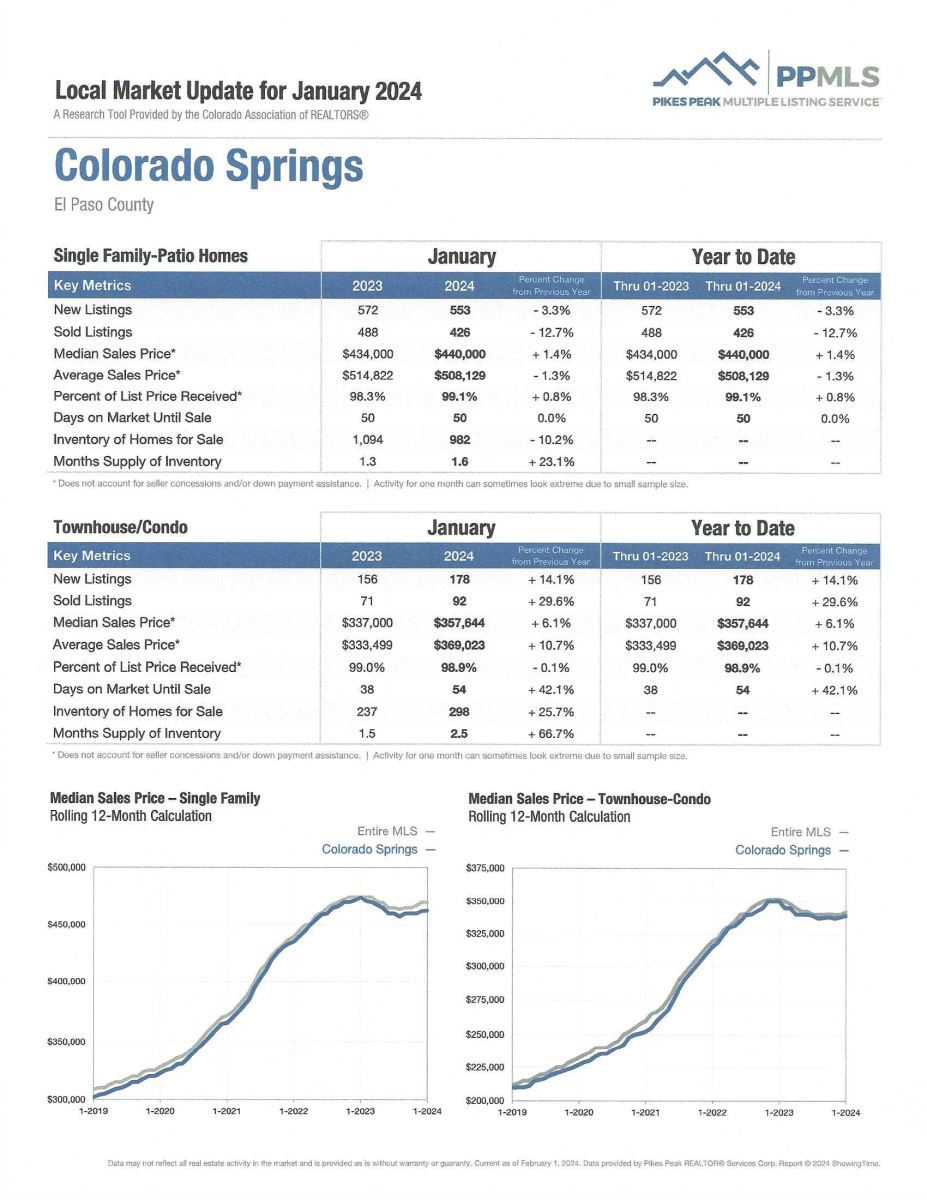

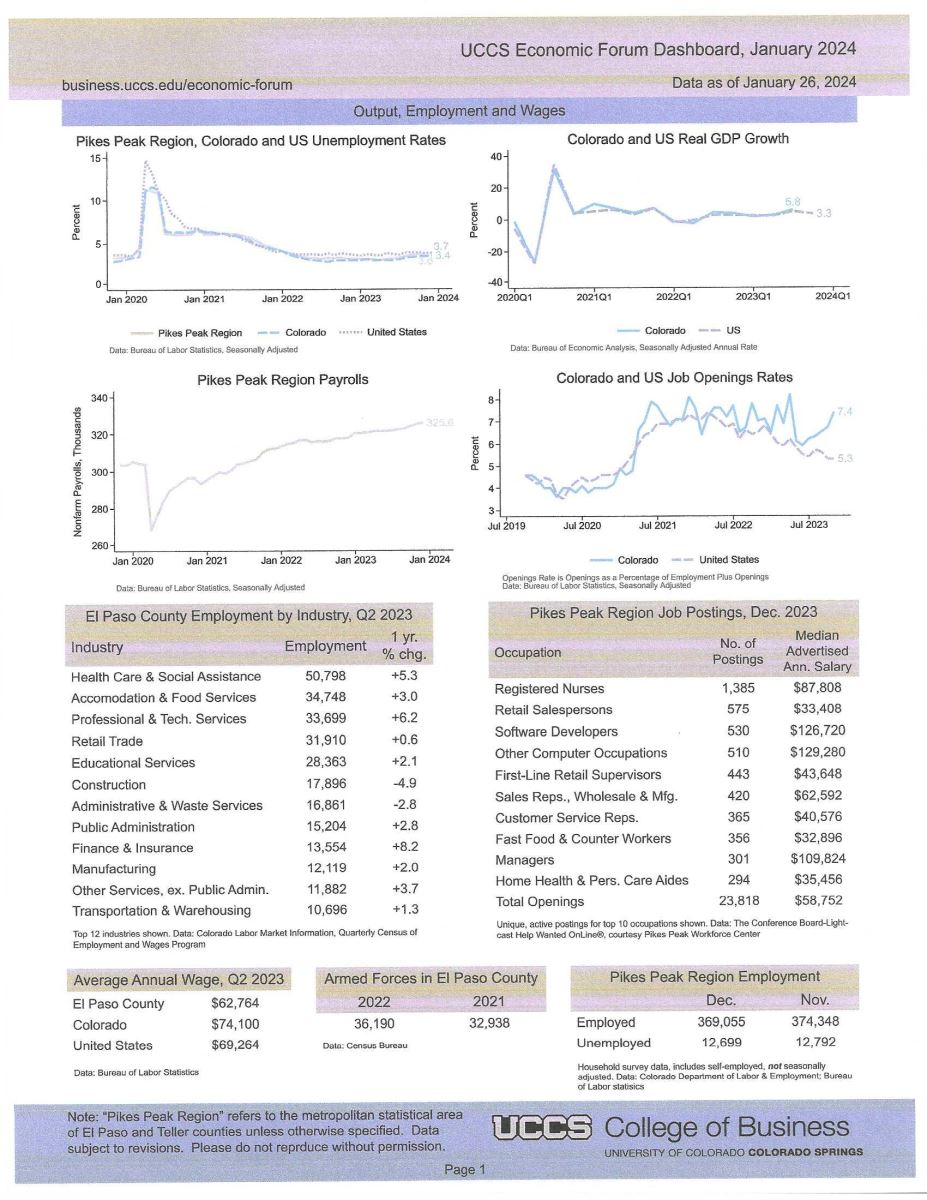

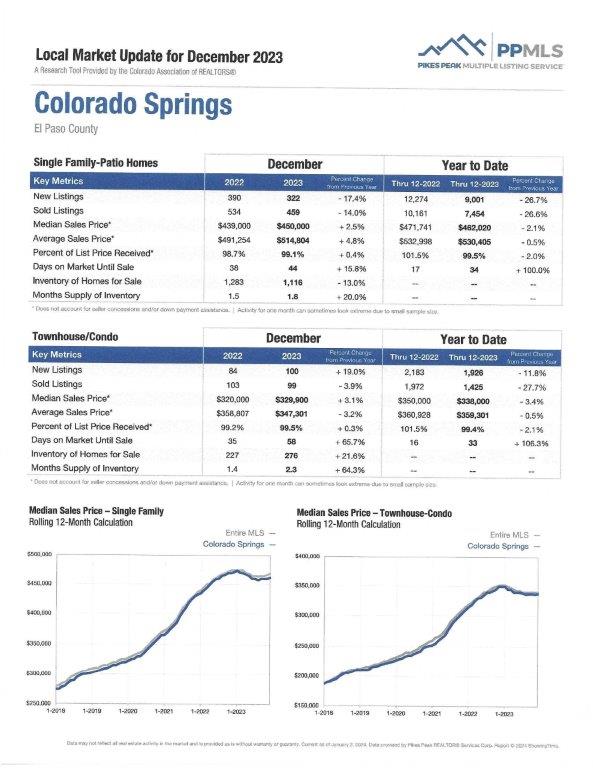

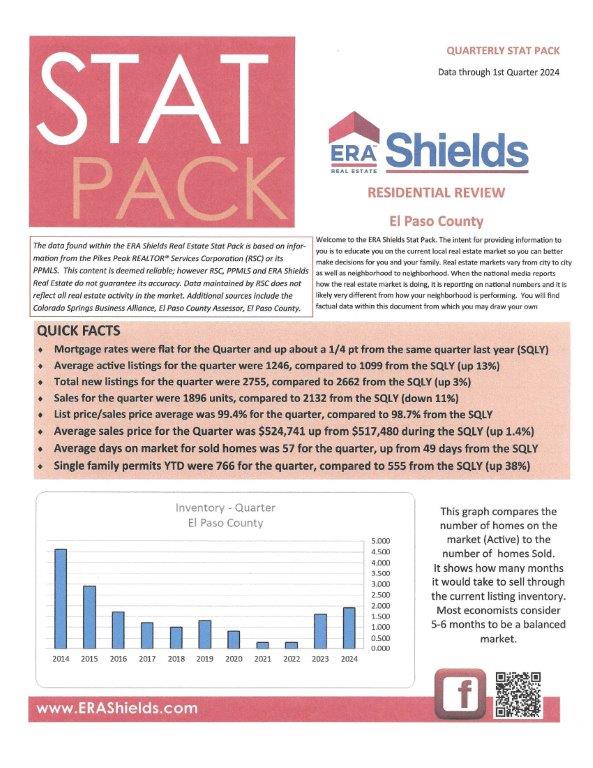

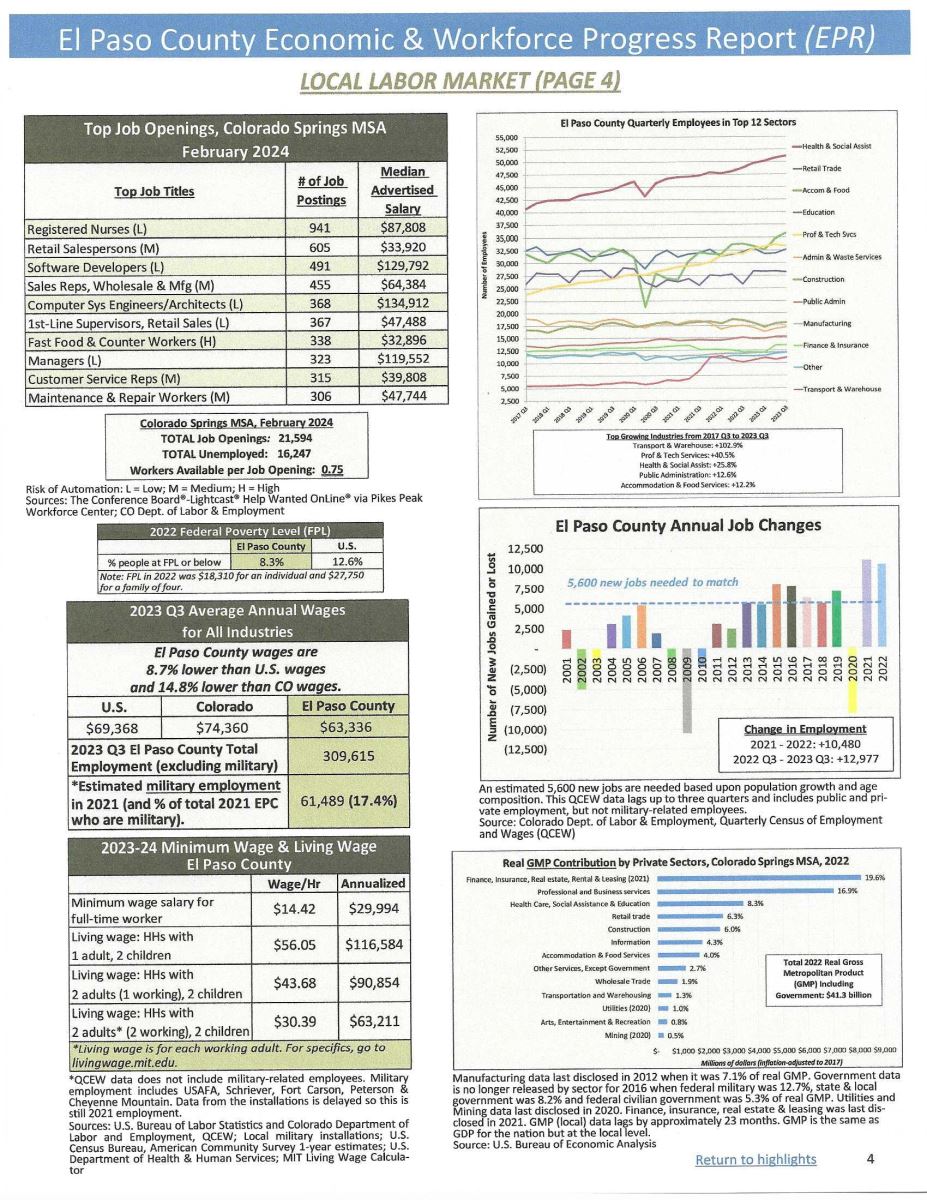

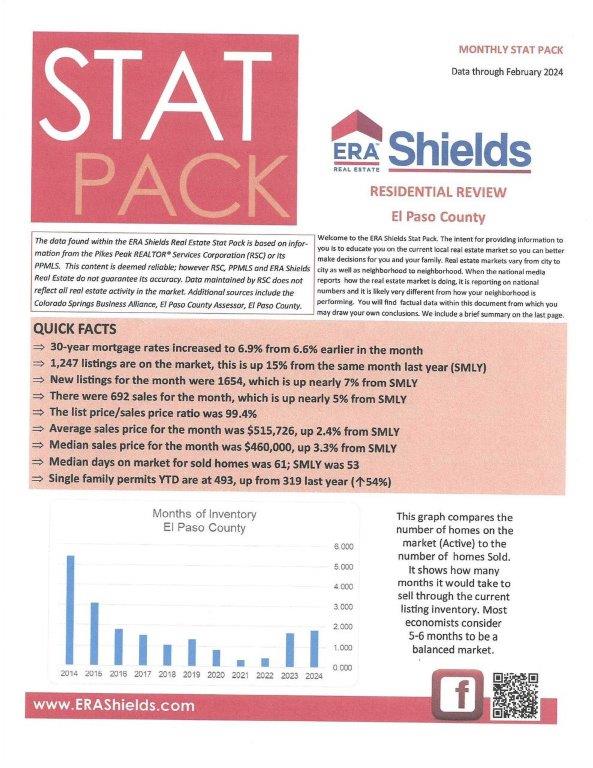

APRIL 2024 MONTHLY INDICATORS AND LOCAL MARKET UPDATE ILLUSTRATE OUR LOCAL TRENDS IN DETAIL

Colorado Association of REALTORS® , Pikes Peak REALTORS Service Corp, or it’s PPMLS

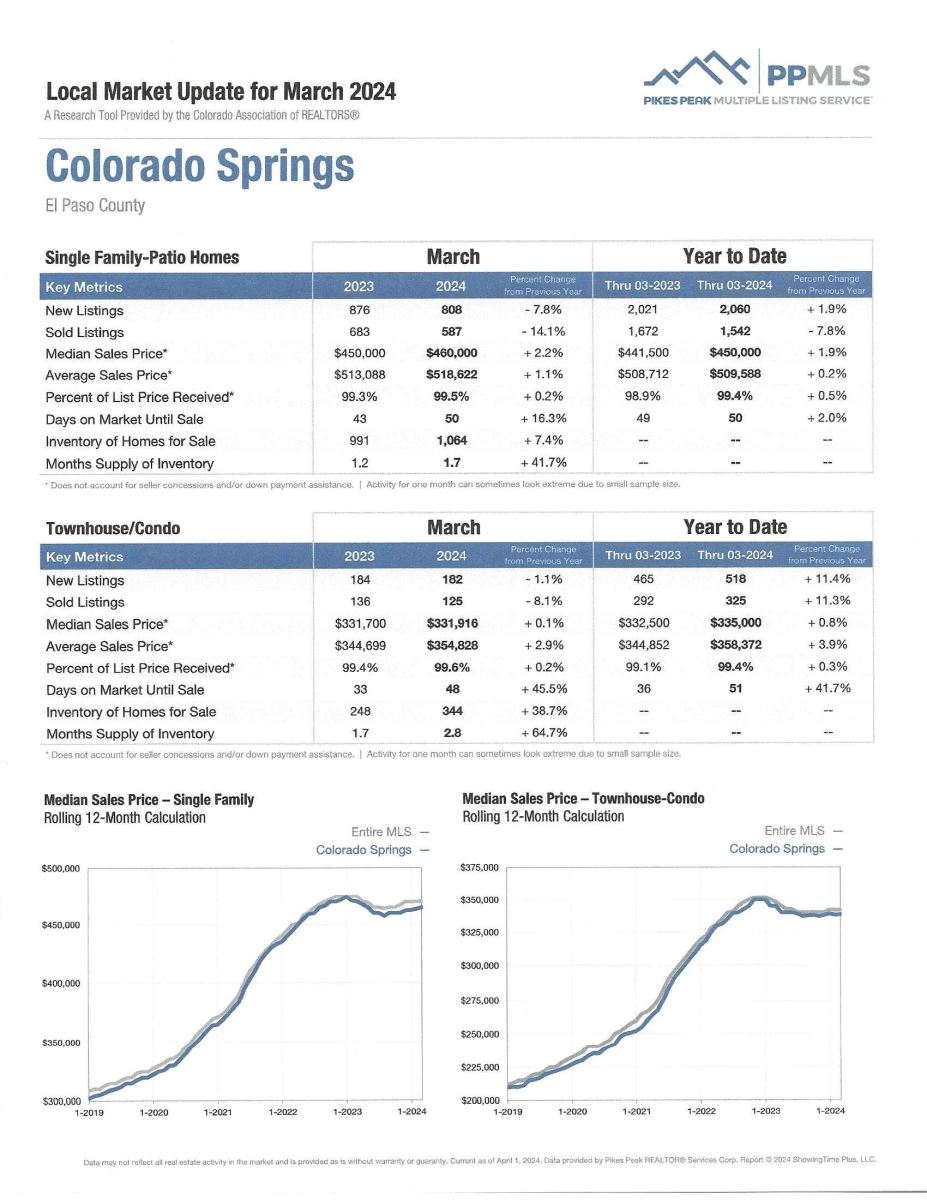

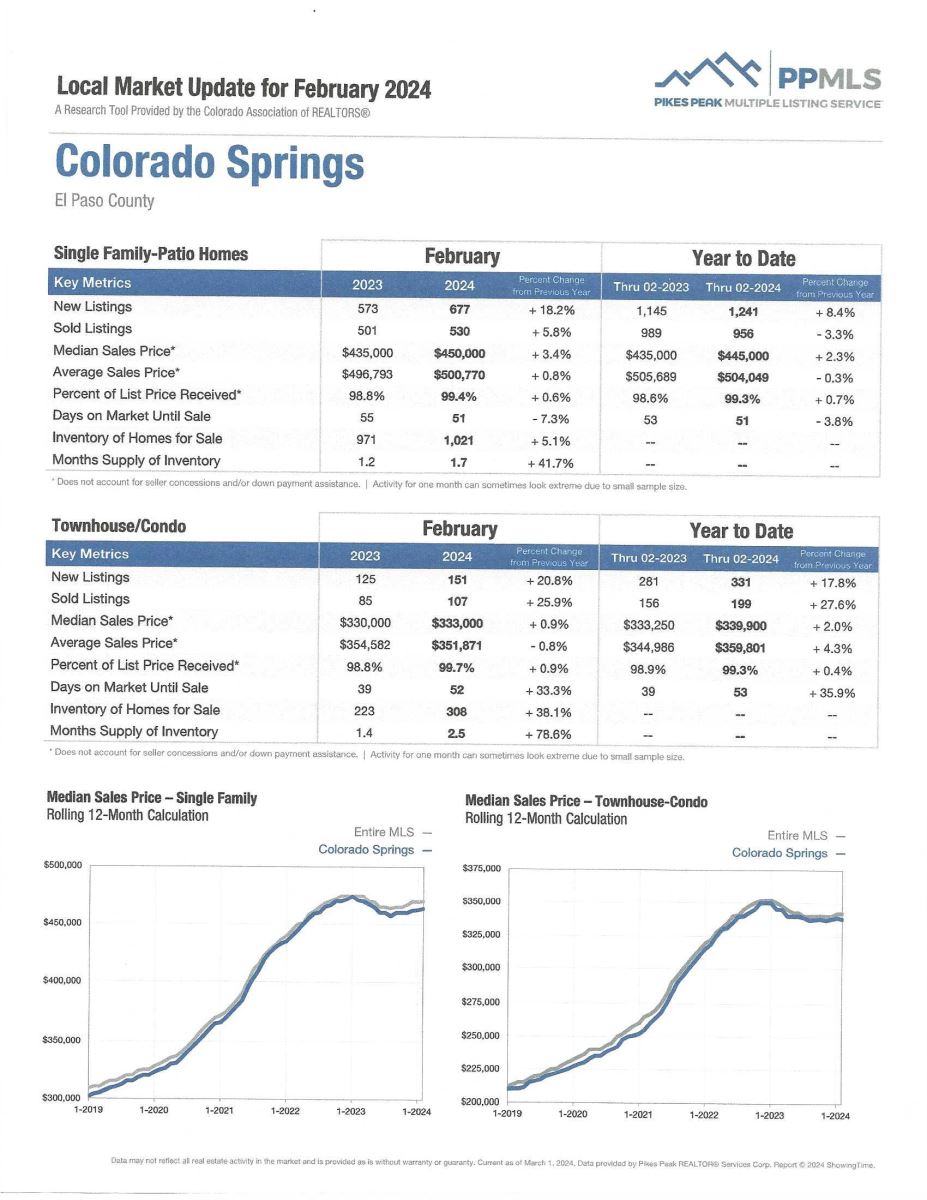

Providing greater detail than the above report, this contains information on both El Paso and Teller counties for Residential real estate.

The “Activity Snapshot” for all residential properties in El Paso and Teller counties shows the Year-to-Date one-year change:

- Sold Listings for All Properties were Down 6.6%

- Median Sales Price for All Properties was Up 5.2%

- Active Listings on All Properties were Up 23.5%

You can click here to read the 16-page Monthly Indicators or click here to get specific information on the geographical are of your choice from the 18-page Local Market Update. It’s a good idea to check out your own area or one that you might be considering in order to get a good idea of the local pulse. As an example, here is a detailed report on the Colorado Springs area:

.jpg)

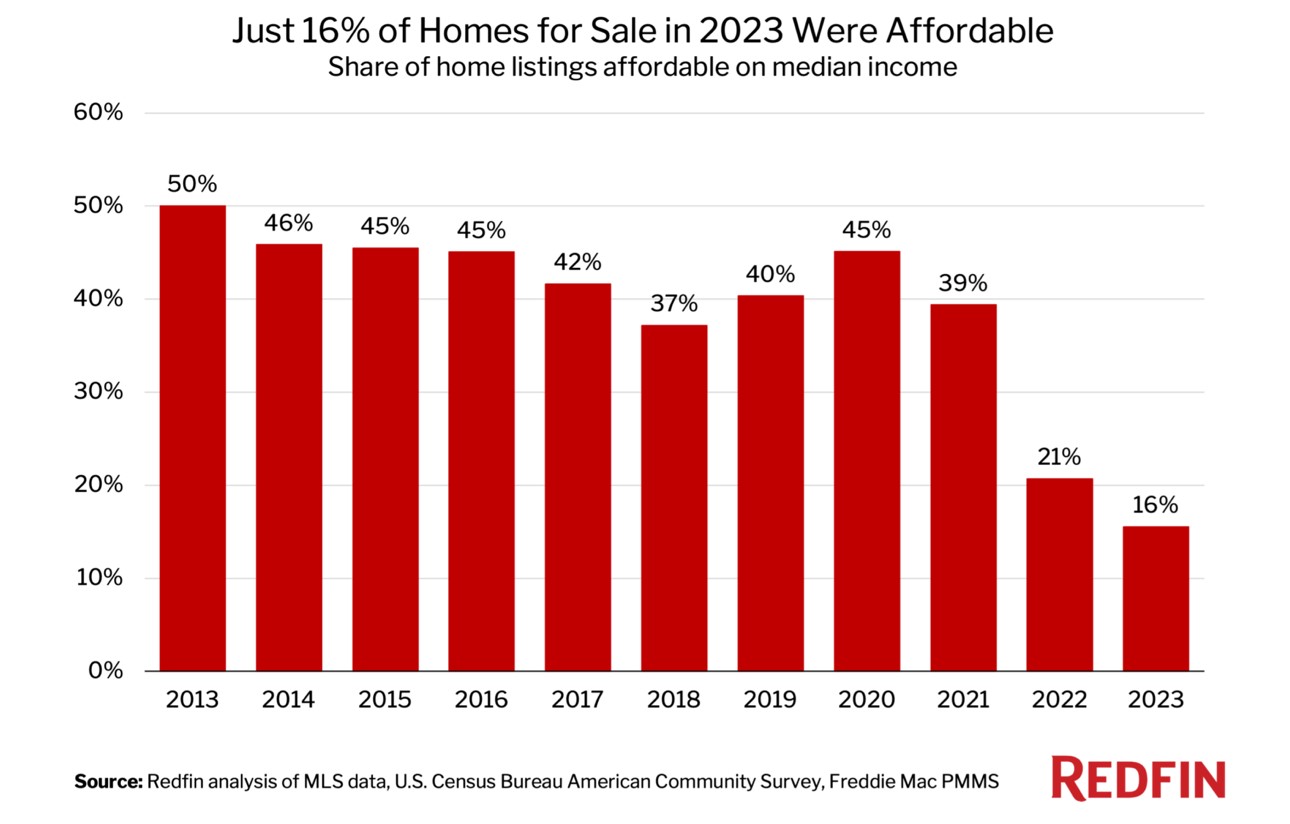

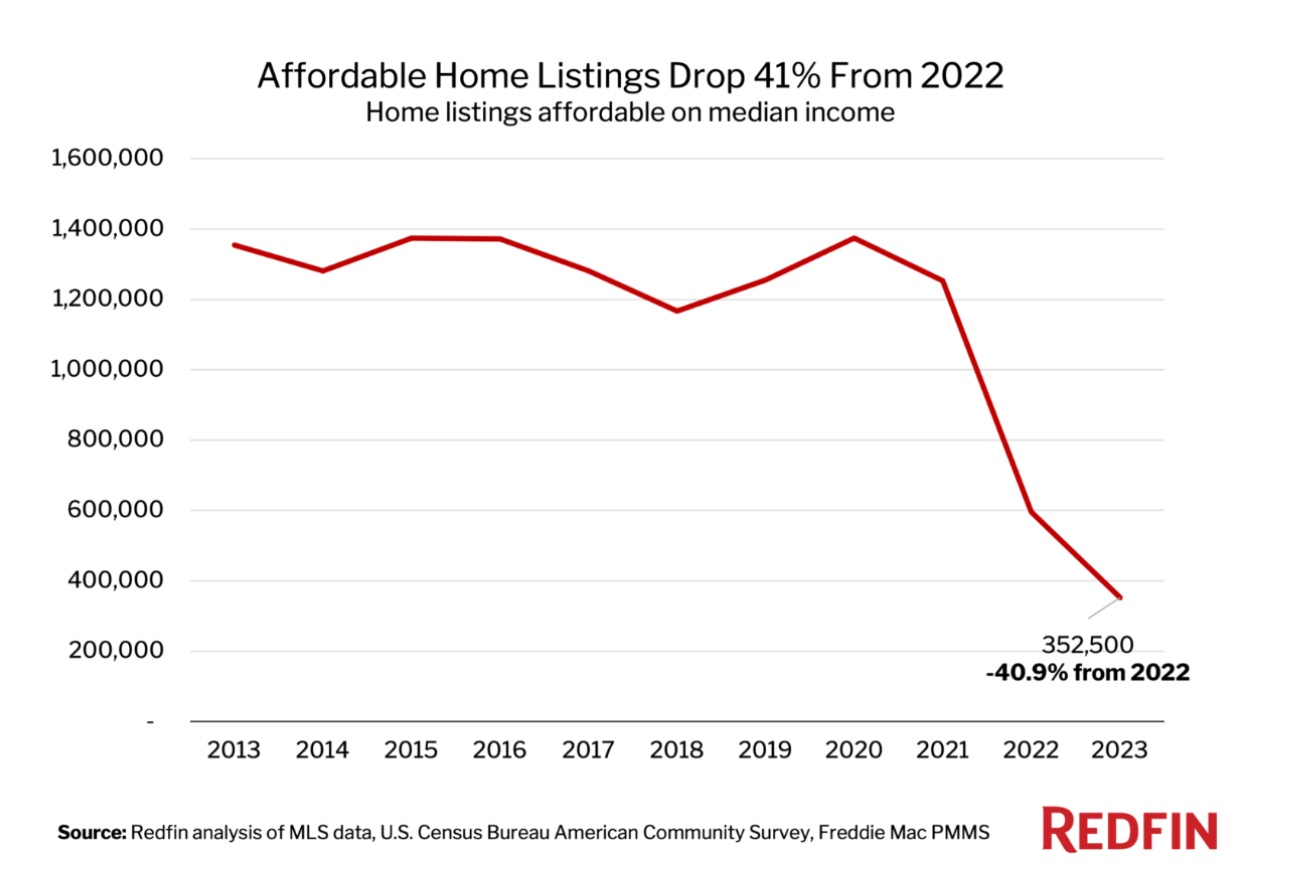

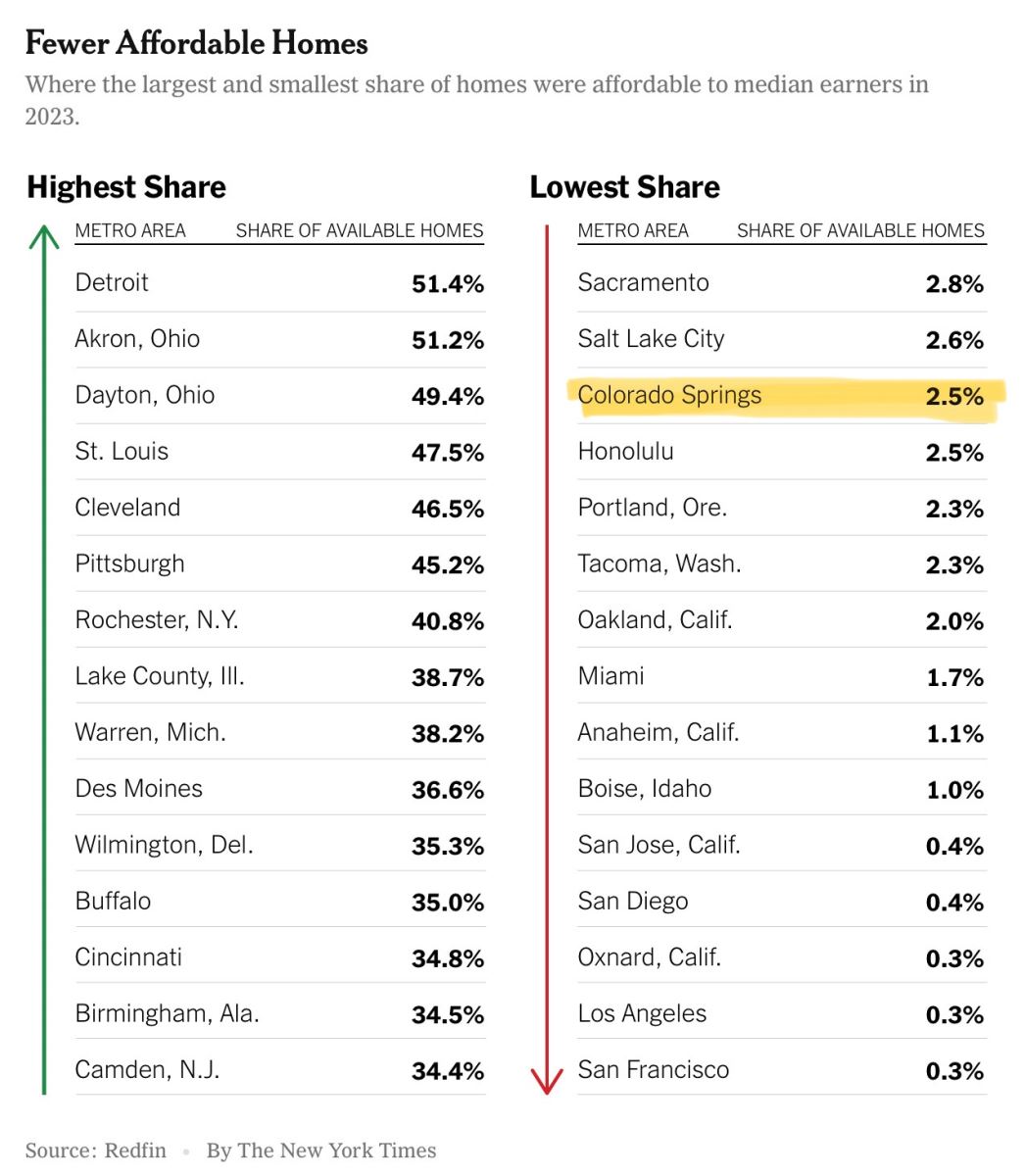

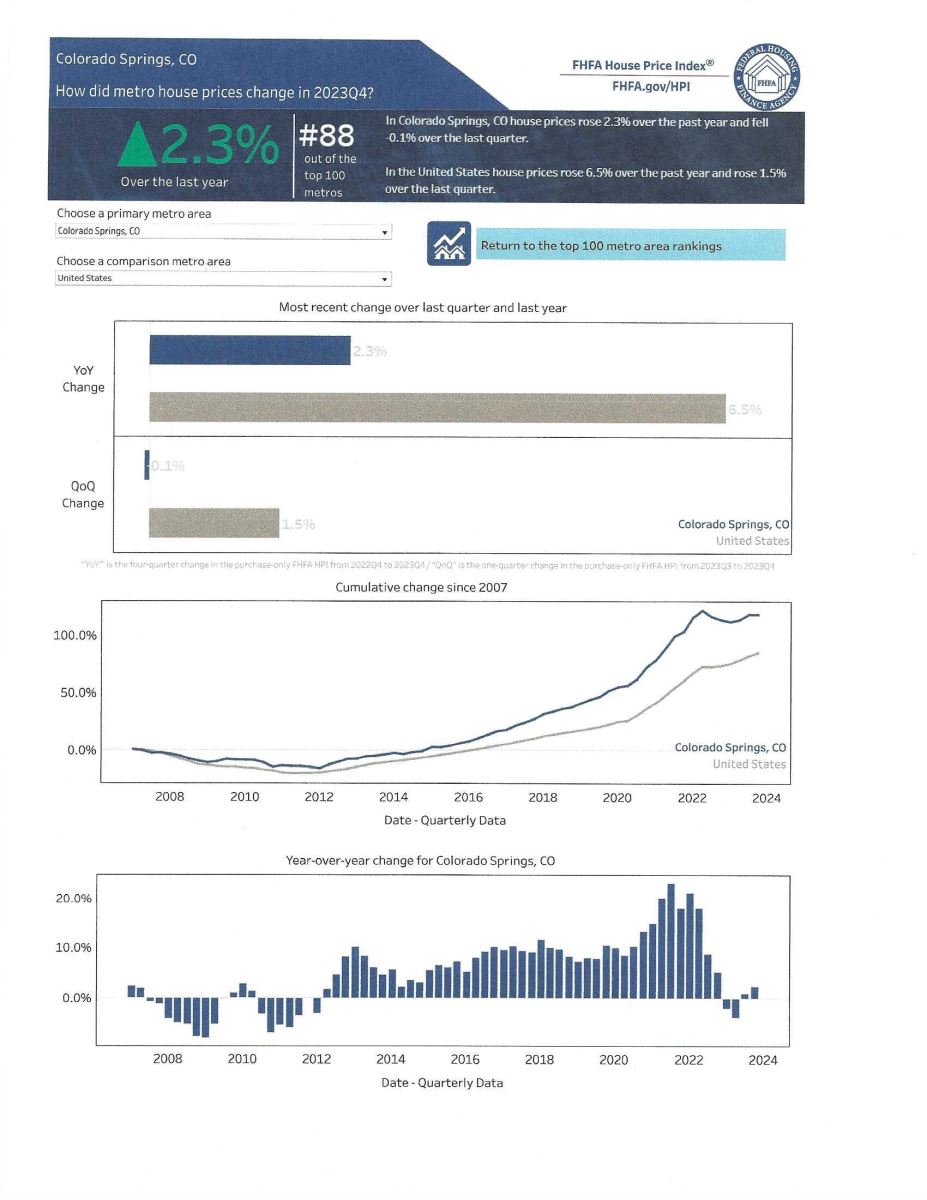

COLORADO SPRINGS HOME PRICES CONTINUE TO RISE IN LAST QUARTER 2023

The National Association of Realtors, 5.8.24

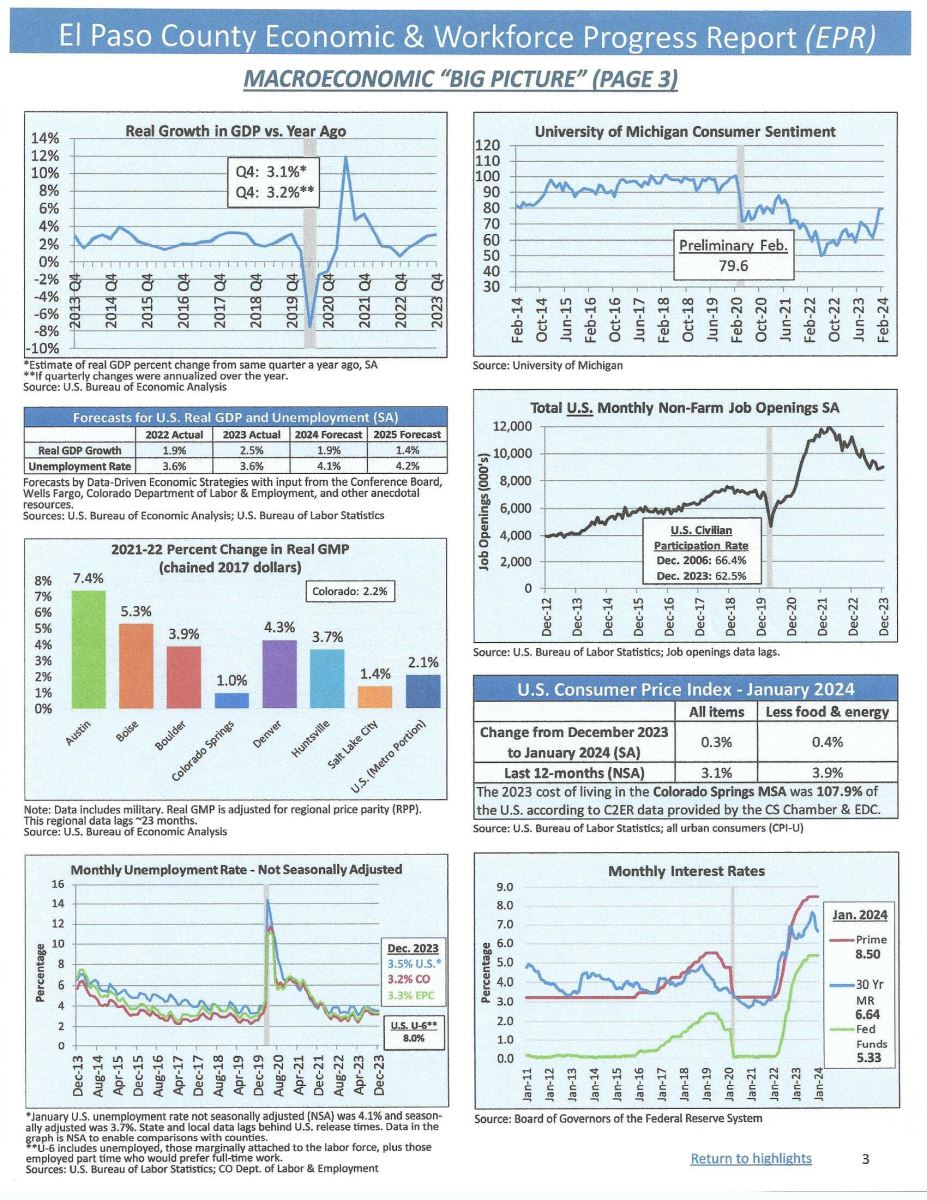

In the recently published report from the National Association of Realtors (NAR), single-family, existing-home prices grew more than 90% in measured metro areas. This is up 86% from the previous quarter.

According to Lawrence Yun, chief economist for NAR, “Astonishingly, greater than 90% of the country’s metro areas experienced home price growth despite facing the highest mortgage rates in two decades. In the current market, rising prices are the direct result of insufficient housing supply not meeting the full demand.”

Compared to a year ago, the national median single-family existing-home price climbed 5% to $389,400. In the prior quarter, the year-over-year national median price increased 3.4%.

The median price of single-family homes in Colorado Springs rose 0.9% to $448.800 during the last quarter of the year, per NAR. This price reflects detached, single-family and patio homes but not townhomes or condominiums.

The median price in the Springs ranked 47th highest of the 221 cities surveyed.

To see all 221 metro areas in alphabetical order, please click here. To see them in ranking order, click here. Or click here to see what income levels are required to purchase homes based on either a 5, 10 or 20 percent down-payment.

If you have any questions, please give me a call.

COLORADO SPRINGS RANKED NUMBER 3 IN BEST PLACES TO LIVE

U.S. NEWS AND WORLD REPORT, 5.19.24, The Gazette, 5.21.24

Colorado Springs jumped six places from number 9 last year to number 3 in the U.S. News and World Report’s “Best Places to Live” rankings for 2024-2025.

“Our secret is out—Colorado Springs is indisputably one of the best places to live in our great country, and we are proud to again rank as one of the top cities in this reputable list by U.S. News & World Report”, said Colorado Springs Mayor Yemi Mobolade via email to The Gazette.

To compile the rankings, the magazine uses data from the Census Bureau, FBI, the federal Department of Labor and its own internal sources. It also surveys thousands of people to determine the most important factors to them when they chose a place to live.

U.S.News categorized its data into four indexes that help determine Best Place to Live scores for the 150 largest cities in the U.S. and Puerto Rico: quality of life, which this year made up 32% of a city’s rankings; value 27%, job market 22% and desirability 19%.

In another key part of the desirability index, U.S. News surveyed 3,500 people nationwide in February to ask in which of the 150 cities they’d most like to live.

The result? Respondents rated Colorado Springs as their No 1 choice, which along with other desirability index components helped propel it to No. 3 overall in the rankings.

Of the other three Colorado cities on the list, Boulder ranked No.10, down from No. 4 last year; Fort Collins slipped to No. 39 from No. 23; and Denver ranked No. 40, considerably higher than their ranking of No.99 last year.

So, once again, when you consider how few existing homes we currently have for sale, you can see part of the reason. Everyone wants to live here!!

AND..THIS JUST IN…A LISTING OF FARMERS MARKETS AROUND THE PIKES PEAK AREA…

HARRY’S JOKE OF THE DAY:

(actually, more truth than fiction in today’s market)

FEATURED LISTING:

Keep looking here in future issues…. a new listing will be here soon. And, if you’re ready to sell, yours will be here as well.

.png)

.jpg)