May 5, 2023

HARRY’S BI-WEEKLY UPDATE

A Current Look at the Colorado Springs Residential real estate Market

As part of my “Special Brand of Customer Service”, it is my desire to share current Residential real estate issues that will help to make you a more successful and profitable Buyer and Seller.

SPRING BUYING AND SELLING SEASON HAS HEATED UP EARLY… WITH NO SIGNS OF SLOWING DOWN

At the end of last year, I would never have predicted that the first quarter of 2023 would be so busy…but it was. I had more closings during this first quarter than in the first quarter of the previous three years and it appears that things are just beginning to heat up.

There are numerous reasons for this, including a ramp up of corporate relocation, greater interest from my investor clients and several family members of friends and clients who are wanting to relocate here to be closer to them.

Whatever the reason, it has kept me as busy as ever and given me the opportunity to do the thing I most enjoy…helping families find just the “right” match for their wants, needs and budget requirements. A house, as it’s said, is a “castle” or “safe haven”, and it gives me so much pleasure to see my clients happily ensconced in their new home.

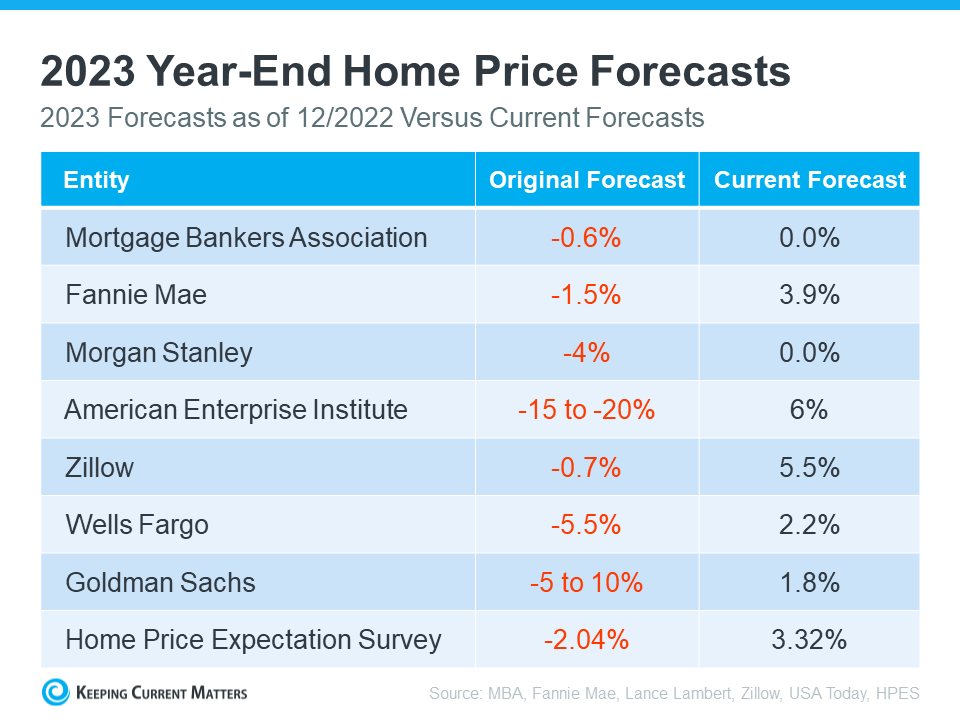

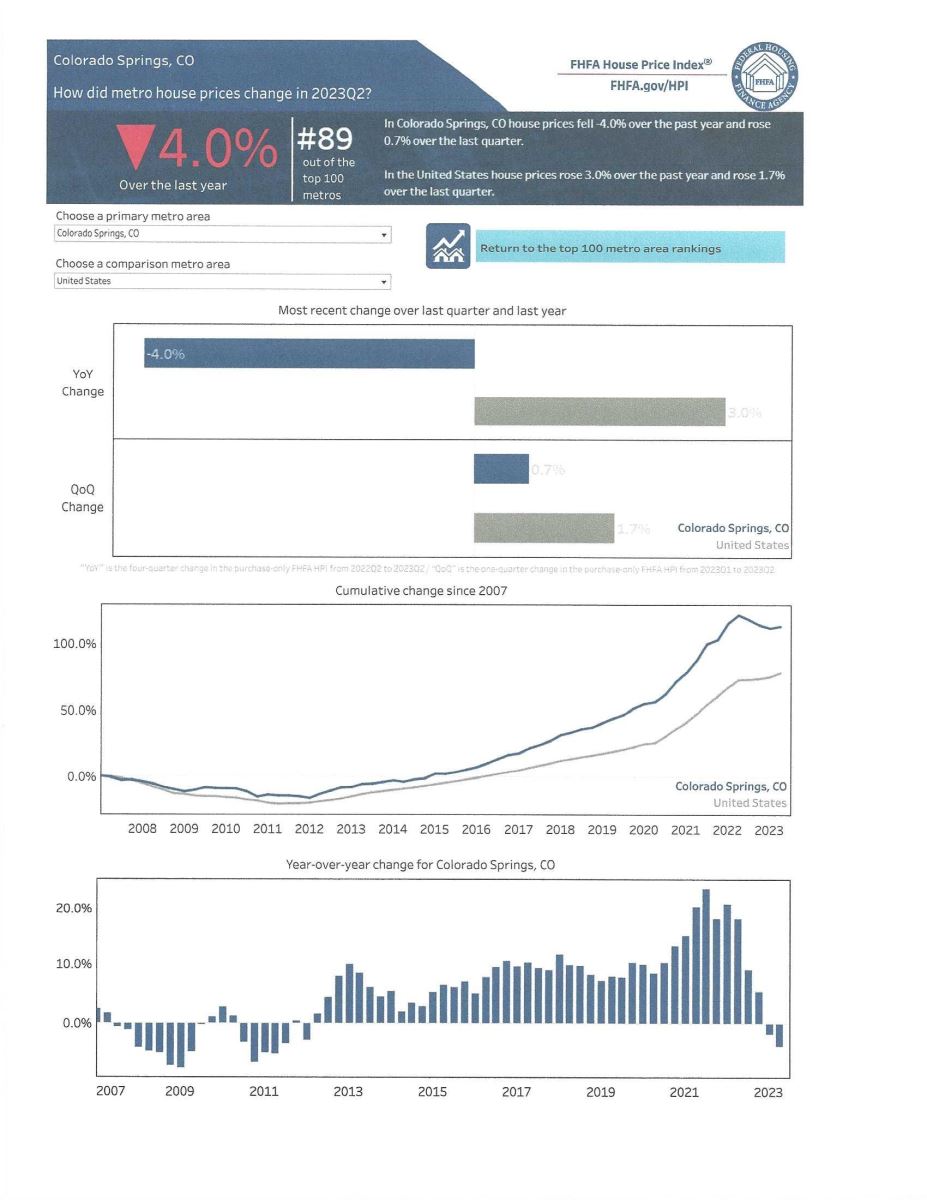

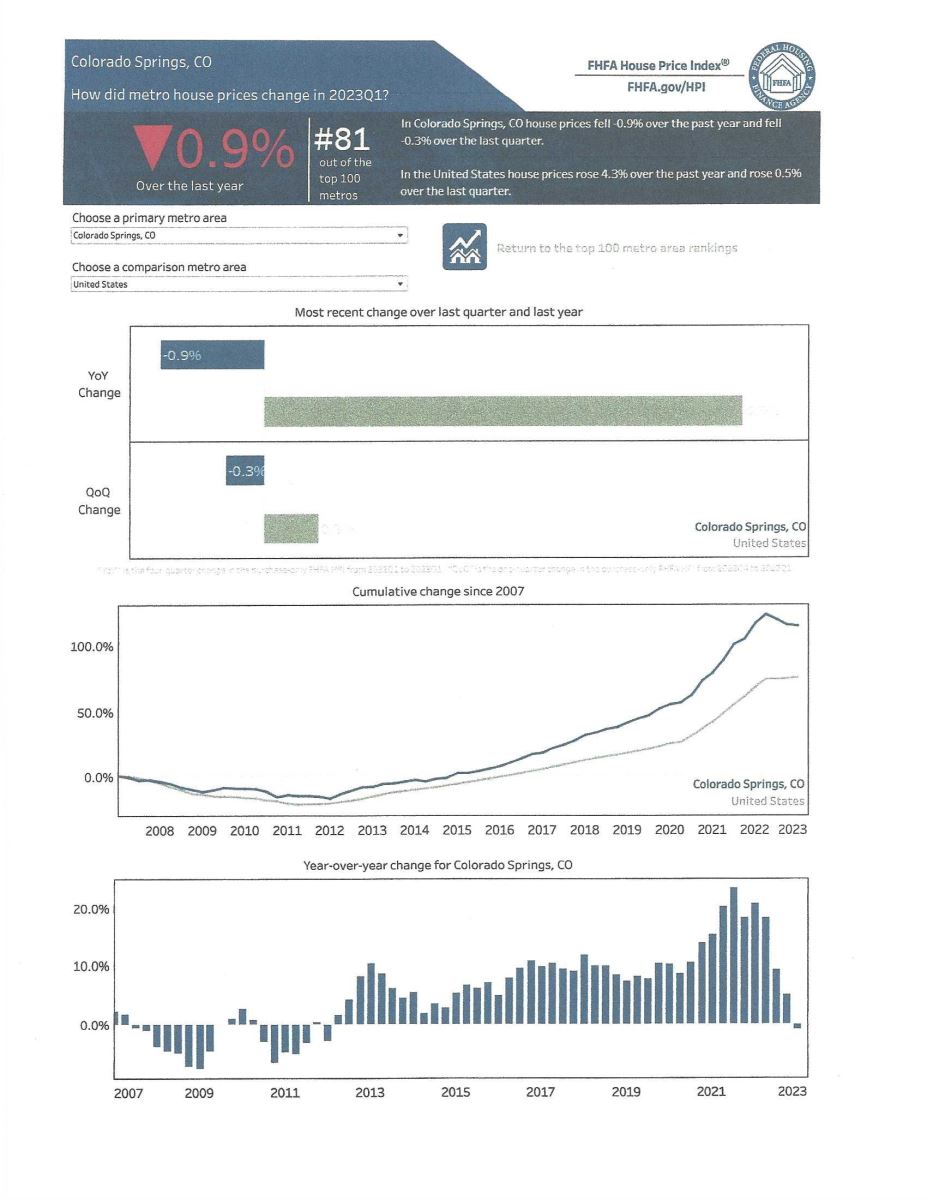

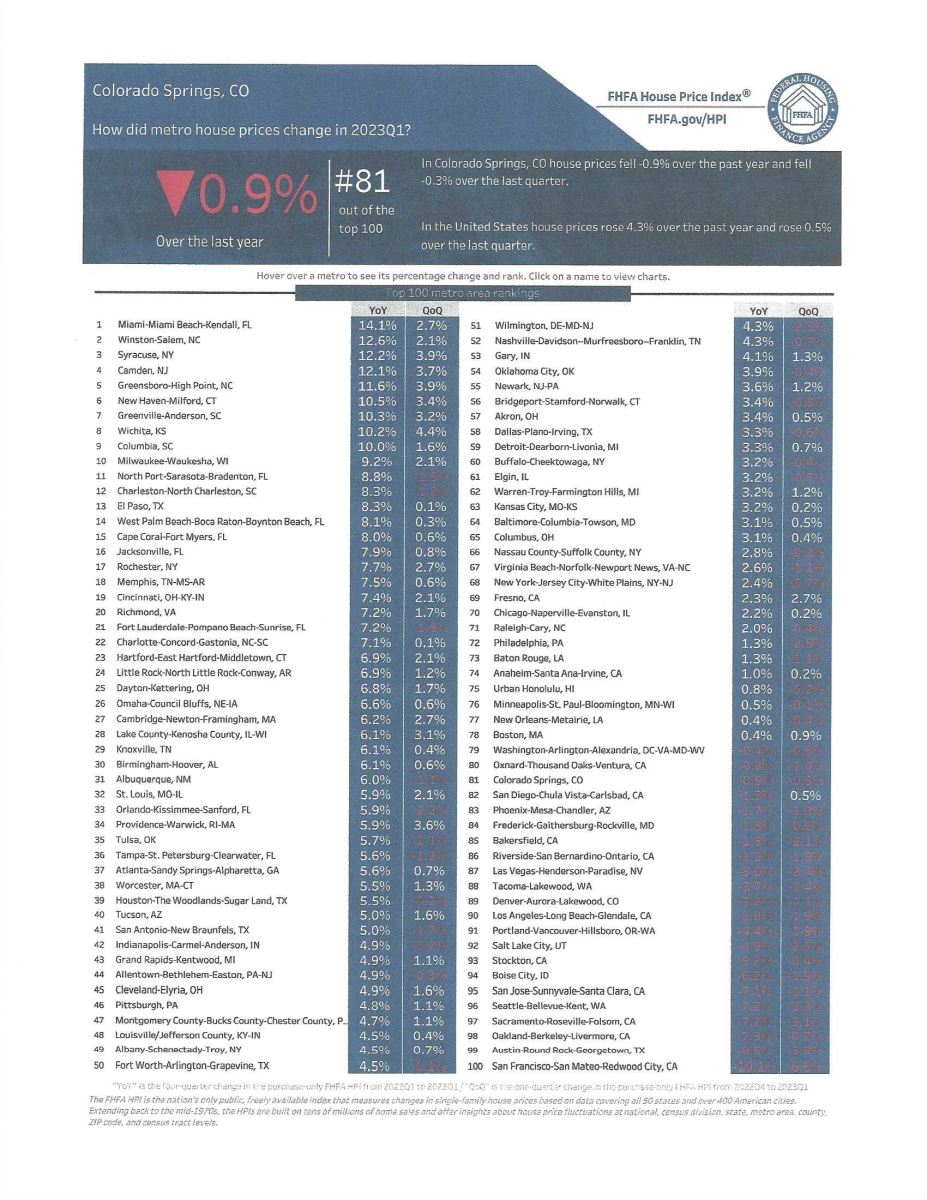

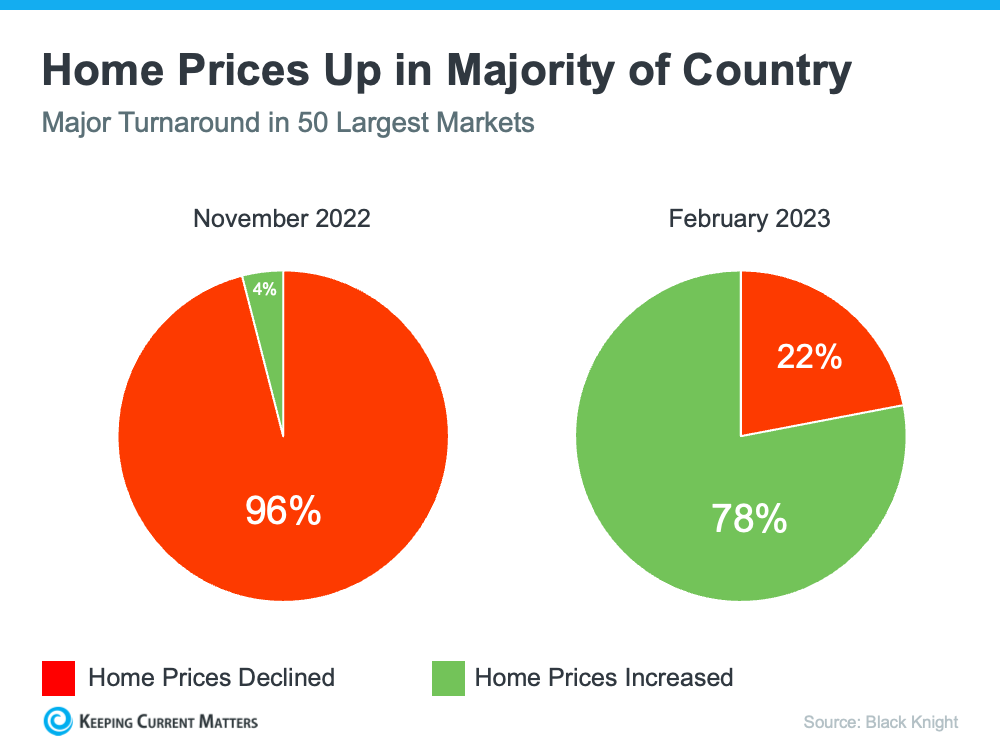

As you will see from the statistics below, homes in the Colorado Springs area are holding their value much better than in some other areas of the country and I would expect them to do even better as the year moves on.

Sales, while not as brisk as a year ago due to the quick rise in interest rates, are starting to increase and total active listings are up 64% over a year ago. New listings are starting to rise as well, month over month, and I would expect that trend to continue. And of most importance to sellers, homes are selling at just about their listing price and with fewer days on the market.

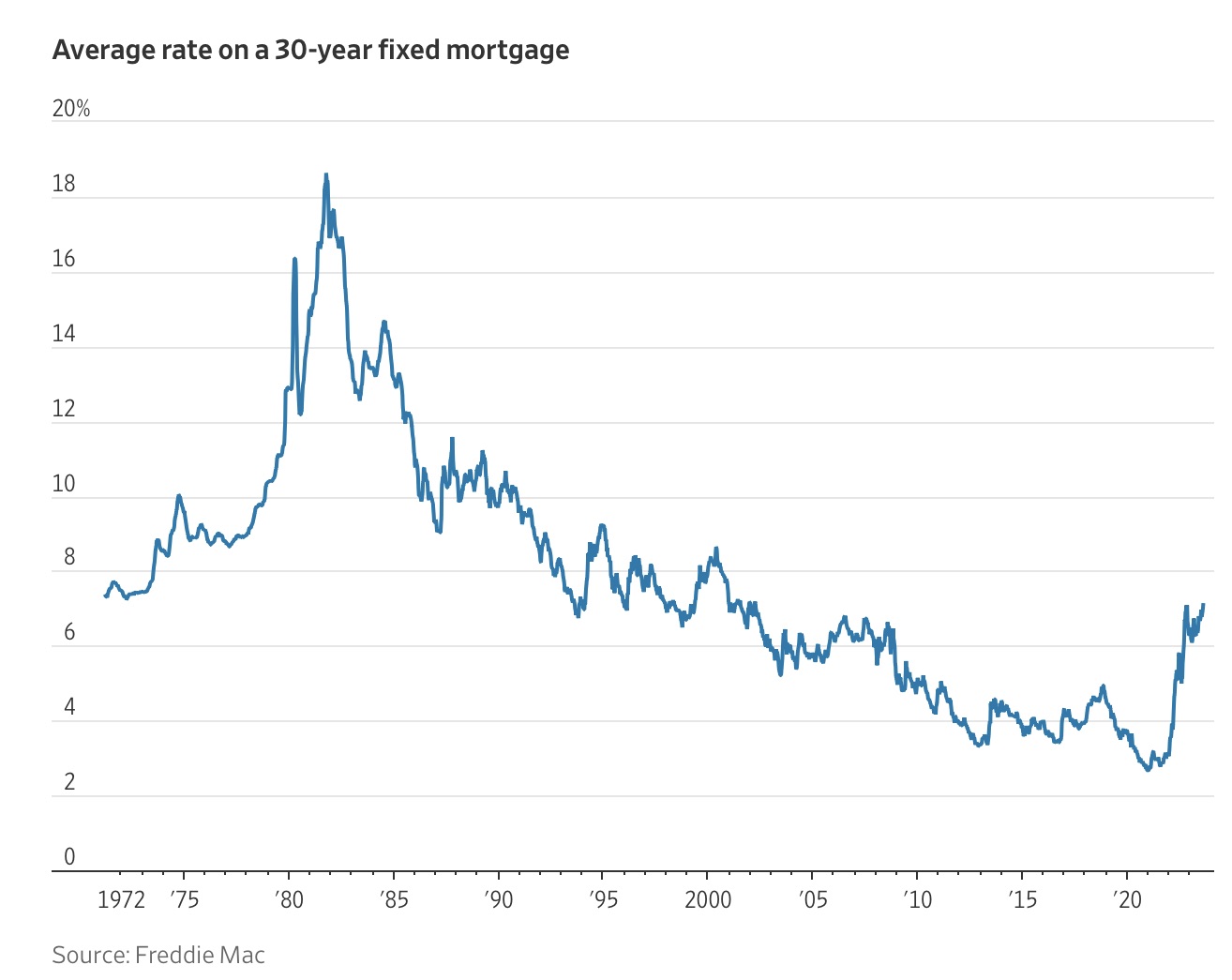

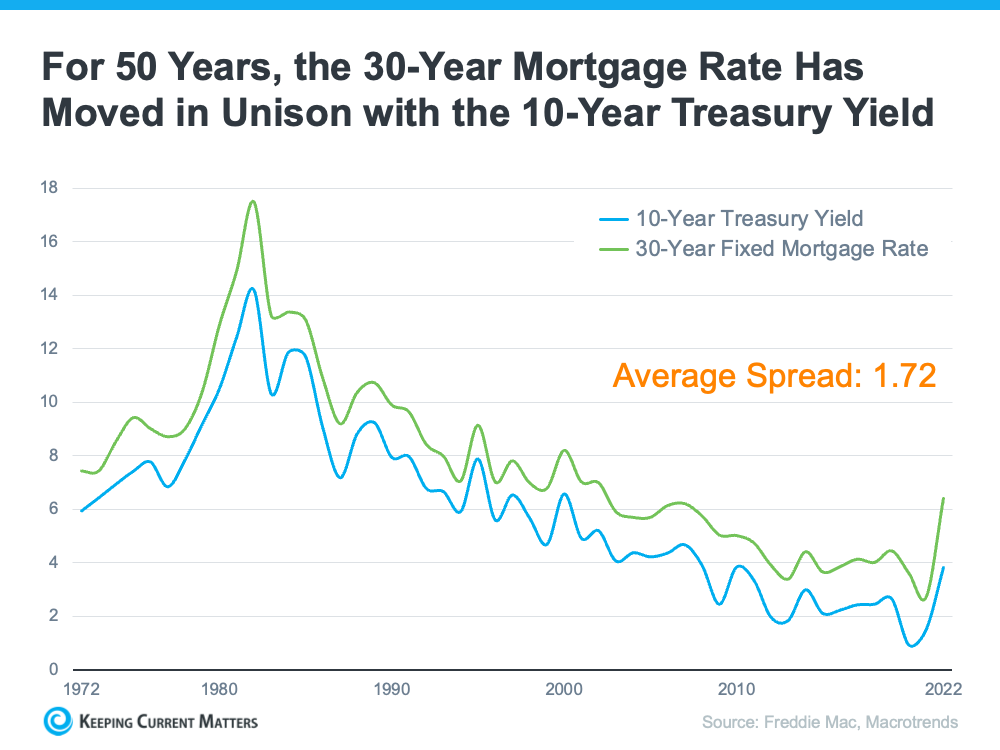

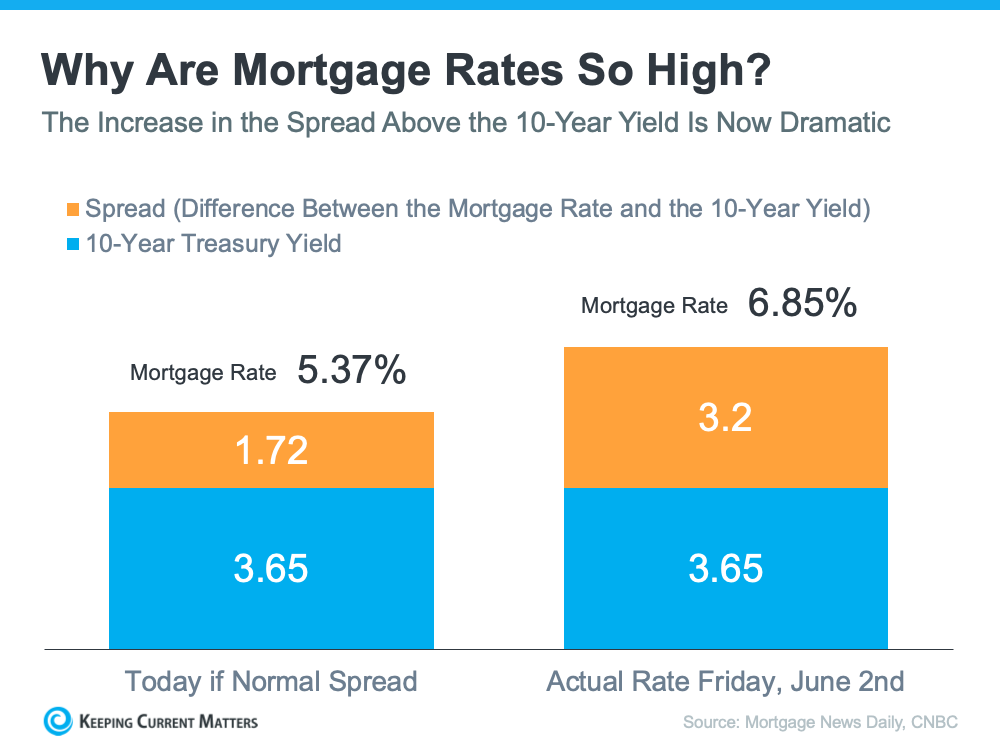

Lenders have been lowering their mortgage interest rates, and apparently folks are taking advantage.

And, as I have always said, there are always those wanting to sell and those wanting to buy…all for various individual reasons. If you have even considered a move, either to sell and trade up, buy for investment purposes or for the first-time, now is the time to start considering your options.

Of course, it’s more important than ever to have a knowledgeable, seasoned real estate professional in your corner when it comes to both buying and selling. Fortunately, you’ve got me.

My long-time experience, coupled with my investment banking background, give me an edge that my clients have found to be crucial in helping them and their families realize their personal real estate visions.

Knowing what you want, need, and can afford is an important first step. The second step is to contact me.

I’ve seen most every type of cycle imaginable and have been able to find solutions that can work for most every situation.

If Residential real estate is among your current hopes and dreams, please give me a call at 719.593.1000 or email me at Harry@HarrySalzman.com and let me help make them come true.

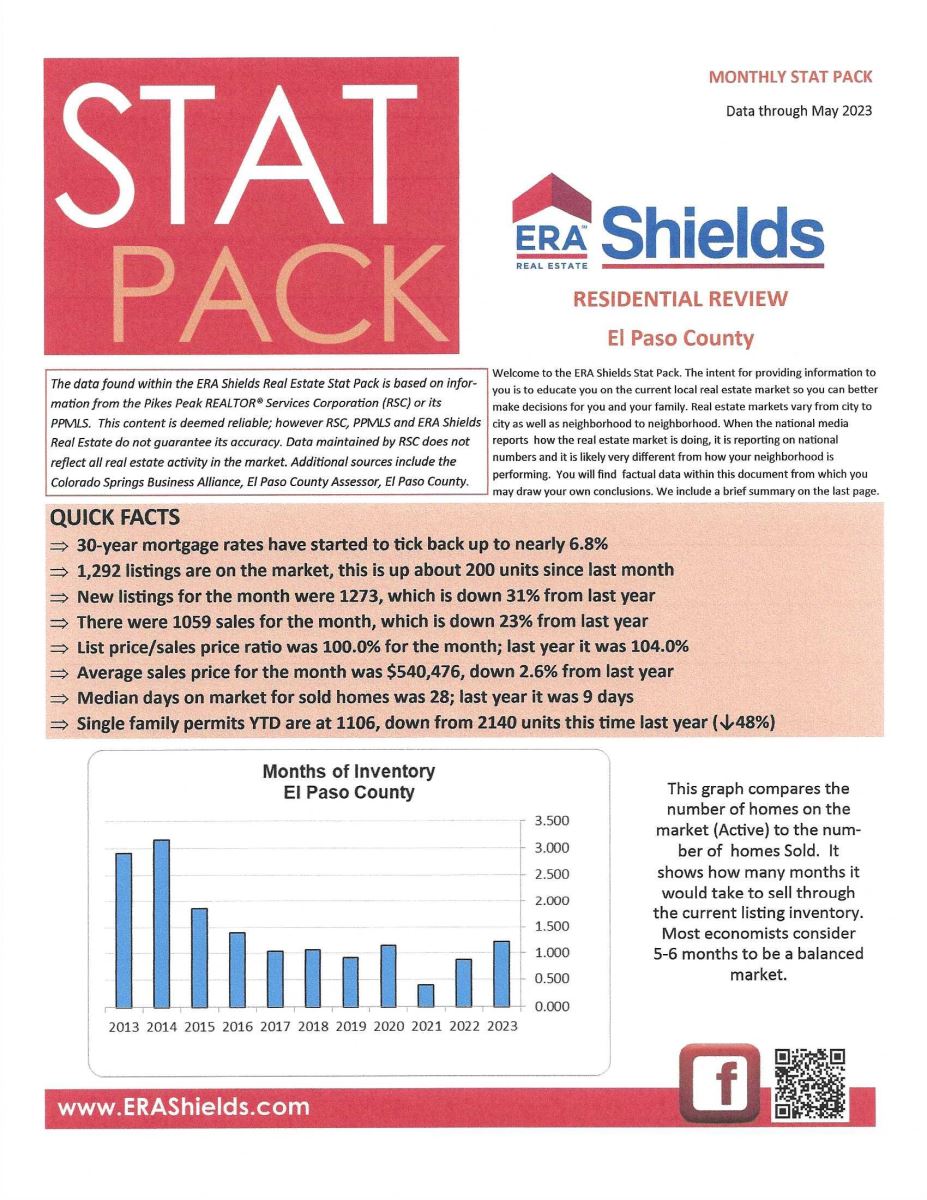

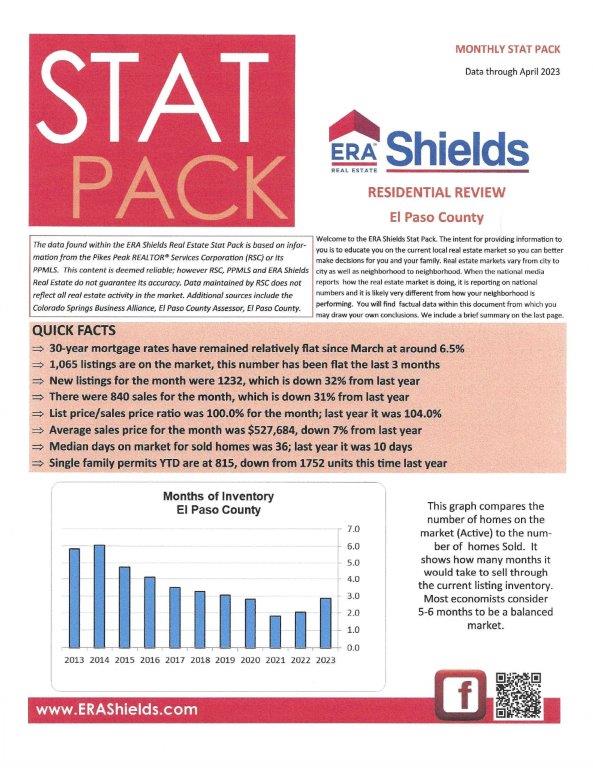

And now for statistics…

APRIL 2023

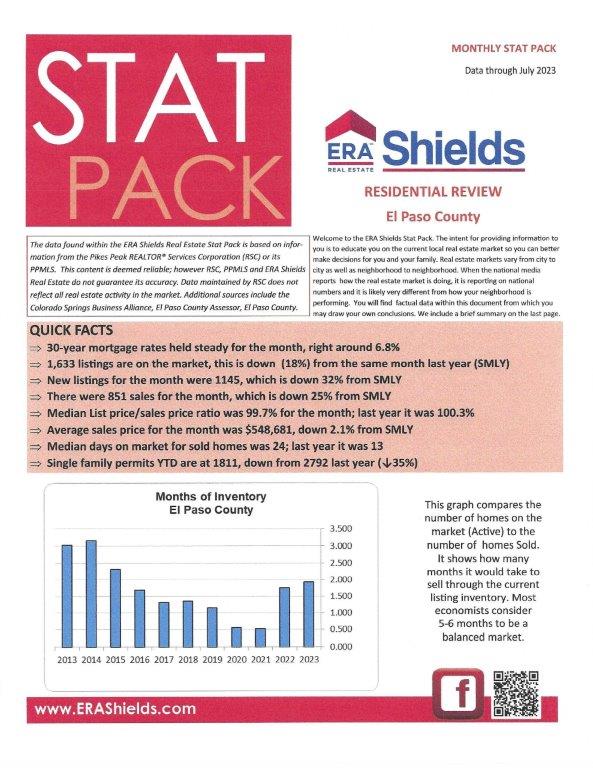

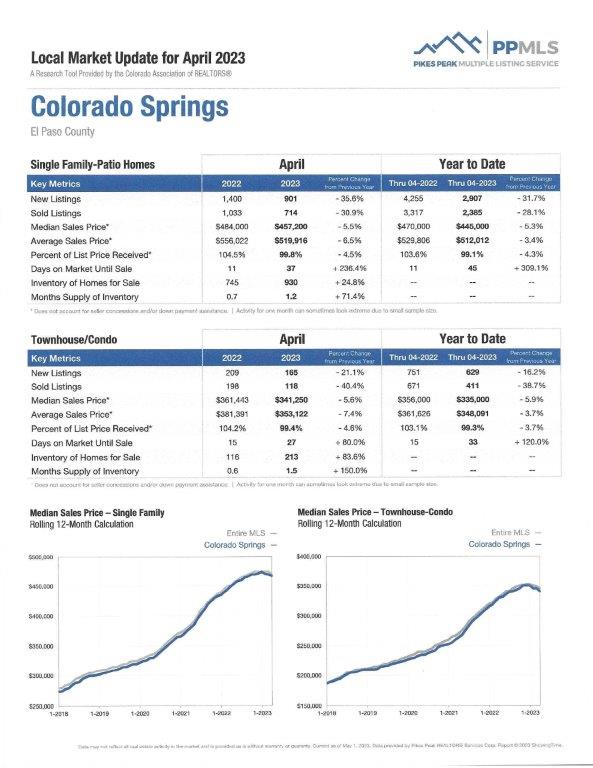

Statistics provided by the Pikes Peak REALTORS Service Corp., or it’s PPMLS

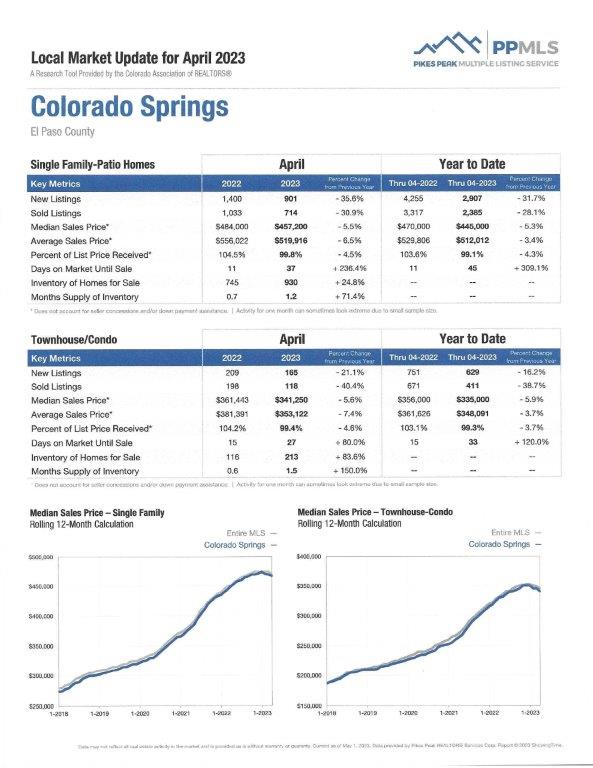

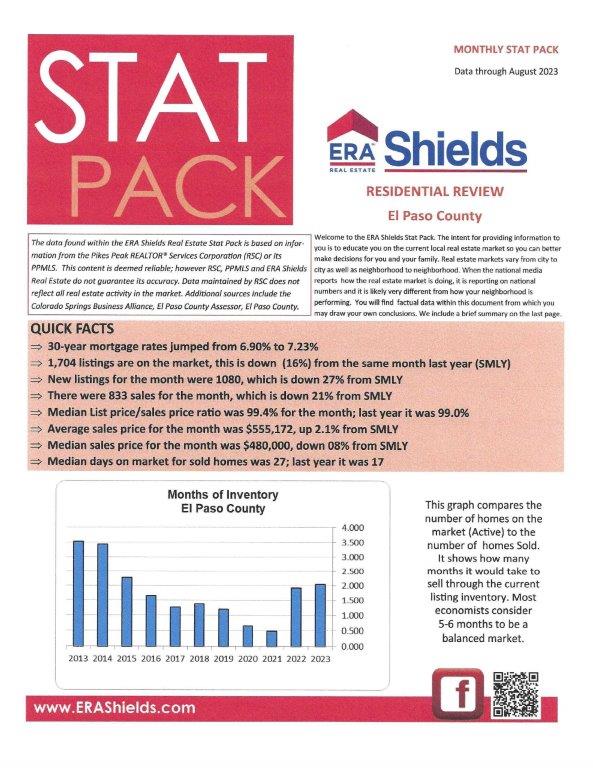

Here are some highlights from the April 2023 PPAR report.

In El Paso County, the average days on the market for single family/patio homes was a 36. For condo/townhomes it was 27.

Also in El Paso County, the sales price/list price for single family/patio homes was 99.8% and for condo/townhomes it was 99.4%.

In Teller County, the average days on the market for single family/patio homes was 56 and the sales/list price was 97.9%.

Please click here to view the detailed 10-page report, including charts. If you have any questions about the report or to find out how it relates to your individual situation, just give me a call.

In comparing April 2023 to April 2022 for All Homes in PPAR:

Single Family/Patio Homes:

· New Listings were 1,495, Down 32.7%

· Number of Sales were 1,090, Down 26.8%

· Average Sales Price was $532,254, Down 5.3%

· Median Sales Price was $459,000, Down 5.3%

· Total Active Listings are 1,590, Up 64.1%

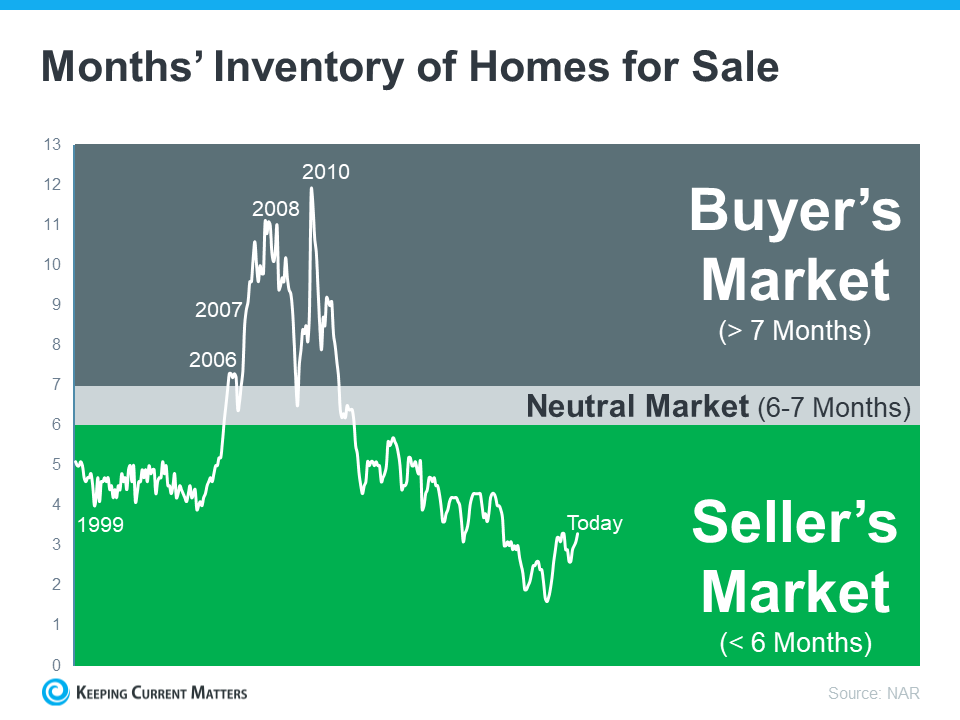

· Months Supply is 1.5, Down 2.4%

Condo/Townhomes:

· New Listings were 209, Down 15.7%

· Number of Sales were 140, Down 38.3%

· Average Sales Price was $364,637, Down 6.0%

· Median Sales Price was $350,000, Down 4.1%

· Total Active Listings are 241, Up 205.1%

· Months Supply is 1.7, Down 5.4%

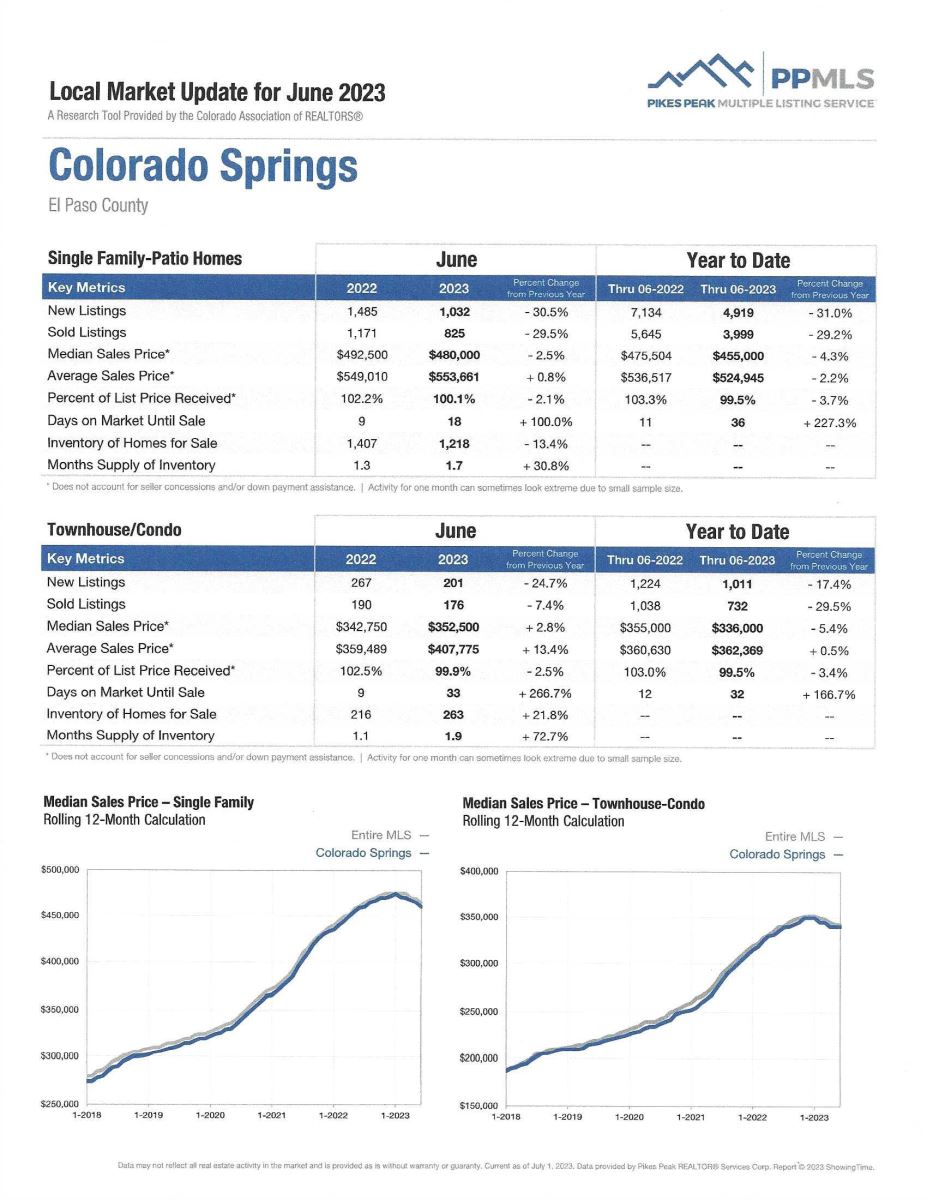

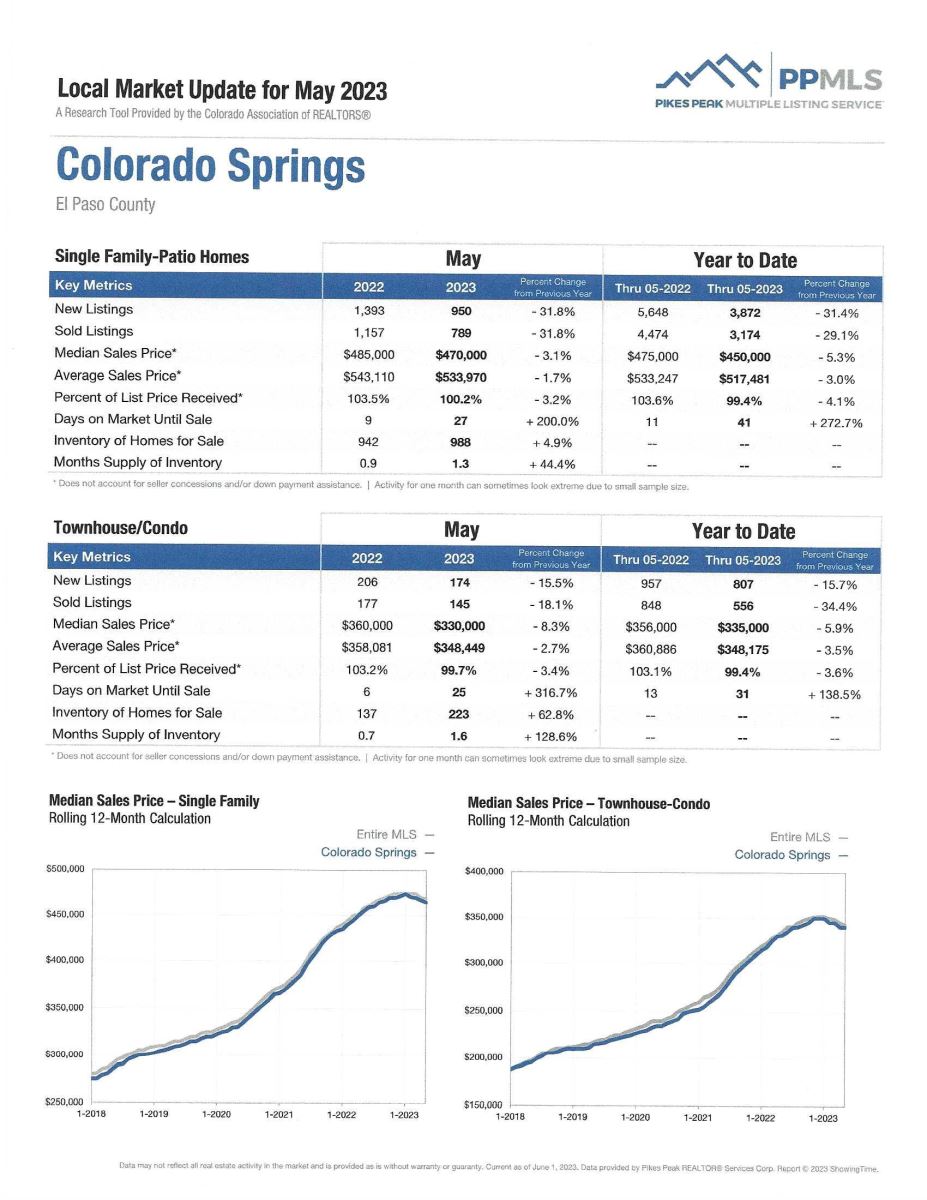

APRIL 2023 MONTHLY INDICATORS AND LOCAL MARKET UPDATE ILLUSTRATE OUR LOCAL TRENDS IN DETAIL

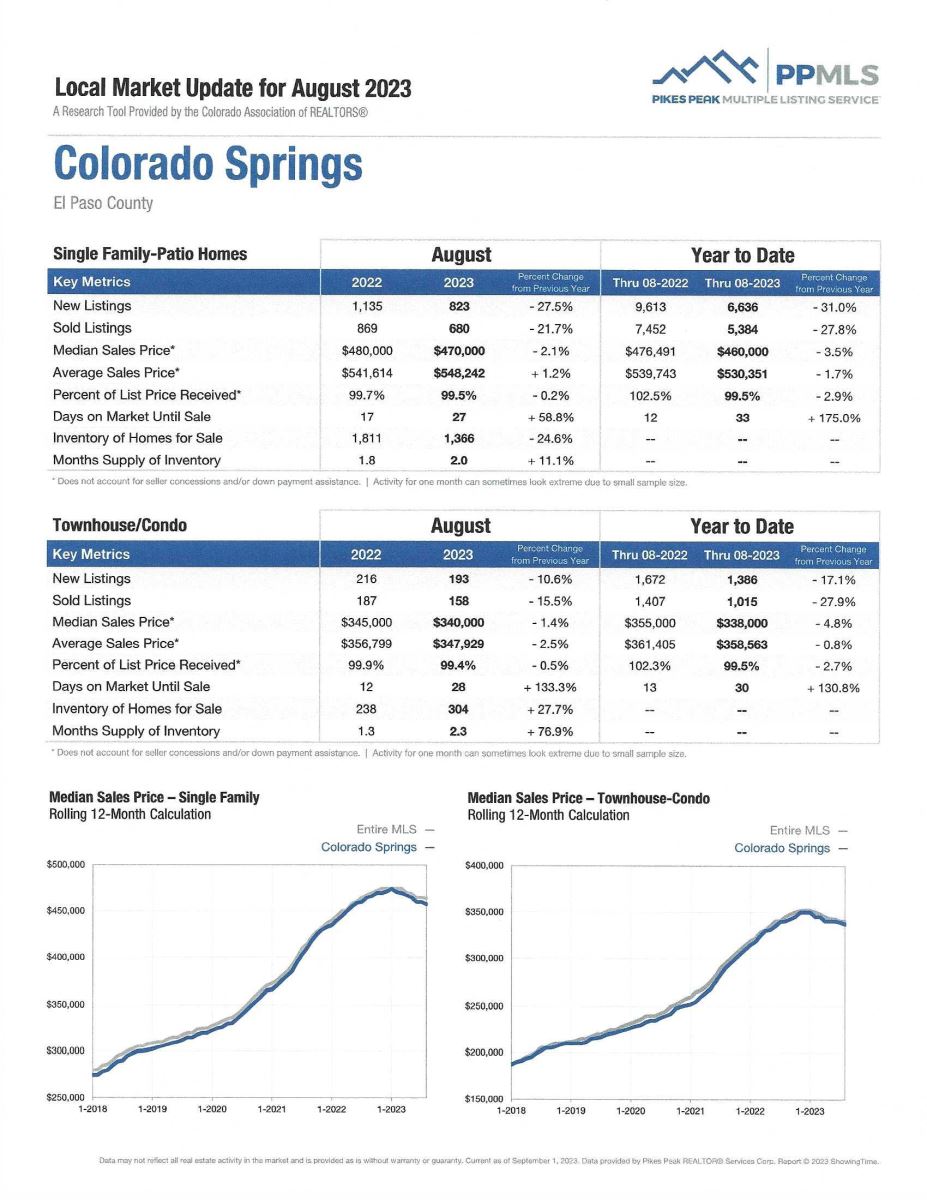

Colorado Association of REALTORS® , Pikes Peak REALTORS Service Corp, or it’s PPMLS

Providing greater detail than the above report, this contains information on both El Paso and Teller counties for Residential real estate.

The “Activity Snapshot” for all residential properties in El Paso and Teller counties shows the Year to Date one-year change:

- Sold Listings for All Properties were Down 31.5%

- Median Sales Price for All Properties was Down 5.3%

- Active Listings on All Properties were Up 31.7%

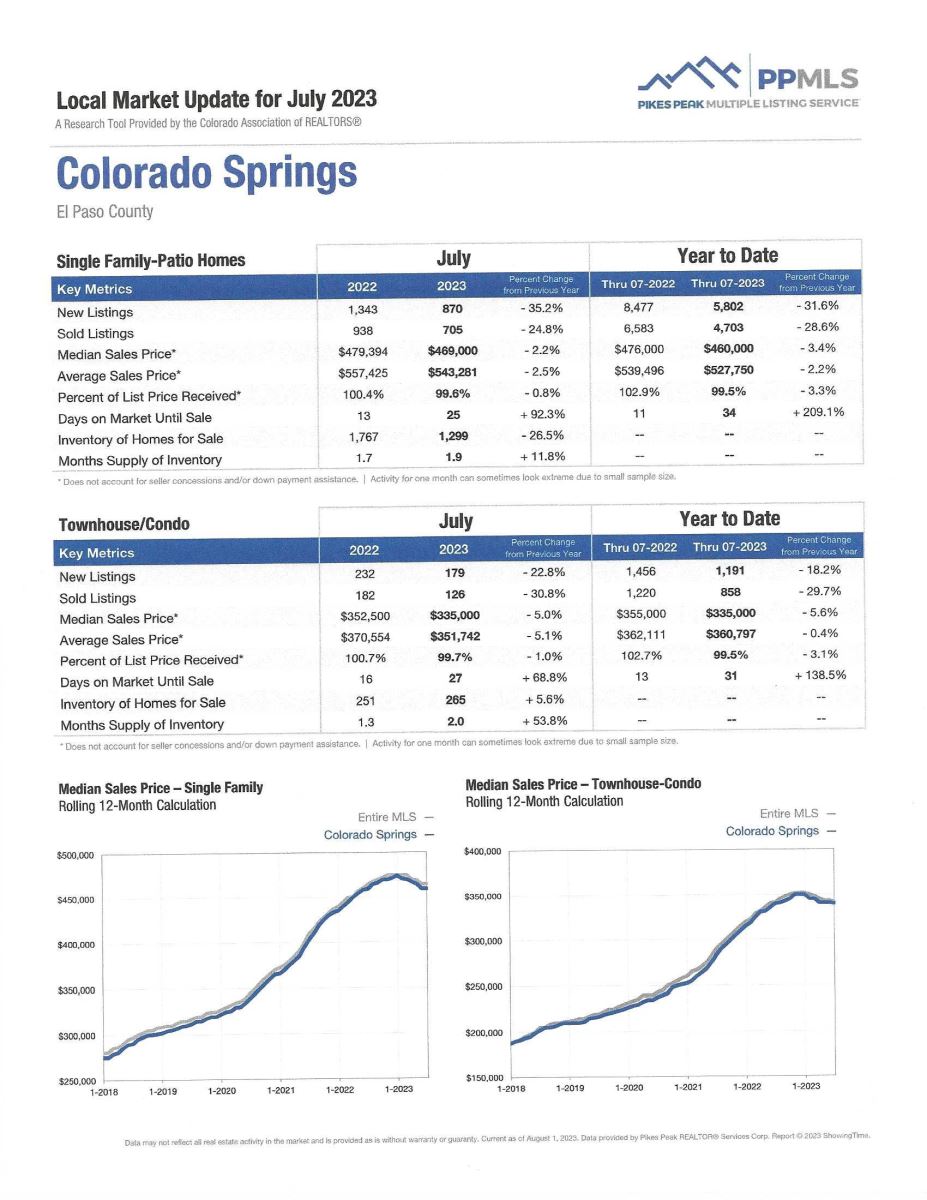

You can click here to read the 16-page Monthly Indicators or click here to get specific information on the geographical are of your choice from the 18-page Local Market Update. It’s a good idea to check out your own area or one that you might be considering in order to get a good idea of the local pulse. As an example, here is a detailed report on the Colorado Springs area:

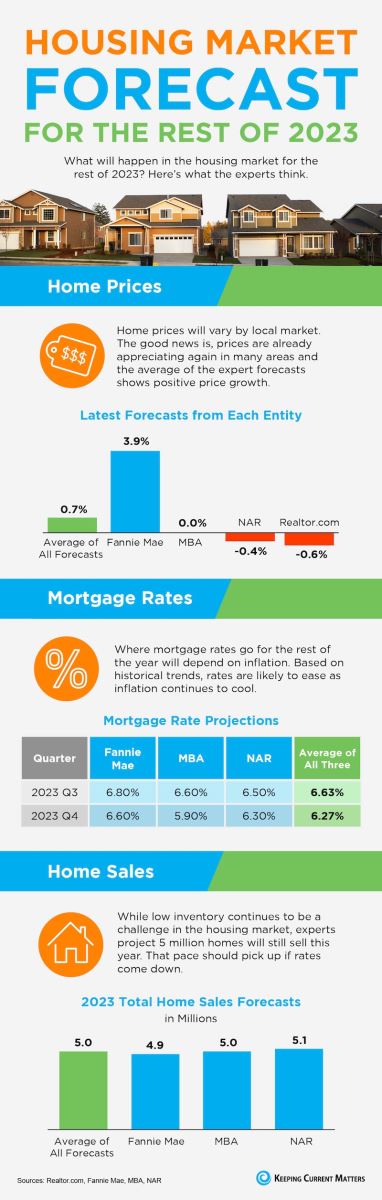

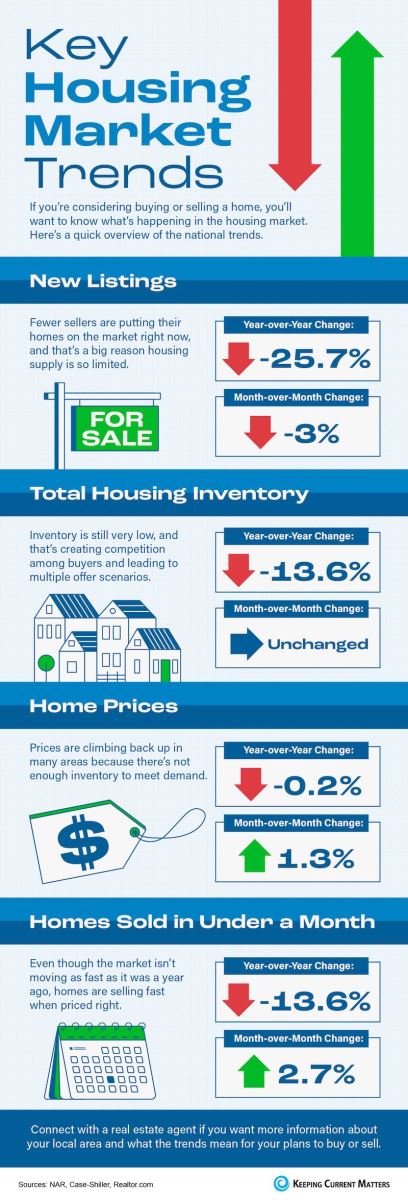

BUYER ACTIVITY IS UP DESPITE HIGHER MORTGAGE RATES

Keeping Current Matters, 5.3.23

As I mentioned earlier, buyer activity is picking up speed even with higher mortgage interest rates. So, if you have wondered if this is a good time to sell your home this is great news.

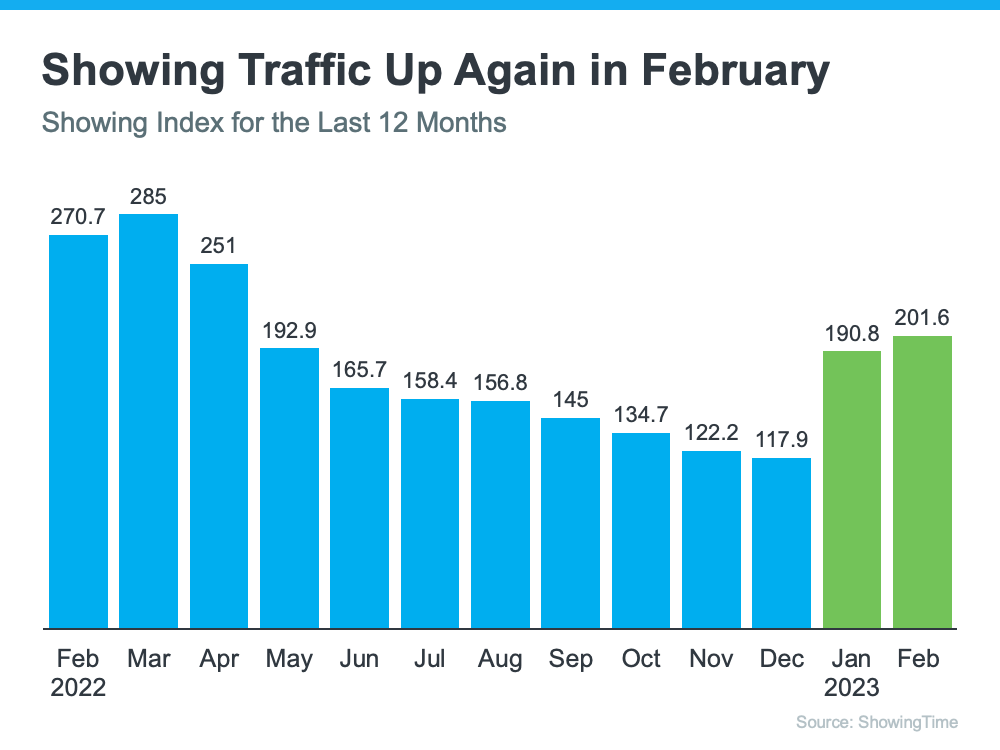

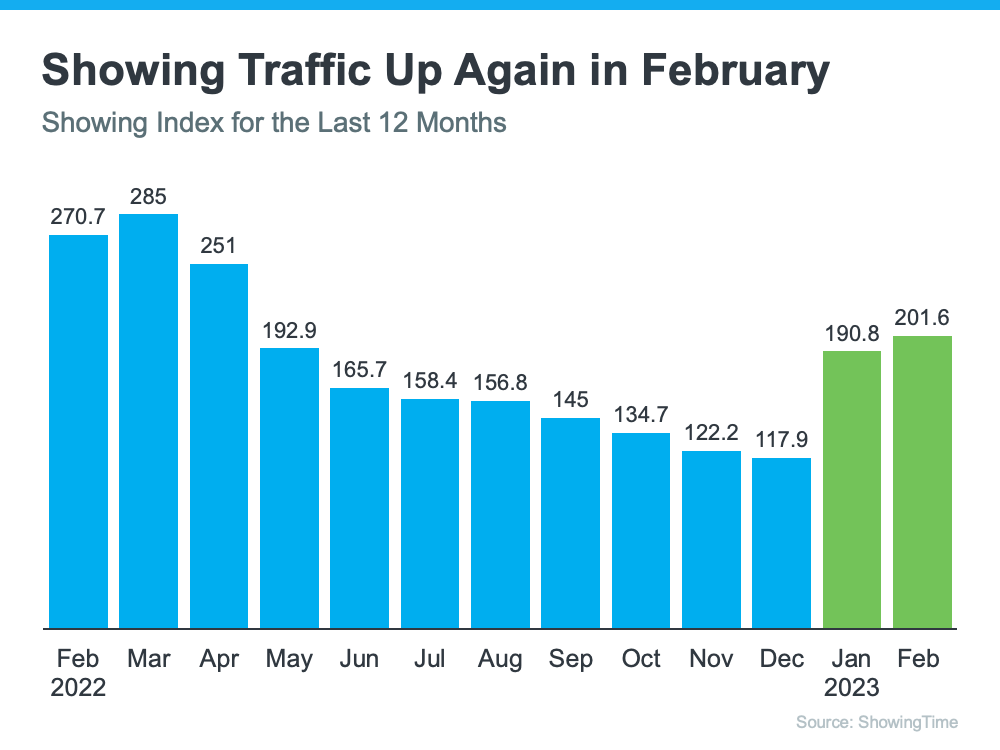

Data from the latest Showing Time Showing Index, which is a measure of buyers actively touring homes, helps paint the picture of how much buyer demand has increased in recent months (see graph below):

As you can see, the first two months of this year saw a noticeable increase in buyer traffic. That’s likely due to the limited number of homes for sale keeping buyers looking for homes even during the colder months.

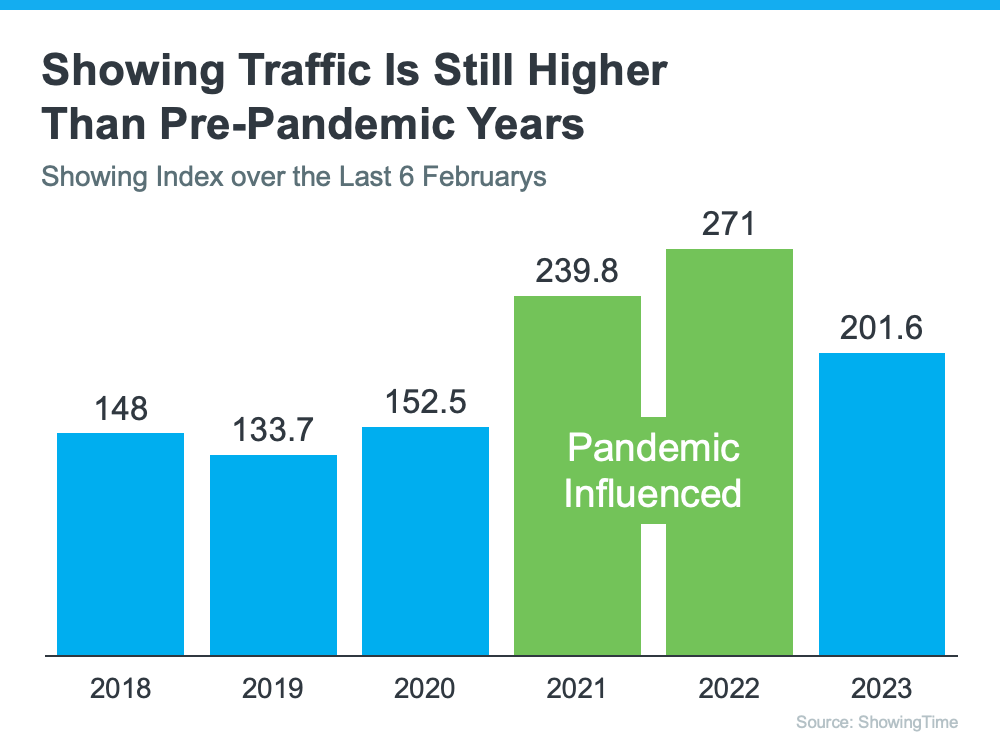

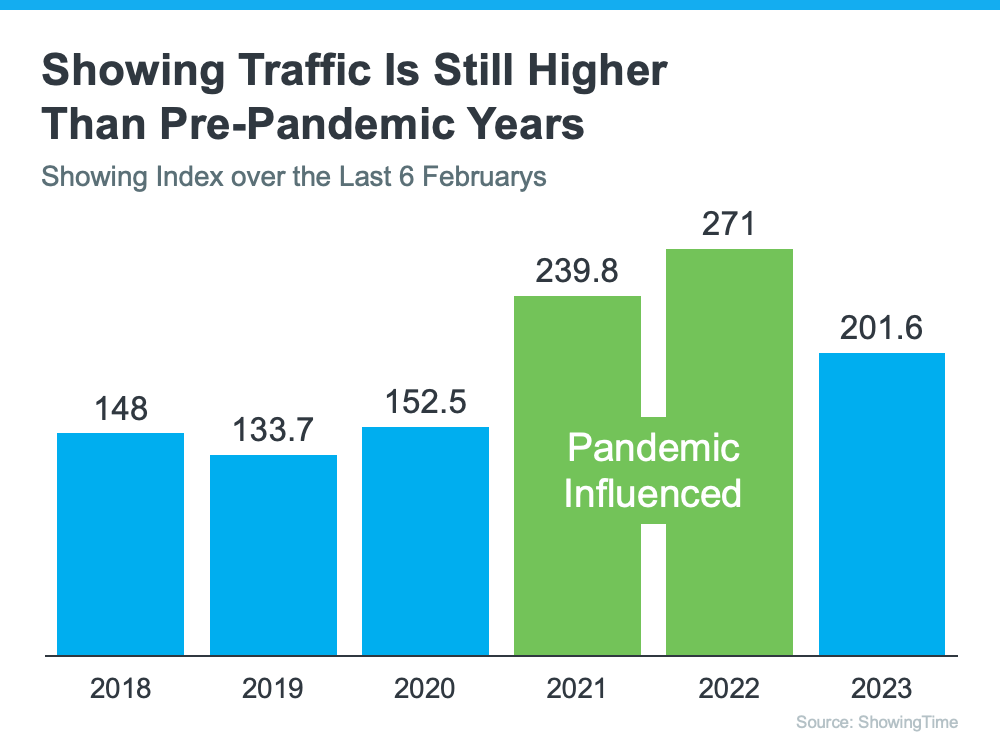

To see why this is significant, let’s compare this February with each February for the last six years (see graph below). It shows this was one of the best Februarys for buyer activity we’ve seen in recent memory!

During the last six years we saw the most February buyer traffic in 2021 and 2011 as you can see in green above, but those were highly unusual years for the housing market. Therefore, if you compare February 2023 with the more normal, pre-pandemic years, data shows this year still marks a clear rise in buyer activity.

This is even more noteworthy considering the increase in mortgage rates this past February. The Freddie Mac 30-year fixed mortgage rate rose from 6.09% during the week of February 2nd to 6.50% in the week of February 23rd. So, even with higher rates, more buyers were looking for a home.

Jeff Tucker, senior economist at Zillow, says the increased buyer activity could continue:

“More buyers will keep coming out of the woodwork. We always see a seasonal uptick in home shoppers in March and April…”

So, if you’re looking to sell, this upward trend in active buyers should be very encouraging. The sooner you meet with me to discuss how this can work for you, the sooner you can get your present home on the market.

I look forward to discussing how we can make this busy spring buying season one that can work for you.

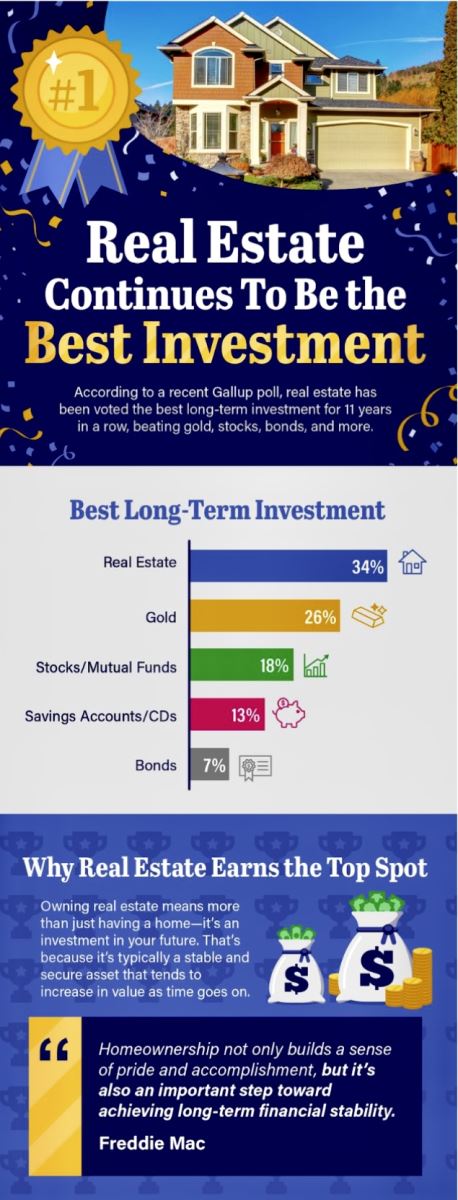

REASONS TO SELL YOUR HOUSE IN TODAY’S MARKET…INFOGRAPHIC.

KeepingCurrentMatters, 5.5.23

.JPG)

With spring buying season underway, there’s no better time than now to get started if you’ve even considered a move. Inventory, while improved from a year ago, is still low and that’s why the number of offers on recently sold homes is on the rise.

Call me sooner than later so we can discuss whether a move at this time makes the most sense for you and your family.

ECONOMIC & WORKFORCE DEVELOPMENT REPORT

Data-Driven Economic Strategies, April 2023

As always, I like to share the useful economic data I receive from our “local economist”, Tatiana Bailey. You will see in these charts what’s happening locally in terms of the economy as well as the most recent Workforce Progress Report.

This information is especially invaluable to business owners; however, I think you all will all find it worthwhile reading.

To access the report, please click here and if you have any questions, please give me a holler.

.jpg)