HARRY'S BI-WEEKLY UPDATE 11.08.24

November 8, 2024

HARRY’S BI-WEEKLY UPDATE

A Current Look at the Colorado Springs Residential real estate Market

As part of my “Special Brand of Customer Service”, it is my desire to share current Residential real estate issues that will help to make you a more successful and profitable Buyer and Seller.

GREETINGS FROM A SNOWED-IN COLORADO SPRINGS…

When I trudged down the driveway to get the mail today, I turned and saw our metal flag buried high in the snow—the top normally reaches my shoulders!!

As I looked at it I was thinking how much has changed in the last couple of days. Some are thrilled, some not so much, but I think we can all agree that as Americans it will be nice to hopefully get back to a less contentious time.

I was also thinking how quickly the lovely fall weather turned into a major snowstorm that disrupted travel and plans for lots of folks. That too will change soon, and we Coloradans can get back to enjoying our great outdoors without freezing and too much snow.

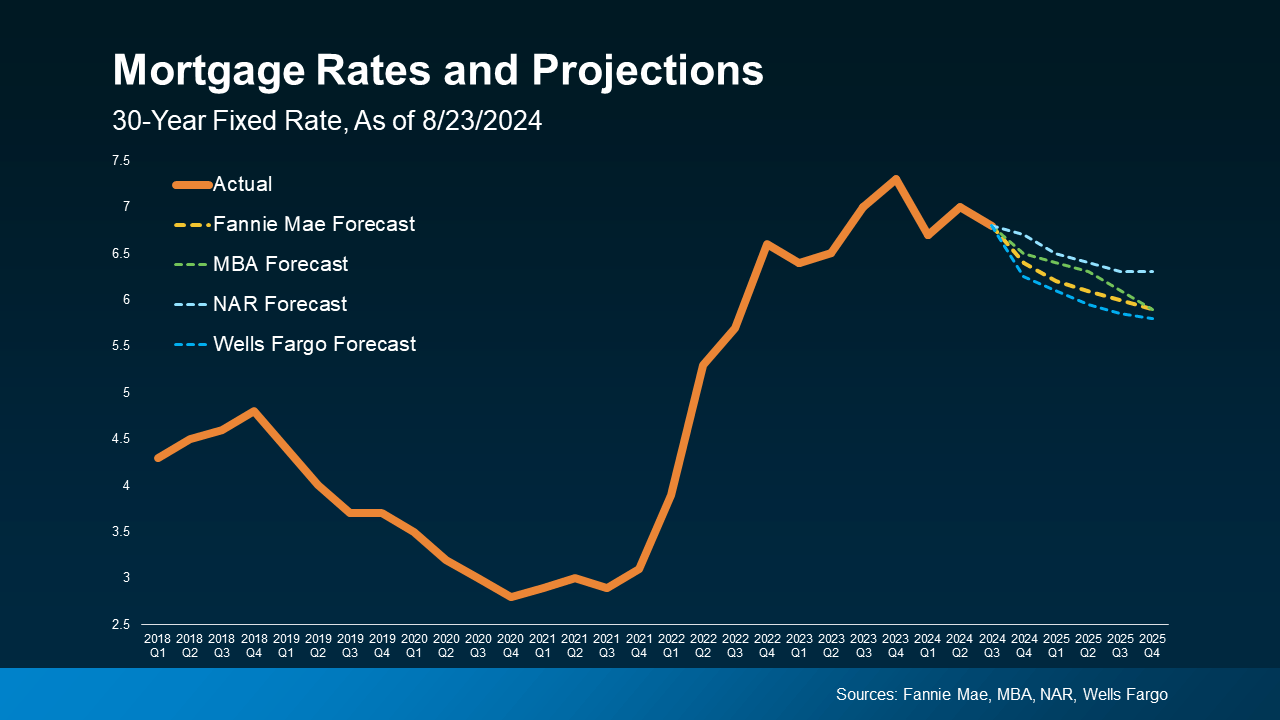

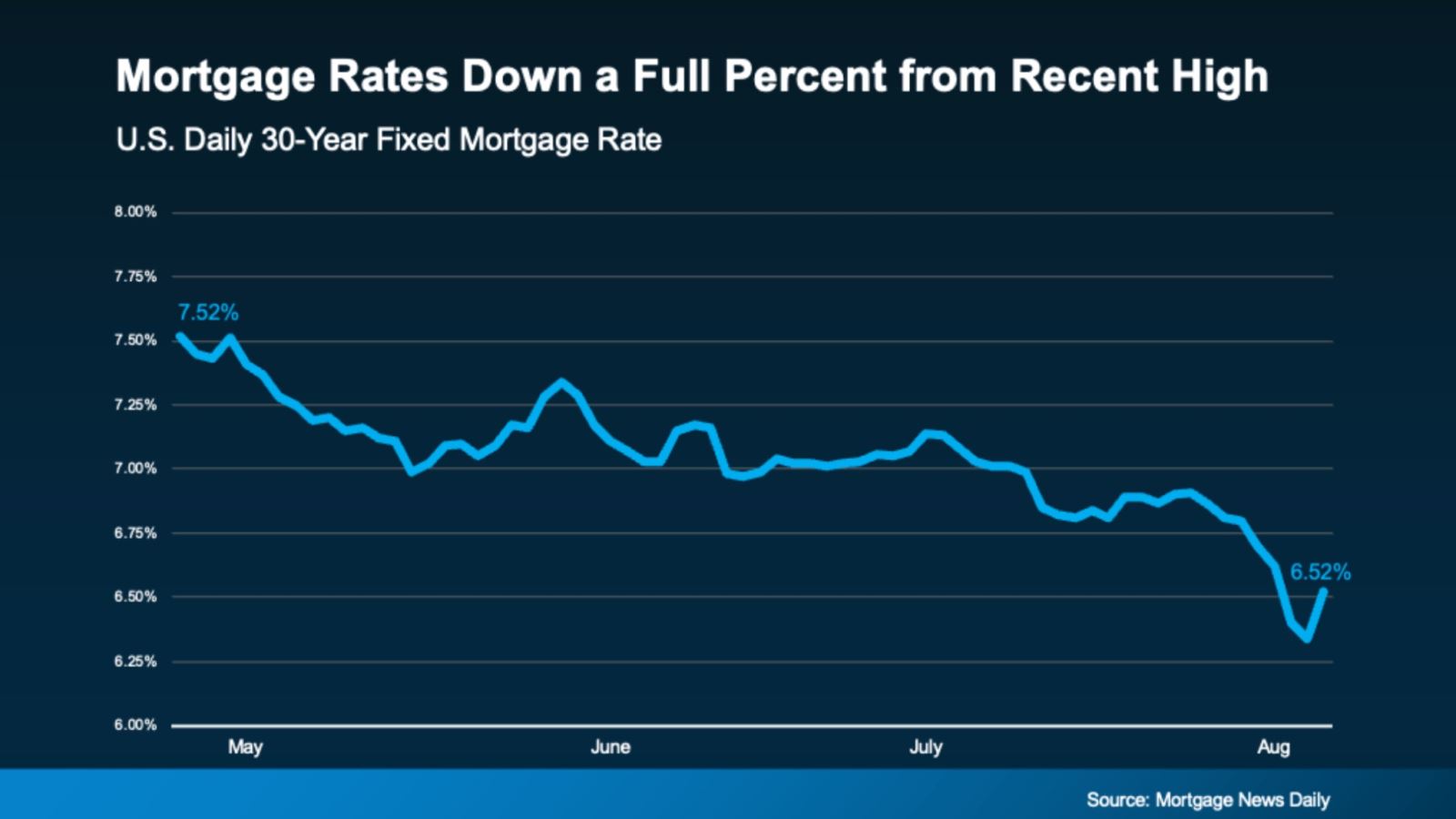

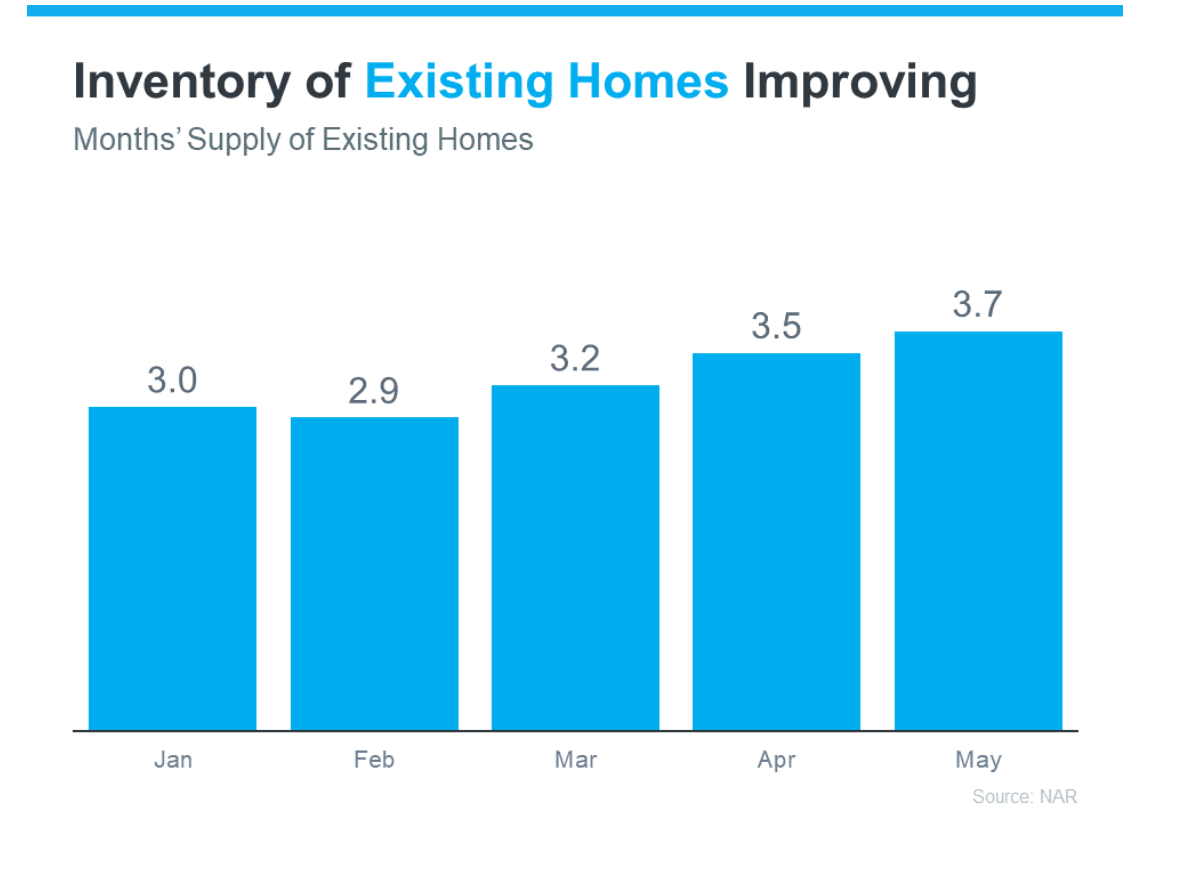

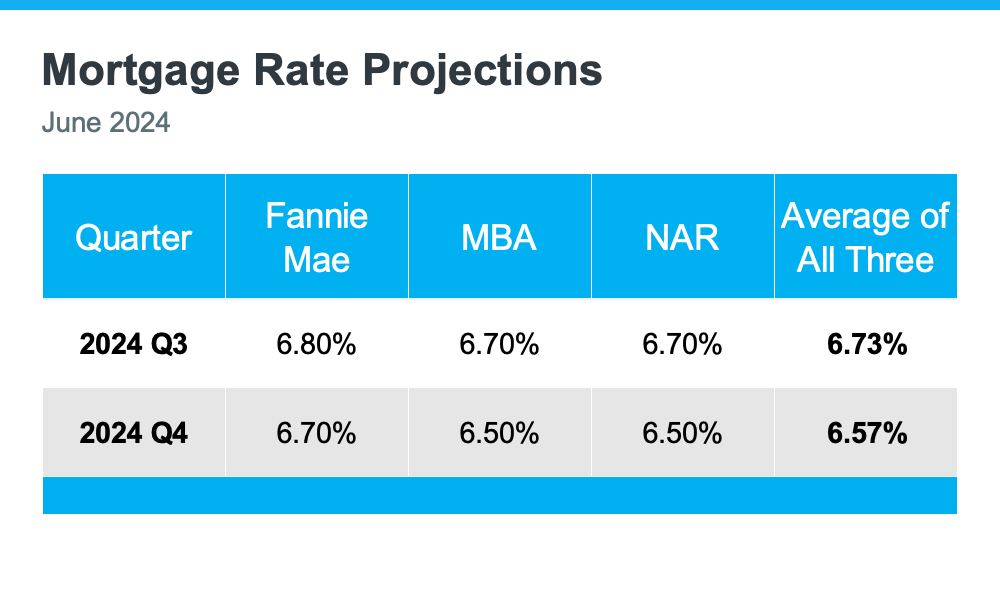

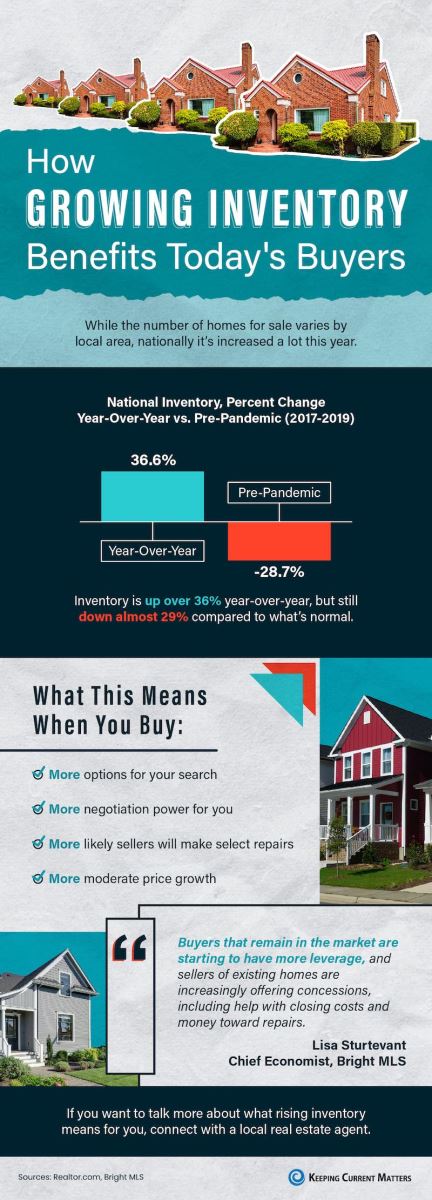

There are lots of statistics to share so I will get to them quickly. I am confident that the housing market will soon be seeing a lot more action as mortgage rates go down and more homes come on the market.

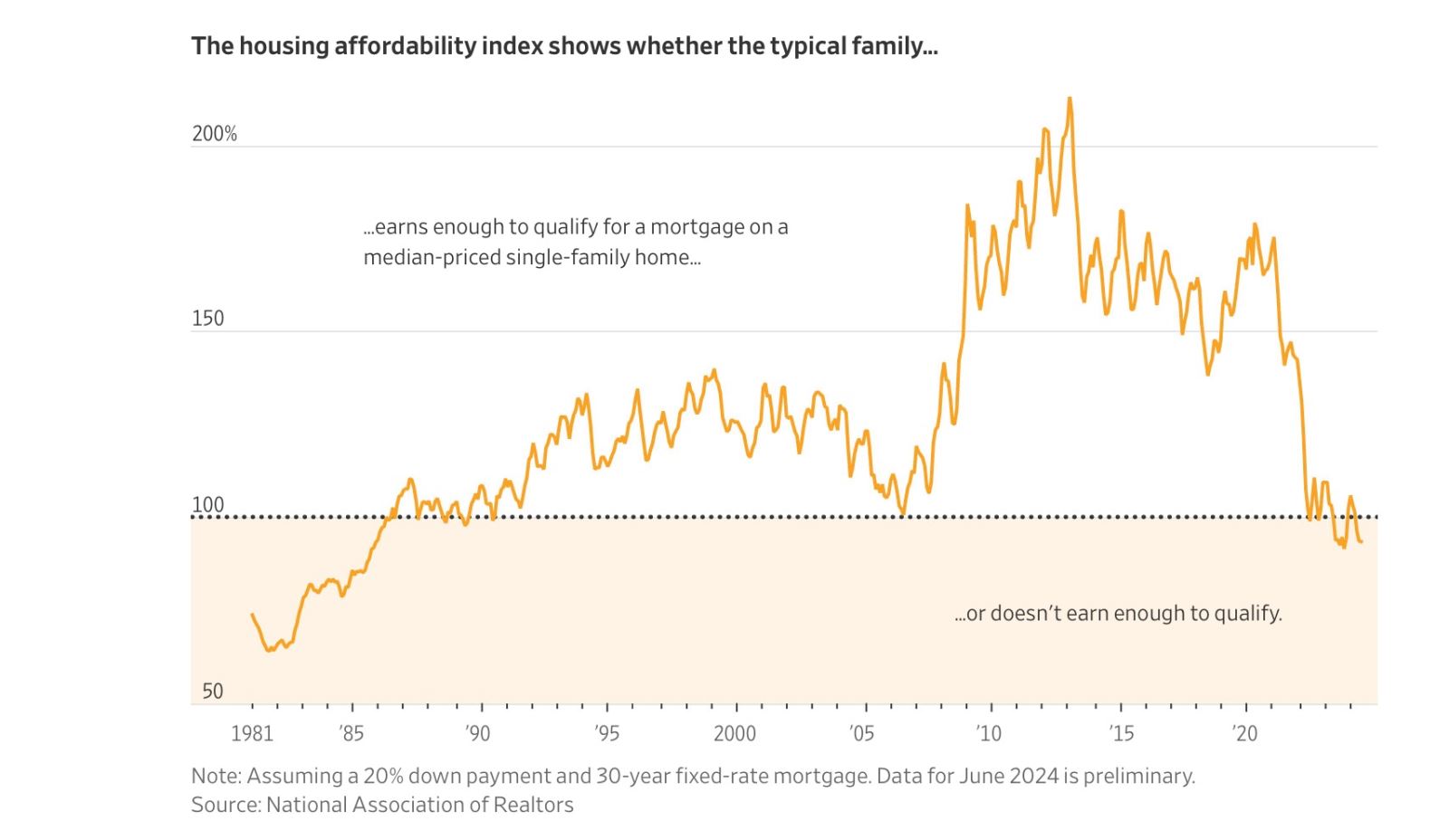

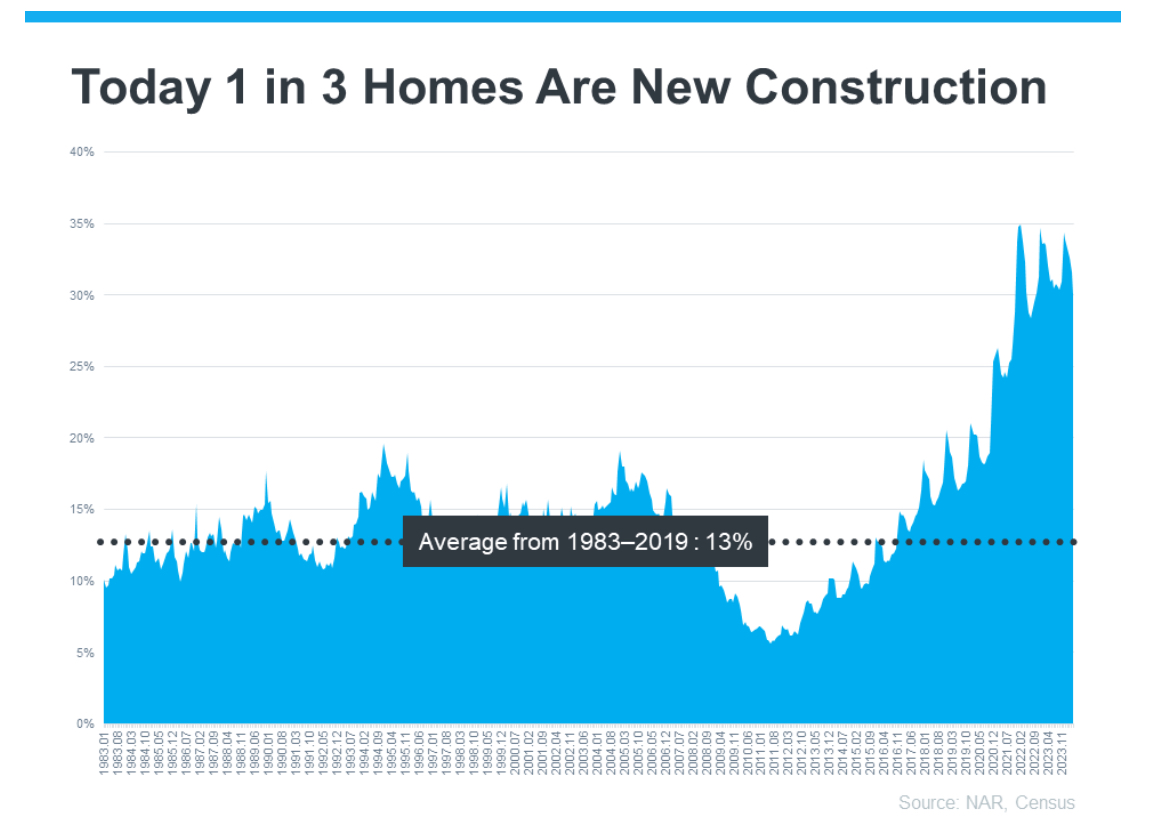

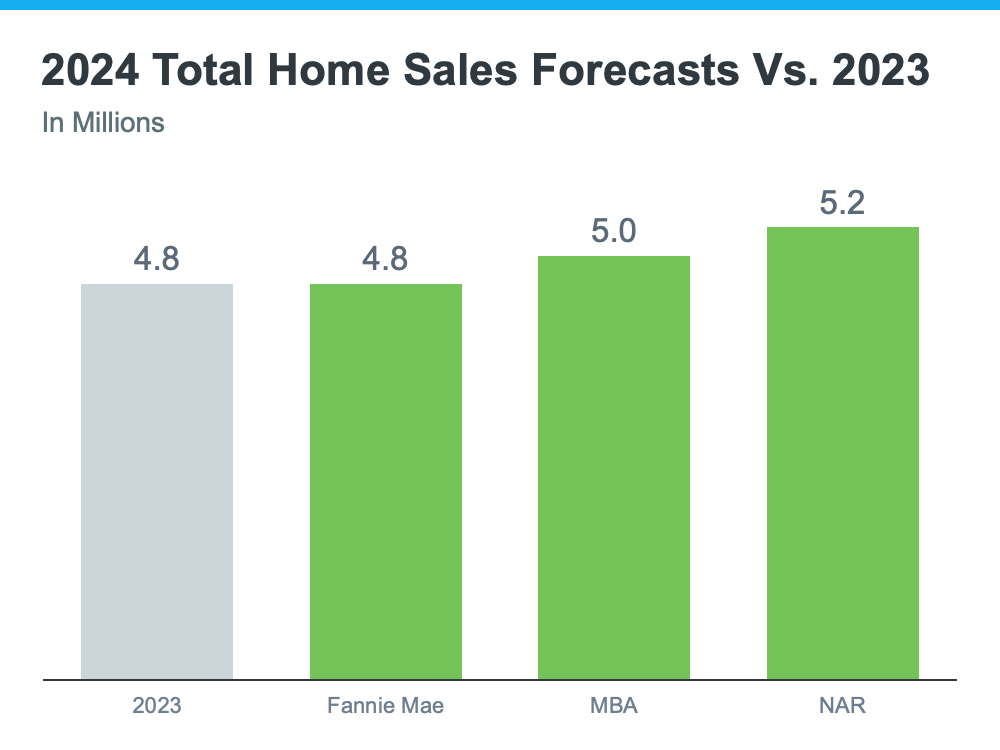

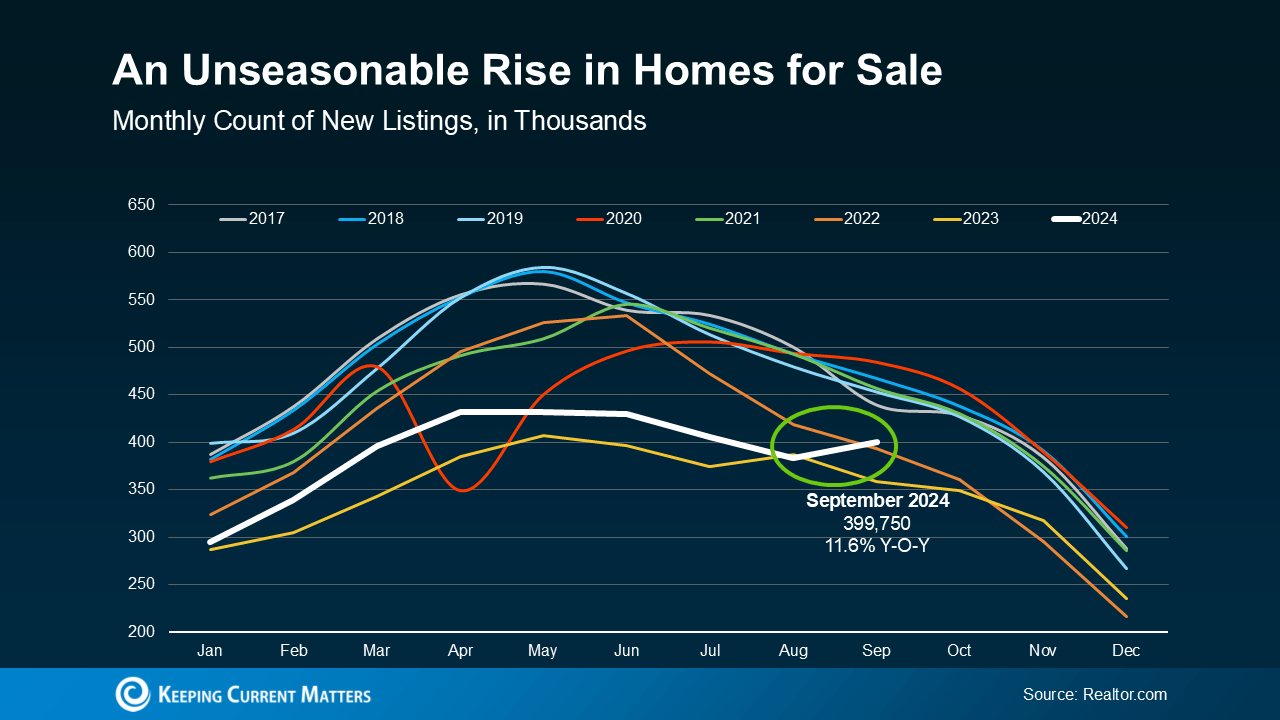

Things have been slow these last few months, both here and nationally. In fact, home sales for 2024 are on track for the worst year since 1995—hitting their lowest point in 30 years last month. Most of that is attributable to the higher mortgage rates, a shortage of available homes for sale and folks waiting for results of the presidential election. Many national economists seem hopeful that 2025 will see lower rates which should make homes more affordable for most and we are starting to see more home listings and sales locally.

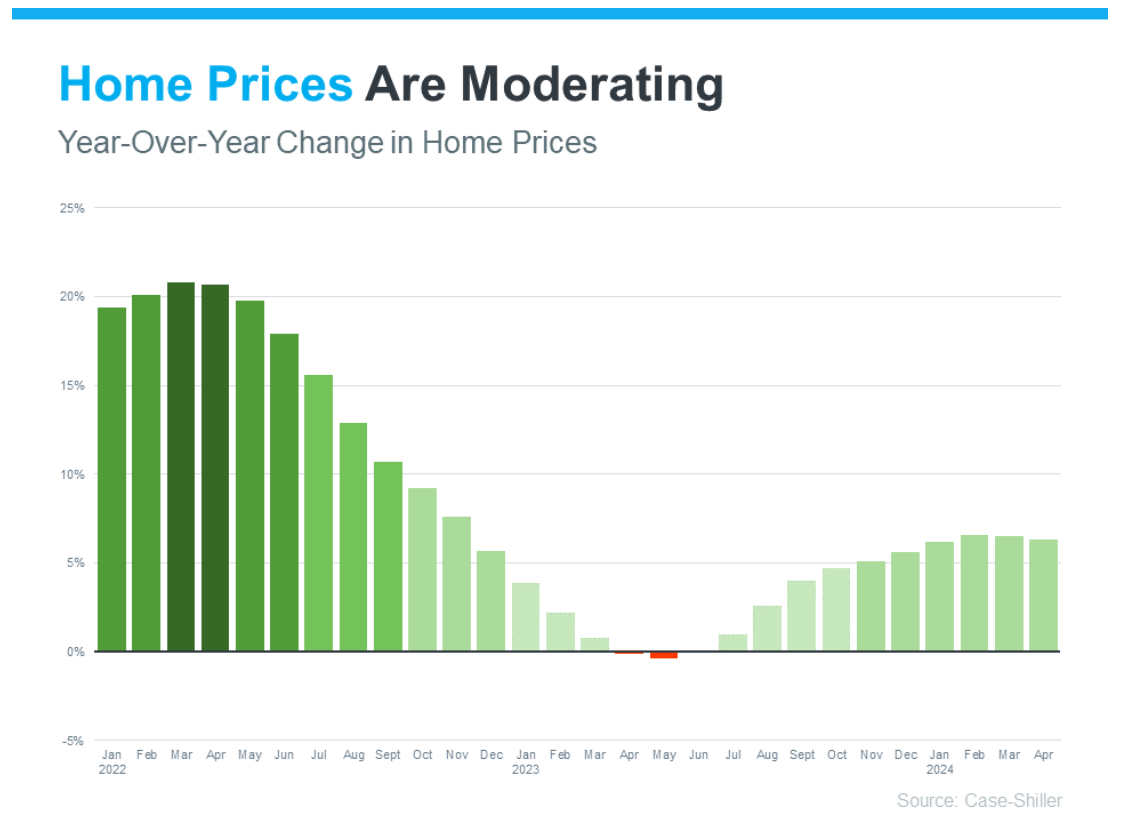

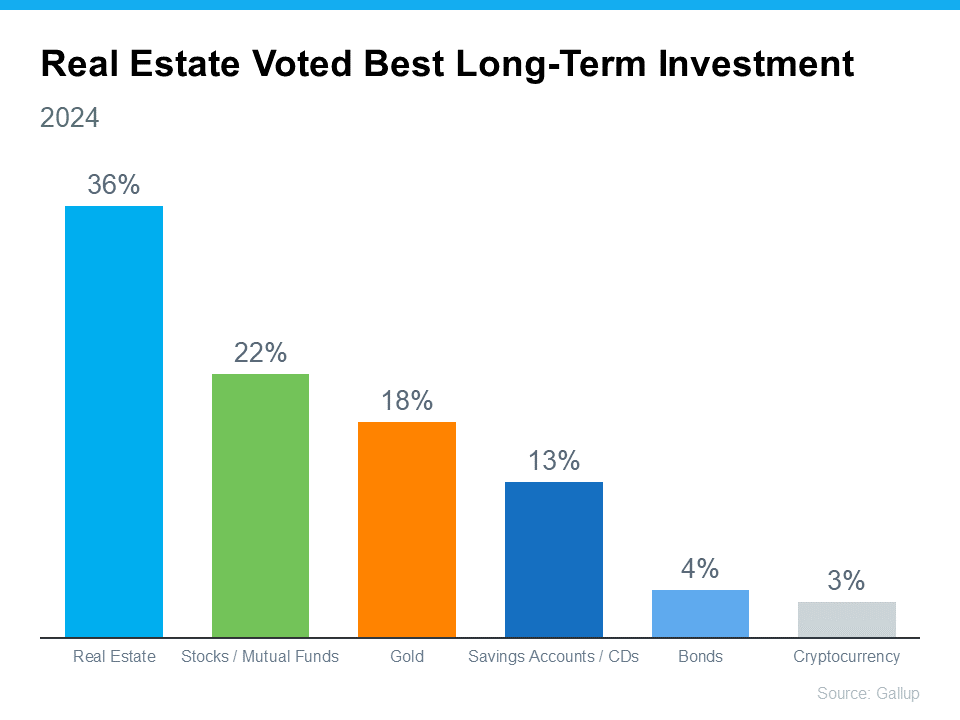

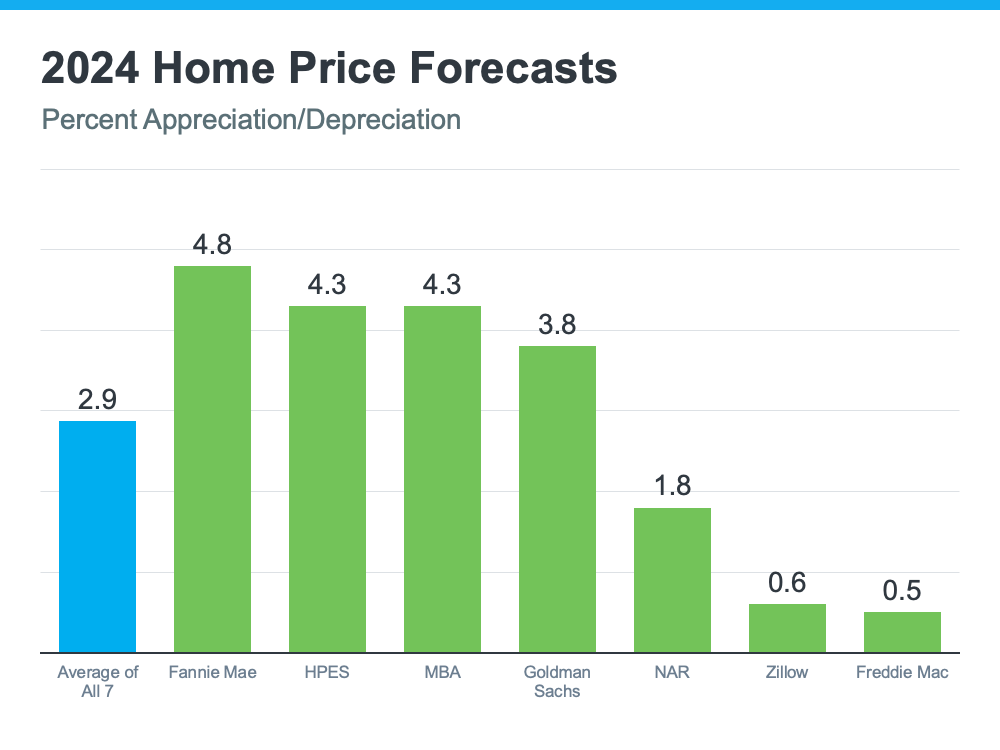

But no matter what, the slower sales have NOT much affected home values which keep rising here and, in most U.S. major metro areas, as you will see below. What that means is that homes are NOT going to get any cheaper. Buying today and refinancing later could be an option, especially considering it’s likely that the home you purchase will be earning equity in the meantime, thus increasing your net wealth.

In my more than 51 years in the local Residential real estate arena I’ve seen most every cycle imaginable, and this is just one of many. Yes, homes were probably averaging $30,000 or less when I got started, but then I’ve also seen mortgage interest rates as high as 18%. So, like they say…it’s all relative.

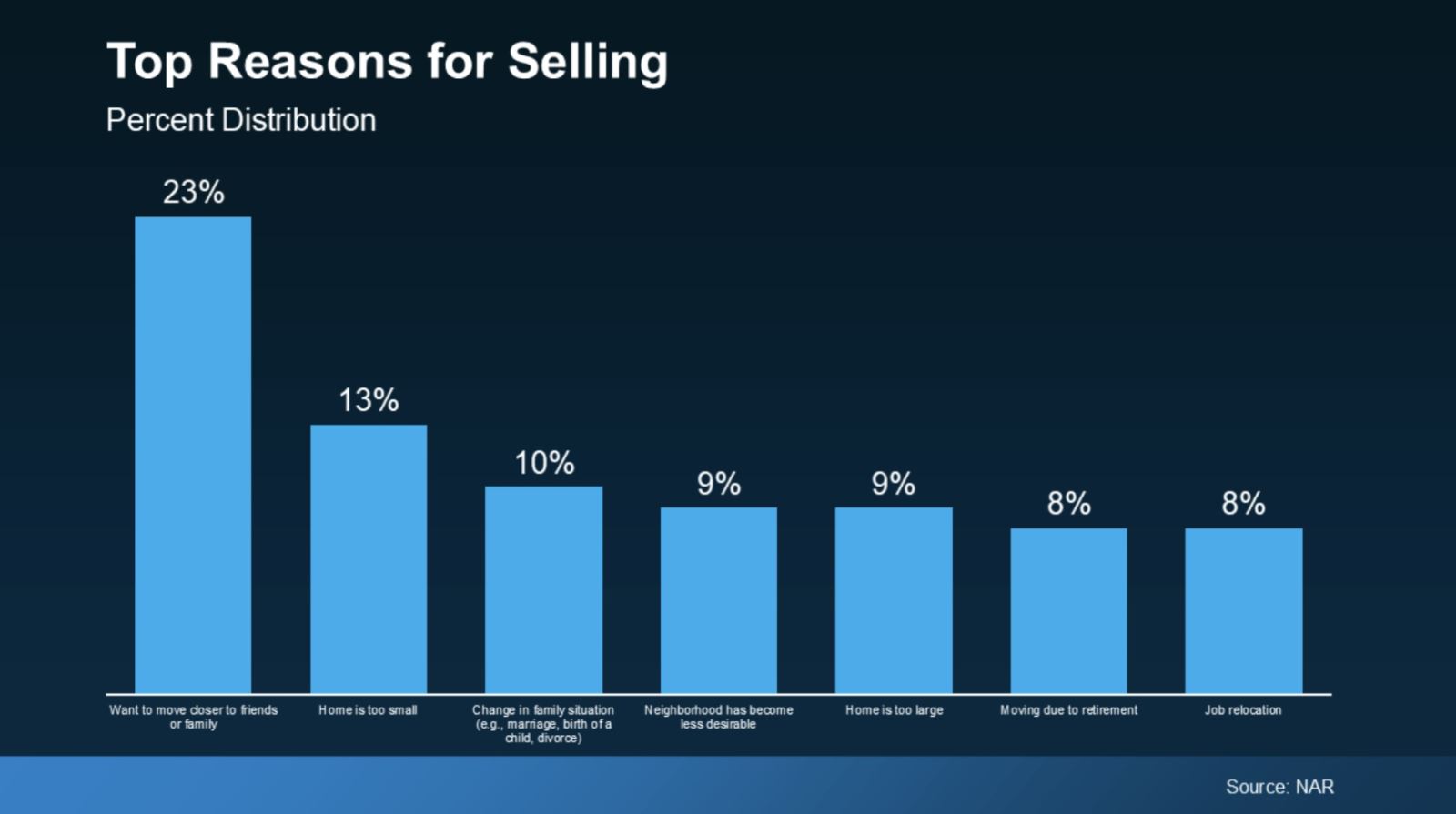

All in all, as I perpetually contend, there will always be those who want or need to sell and those who need or want to buy. And I’ve been here through the years to help them get the very best for their individual wants, needs and budget requirements.

My investment banking background has been quite helpful in insuring that my clients are able to find the best lending opportunities and I’m proud of the fact that I am now working with not only children, but also grandchildren of some original clients. That’s such a wonderful full circle thing for me and I never take it for granted.

So, without further ado…. here comes lots of statistics.

As always, if you have any questions or just want to chat about the possibilities available for you and your family, you can reach me at 719.593.1000 or email me at Harry@HarrySalzman.com. I look forward to speaking with you soon.

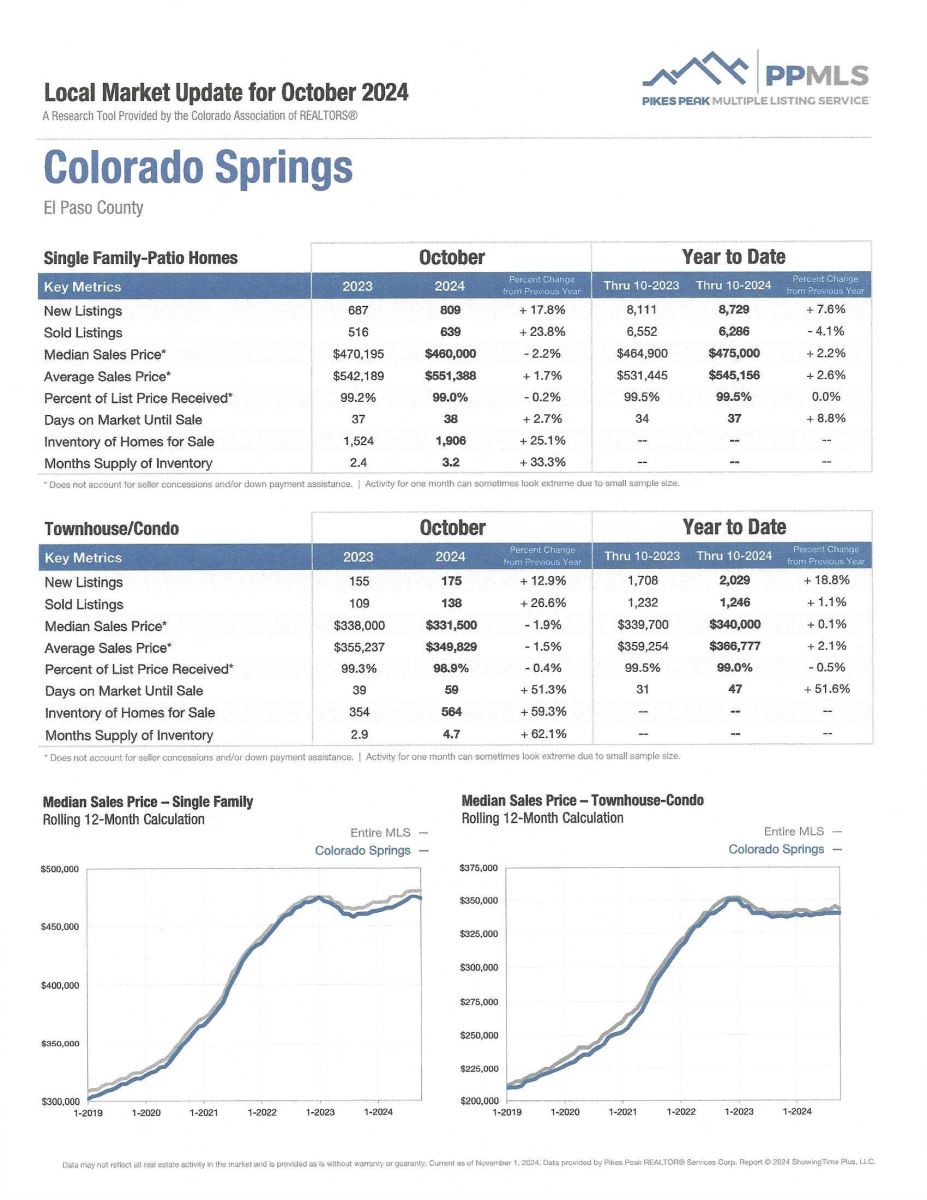

OCTOBER 2024

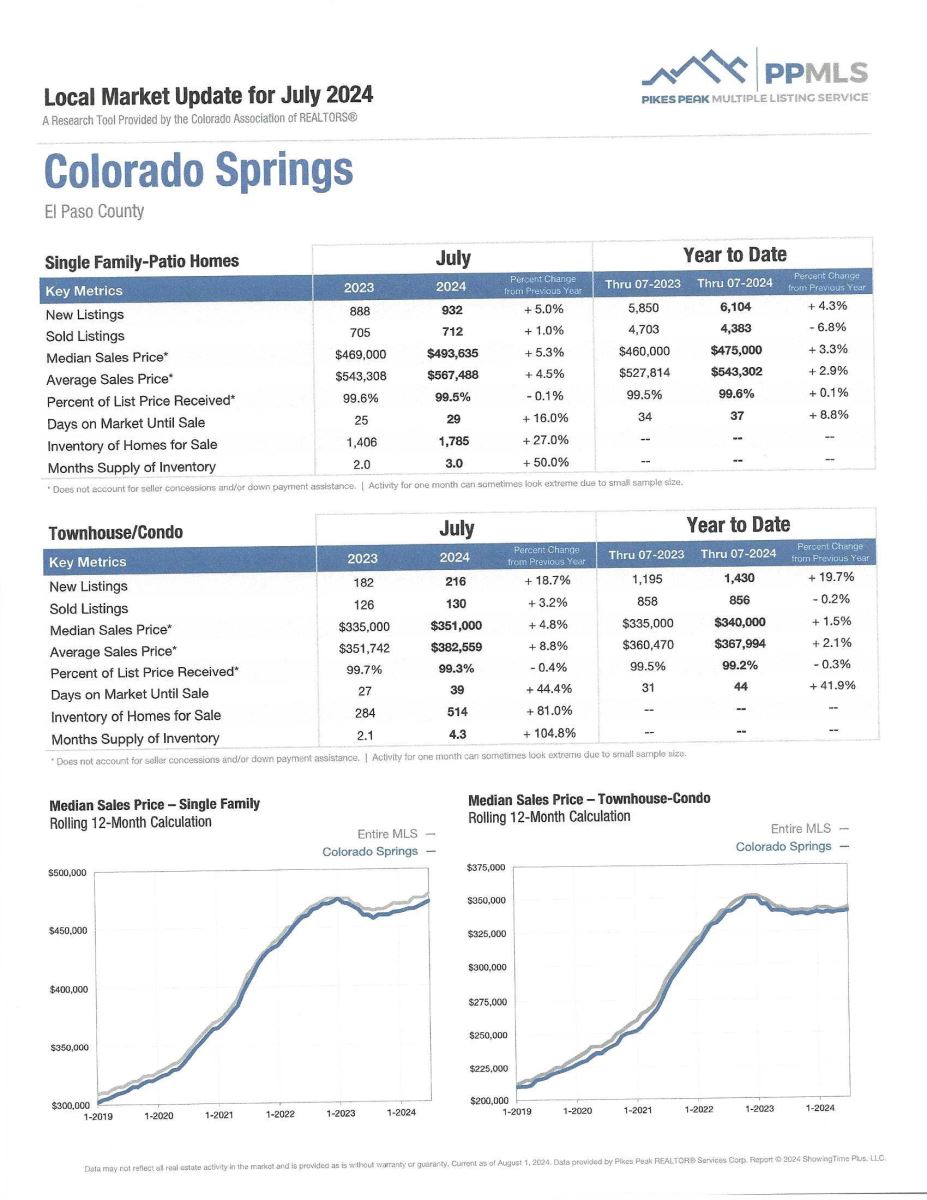

Statistics provided by the Pikes Peak REALTORS Service Corp., or it’s PPMLS

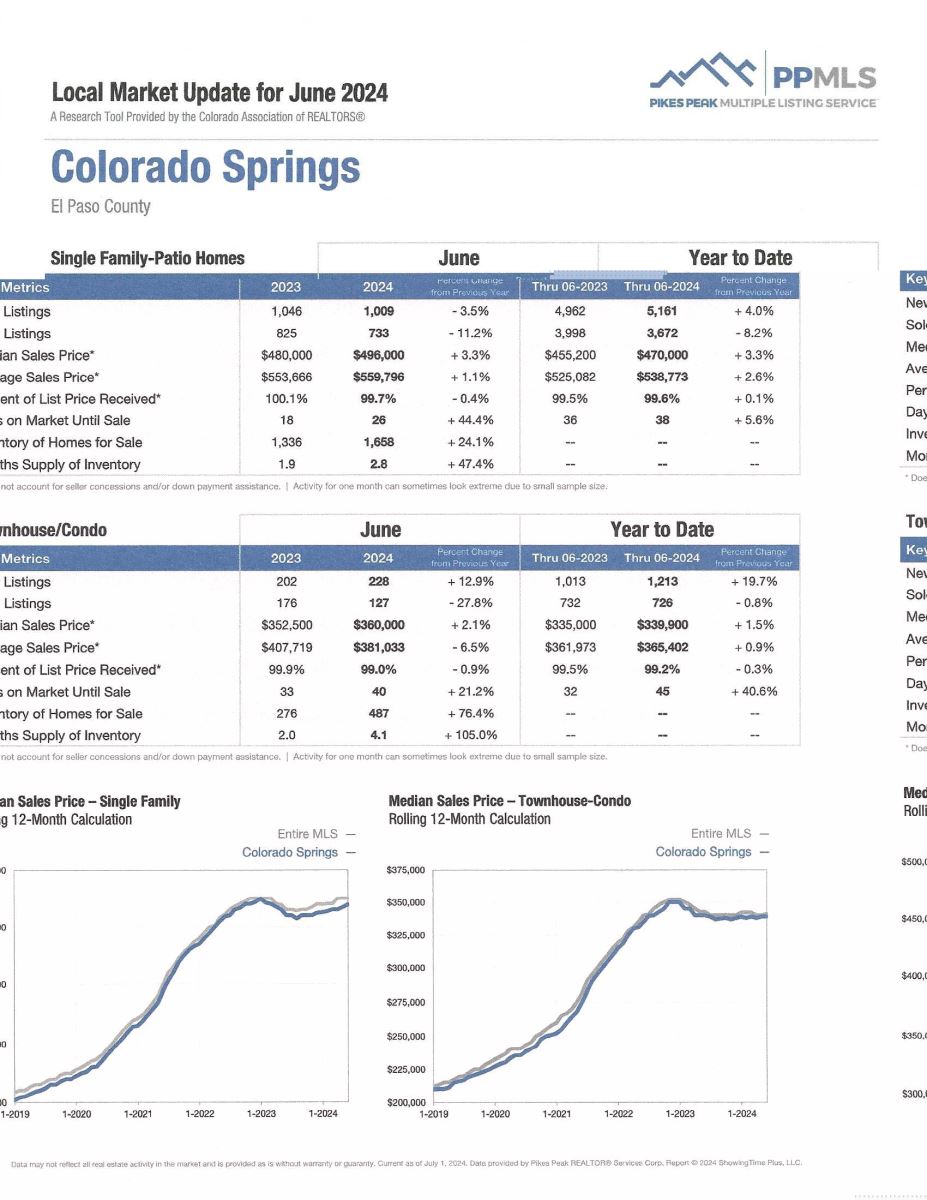

Here are some highlights from the October 2024 PPAR report. You might note that while homes are selling at close to asking price as in the past several months, the days on the market are a tad longer. I expect both to change if interest rates go down more.

In El Paso County, the average days on the market for single family/patio homes was 40. For condo/townhomes it was 57.

Also in El Paso County, the sales price/list price for single family/patio homes was 98.0% and for condo/townhomes it was 98.9%.

In Teller County, the average days on the market for single family/patio homes was 66 and the sales/list price was 98.0%.

Please click here to view the detailed 10-page report, including charts. If you have any questions about the report or to find out how it relates to your individual situation, just give me a call.

In comparing October 2024 to October 2023 for All Homes in PPAR:

Single Family/Patio Homes:

· New Listings were 1,408, Up 18.8%

· Number of Sales were 998, Up 17.3%

· Average Sales Price was $557,741, Up 0.1%

· Median Sales Price was $475,000, Down 2.1%

· Total Active Listings are 3,394, Up 35.5%

· Months Supply is 3.4, Down 2.1%

Condo/Townhomes:

· New Listings were 198, Up 7.0%

· Number of Sales were 159, Up 24.2%

· Average Sales Price was $353,312, Down 5.3%

· Median Sales Price was $335,000, Down 4.3%

· Total Active Listings are 640, Up 69.3%

· Months Supply is 4.0, Up 2.9%

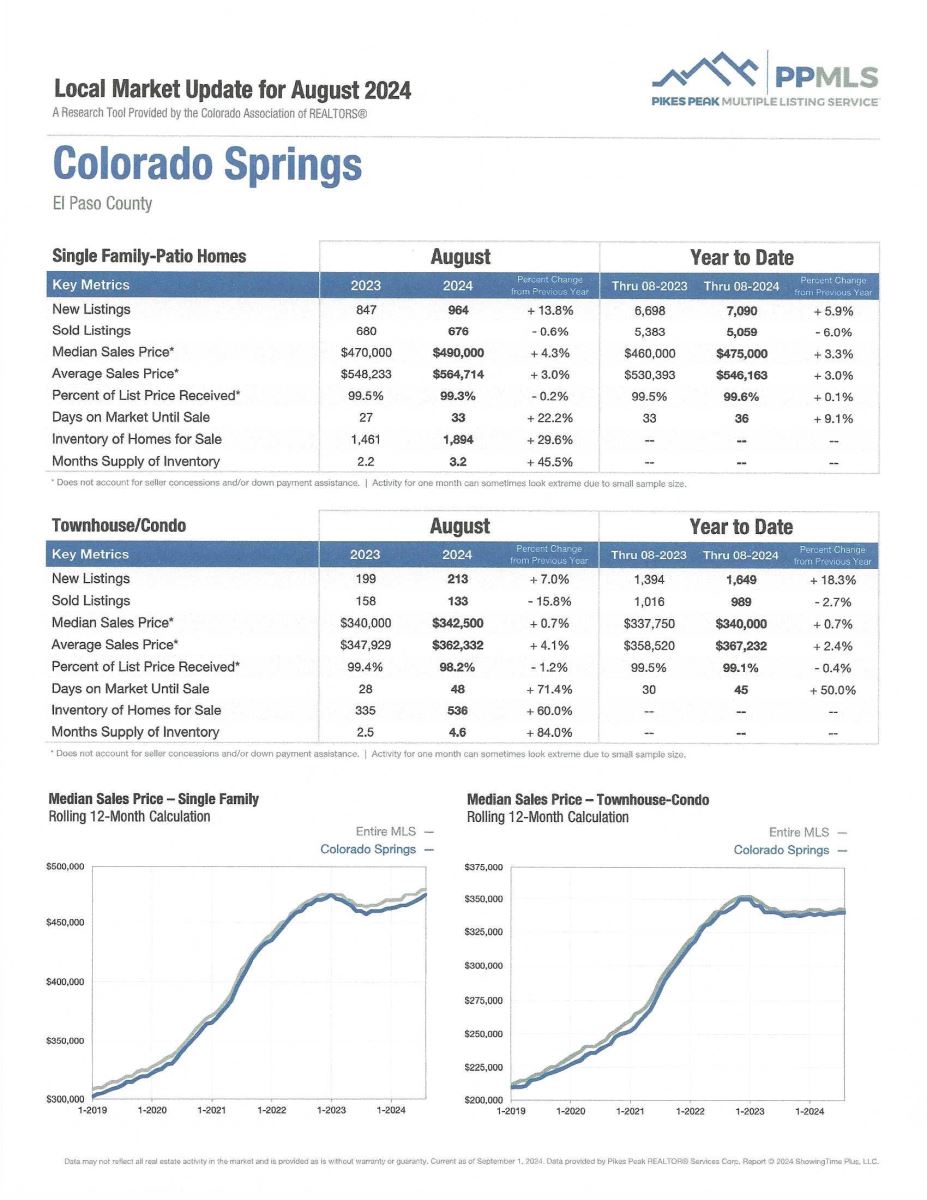

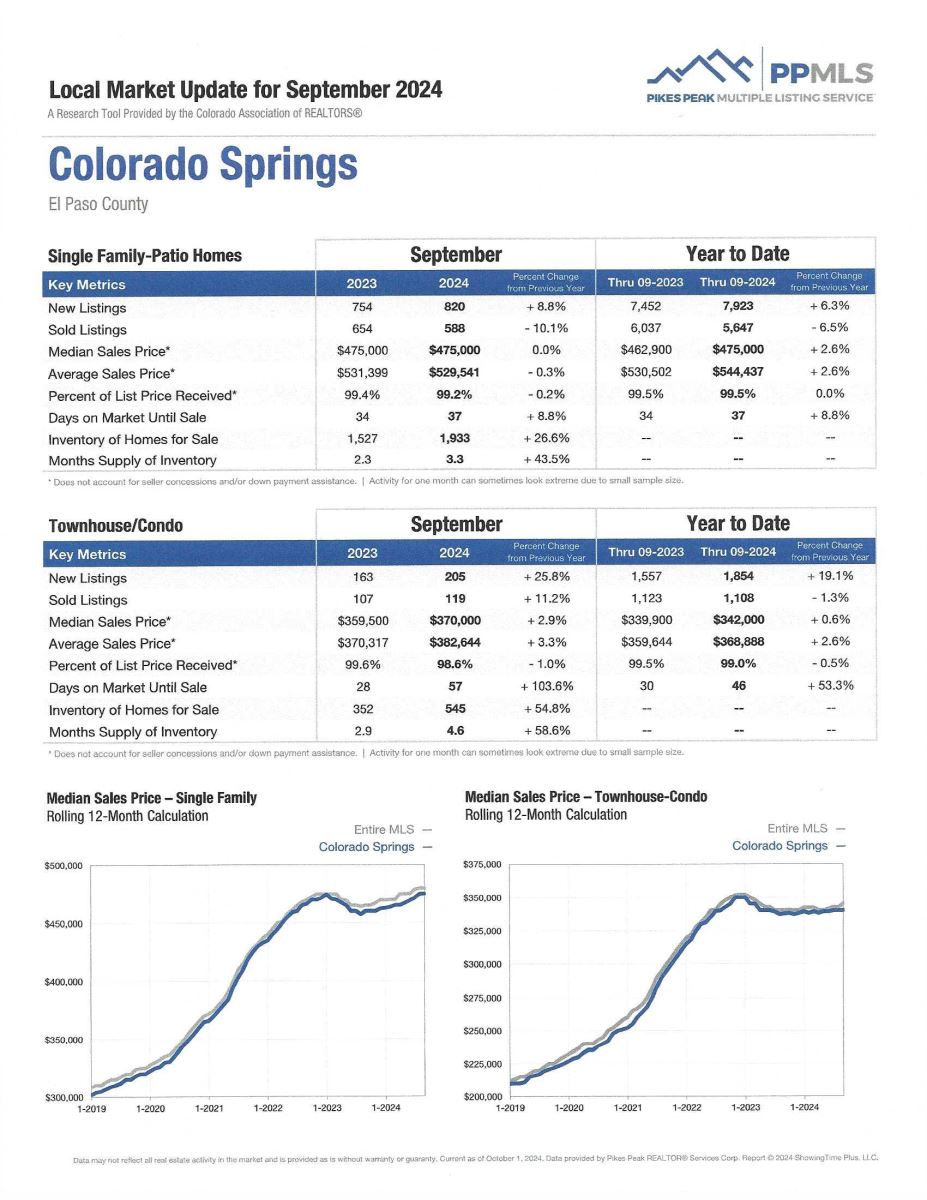

OCTOBER 2024 MONTHLY INDICATORS AND LOCAL MARKET UPDATE ILLUSTRATE OUR LOCAL TRENDS IN DETAIL

Colorado Association of REALTORS® , Pikes Peak REALTORS Service Corp, or it’s PPMLS

Providing greater detail than the above report, this contains information on both El Paso and Teller counties for Residential real estate.

The “Activity Snapshot” for all residential properties in El Paso and Teller counties shows the Year-to-Date one-year change:

- Sold Listings for All Properties were Up 21.4%

- Median Sales Price for All Properties was Down 2.4%

- Active Listings on All Properties were Up 30.1%

You can click here to read the 16-page Monthly Indicators or click here to get specific information on the geographical are of your choice from the 18-page Local Market Update. It’s a good idea to check out your own area or one that you might be considering in order to get a good idea of the local pulse. As an example, here is a detailed report on the Colorado Springs area:

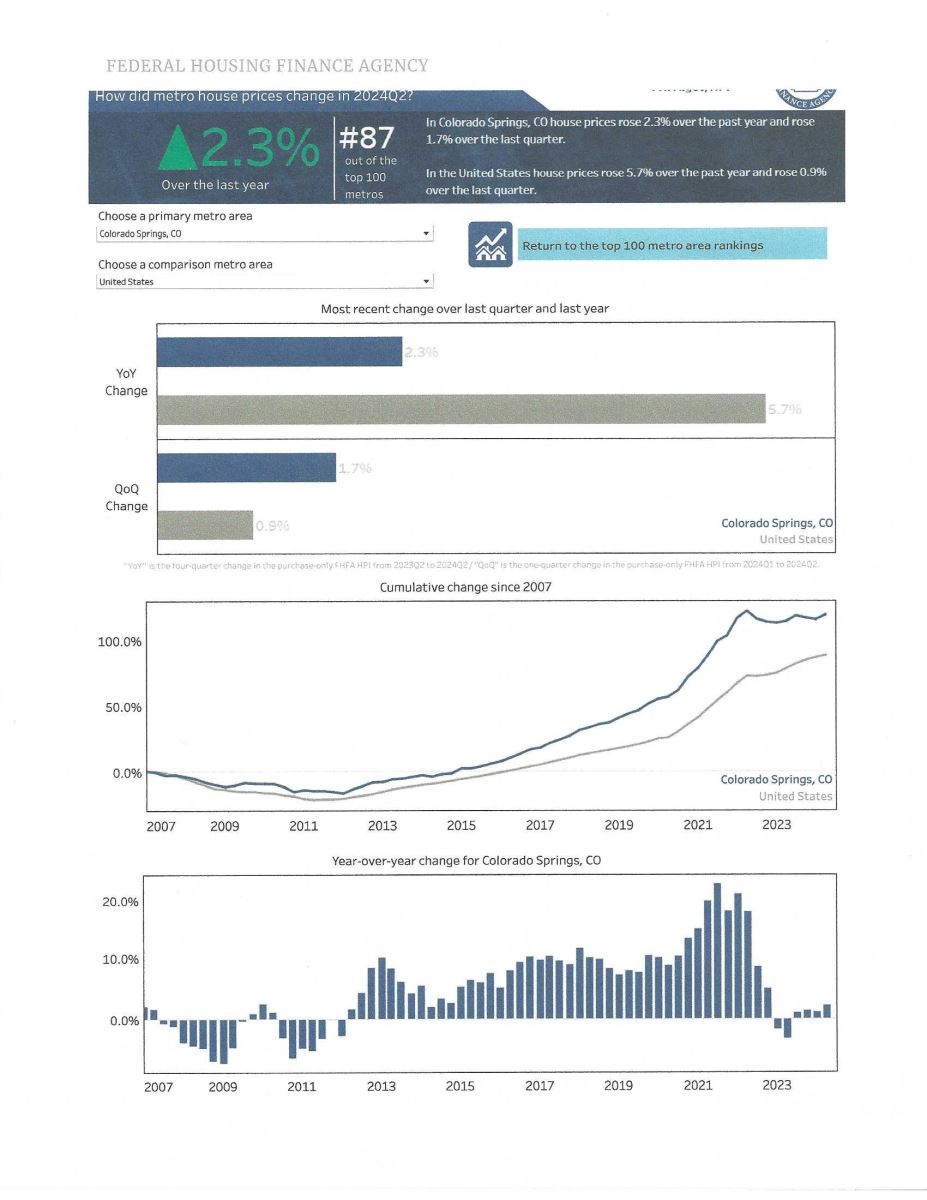

COLORADO SPRINGS HOME PRICES CONTINUE TO RISE IN THIRD QUARTER 2024

The National Association of Realtors, 11.7.24

In the just released report from the National Association of Realtors (NAR), single-family, existing-home prices grew in 87% of measured metro areas. This is down from 89% the previous quarter.

According to Lawrence Yun, chief economist for NAR:

“Home prices remain on solid ground as reflected by the vast number of markets experiencing gains. A typical homeowner accumulated $147,000 in housing wealth in the last five years. Even with the rapid price appreciation over the last few years, the likelihood of a market crash is minimal. Distressed property sales and the number of people defaulting on mortgage payments are both at historic lows.”

Compared to one year ago, the national median single-family existing-home price climbed 3.1% to $418,700. In the prior quarter, the year-over-year national median price increased 4.9%.

The median price of single-family homes in Colorado Springs rose 1.5% to $473,200 compared to one year ago per NAR. This price reflects detached, single-family and patio homes but not townhomes or condominiums.

The median price in the Springs ranked 49th highest of the 226 cities surveyed.

Housing affordability slightly improved in the third quarter as mortgage rates trended lower. The monthly payment (nationally) on a typical existing single-family home with a 20% down payment was $2,137, down 5.5% from the second quarter ($2,262) and 2.4% - or $52 – from one year ago. Families typically spent 25.2% of their income on mortgage payments, down from 26.9% in the prior quarter and 27.1% one year ago.

“Housing affordability has been a challenge, but the worst appears to be over, Yun said. “Rising wages are outpacing home price increases. Despite some short-term swings, mortgage rates are set to stabilize below last year’s levels. More inventory is reaching the market and providing additional options for consumers.”

To see all 226 metro areas in alphabetical order, please click here. To see them in ranking order, click here. Or click here to see what income levels are required to purchase homes based on either a 5, 10 or 20 percent down-payment.

If you have any questions, please give me a call.

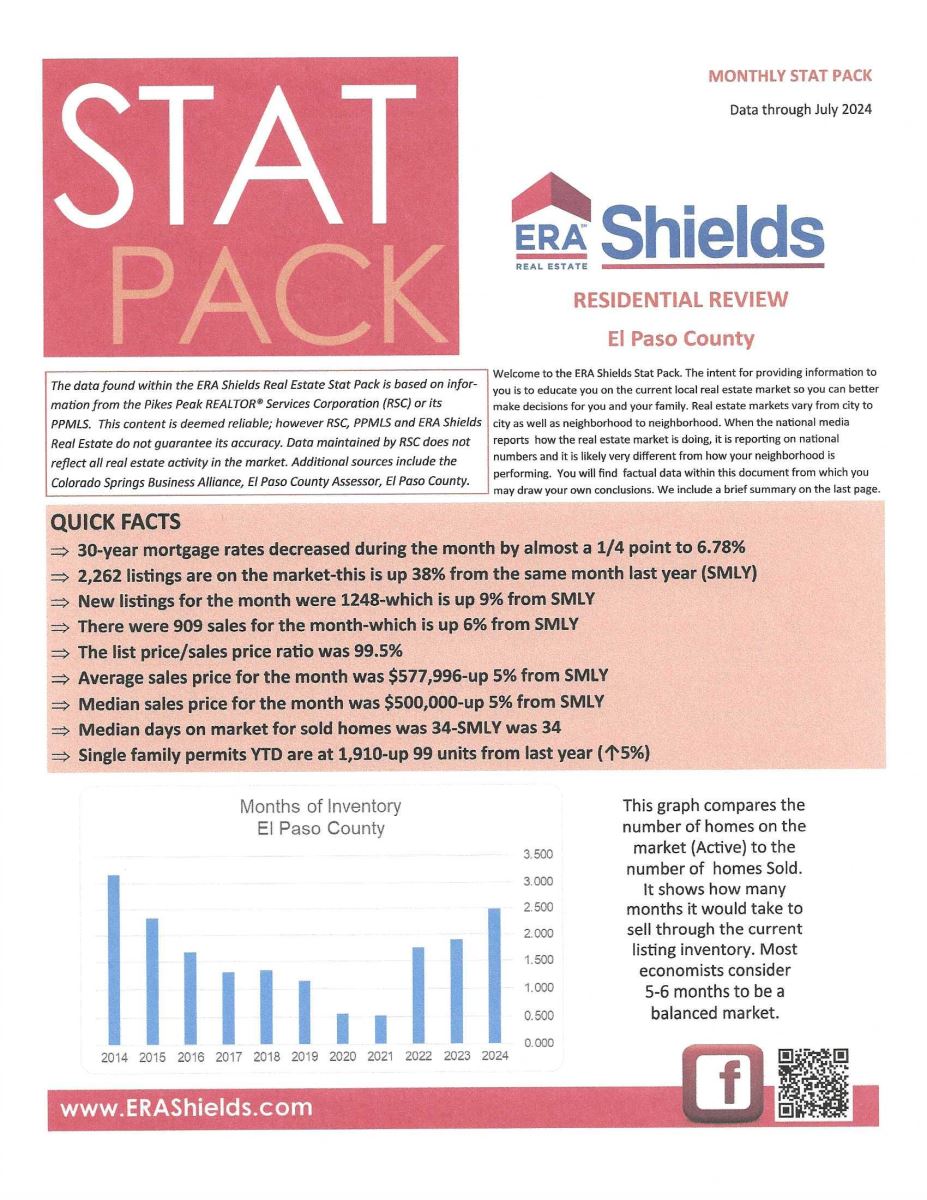

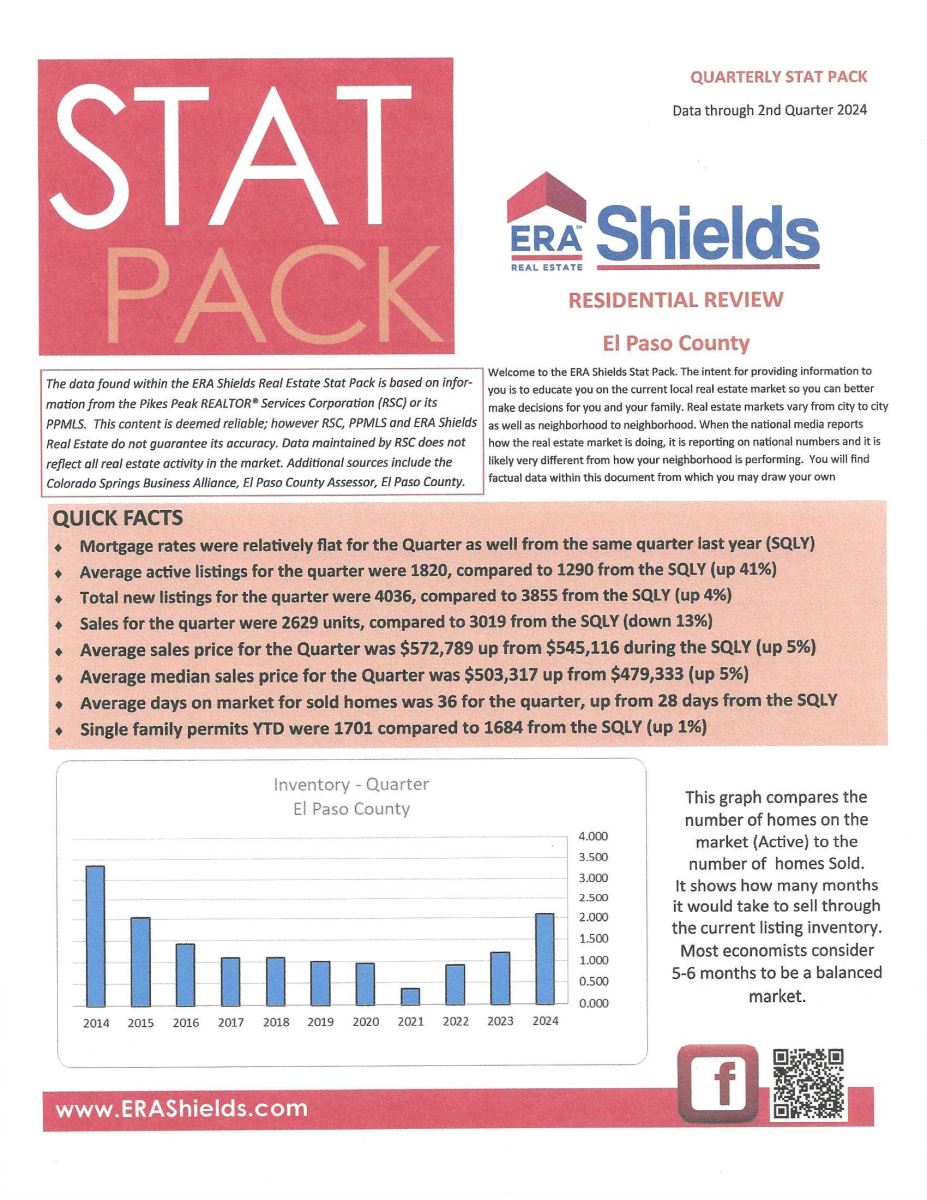

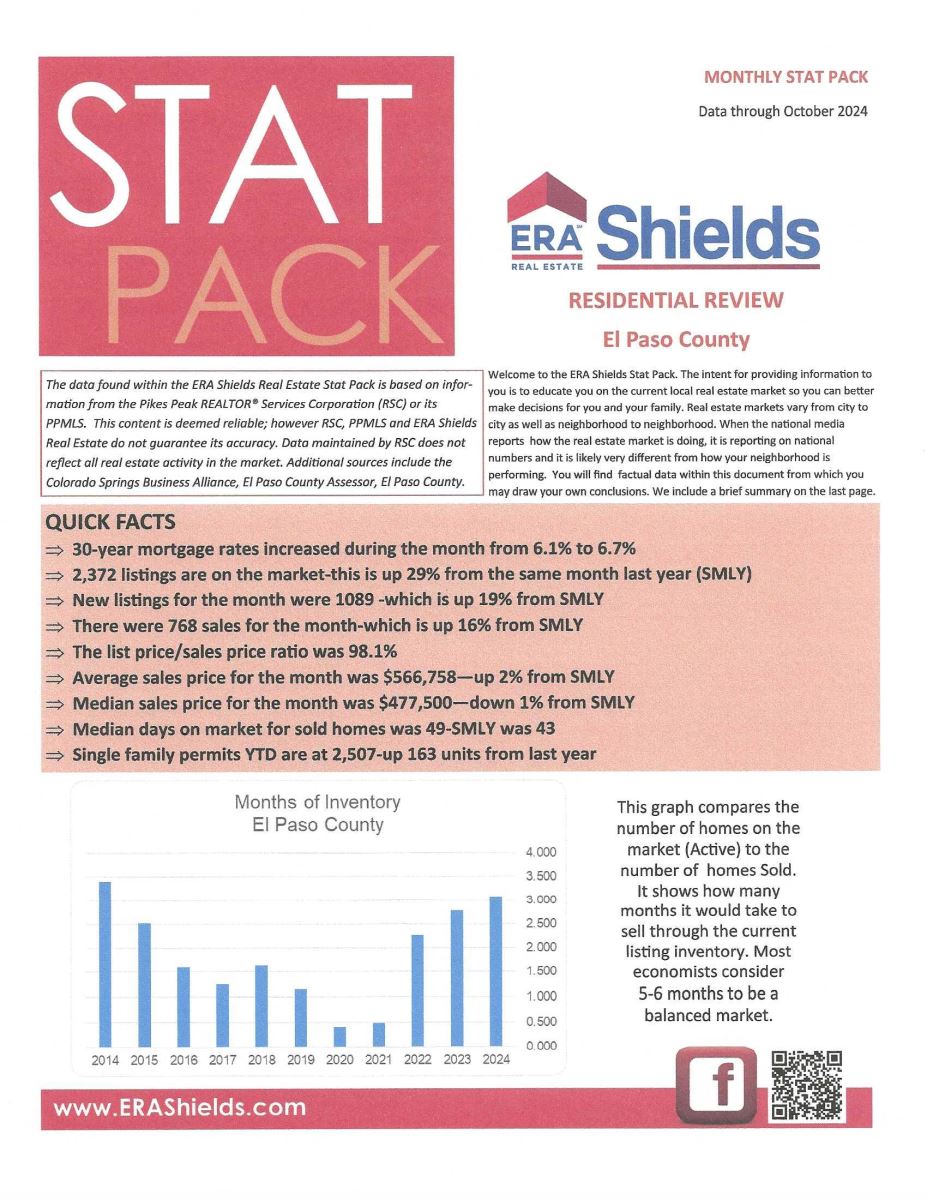

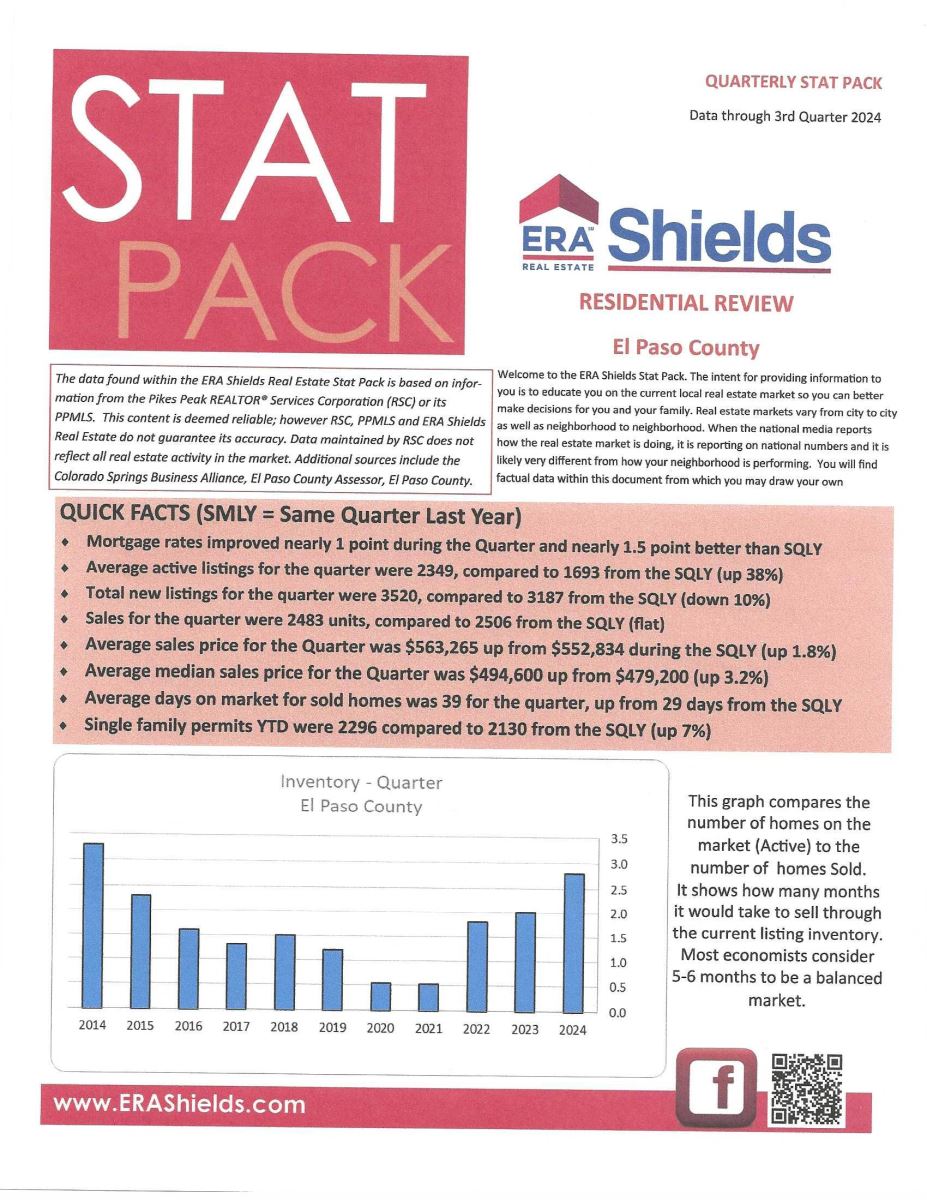

ERA SHIELDS STAT PACK

Data through October 2024, ERA Shields

Here is data from my company’s monthly “Stat Pack” that can better help you understand the local buying and selling reality. I have reproduced the first page, and you can click here to get the report in its entirety.

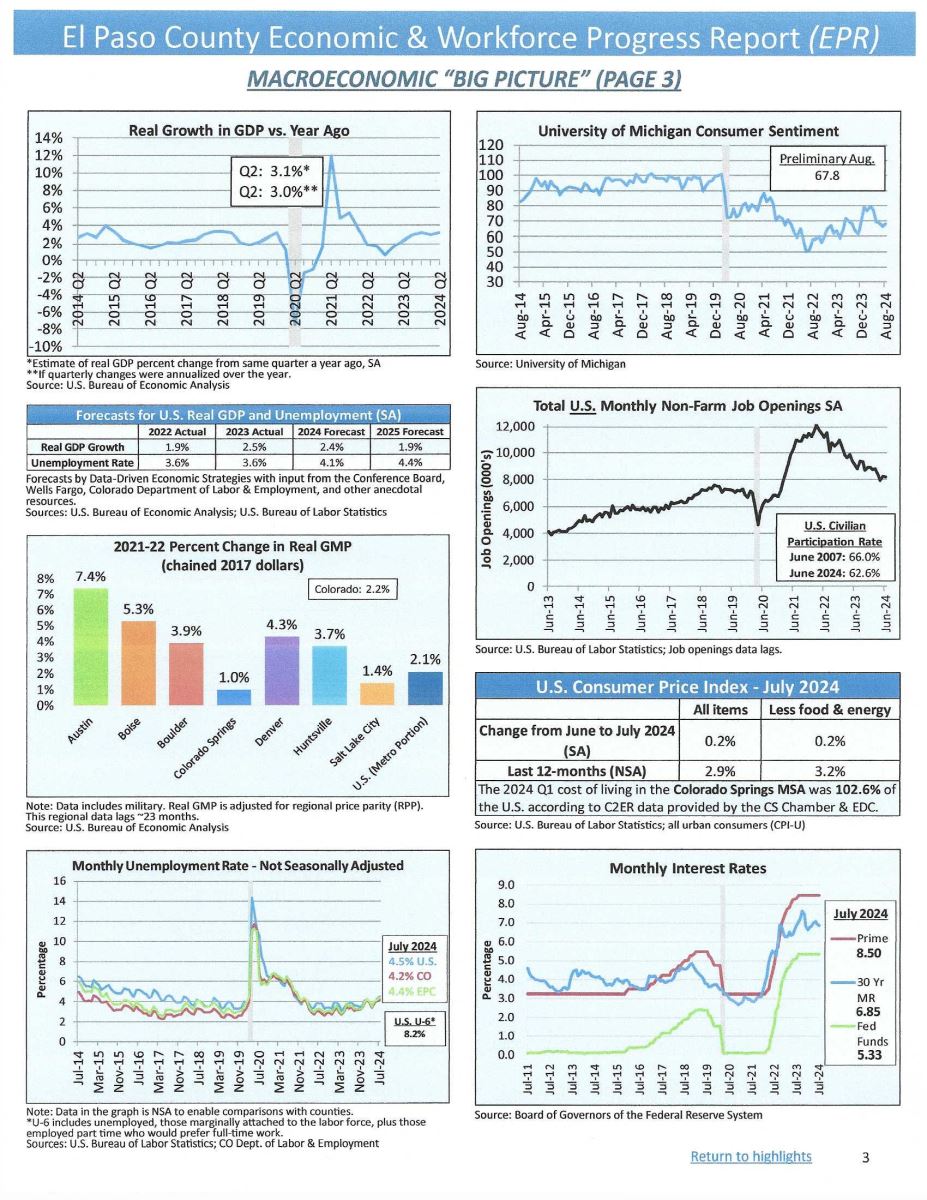

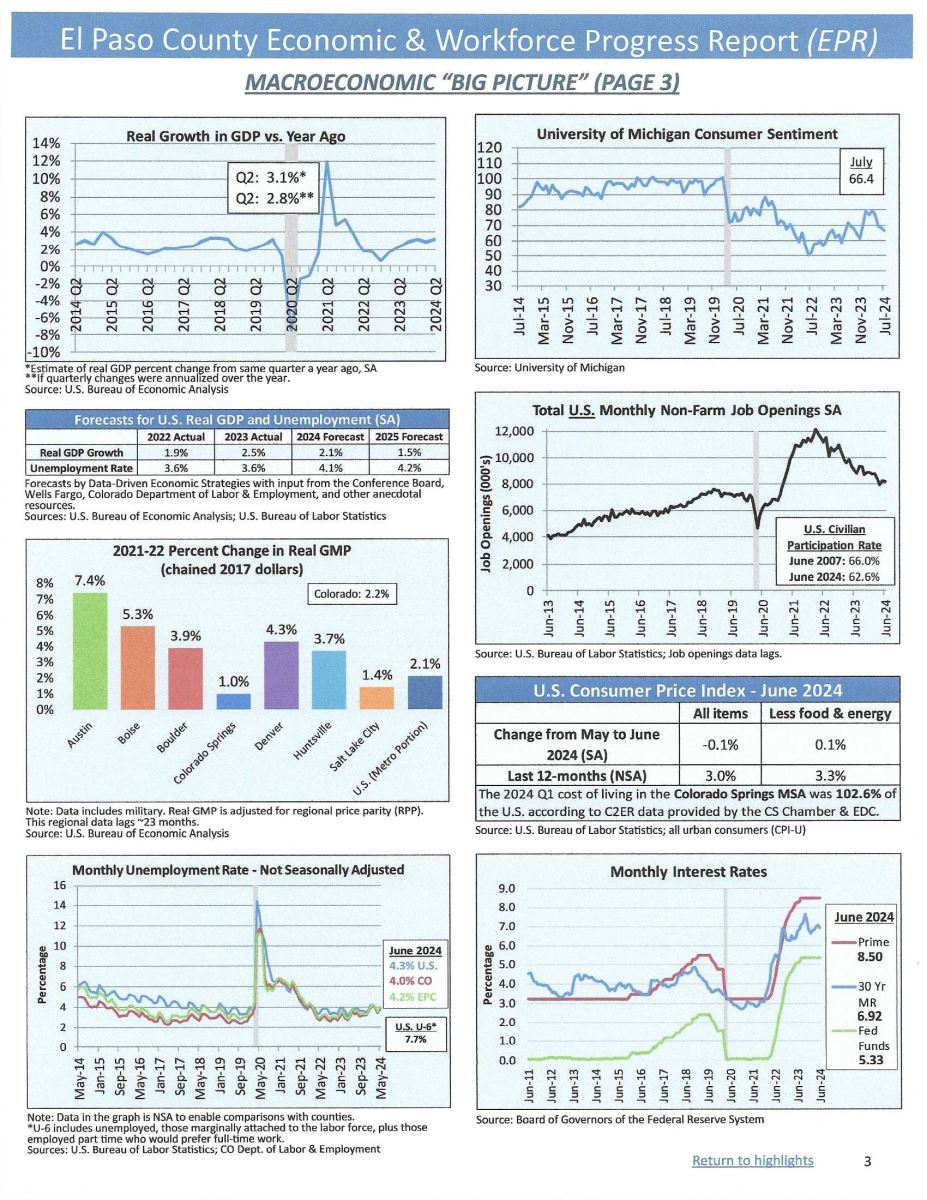

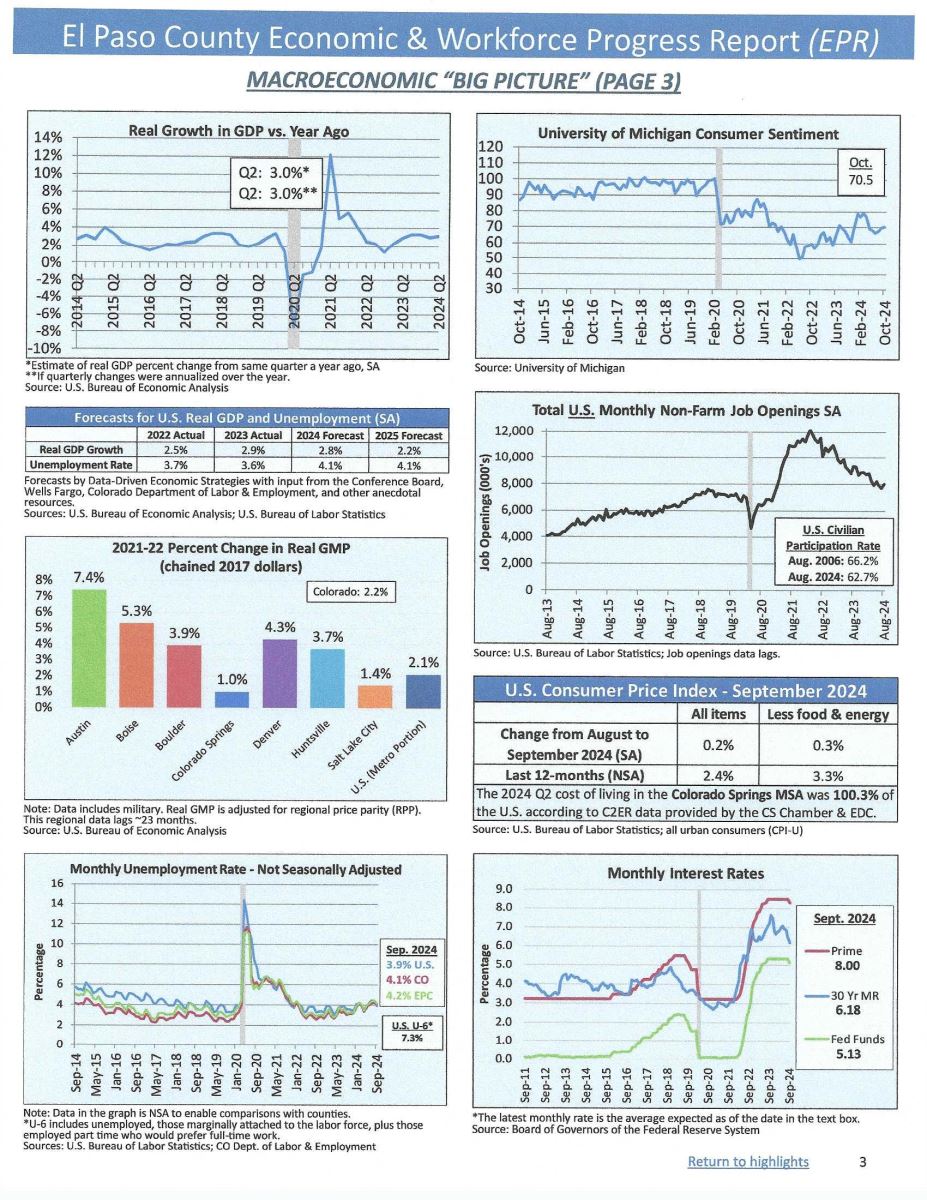

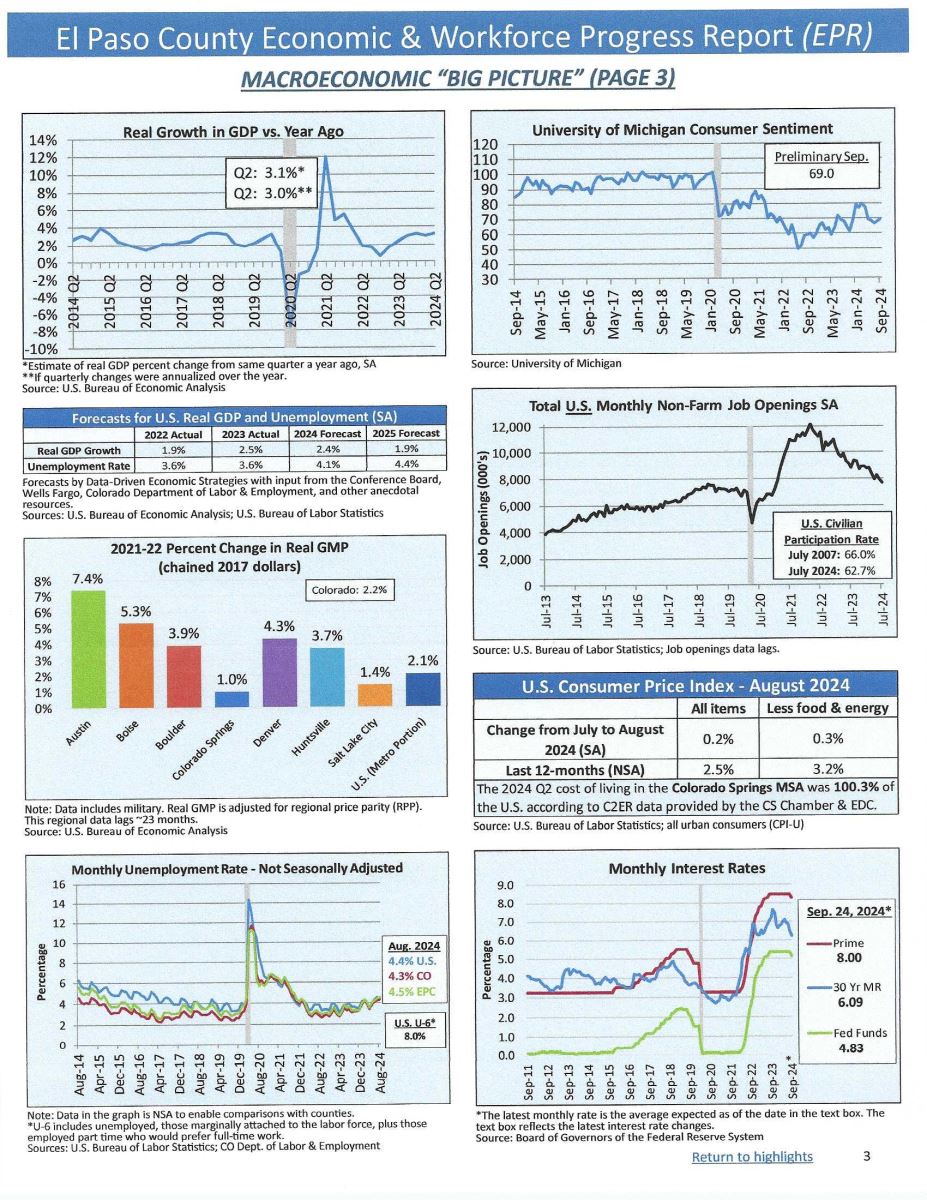

ECONOMIC & WORKFORCE DEVELOPMENT REPORT

Data-Driven Economic Strategies, October 2024

As always, I like to share the useful data I receive from our “local economist”, Tatiana Bailey. You will see in these charts what’s happening locally in terms of the economy as well as the most recent Workforce Progress Report.

This information is especially invaluable to business owners; however, I know you all will all find it worthwhile reading.

Below is a reproduction of the first page of graphics. To access the full report, please click here. And if you have any questions, give me a call.

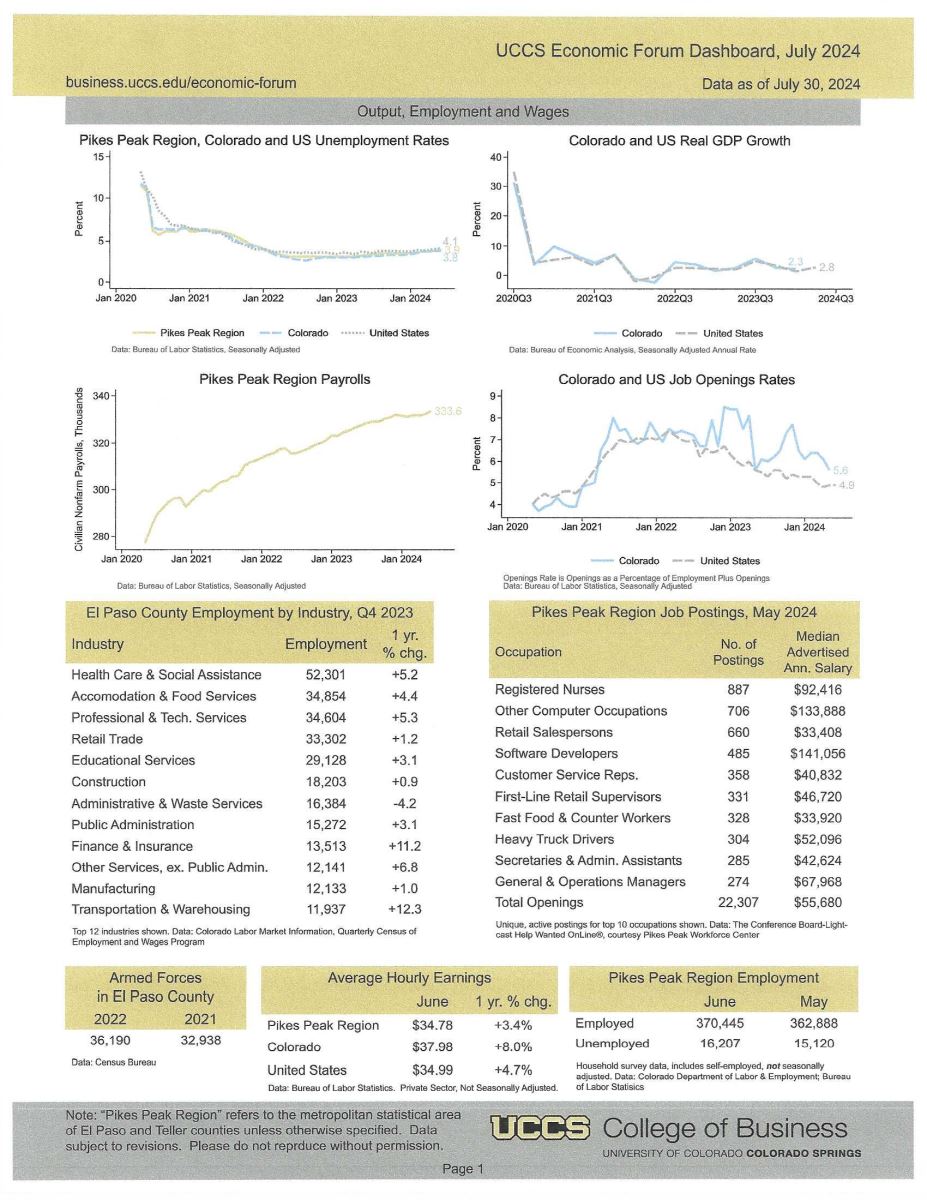

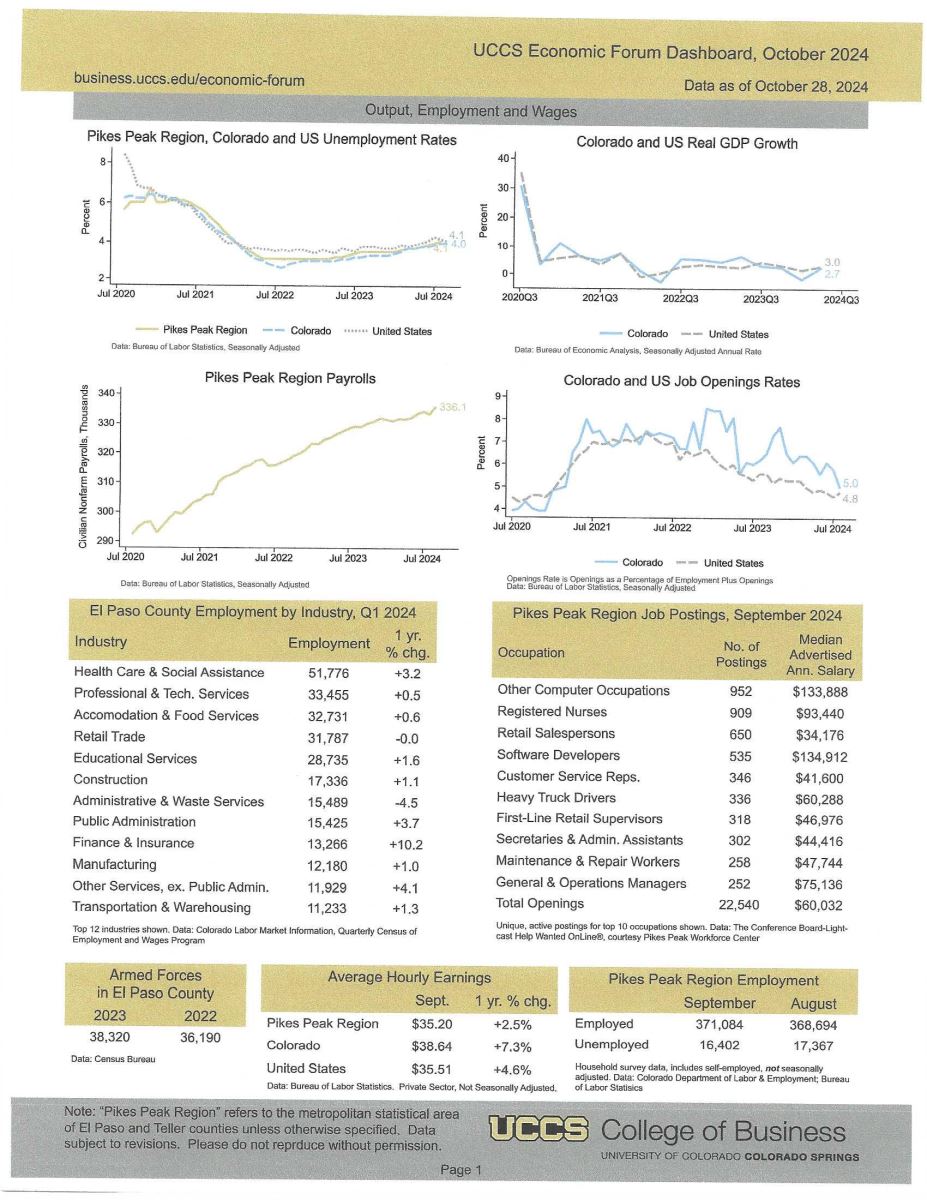

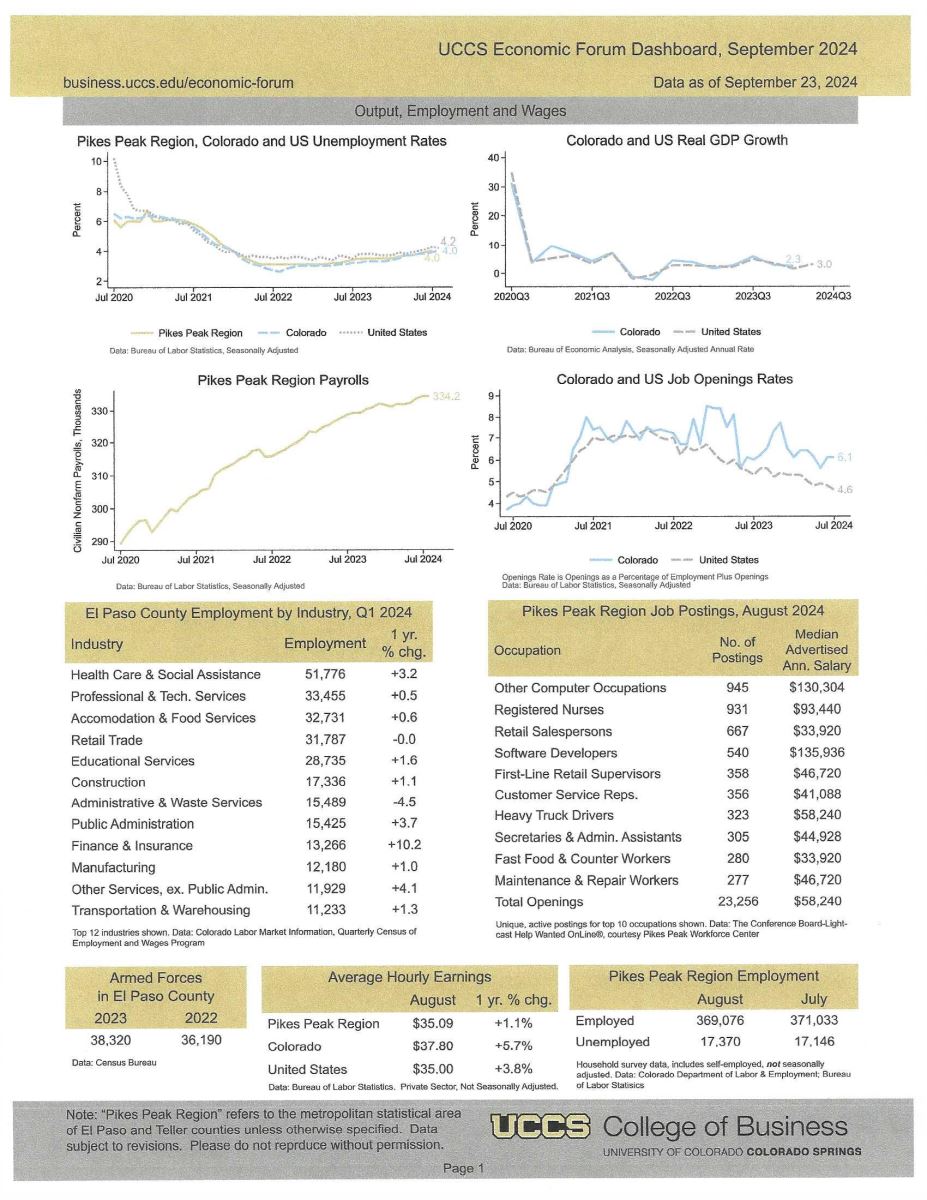

UCCS ECONOMIC FORUM MONTHLY DASHBOARD

UCCS College of Business/Economic Forum, Updated October 2024

Here is the monthly report from the UCCS College of Business Economic Forum. It is created by professor Dr. Bill Craighead, who is the Forum Director. He also publishes an on-line “Weekly Economic Snapshot” you might enjoy.

I know several of you who like statistics and use this information in your daily business life, and I will share it with you when I receive it each month.

I’ve reproduced the first page of the charts below. To access the report in its entirety, please click here.

.png)

.jpg)