HARRY'S BI-WEEKLY UPDATE 6.26.24

June 26, 2024

HARRY’S BI-WEEKLY UPDATE

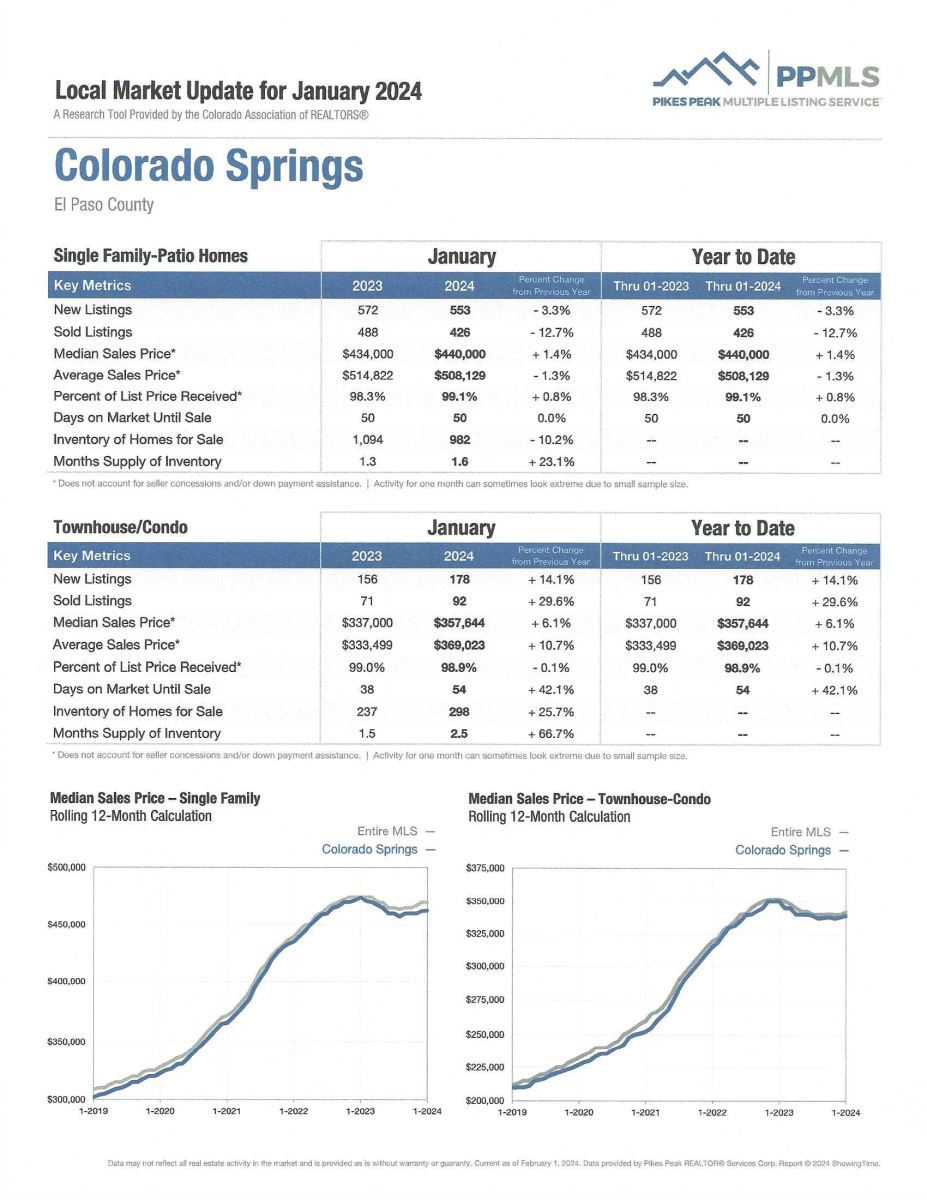

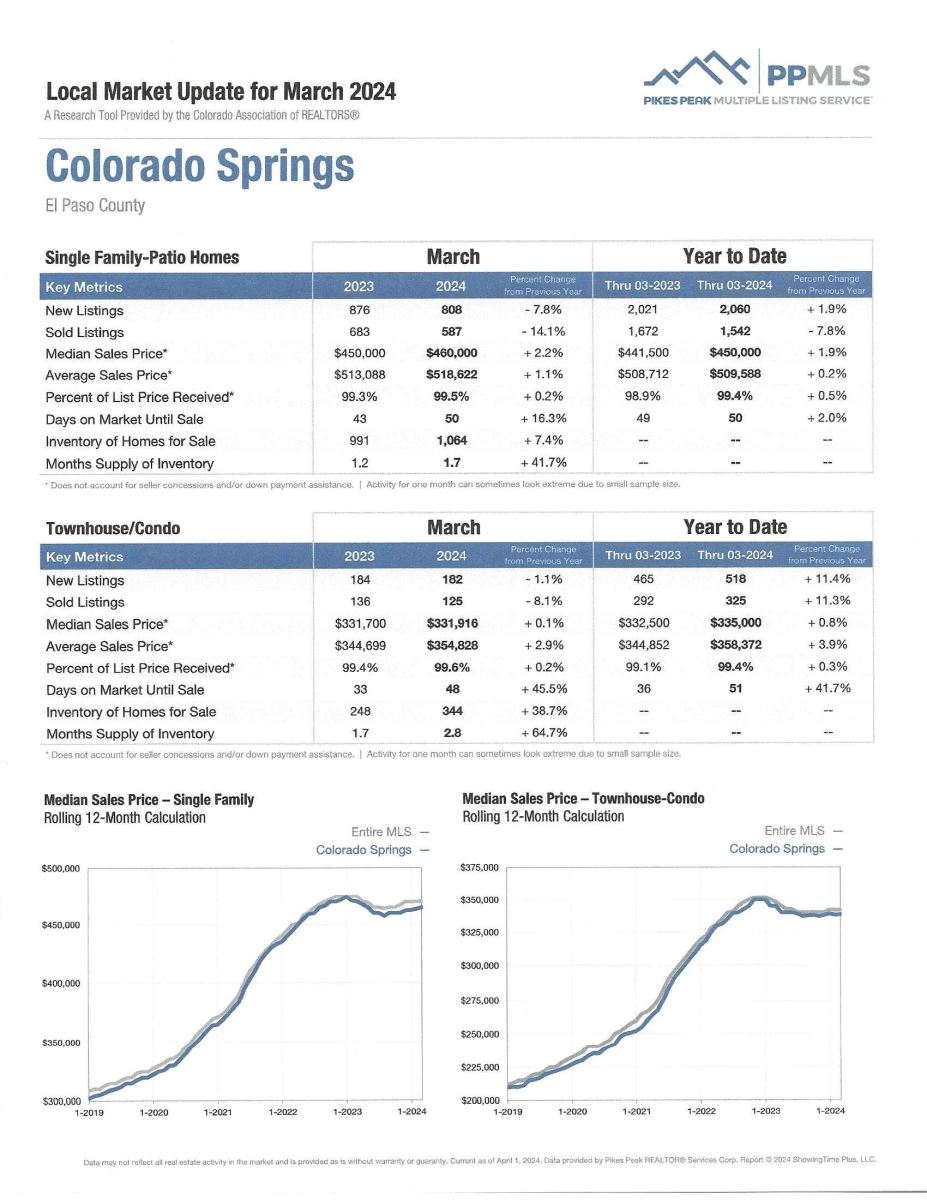

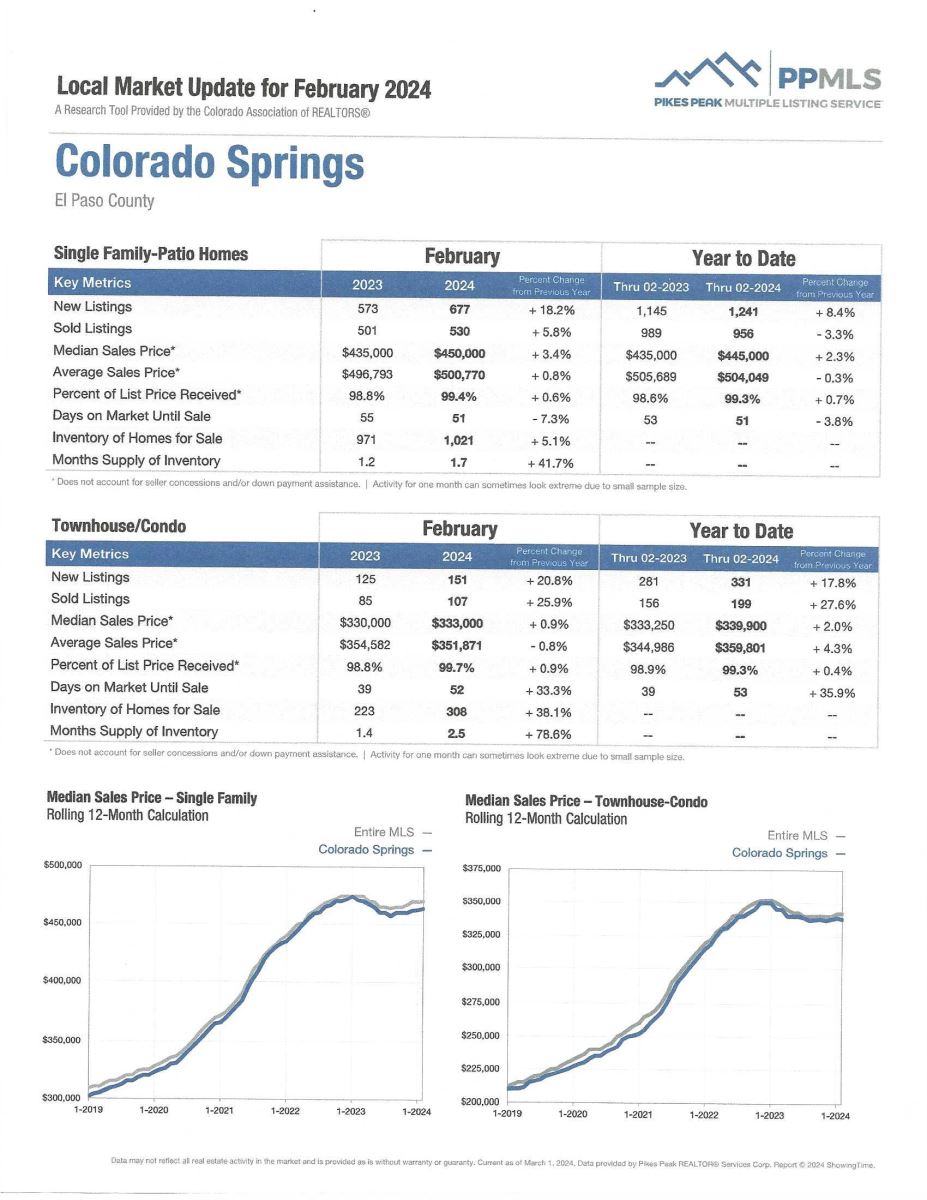

A Current Look at the Colorado Springs Residential real estate Market

As part of my “Special Brand of Customer Service”, it is my desire to share current Residential real estate issues that will help to make you a more successful and profitable Buyer and Seller.

AS AN ETERNAL OPTIMIST, THE housing market OF LATE HAS CERTAINLY TESTED MY BELIEF SYSTEM

Yes, between the shortage of available homes for sale and higher mortgage interest rates, it’s been a unique situation for me to guide my buyers and sellers in a direction that best fits their individual needs, wants and budget requirements.

My background in Investment Banking has given me a heads up on most Residential real estate brokers and also has proven to me that in most situations it is still in the best interest of my clients to buy and/or sell at most any time. As I have perpetually advocated…there is always someone who needs or wants to sell and one who needs or wants to buy. With that in mind, we can make the best of most any situation.

As many of my past clients can attest, unless I can find the right fit, I don’t want to have a sale. I’ve been doing this for more than 52 years on April 1 and I’m in it for the relationships…not just a quick sale. I take great pleasure in the many long-term clients who have become friends and I have enjoyed working with their children and even grandchildren in recent years.

That being said, it’s been quite a different couple of years for my clients and that makes me work all the harder to find positive endings for them and their families.

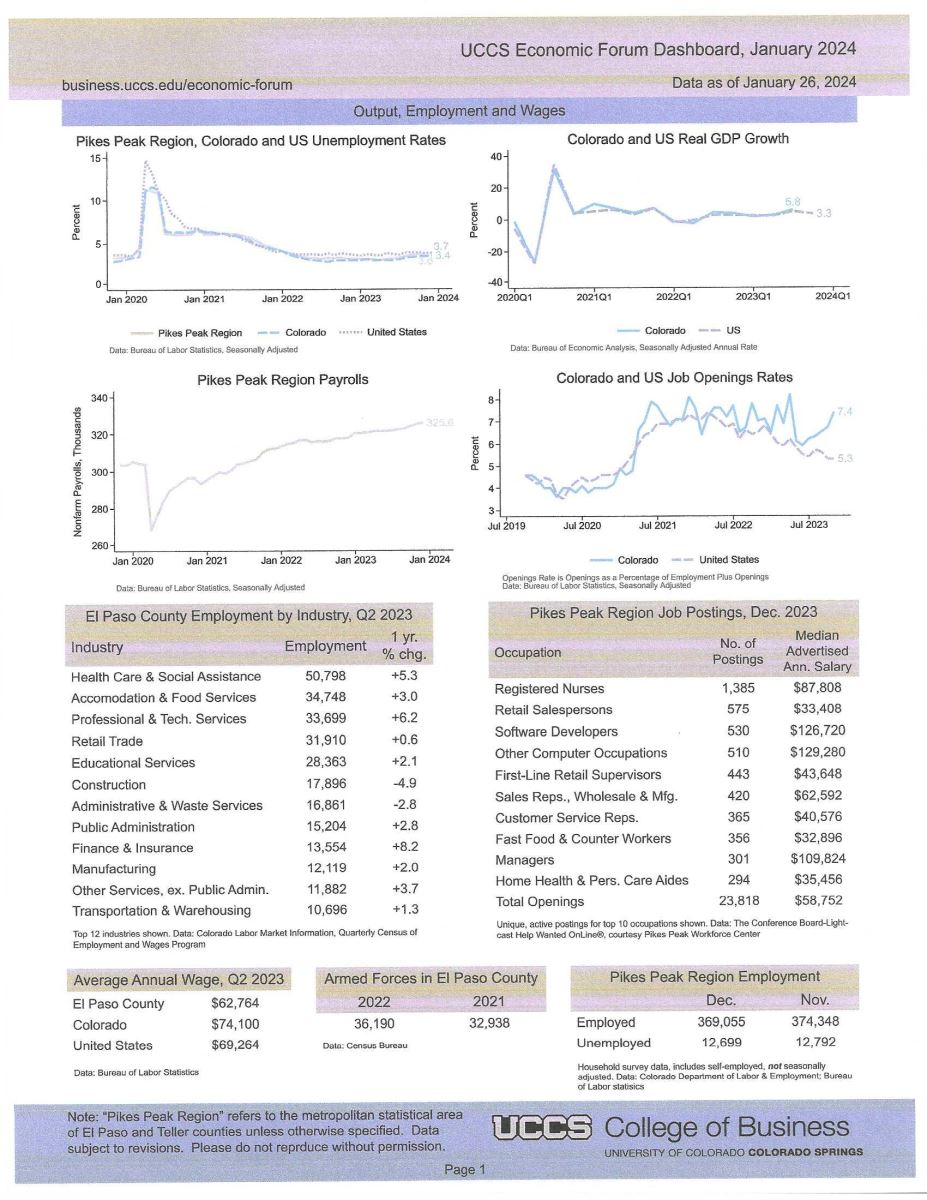

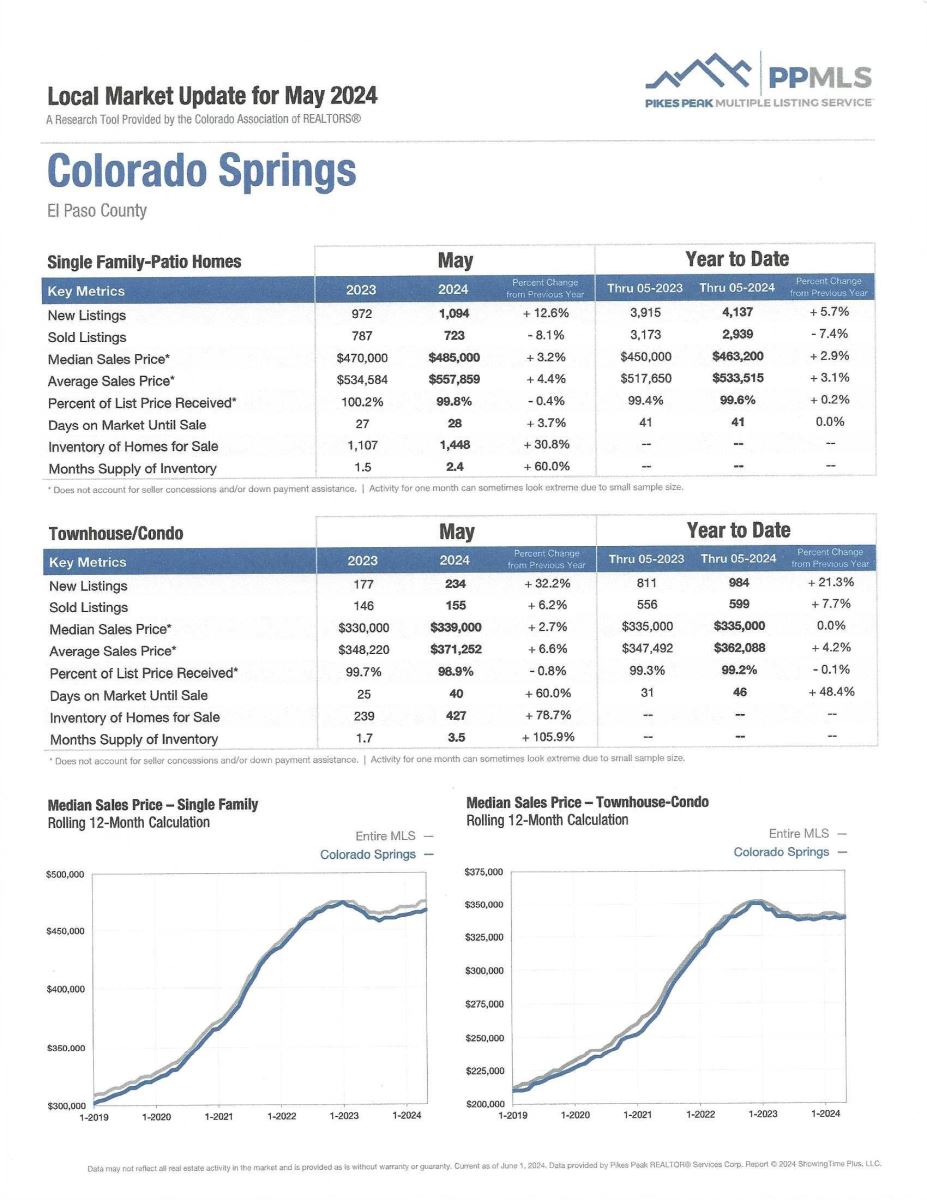

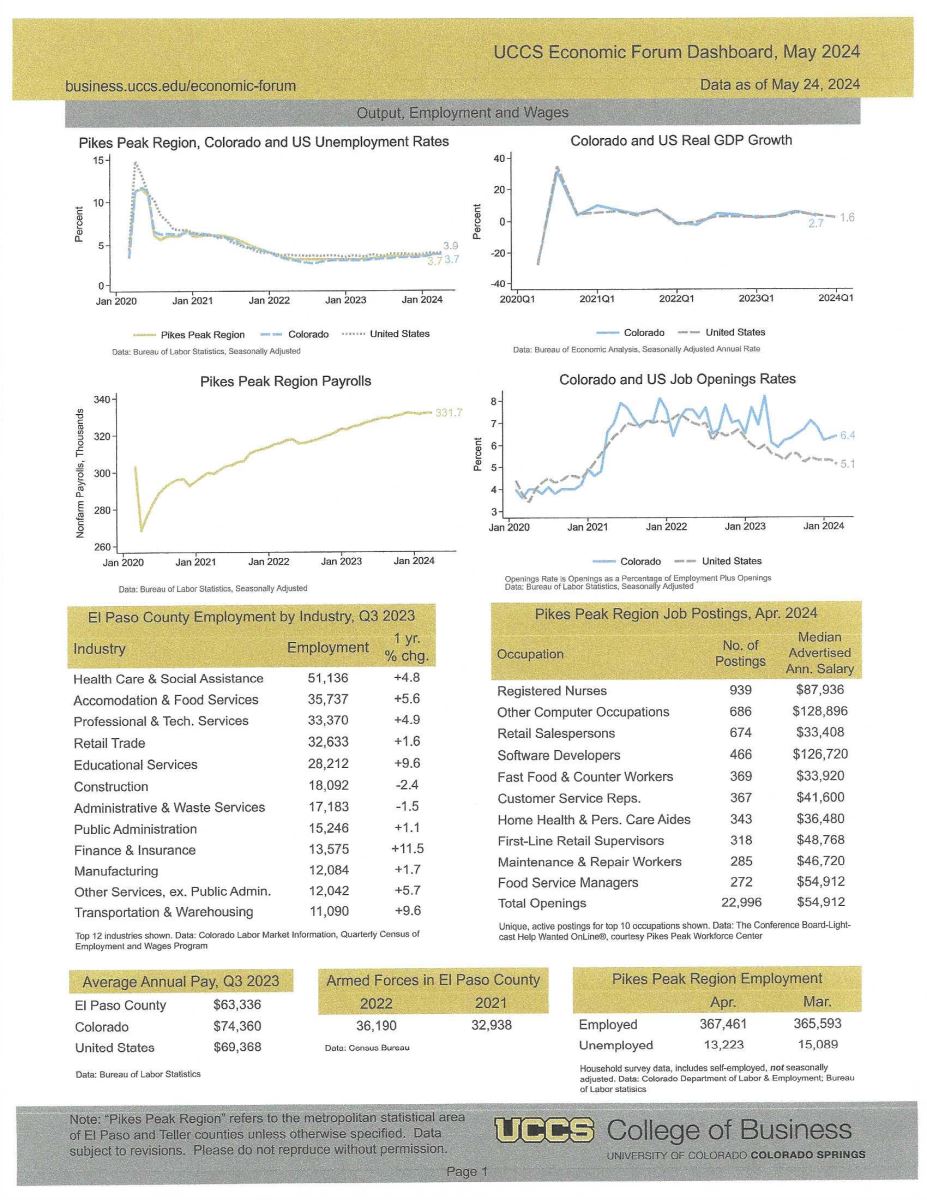

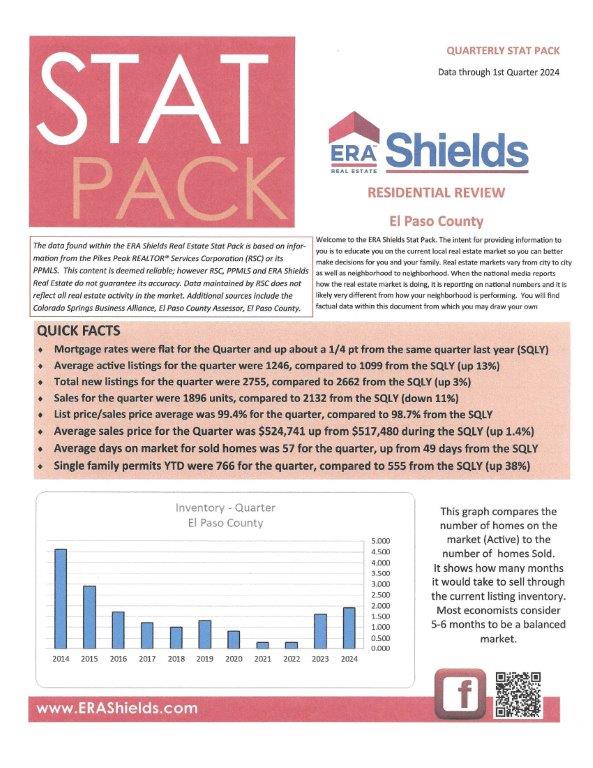

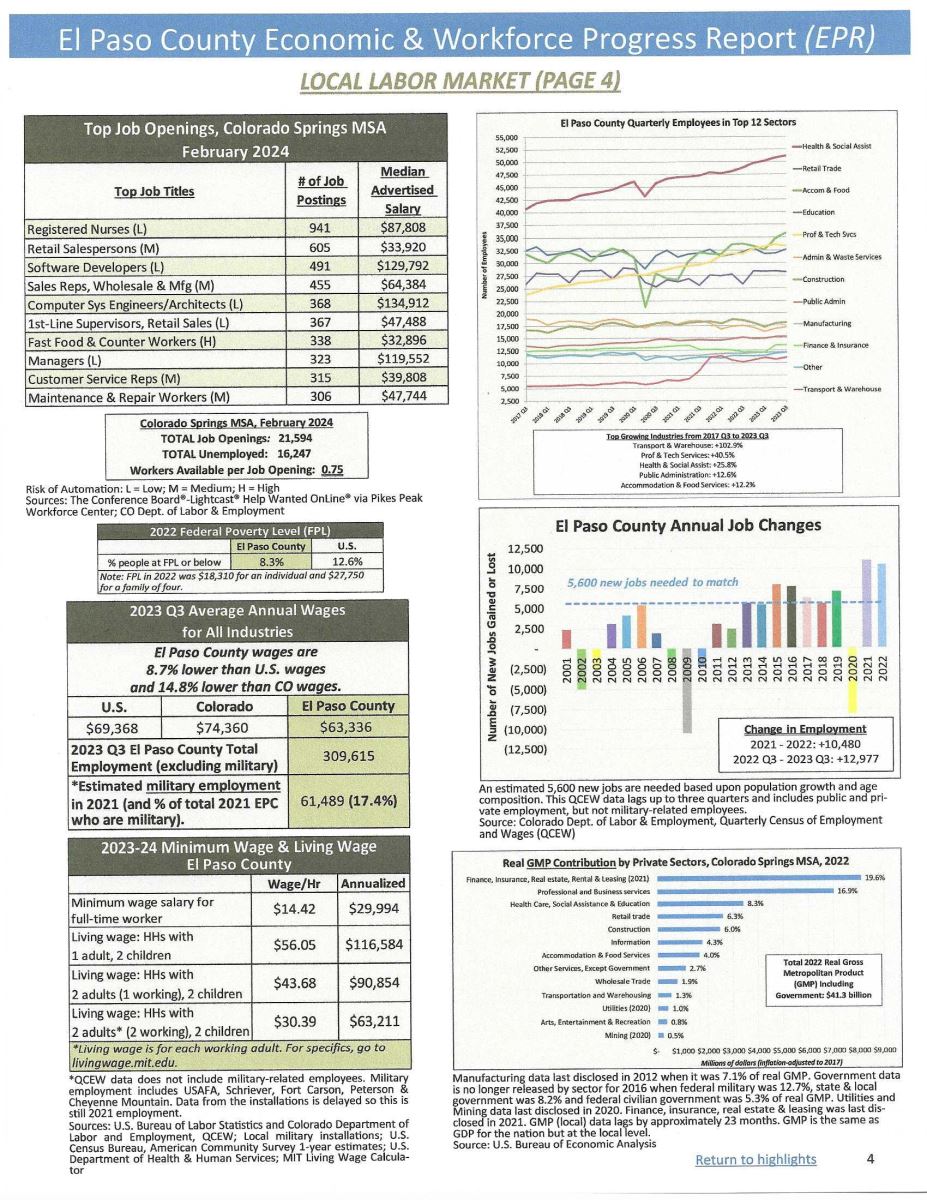

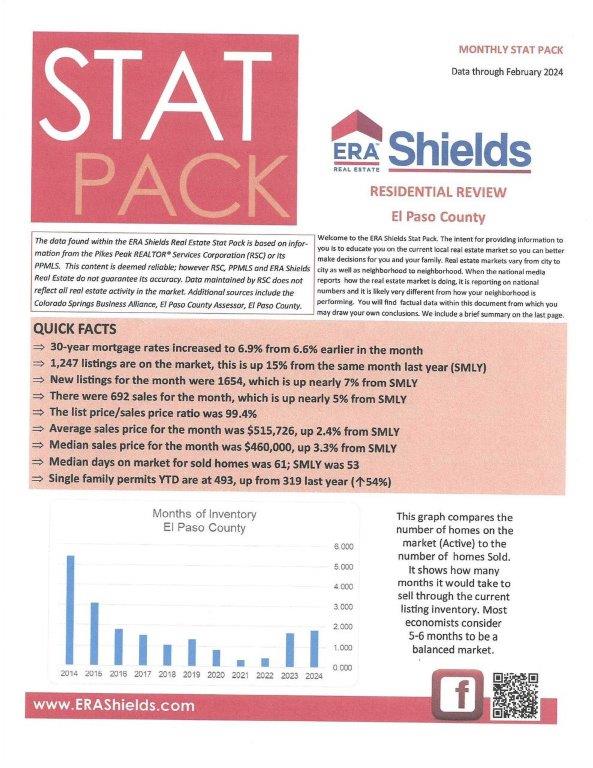

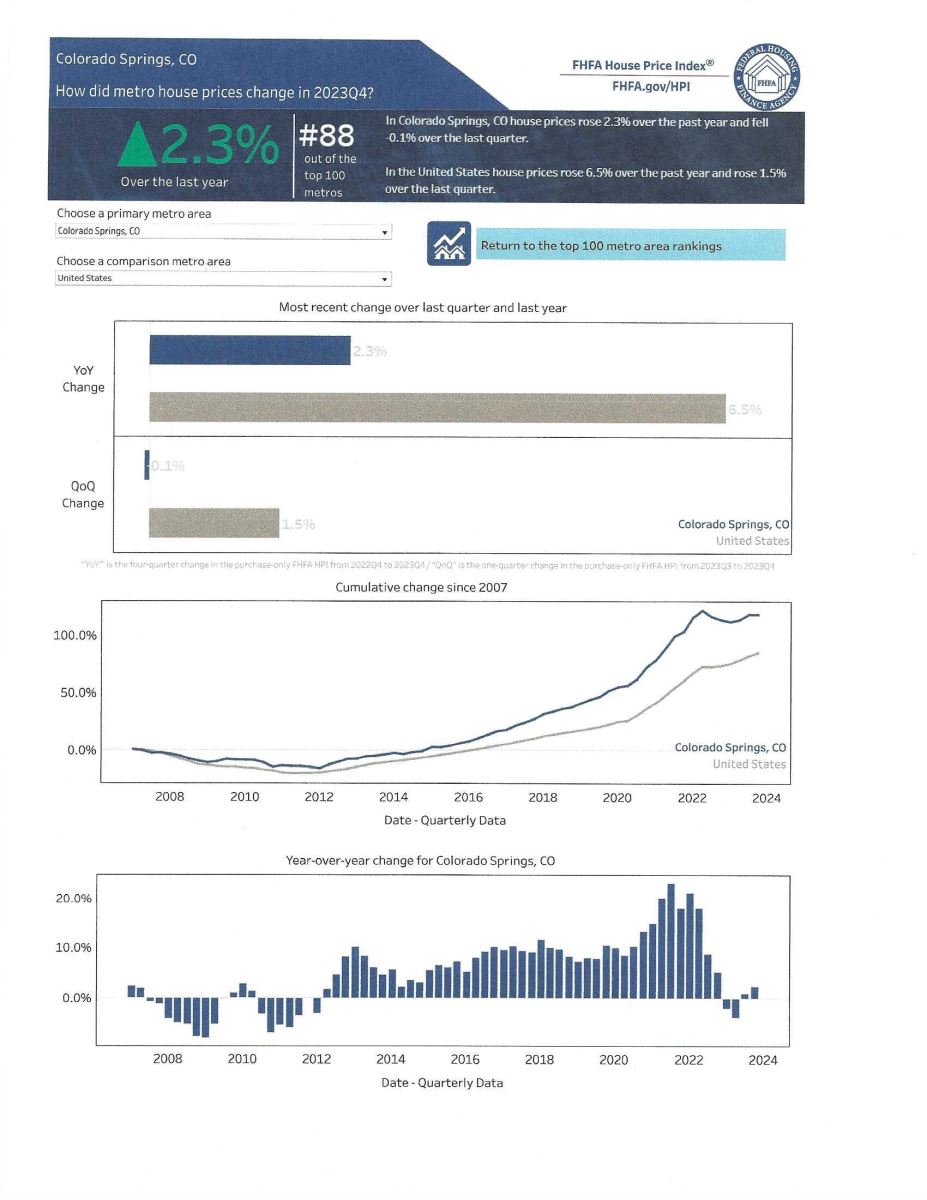

Colorado Springs has always been a great place to live, especially with its terrific work/life balance. For a long time it was “our little secret” and that kept the price of housing more affordable. Not so at the moment with the shortage of available homes for sale. Hopefully that will turn around before too long.

It seems lots of folks want to relocate here either for a job, to be closer to family, to retire, or simply because it’s such a special place to live. Whatever the reason, these folks are all competing for the same homes and there just aren’t enough of them to fill demand.

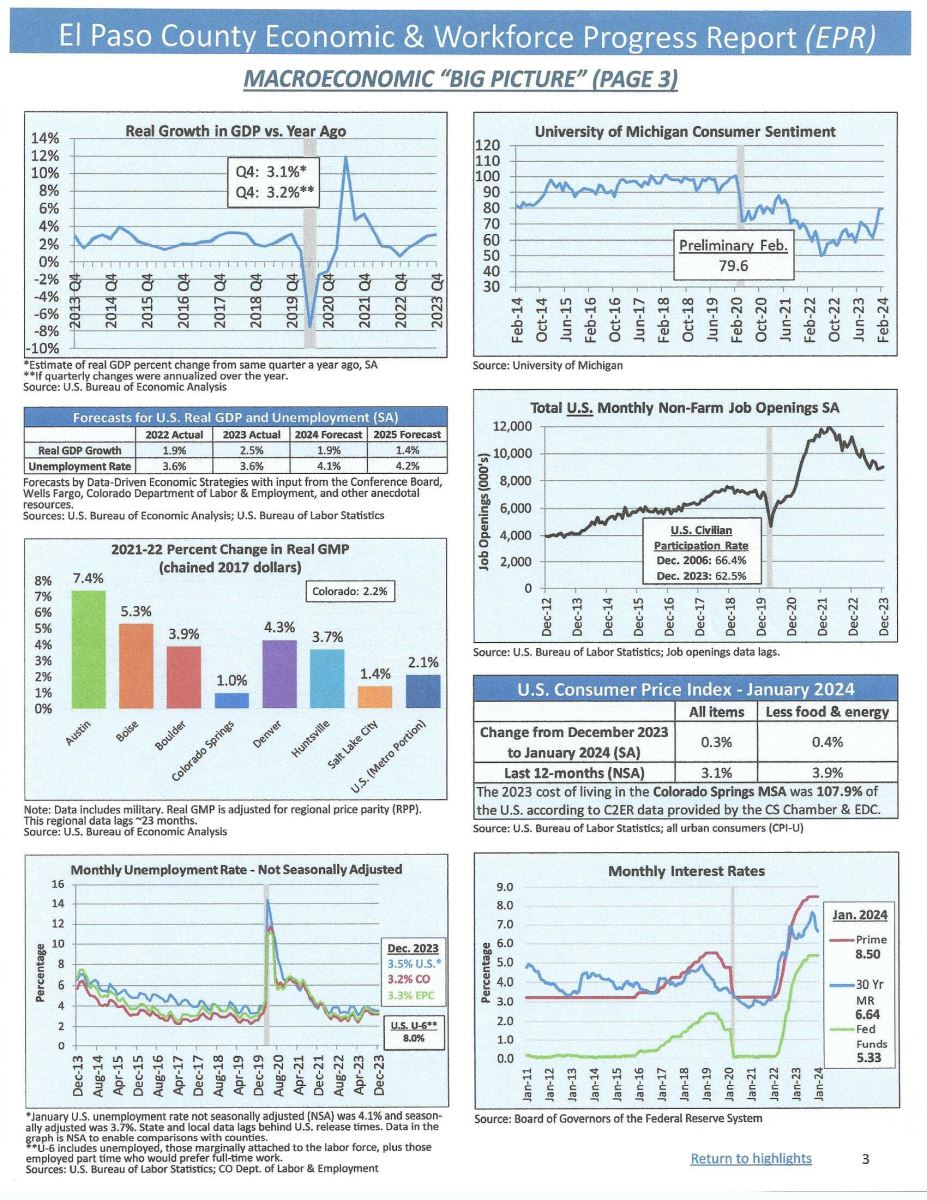

With predictions of at least one rate cut by the Fed before year’s end, this could lead to a gradual easing of mortgage rates. That could help folks who have been on the fence to finally list their present home and look toward their future.

The recent big rally in bonds has also been a boost for housing in that it pushed down the yield on the 10-year U. S. Treasury note by nearly a half percentage point, another hopeful indicator for lowered mortgage rates in the future.

A good sign locally is that building permits for new home construction jumped in May, indicating that some on-the-fence buyers are no longer waiting for rates to drop significantly before purchasing a new home.

One of the articles below shows you the predictions for the second half of 2024 and me being me...I’m all in on hoping that everyone who is looking to buy and/or sell can have a happy ending.

If you’ve been waiting, now is a good time to at least explore the possibilities. Give me a call at 719.593.1000 or email me at Harry@HarrySalzman.com and let’s together see what we can do to make 2024 the year your Residential real estate dreams come true.

If you’ve got two minutes and three seconds, look at my newest podcast on this very subject. Simply click on the link below and you will be directed to my personal YouTube channel.

To watch, click here:

To read the entire 47-page copy of “The State of the Nation’s Housing…2024” that I reference in the video, please click here.

And while you’re at it you might want to subscribe to my channel so you won’t miss future broadcasts. It won’t cost you anything. Well, it could cost you… if you miss some of my informative musings!

housing market FORECAST: WHAT’S AHEAD FOR THE 2ND HALF OF 2024

KeepingCurrentMatters, 6.24.24

Moving further into the second half of 2024, here’s what experts say you should expect for home prices, mortgage rates, and home sales.

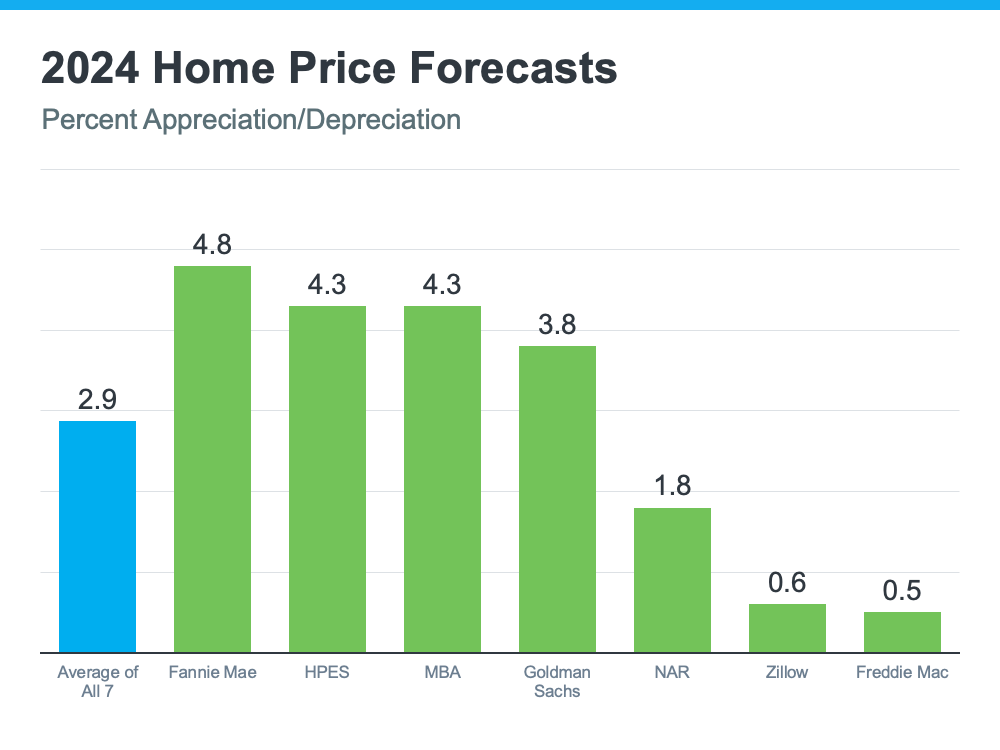

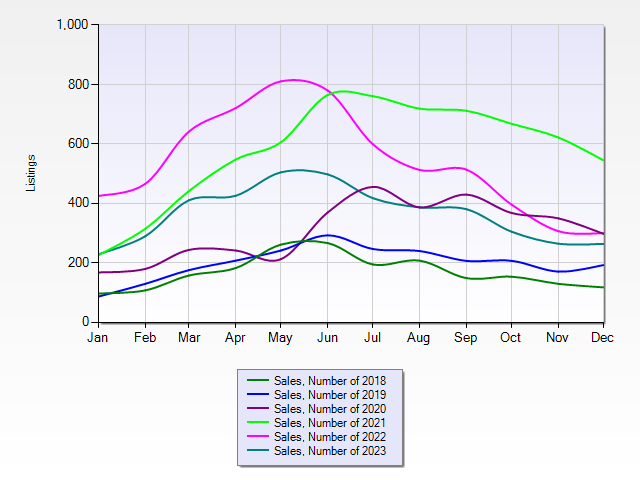

Home Prices Are Expected to Climb Moderately

As in the recent past, home prices are forecasted to continue rising at a more normal pace. The graph below shows the latest forecasts from seven of the most trusted sources in the industry.

As I’ve said before, and according to Jessica Lautz, Deputy Chief Economist at the National Association of Realtors (NAR), “One thing that seems to be pretty solid is that home prices are going to continue to go up, and the reason is that we don’t have housing inventory.”

Yes, inventory is up compared to the last couple of years but it’s still low overall, both nationally and here in Colorado Springs. And because there still aren’t enough homes to go around, that’s going to keep upward pressure on prices.

If you are currently thinking of buying, the good news is you won’t have to deal with prices skyrocketing like they did during the pandemic. But remember, prices are not expected to drop. They will continue climbing, just at a slower pace.

Getting into the market sooner than later could still save you money in the long run. Plus, you can feel confident experts say your home will grow in value after you purchase it.

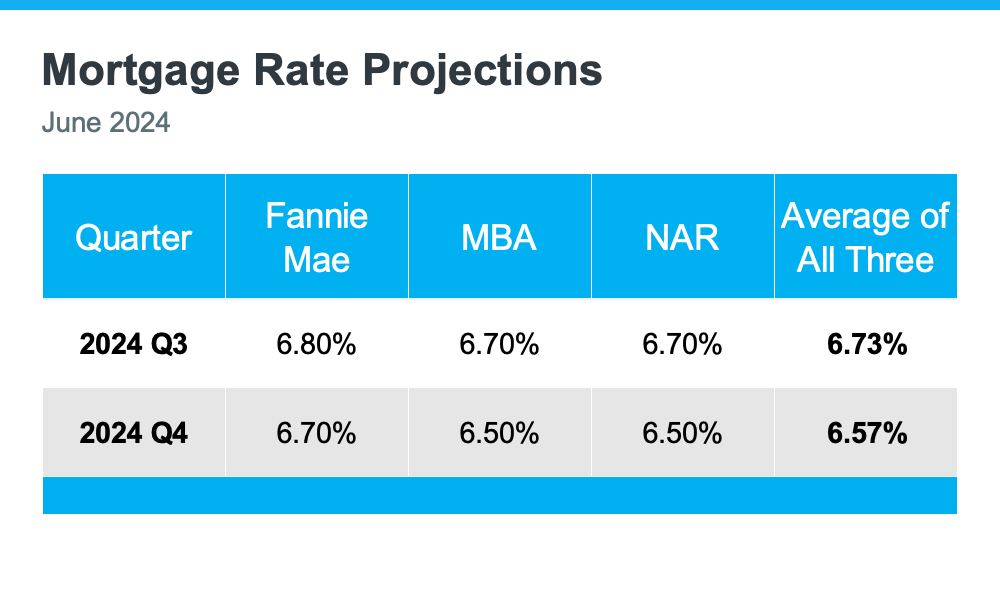

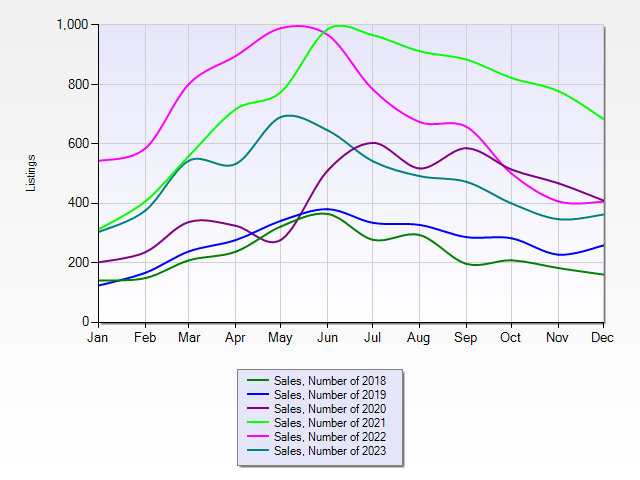

Mortgage Rates Are Forecast to Come Down Slightly

A good piece of news for both buyers and sellers is that mortgage rates are expected to come down a bit, according to Fannie Mae, the Mortgage Bankers Association (MBA), and NAR.

When you buy, even a small drop in mortgage rates can make a big difference in your monthly payments. For sellers, lower rates are going to bring more buyers into the market which can help you sell faster and potentially at a higher price.

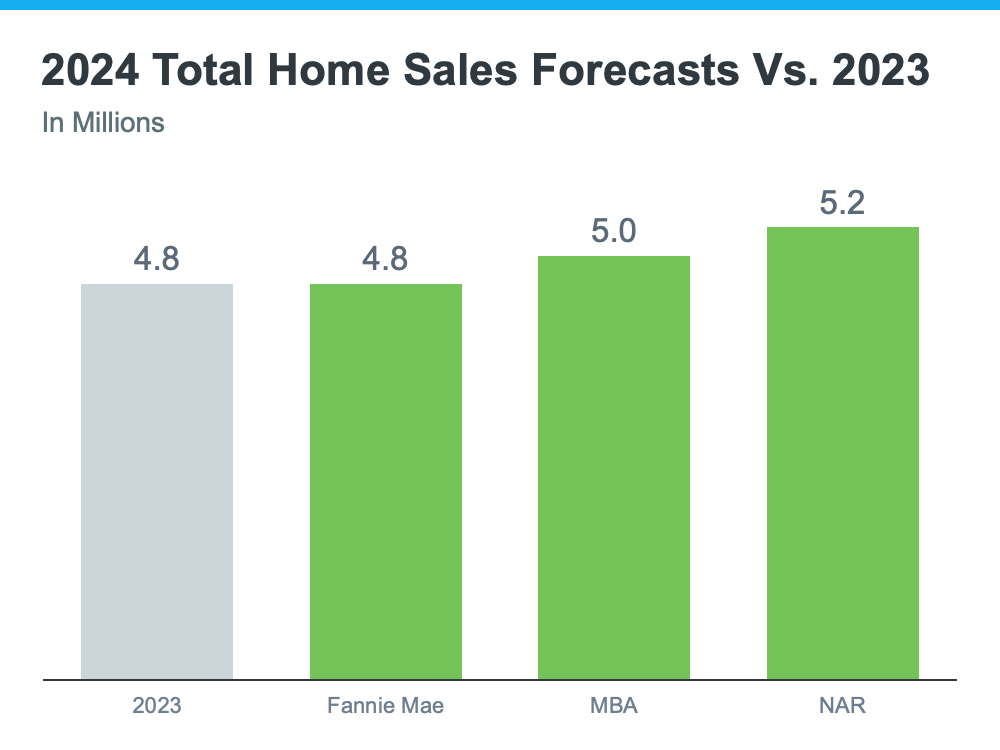

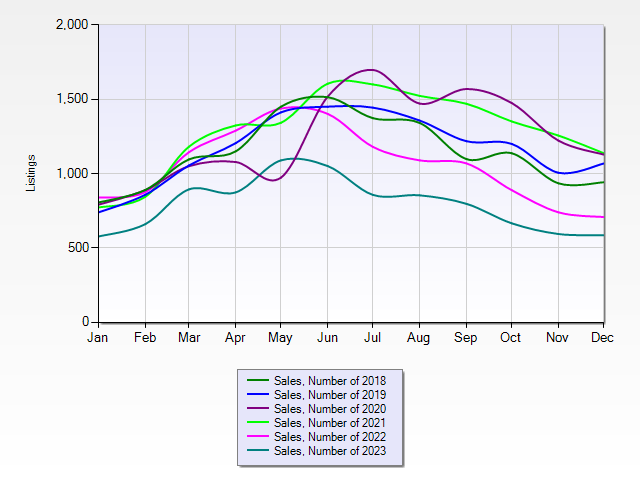

Home Sales Are Projected to Hold Steady

We should see about the same number of home sales in 2024 as we did last year and perhaps a few more. The graph below compares the 2024 homes sales forecasts from Fannie Mae, MBA and NAR to the 4.8 million homes that sold nationally last year.

The average of the three forecasts is about 5 million sales nationally in 2024—a small increase from 2023. Lawrence Yun, Chief Economist at NAR puts it this way:

“Job gains, steady mortgage rates and the release of inventory from pent-up home sellers will lead to more sales.”

With more available inventory and lowered mortgage rates expected a few more homes should be sold this year compared to 2023.

If you are looking to buy or sell, this is good news. Call me sooner than later to explore all your options.

.jpg)

.png)

.jpg)