HARRY'S BI-WEEKLY UPDATE 6.5.2024

June 5, 2024

HARRY’S BI-WEEKLY UPDATE

A Current Look at the Colorado Springs Residential real estate Market

As part of my “Special Brand of Customer Service”, it is my desire to share current Residential real estate issues that will help to make you a more successful and profitable Buyer and Seller.

PRICES CONTINUE TO RISE AND THE BUYING AND SELLING SEASON IS NOW HERE

Things are starting to pick up as you will see by the statistics below. Active listings are up 51% for single-family/patio homes and Condo/Townhome listings are up a whopping 87% year-over-year.

And the median sales price for single family/patio homes is up 5.1%.

What does that tell me? Just what I’ve been telling you for a while now…folks are ready to sell, either to trade up, move to a new neighborhood or simply want to buy for investment purposes. Whatever the reason, things are beginning to move (pun intended).

While interest rates are still high compared to several years ago, they haven’t fluctuated much and aren’t likely to go down significantly this year.

On the other hand, as you will continue to see, prices are continuing to rise and that’s not likely to change much either.

If you have even considered a move, give me a call and let’s see how together we can make that happen.

In April I began 52 years in local Residential real estate. As you might imagine, I’ve seen most every cycle imaginable and have always been able to help my clients find what they want, need, and can afford, either for themselves or for investment purposes.

Coupling that with my Investment Banking background, I have an edge up that my clients have found to be crucial in helping with their individual situations. When I work with you, your goals become mine and together we make a great team to realize all your Residential real estate dreams.

If Residential real estate is among your hopes and dreams for 2024, please give me a call at 719.593.1000 or email me at Harry@HarrySalzman.com and let me help make them come true.

And, if you’ve got one minute and 52 seconds, look at my new and improved video podcast. Simply click on the link below and you will be directed to my personal YouTube channel.

To watch, click here:

While you’re at it you might want to subscribe to my channel so you won’t miss future broadcasts. It won’t cost you anything…well, it could cost you… if you miss some of my informative musings!

And now for statistics…

MAY 2024

Statistics provided by the Pikes Peak REALTORS Service Corp., or it’s PPMLS

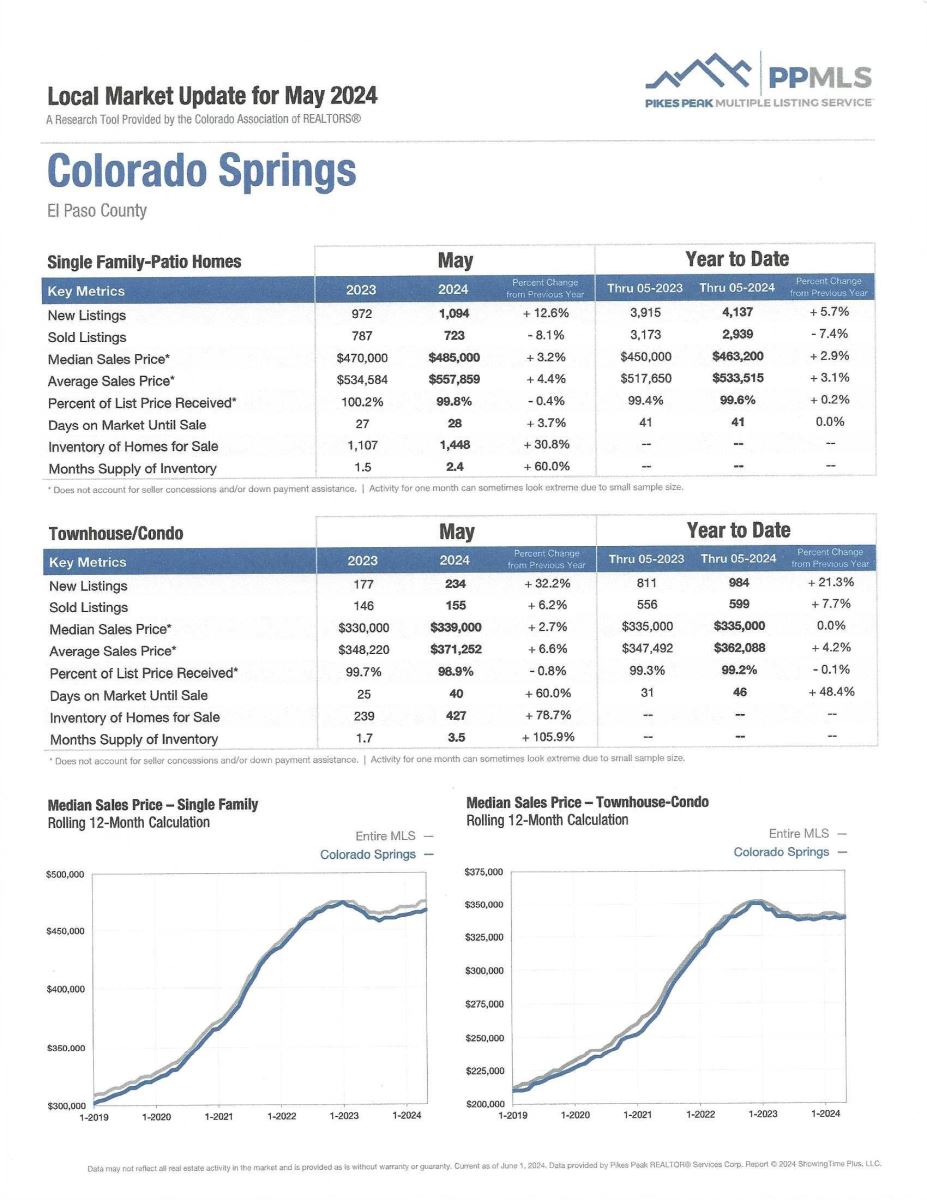

Here are some highlights from the May 2024 PPAR report.

In El Paso County, the average days on the market for single family/patio homes was 31. For condo/townhomes it was 37.

Also in El Paso County, the sales price/list price for single family/patio homes was 99.8% and for condo/townhomes it was 99.0%.

In Teller County, the average days on the market for single family/patio homes was 62 and the sales/list price was 97.5%.

Please click here to view the detailed 10-page report, including charts. If you have any questions about the report or to find out how it relates to your individual situation, just give me a call.

In comparing May 2024 to May 2023 for All Homes in PPAR:

Single Family/Patio Homes:

· New Listings were 1,848, Up 16,2%

· Number of Sales were 1,142, Down 8.1%

· Average Sales Price was $557,050, Up 3.8%

· Median Sales Price was $499,000, Up 5.1%

· Total Active Listings are 2,645, Up 51.1%

· Months Supply is 2.3, Down 6.3%

Condo/Townhomes:

· New Listings were 302, Up 24.8%

· Number of Sales were 183, Down 1.6%

· Average Sales Price was $370,732, Up 2.1%

· Median Sales Price was $340,000, No change

· Total Active Listings are 492, Up 87.1%

· Months Supply is 2.7, Down 54.0%

MAY 2024 MONTHLY INDICATORS AND LOCAL MARKET UPDATE ILLUSTRATE OUR LOCAL TRENDS IN DETAIL

Colorado Association of REALTORS® , Pikes Peak REALTORS Service Corp, or it’s PPMLS

Providing greater detail than the above report, this contains information on both El Paso and Teller counties for Residential real estate.

The “Activity Snapshot” for all residential properties in El Paso and Teller counties shows the Year-to-Date one-year change:

- Sold Listings for All Properties were Down 7.6%

- Median Sales Price for All Properties was Up 3.3%

- Active Listings on All Properties were Up 39.2%

You can click here to read the 16-page Monthly Indicators or click here to get specific information on the geographical are of your choice from the 18-page Local Market Update. It’s a good idea to check out your own area or one that you might be considering in order to get a good idea of the local pulse. As an example, here is a detailed report on the Colorado Springs area:

SHOULD I RENT OR SHOULD I BUY…AN INFOGRAPHIC

KeepingCurrentMatters 5.17,24

This is a question I’ve been asked quite often during the last year since interest rates are higher than they were several years ago.

Bottom Line:

- While renting may be less expensive in some areas right now, there are three big benefits homeownership provides that renting can’t.

- Owning a home means you get to say “goodbye” to rising rents and “hello” to stability. It also gives you the opportunity to gain equity as home values rise over time.

- And, if you have a mortgage you will have a nice tax deduction on both your interest expense and property taxes.

Sometimes it’s easier to become a first-time homeowner than you might imagine. If this is something you are considering, why not give me a call and let’s see if homeownership might be in your near future.

IS IT TIME TO BUY OR WAIT?

The Wall Street Journal 5.31.24

As most any active residential real estate broker will tell you, the period between mid 2020 through 2022 was a crazy time for us. Rates were low and we could hardly keep up with the demand.

Well, buyers want the historically low interest rates of three years ago, not the 6 % to 7% they are looking at now.

But, quite honestly, in real estate, the show must go on.

“We forget that residential real estate is a unique asset class because it stores human beings,” says Leo Pareja, CEO of eXp Realty, a worldwide real estate brokerage operating in 24 countries. “In my experience, 80% to 90% of all moves are that of the human condition. We fall in love, we make little people, we need more space or less space. I don’t think anybody ever woke up and said, ‘Hey, rates are perfect. I’m gonna buy a house.’ It’s that human condition trigger than happens regardless—death, divorce, promotions—that motivates people.”

“I’ve always been of the opinion to focus on the folks who need to move, those who need another bedroom or who have to sell, whether it’s for financial difficulties or any other life changes,” he added.

It’s exactly what I’ve always told you—there are always people who need or want to sell and those who need or want to buy.

Interest rates are not going down significantly in the immediate future and will likely never go as low as the early 2020’s.

However, home prices will continue to rise and with them is the equity you are earning in what is likely your greatest asset.

So, is it the right time for you? Only you can answer that. If you need more or less space or want to move to another neighborhood the answer is probably yes.

But you won’t know for sure unless you sit down with me and discuss all the pros and cons and various available options.

If you’ve been waiting, the time is now. Give me a call and let’s see what we can do for you and your family.

THE FED ISN’T THE ONLY FACTOR AFFECTING HOME RATES

The Wall Street Journal, May 2024

Most buyers are accepting that the Fed is not going to give them a break by lowering rates this spring.

But the Fed isn’t the only factor affecting mortgage costs. If you give your financial information to two different lenders you may find that you will receive two very different quotes that can mean saving or losing tens of thousands of dollars. That variation has grown since the Fed started raising rates in 2022.

It’s often common to find a half-point difference between lender A and lender B simply by making a couple of phone calls.

Optimal Blue, a mortgage technology and data company that processes rate locks for roughly a third of residential mortgages, analyzed its data to show a few of the variables baked into your rate. They range from credit scores to geography to the company that extends your loan.

The 800 Club

As rates have risen, the payoff for having a great credit score has paid off. People with scores of 800 or more locked in an average rate that is sometimes been more than a quarter of a percentage point lower.

That suggests that borrowers with higher credit scores tend to be more aggressively shopping for rates, according to Brennan O’Connell, director of data solutions at Optimal Blue.

Research has found that financially savvy borrowers ten to lock in the lowest rates. Buyers of all credit types are encouraged to shop around. The Consumer Financial Protection Bureau has a tool that shows the range of rates available to buyers.

State by State

Mortgage rates, like most everything else in real estate, come down to location. According to data from Optimal Blue, similarly situated buyers in Iowa and New Hampshire might lock in rates that differ by half a percentage point.

While it’s hard to explain why rates vary from state to state, economists say there are differences between regions that can affect rate, such as the financial sophistication of the population, or state regulations and taxes.

Who’s Your Lender?

The first step in mortgage shopping is figuring out where to go for a quote. Credit unions, banks and mortgage companies all offer home loans, but their rates often differ based on how much they want your business.

Not-for-profit credit unions on average offer the lowest rates. Mortgage companies are a bit higher and banks are currently the highest. Banks at one time were offering lower rates than mortgage companies but they have currently ceded market share to mortgage companies.

Banks became less aggressive after the financial crisis of 2008. Mortgage companies made 71% of originations in the first nine months of 2023 according to industry research group inside Mortgage Finance.

Fannie and Freddie

Well over half of home loans end up in the hands of Fannie Mae and Freddie Mac. These companies don’t extend loans but buy them from lenders and package them into securities to sell to investors.

There are federal guidelines for how Fannie and Freddie should price mortgages to compensate for the risks embedded in them. Mortgages for primary residences, for example, tend to have lower rates than loans for investment properties.

Even small changes in that pricing can have big consumer impacts.

I look at the price of wholesale money each morning and work to direct my clients to the best lenders for their individual situations. Just one of the services I am happy to provide to make certain my clients get the best rates available to them.

ECONOMIC & WORKFORCE DEVELOPMENT REPORT

Data-Driven Economic Strategies, May 2024

As always, I like to share the useful data I receive from our “local economist”, Tatiana Bailey. You will see in these charts what’s happening locally in terms of the economy as well as the most recent Workforce Progress Report.

This information is especially invaluable to business owners; however, I know you all will all find it worthwhile reading.

To access the report, please click here. And if you have any questions, give me a call.

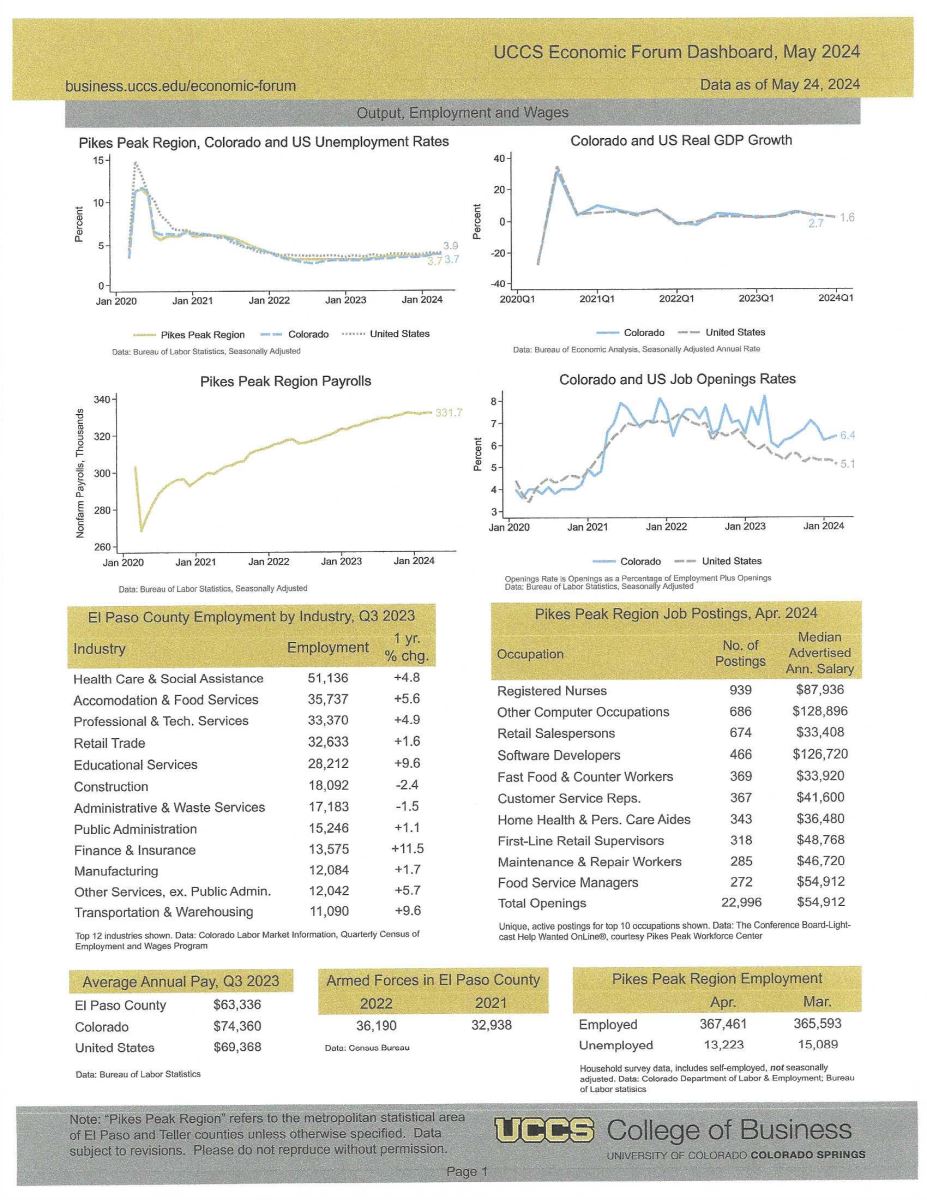

UCCS ECONOMIC FORUM MONTHLY DASHBOARD

Updated May 2024, UCCS College of Business/Economic Forum

Here is the monthly report from the UCCS College of Business Economic Forum. It is created by professor Dr.Bill Craighead, who is the Forum Director. He also publishes an on-line “Weekly Economic Snapshot” you might enjoy.

I know several of you who like statistics and use this information in your daily business life, and I will share it with you when I receive it each month.

I’ve reproduced the first page of the charts below. To access the report in its entirety, please click here.