HARRY'S BI-WEEKLY UPDATE 6.4.21

June 4, 2021

HARRY’S BI-WEEKLY UPDATE

A Current Look at the Colorado Springs Residential real estate Market

As part of my Special Brand of Customer Service, it is my desire to share current real estate issues that will help to make you a more successful and profitable buyer or seller.

I’VE BEEN SAYING THIS FOR MORE YEARS THAN MANY OF YOU HAVE BEEN ALIVE…

…and here you go. For the eighth year in a row, Americans have chosen real estate as “The Best Investment” as reported by Gallop. And this year, at 41%, real estate earned the highest percentage in the history of the survey!

The only drawback in the last couple of years is that supply has most definitely been greatly overtaken by demand and that’s made it difficult for folks to find a new home, most especially first-time buyers.

The historically low interest rates helped ramp up sales and then the pandemic hit, creating a different kind of scenario. A number of folks decided to stay put and renovate their existing homes. And with the ease of home delivery of groceries, meals and other necessities, more older folks decided they would be happy to “age in place”. A lot of others found new wants and needs for their living situations during that same time and started their new home search as early as they were able.

And then…once more…demand overtook supply, prices of lumber, copper, aluminum and other home materials went through the roof and even the possibility of new home construction became one that would force a much longer than normal wait time, and even without a guaranteed price at that.

When you add that to the fact that apartment rental rates in Colorado Springs are at an all-time high, with the average exceeding $1,300 for the first time, it’s no wonder folks are doing whatever possible to become homeowners or to buy for investment purposes.

In fact, investment buyers, including those purchasing second homes, accounted for 17% of national homes sales in April 2021, up from 10% a year earlier, according to the National Association of Realtors (NAR).

Job recovery here in the Springs is rebounding faster than the nation and even the state of Colorado. Through last month, the area has added back all but 4,000 of the 38,700 jobs lost in March and April 2020 and has added 8,800 jobs in the first four months of this year—an average of 2,200 a month. When you consider that lots of folks are relocating here either to fill some of these openings or because they can work from home and would rather live here, well, you get the picture. They need a place to call home and are joining all the other folks who are actively looking for a home here.

And according to a senior economist at realtor.com, of the sales in the 250 largest metro areas, Colorado Springs is number 3 in fastest home sales, selling in an average of 12 days!

See where this is headed? I have been saying for as long as I can remember that if you’ve even considered a move, yesterday would have been a preferable time to start, and many of you heeded my words. It wasn’t always your first choice, and it most certainly wasn’t as easy and stressless an experience as I like for my clients, but in most cases, we got it done! After all, they don’t call me Mr. Negotiator for nothing.

However, as the months go on with so few available homes for sale, it’s a challenge for even a seasoned, knowledgeable real estate professional like me. But those of you who know me at all know that where there’s a will, I’ll find a way.

And to quote my friend Robert August who wrote me after my last eNewsletter said:

“Another reason not to tarry, when you’ve got Harry…

…and to quote The Talmud: “If not now, when?”

I couldn’t have said it better myself. Thanks, Robert!

If you’ve even considered a move, now is the time to get started. Prices aren’t going down any time soon and mortgage rates essentially have nowhere to go but up, so today is the best time to start. It shouldn’t take long to sell your present home and it will likely go for far more than you might imagine. However, finding a replacement will likely take some time so it’s best to start in that direction first.

Meanwhile, the best move you can make is to call me at 593.1000 or email me at Harry@HarrySalzman.com to get any and all of your questions answered. I look forward to speaking with you and helping to make all your Residential real estate dreams come true.

MAY 2021

Statistics provided by the Pikes Peak REALTORS Service Corp., or it’s PPMLS

Here are some highlights from the May 2021 PPAR report. Remember that the new format of this report no longer provides monthly statistics for each individual neighborhood. However, if you are interested in what’s happening in your neighborhood, I can provide you with this information through other means.

In El Paso County, the average days on the market for single family/patio homes was a very low 8. For condo/townhomes it was 4.

Also in El Paso County, the sales price/list price for single family/patio homes was 103.5% and for condo/townhomes it was 104.3%.

It’s noteworthy that in May of 2020, we couldn’t show homes due to the pandemic so it is no surprise that the number sales in comparing this year to last would be up considerably. The numbers aren’t indicative of more available homes or more home sales.

Please click here to view the detailed 10-page report, including charts. If you have any questions about the report or to find out how it relates to your individual situation, just give me a call.

In comparing May 2021 to May 2020 for All Homes in PPAR:

(A Big WOW is all I can add here!)

Single Family/Patio Homes:

· New Listings were 1,876, Down 3.6%

· Number of Sales were 1,553, Up 37.2%

· Average Sales Price was $489,376, Up 24.4%

· Median Sales Price was $432,095, Up 23.5%

· Total Active Listings are 582, Down 62.4%

· Months Supply is 0.4, Down 1.7%

Condo/Townhomes:

· New Listings were 206, Down 18.6%

· Number of Sales were 220, Up 46.7%

· Average Sales Price was $318,936, Up 24.2%

· Median Sales Price was $310,500, Up 23.9%

· Total Active Listings are 66, Down 61.8%

· Months Supply is 0.3, Down 1.3%

Now a look at more statistics…

MAY 2021 MONTHLY INDICATORS AND LOCAL MARKET UPDATE ILLUSTRATE OUR LOCAL TRENDS IN DETAIL

Colorado Association of REALTORS® , Pikes Peak REALTORS Service Corp, or it’s PPMLS

Providing greater detail than the above report, this contains information on both El Paso and Teller counties for Residential real estate

The “Activity Snapshot” for all residential properties in El Paso and Teller counties shows the Year to Date one-year change:

- Sold Listings for All Properties were Up 37.0%

- Median Sales Price for All Properties was Up 22.6%

- Active Listings on All Properties were Down 61.3%

You can click here to read the 16-page Monthly Indicators or click here to get specific information on the geographical area of your choice from the 18-page Local Market Update. I recommend that you check out your own area or one that you are considering, to get a good idea of the local pulse. As an example, here is a detailed report on the Colorado Springs area in general:

COLORADO SPRINGS IS #22 OUT OF 100 METRO AREAS IN HOME PRICE INCREASES

Federal Housing Finance Agency, 5.25.21

In their recently released report, the Federal Housing Finance Agency (FHFA) listed Colorado Springs at number 22 out of 100 top measured metro areas in home price increases over the past year.

As you will see in the chart below, home prices in Colorado Springs rose 15.6% over the past year and rose 3.6% in the last quarter. That’s in comparison to the U.S. as a whole, where prices rose 12.6% over the past year and rose 3.5% over the last quarter. The combined Denver/Aurora/Lakewood area came in at number 42.

Here is a look at the Colorado Springs data from 2007 to Quarter 1 2021:

.jpg)

A RECORD NUMBER OF HOMES ARE SELLING ABOVE LIST PRICE

Realtor mag, 6.1.21

More than half of homes—51%--are selling for more than the asking price—a record high, according to new research from real estate brokerage Redfin. A year ago, 26% of homes were selling above asking price.

This again is indicative of the fact that many more people want homes than there are homes for sale. More home buyers are waiving appraisals so that the sale doesn’t fall through. In April, 19% of homes had their appraised value come in below the contract price, according to data from CoreLogic. Over the two previous years, 8% of homes were appraised for lower than the contract price.

“The frequency of buyers being willing to pay more than the market data supports is increasing,” said Shawn Telford, chief appraiser at CoreLogic.

Meanwhile, 24% of homeowners surveyed by realtor.com say they expect to get more than their asking price when they sell, and 29% of sellers plan to ask for more than what they think their home is worth as well.

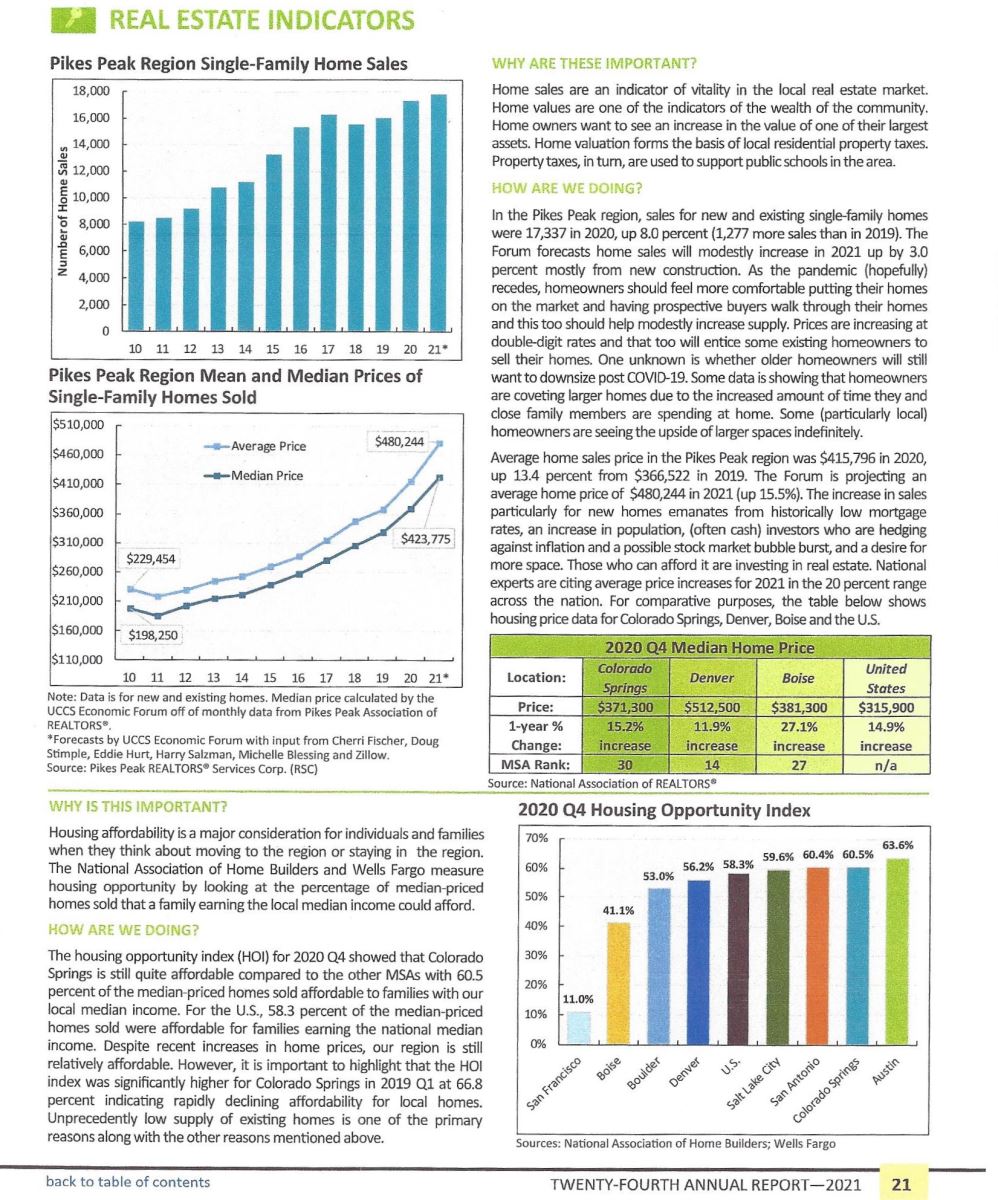

UCCS ECONOMIC FORUM UPDATE

College of Business, UCCS, 4.30,21

As always, I’ve included the most recent economic update from the UCCS Economic Forum. It provides data concerning all aspects of the economy, on both the National and Colorado Springs levels.

You can click here to read the report which was published last week in its entirety and if you have any questions, please give me a call.

.jpg)

.jpg)

.jpg)

.jpg)