HARRY'S BI-WEEKLY UPDAATE 10.27.14

October 27, 2014

HARRY’S BI-WEEKLY UPDATE

A Current Look at the Colorado Springs Residential real estate Market

As part of my Personal Service, it is my desire to share current real estate issues that will help to make you a more successful and profitable buyer or seller.

NOTE TO SELLERS -- “TAKE TWO TYLENOL AND CALL ME IN THE MORNING”

The Wall Street Journal, 10.24.14

An article to be published next year in the Journal of Experimental Social Psychology is entitled, “Can Acetaminophen Reduce the Pain of Decision-Making?”. It builds on previous work that shows emotional pain can overlap with the physical kind.

This study caused Stefanos Chen, a columnist for The Wall Street Journal, to wonder if the painkiller Tylenol (brand name for Acetaminophen) could compel homeowners to reduce their asking price.

I, of course, read this article and couldn’t help but smile. I thought you might enjoy a brief synopsis.

According to Nathan DeWall, co-author and professor of psychology at the University of Kentucky, “when people talk about decisions they have to make, they talk in terms of pain.” Consider the neighbor who says that selling his house “hurt”.

An experiment of 95 undergraduate students showed, as predicted by researchers, that “loss aversion”, a decision-making theory that people would much rather avoid losses than acquire gains, can be proven scientifically. Loss was found easier to accept by those taking acetaminophen than those who did not.

“It was easier for them to give up something they owned—and that’s really hard for people to do,” Prof. DeWall said of the group on acetaminophen.

“It’s the same principle at play when a sentimental homeowner balks at an agent’s comparable sales figures and demands a higher price for his home,” he added.

The study certainly offers insight but not all the answers, he said. “I’m not saying that if you take acetaminophen people are going to stop fighting with their real-estate agents.”

The moral of the story? When you and your real estate Agent are at odds over the pricing of your home or the thought of lowering the asking price—try Tylenol—and see if it helps. It certainly can’t hurt!

RELAXED MORTGAGE LENDING RULES, LOWER DOWN-PAYMENTS, IN THE PIPELINE

The Wall Street Journal, RealtorMag, The Gazette, HousingWire, 10.14

So many stories this last week concerning new rules and regulations for home financing. This past year has been tough for those looking for mortgages, especially first-time borrowers, in part due to the Dodd-Frank Act which went into effect January 10, 2014. This regulation was intended to help financial institutions avoid sending the housing market into another recession due to “risky” mortgages made to borrowers who had marginal credit and little documentation to justify the loans.

Unfortunately, as I and many others predicted, enforcement of the new regulations hampered many borrowers from obtaining a mortgage and the housing market slowed down substantially.

Several things are in the pipeline and include:

- An agreement between Fannie Mae and Freddie Mac, which could lower barriers and restrictions on borrowers with weak credit. This would help lenders protect themselves from claims of making bad loans and would require a 3% down-payment (as was once the case) rather than the 5% minimum of recent times. It’s possible the 3% could be limited to first time homebuyers, but those are the ones who have been hurt the most recently and this will drastically reduce their expense in obtaining their first home mortgage.

Fannie and Freddie do not make loans directly. They buy them from lenders and package them into securities and then give guarantees to make investors whole if borrowers do not repay. This payback comes from penalties charged to mortgage lenders and in turn, lenders have been making mortgage loans only to borrowers with excellent credit in the recent past. Regulators and lenders are still walking a fine line between expanding mortgage access and moving too far toward the loose credit that led to the crisis. Borrowers will still be required to not carry excessive debt relative to their income, but with the “lower down-payment loans” made “sellable”, more buyers will qualify for loans.

- A long stalled provision of the Dodd-Frank Act has been approved by The Federal Reserve, Securities and Exchange Commission and the Department of Housing and Urban Development which will result in relaxed mortgage-lending rules.

Originally, lenders were required to hold 5% of the risk of mortgages packaged and sold to investors or require a 20% borrower down payment. But regulators, concerned that overly stringent rules would harm the housing market’s continued recovery, backtracked on the 20% down payment.

Banks will now be able to avoid the 5% risk-retention requirement if they verify a borrower’s ability to pay back the loan and comply with other requirements, such as a borrower’s debt payments not exceed 43% of income. These represent an effort to ensure that more mortgage loans are available to consumers.

- Mortgage lenders are looking to lower the minimum FICO scores that borrowers need to qualify for a jumbo loan. A FICO score is the most commonly used method for determining credit scores and is used by Trans-Union, Equifax and Experian, the nation’s three biggest credit agencies.

While today a borrower may be able to get a jumbo loan with a FICO score as low as 680 out of a possible 850, many lenders draw the line at anything below 720. The best terms go to those with a score of 760 and higher. Now, though, lenders are wanting to get more jumbo loans, those that exceed Fannie Mae and Freddie Mac conventional loan limits of $417,000 in most places and $625,00 in some high-price areas. To do so they are looking at lowering the required minimum FICO score if all other factors are met.

I realize all of this can be a bit complicated and every situation is different. That’s why I’m here for you. I study all the new regulations as they come out and do my best to mesh the best mortgage lender for each individual client. My forty-two plus years in the local real estate arena has given me the edge in knowing exactly what’s available and I can help steer my clients in the right direction for their personal situation. If you, or any family member or co-worker is in the market for a new, or new-to-you, home, please give me a call at 598-3200 or email me at Harry@HarrySalzman.com and let me put my extensive knowledge to work for you.

MORTGAGE RATES STILL HISTORICALLY LOW, DEFYING EXPERTS’ PREDICTIONS

Housing Wire 10.15.14, The Wall Street Journal 10.26.14

Despite experts who have long predicted differently, interest rates keep tumbling and are offering borrowers a fresh opportunity to save money.

The week ending October 17, 2014 saw the fixed-rate, 30-year mortgage fall to 4.03%, the lowest level since June 2013 and it remained there through last Thursday. This compares to 4.29% in mid-September and can translate into tens of thousands of dollars in savings through lower monthly payments over the course of a 30-year mortgage.

Along with lower interest rates, home loan demands have surged, with applications jumping nearly 12% in the week ending October 17th compared with a week prior, according to the Mortgage Bankers Association.

This increase is being driven by those wishing to refinance existing mortgages, but falling interest rates are also helping ease the sting of rising home prices by making it possible to afford a house that might otherwise by out of reach.

All of this is good news for both Buyers and Sellers. If you are looking to Sell and Trade Up, or Buy for the first time or for Investment purposes, the low mortgage loan rates are going to work in your favor.

First time buyers will find that with increasing rental payments, it makes sense to own if at all feasible. When you rent, you’re paying someone’s mortgage, so why not find out if it’s to your advantage to pay your own?

If you’re looking to Buy for Investment purposes, those higher rental prices are going to help you recoup your investment a lot sooner.

And, if you’re looking to Sell and Trade Up, the lower interest rates will help you keep your new mortgage payments down while helping your potential Buyers do the same.

All in all, it’s a great time to be in the housing market and if you’ve been sitting on the fence, now is a great time to give me a call and determine whether or not your real estate dreams can be realized.

WHEN PURCHASING A NEW HOME, SHOULD YOU RENT YOUR HOUSE RATHER THAN SELL IT?

Keeping Current Matters, 10.14.14

A recent study concluded that 39% of Buyers prefer to rent out their last home rather than sell it when purchasing their new home. The reasons cited were that “many homeowners were able to refinance and ‘locked in a very low mortgage rate in recent years. That low rate, combined with a strong rental market, means they can charge more in rent than they pay in mortgage each month…so they are going for it.’”

Residential real estate is a great investment right now and in some cases this makes perfect sense. However, there are a number of questions you might ask yourself BEFORE you decide to follow this path.

- How will you respond if your tenant says they can’t afford to pay the rent this month because of more pressing obligations? (This happens most often during holiday season and back-to-school time when families with children have extra expenses).

- Because of the economy, many homeowners cannot make their mortgage payment. What percentage of tenants do you think cannot afford to pay their rent?

- Have you interviewed experienced eviction attorneys in case a challenge does arise?

- Have you talked to your insurance company about a possible increase in premiums as liability is greater in a non-owner occupied home?

- Will you allow pets? Cats? Dogs? How big a dog?

- How will you actually collect the rent? By mail? In person?

- Repairs are part of being a landlord. Who will take tenant calls when necessary repairs come up?

- Do you have a list of craftspeople readily available to handle these repairs?

- How often will you do a physical inspection of the property?

- Will you alert your current neighbors that you are renting the house?

Bottom line: Historically, renting out Residential real estate is a great investment but not one without its challenges. Be certain that you have decided to rent your home because you want to become an Investor, not because you are hoping to get a few extra dollars by postponing a sale.

WINTER SKI GUIDES AVAILABLE AT THE OFFICE

We have a limited number of copies of the 2014-15 Winter Guide produced by Colorado Ski Country USA at the office, so if you’re interested, just stop by and pick one up.

HARRY’S PHILOSOPHY OF THE DAY

(some more words of wisdom I picked up at the Chicago conference..)

“Luck is a dividend of sweat. The more you sweat, the luckier you get.” --Ray Kroc

“To find joy in work is to discover the fountain of youth.” --Pearl S. Buck

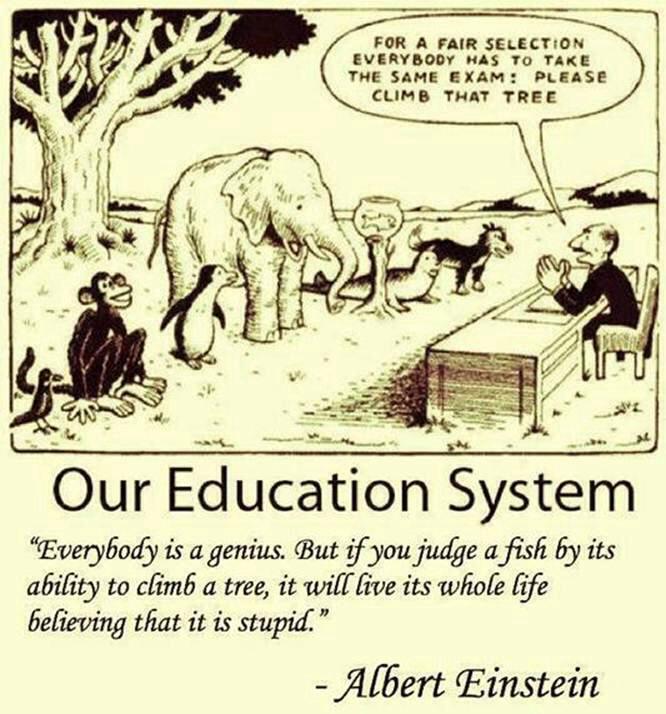

“”Try not to become a person of success, but rather try to become a person of value.”

--Albert Einstein

“The two most important days of your life are the day you were born and the day you found out Why.” --Mark Twain