HARRY'S BI-WEEKLKY UPDATE 1.27.25

January 27, 2025

HARRY’S BI-WEEKLY UPDATE

A Current Look at the Colorado Springs Residential real estate Market

As part of my “Special Brand of Customer Service”, it is my desire to share current Residential real estate issues that will help to make you a more successful and profitable Buyer and Seller.

.png)

ONCE AGAIN…LOTS OF QUESTIONS ABOUT RESIDENTIAL real estate

Well, the new year started off with both national and local reports about the state of Residential real estate and as I had been predicting…. U.S. home sales in 2024 fell to their lowest level in nearly 30 years—since 1995.

That being said, the optimist in me, along with my having lived through so many cycles in my almost 52 years in the business of Residential real estate, I believe this year will be one that helps turn around the trend of the last several years.

Yes, interest rates are over 7% at present, but that is only one side of the story. As I’ve mentioned time and again, the 7% rate is not set in stone. I work with a number of lenders who are more than willing to look at each individual situation and try to come up with a more workable interest rate. Hey, they want to lend and are doing whatever it takes to make that happen if at all possible.

And, of course, rates will go down. Not to the historic lows of several years ago—I doubt we will see those again soon or possibly ever—but they will probably settle in the 6.25% or a bit higher range by the end of 2025 per the National Association of Realtors (NAR) and at that time it will likely be possible to refinance and obtain a lower monthly payment.

The most important thing though is that home appreciation is still happening and that is not likely to stop. So, while you may have a higher interest rate if you buy now, you are building equity which in turn is adding to your family’s wealth.

For most, a home is their greatest financial asset and their biggest investment in themselves. At the same time, it provides a place for you and your family to make memories and build a life together. That in itself is priceless.

We are starting to see more homes come on the market this year in readiness for the spring buying and selling season. I believe the reason is that those who were waiting for interest rates to drop before selling to trade up or move to a new neighborhood or location are finally accepting the fact that waiting is no longer a viable option.

Many folks have considerable home equity which will make moving a bit easier in terms of what the monthly output will be in new situation. In some cases, the monthly payment could even be lower.

And folks who are looking to stop paying rent and thus someone else’s mortgage will certainly appreciate the knowledge that the monthly payment is going to help their own financial future.

But all of this takes time and decision making, which of course is based on your individual wants, needs and budget constraints.

And that’s where I can help. If you have even considered a move, NOW is the time to figure this all out. With more options, both in available homes and in interest rate choices, you might want to get ahead of the traditional spring buying and selling season so you will be ready to pounce once you find “the one”.

I look forward to meeting with you sooner than later because as you might suspect…Time is of the Essence…. or “the early bird gets the worm” as they say. In this case, the early bird gets the opportunity to grow their personal assets first. I like to see my clients get a jump on the rest as I know the excellent opportunities of which they can avail themselves.

Also very important to consider is that when interest rates do fall below 7% as they are forecasted to do, available homes will cost more since there will be greater demand.

Give me a call today at 719.593.1000 or email me at Harry@HarrySalzman.com and together let’s see how your Residential real estate dreams can become reality in the best time frame for you.

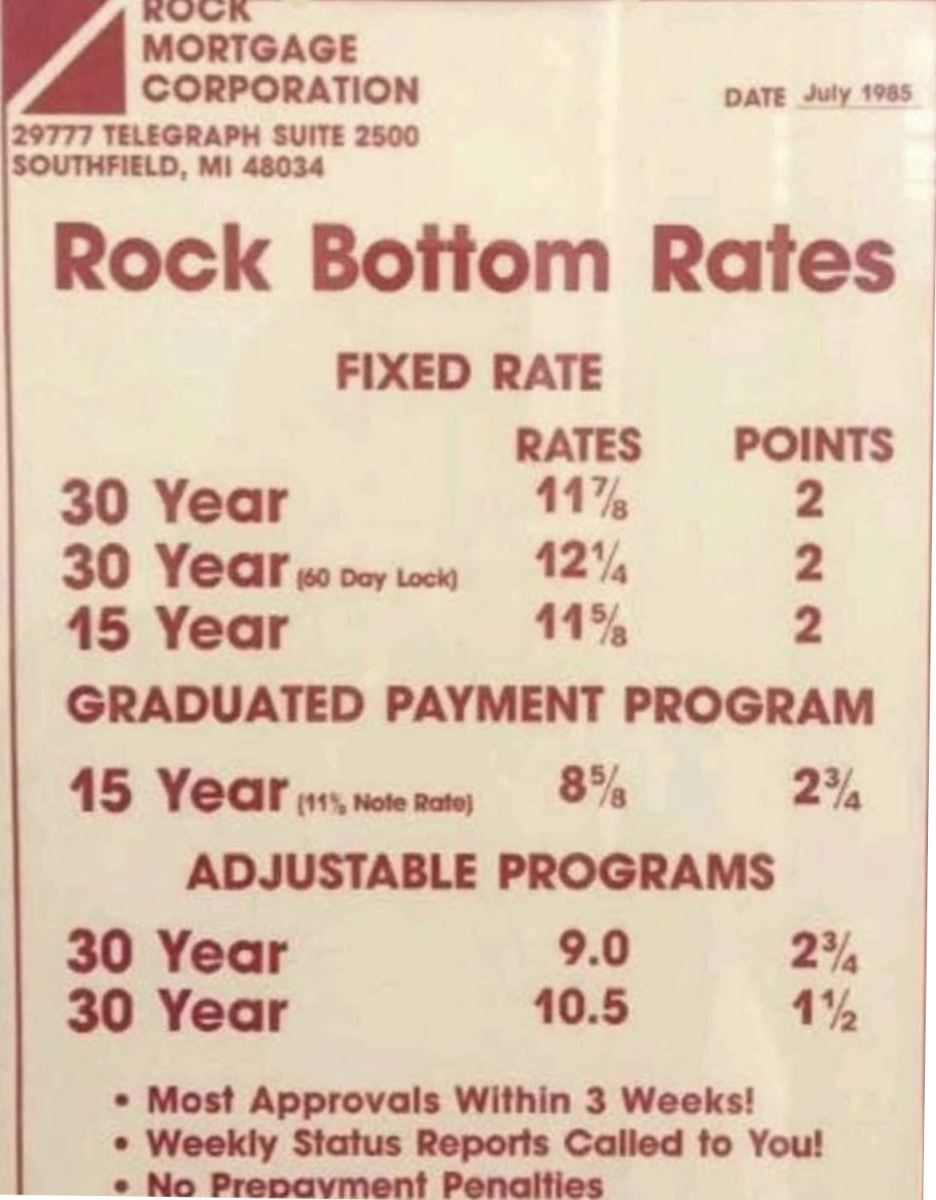

AND JUST TO SHOW YOU THAT 7% INTEREST RATES AREN’T SO BAD…

I just came across the ad for a mortgage company from 1985. Guess this does back me up when I say I remember those days and even rates as high as 18%. So, while 7% may look high…it’s low compared to other times in Residential real estate.

HOUSING SHORTAGE STILL A BIG OBSTACLE

The Wall Street Journal, 1.24.25

While volatile interest rates have hurt sales in the recent housing market, a severe shortage of existing homes for sale is probably the most critical obstacle for would-be buyers, according to Zillow Group Chief Executive, Jeremy Wacksman.

Wacksman said recently, “Not to oversimplify, but you really can boil the housing affordability crisis down to an availability crisis. Getting more homes available is going to be ultimately what starts to unstick the housing market.”

This has certainly contributed to making 2024 the worst year since 1995 in homes sales both nationally and here in Colorado Springs, but as I’ve been telling you recently, listings are starting to pick up locally and I believe that will lead to more sales in 2025.

So once again, if you are ready, don’t delay. The best time to prepare is now before the traditional spring buying and selling season.

IF YOU WANT TO BUY A HOUSE, FIRST FIGURE OUT HIDDEN COSTS

The Wall Street Journal, 1.7.25

If you are a first-time homebuyer you can easily get blindsided by costs other than the downpayment and monthly mortgage payments so it is always a good idea to consider what other hidden costs could pop up unexpectedly.

Some things to take into consideration BEFORE buying that first home can include:

- Home Insurance

- Maintenance

- Association Fees

- Property Taxes

- Utilities

I always work with my first timers to help them take into consideration most of the additional costs associated with homeownership that they might not have realized will be there.

This is simply a heads up to remind first timers that there will be things that could affect how much they might want to spend on their first home so they can plan accordingly. Most of those fees will be known upfront but it never hurts to plan ahead to avoid surprise costs later.

ECONOMIC & WORKFORCE DEVELOPMENT REPORT

Data-Driven Economic Strategies, December 2024

As always, I like to share the useful data I receive from our “local economist”, Tatiana Bailey. You will see in these charts what’s happening locally in terms of the economy as well as the most recent Workforce Progress Report.

This information is especially invaluable to business owners; however, I know you all will all find it worthwhile reading.

Below is a reproduction of the first page of graphics. To access the full report, please click here. And if you have any questions, give me a call.

.jpg)

UCCS ECONOMIC FORUM MONTHLY DASHBOARD

Updated December 2024, UCCS College of Business/Economic Forum

Here is the monthly report from the UCCS College of Business Economic Forum. It is created by professor Dr. Bill Craighead, who is the Forum Director. He also publishes an on-line “Weekly Economic Snapshot” you might enjoy.

I know several of you who like statistics and use this information in your daily business life, and I will share it with you when I receive it each month.

I’ve reproduced the first page of the charts below. To access the report in its entirety, please click here.

.jpg)

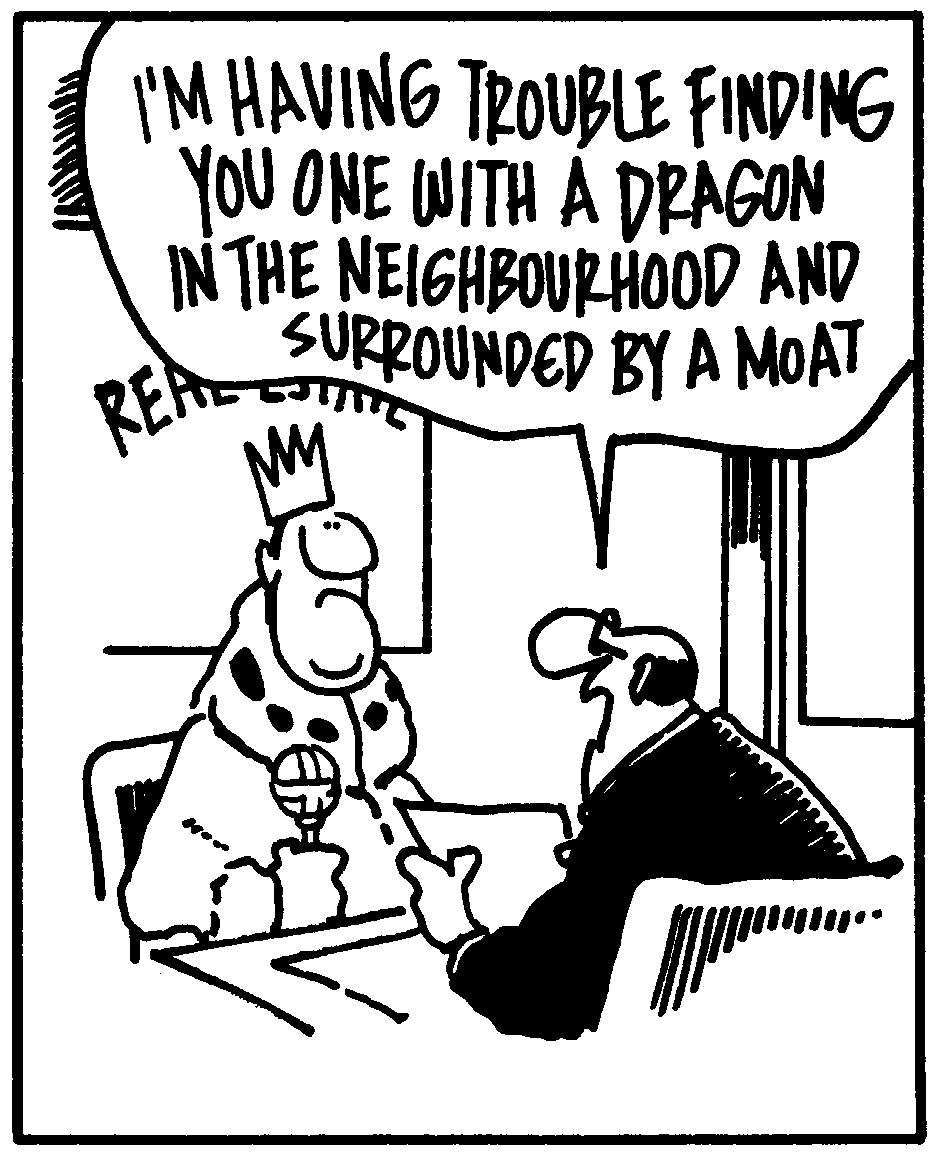

HARRY’S JOKE OF THE DAY:

FEATURED LISTING:

The price was recently reduced so it might not last long, but this is a great buy in a good neighborhood.