HARRY'S BI-WEEKLY UPDATE 9.23.22

September 23, 2022

HARRY’S BI-WEEKLY UPDATE

A Current Look at the Colorado Springs Residential real estate Market

As part of my Special Brand of Customer Service, it is my desire to share current real estate issues that will help to make you a more successful and profitable buyer or seller.

IN THE MIDST OF A VERY “DIFFERENT” CURRENT real estate MARKET…SOME FABULOUS NEWS I COULDN’T WAIT TO SHARE

When I was 15 years old and became interested in all things to do with finance and business, I began my lifelong addiction to reading The Wall Street Journal. It is the first thing I read every morning to see how the housing, mortgage, commodities, and financial markets are faring. It wasn’t until I was 21 that I could actually afford my own subscription and I’ve been a subscriber ever since.

My intention was to begin this eNewsletter with some personal thoughts about how the many mixed messages regarding Residential real estate are affecting sales. When I opened today’s WSJ to the Friday Mansion section, the headline on top of Page 1 read, “Luxury Home Sales Plunge Across the U.S.”. My thought exactly and good info for me to use.

But then I looked at the bottom of Page 1 and to my delight and amazement saw this:

“A Newly Hip Colorado Springs Blooms”

I stopped dead in my tracks so to speak! As someone who has loved and believed in Colorado Springs for more than 50 years now, I was not surprised by the content of the article but was totally amazed that our fabulous city is now getting the respect I’ve most always thought it deserved.

The article goes on the explain how a once “bedroom community” to Denver is now becoming a choice for its own sake. Something most of us who live here already know, but how nice to get the recognition we have earned through the hard work and perseverance of so many, and most especially Mayor John Suthers, Doug Price of Visit Colorado Springs, the Chamber and EDC, City Council and UCCS Chancellor Venkat Reddy to name a few.

If you have a subscription, you can read the article here:

It's possible you can read it by going to the Wall Street Journal online and look under the "real estate" section, but I am not able to reproduce it here at this time.

If you have any questions or comments, please call me at 719.593.1000 or email me at: Harry@HarrySalzman.com .

AND NOW FROM ME, THE ETERNAL OPTIMIST…

The good news around the country is that home prices are not rising quite as fast as they have been and there are more available homes for sale.

The good/bad news in Colorado Springs is that our home prices are such that as of last week, “only 22% of homes sold in Colorado are affordable”.

According to local economist, Tatiana Bailey, “The Housing Opportunity Index shows the proportion of homes sold that are affordable to a typical household that earns the median income.” She said that the Index shows that previously 70% of homes sold in Colorado were affordable for the median income, but now only 22% of homes sold are affordable.

This is good for the rental market and rents in Colorado Springs are hitting new highs each month, but not so great for those wanting starter homes to build equity of their own.

A word about the rising interest rates…

I have always advocated that all things should be “localized”, and most especially Residential real estate. What happens across the country is not always a good indicator of what is happening in our own backyard.

An example would be the Housing Crisis of 2008-2011 when home prices across the country dropped and foreclosures were prevalent. Here in Colorado Springs we did not see this nearly as bad as many other cities in the U.S. and thus were able to come “back” much faster than most. This is true today as well.

Still, no matter how you look at it, mortgage rates have hit their highest mark since 2008, jumping past 6% last week.

Our city is more desirable than ever, and we are seeing new companies wanting to relocate here more than even in the recent past. We who live here know the reasons, and now many others are finding out as well.

Yes, home prices are escalating, and interest rates have doubled in the last several months, but there are still many ways to make buying a home affordable.

Interest rates are not going to stay where they are now forever, and we are now seeing “5/1 ARMs” revitalizing as I write. While rates were so low, we heard very little about Adjustable-Rate Loans (ARMs), but for those who are buying in today’s market, these loan alternatives are becoming attractive.

While these rates are riskier than 30-year fixed loans, they could help make up for the decline in affordability in 2022, especially if rates fall, as many predict they will.

This time last year homeowners were getting mortgage rates as low as 2.86%. Today the average rate for a 30-year fixed loan is 6.625%.

Housing affordability is at its lowest level since 1989, and folks who want or need to buy a home now are looking for ways to make it work. ARMs can prove to be one of those ways. The current ARM prices are around 1% less than the 30-year fixed rates. Today’s rate is 4.875%.

With Fannie Mae predicting the average rate on a 30-year fixed mortgage to fall to 4.5% by the second quarter of 2023, someone who purchases a home today with an ARM could possibly refinance at a lower rate at that time.

There is obviously a lot of math to be done and it’s important to talk to your financial and tax advisors before making any big monetary decision, but I wanted to let you know that there ARE alternatives that can help make today’s homes more affordable.

Please call me for any needed explanations. I’m always here to help you make the most informed decision for your personal situation.

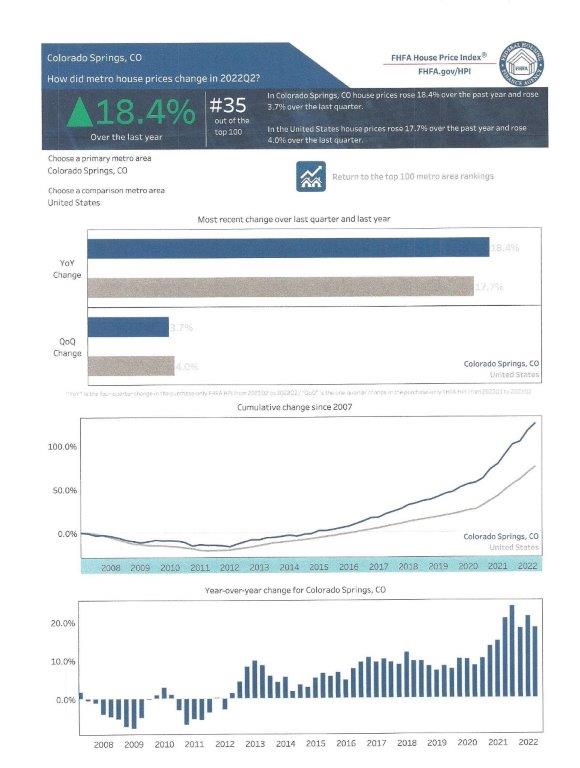

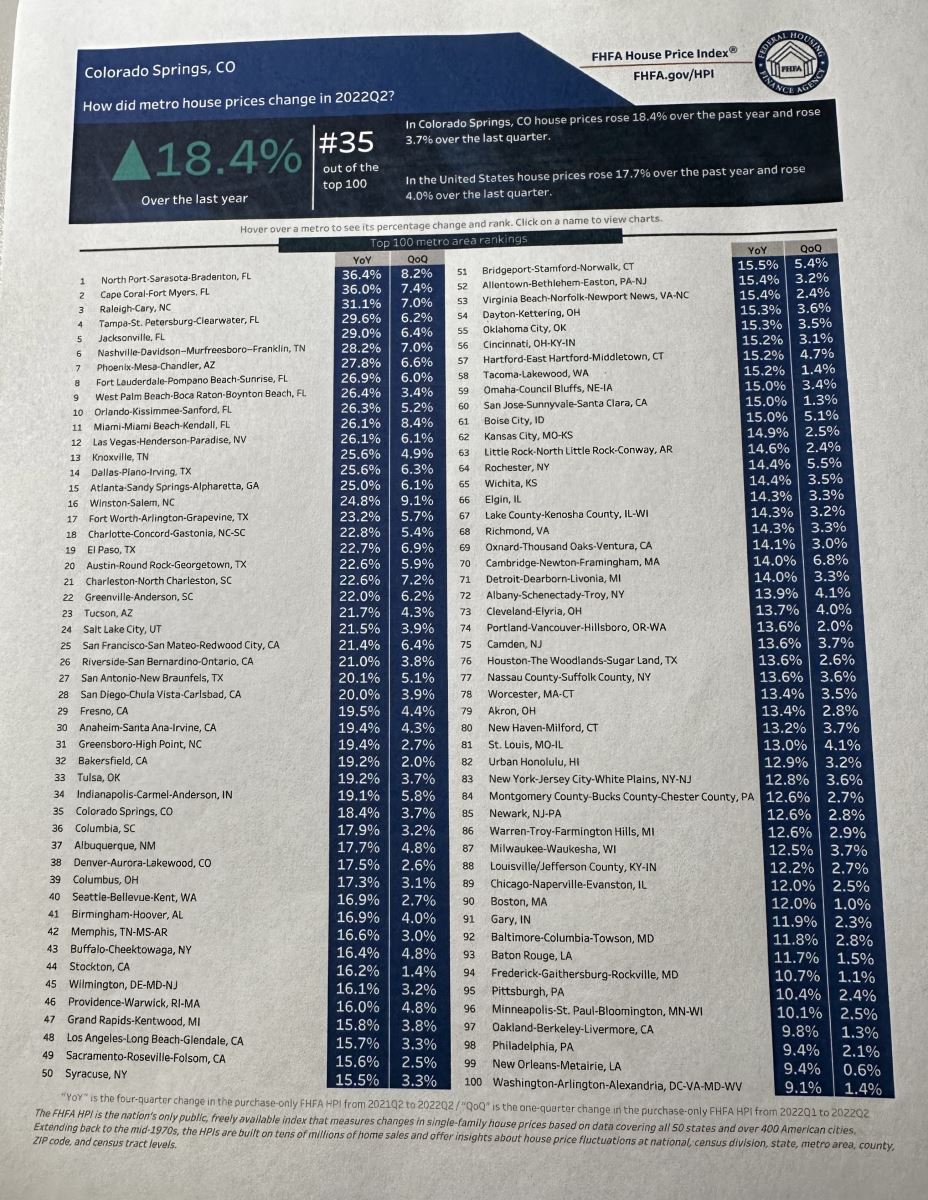

COLORADO SPRINGS RANKS #35 IN THE Q2 FHFA HOUSE PRICE INDEX

FHFA, 5.31.22

The recently published FHFA House Price Index for second quarter 2022 lists Colorado Springs as #35 out of the top 100 in house price changes during that quarter. As you will see in the chart below, we are still trending higher than most of the country, with a year-over-year price change of 18.4%. Our quarter-over-quarter change of 3.7% is just a tad lower than the 4.0% U.S. average.

We would have ranked considerably higher if we had more available homes for sale during that time period.

Here is a copy of the Colorado Springs changes:

Here is the list of 100 measured cities in ranking order:

And, if you have any questions, you know who to call.

WILL MY HOUSE STILL SEE IN TODAY’S MARKET?

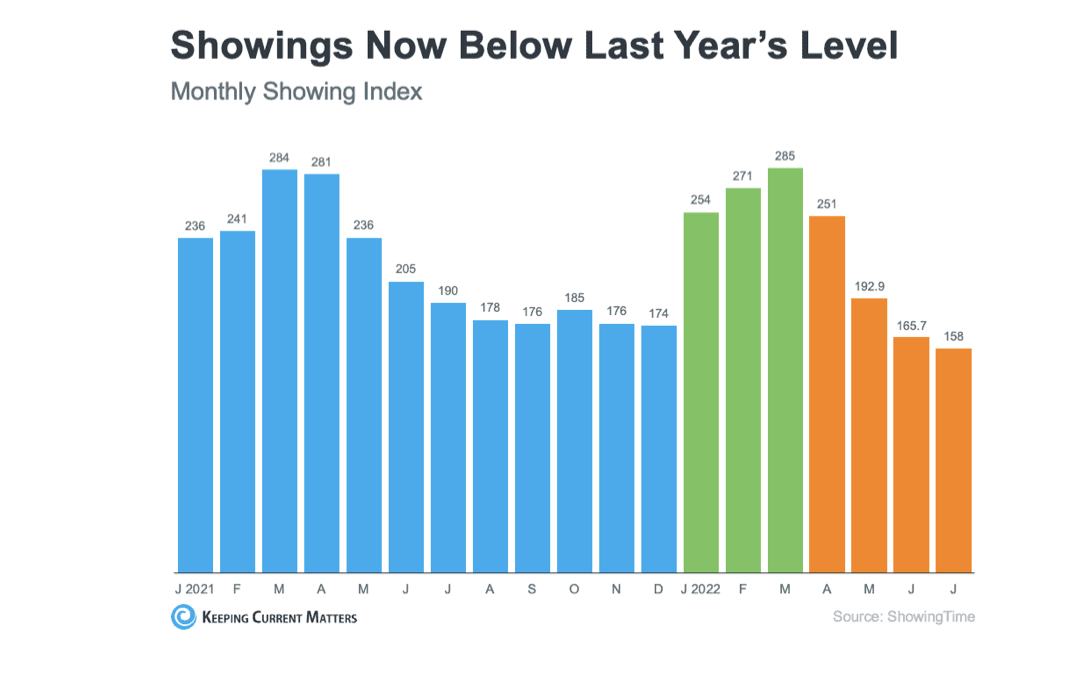

KeepingCurrentMatters, 9.19.22

Many of my clients have wondered whether, with buyer demand moderating a bit, they have missed their chance to sell. It’s important to note that buyer demand has not disappeared, it has simply eased from the peak intensity of the past several years.

During the pandemic, mortgage rates hit record lows and the spurred a significant rise in buyer demand. This year, as rates have increased due to factors such as rising inflation, buyer demand has pulled back or softened as a result. The chart below with data from ShowingTime confirms this trend:

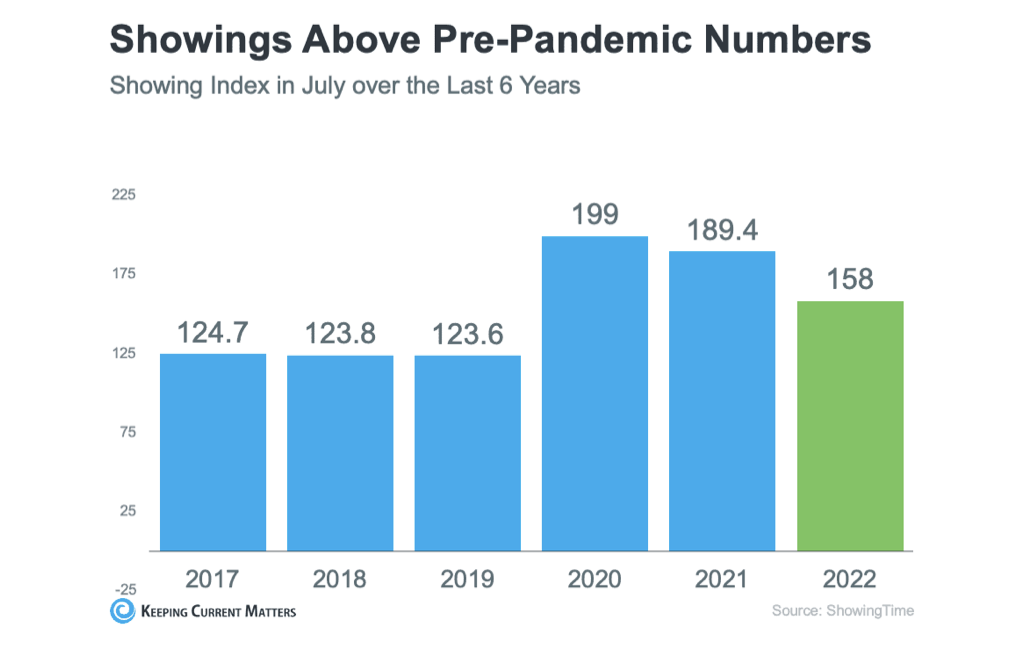

The orange bars above represent the last few months of data and the clear cooldown in the volume of home showings the market has seen since the rates started to rise. But it is important to take context into consideration. To get the full picture of where today’s demand stands, take a look at the July data for the past six years:

This graph makes it clear that, while moderating compared to the frenzy of 2020 & 2021, showing activity is still higher than pre-pandemic levels—and those pre-pandemic years were great years for the housing market.

That proves that there is still demand if you sell your home today. Yes, showings are down, especially with more available homes for sale, and we are not going to see multiple offers on day one of a listing, but…over time…homes WILL sell.

It can be frustrating for sellers who expect to see the very “un-normal” and unsustainable buying frenzy of the recent past, but there are buyers for most all homes. It just is going to take a more “normal” amount of time for this to happen.

Another issue is the “asking price” and selling price expectations. In the very recent past, there was little room for negotiation when buying and selling a home. Homes were selling for over list price, and at times considerably over. This is not true today and I’m finding that many list prices of recent weeks have been lowered, sometimes more than once, to help spark buyers’ interest. I will write more about this in my next eNewsletter.

So once again, with feeling…. if you are wanting to sell…it’s still a great time…but you will need more realistic expectations. As always, I am here to help explain and help you in pricing your home to make it just “right” for the next occupant!

ERA SHIELDS “STAT PACK” PROVIDES A GOOD RESIDENTIAL real estate OVERVIEW

ERAShields, 8.31.22

As always, I am pleased to provide you with the most current local information. This easy-to-understand report, along with graphs, gives you a good idea of the state of local Residential real estate.

Below I’ve reprinted the first page of the report and you can click here to read the report in its entirety.

HARRY’S THOUGHT OF THE DAY:

REST IN PEACE, QUEEN ELIZABETH II