HARRY'S BI-WEEKLY UPDATE 7.7.2022

July 7, 2022

HARRY’S BI-WEEKLY UPDATE

A Current Look at the Colorado Springs Residential real estate Market

As part of my Personal Service, it is my desire to share current real estate issues that will help to make you a more successful and profitable buyer or seller.

YOUR HOME IS LIKELY YOUR MOST “APPRECIATED” ASSET…IN MORE WAYS THAN ONE…

Our homes are our safe havens, our respite from the frenzy of everyday life. They are where we make memories with our friends and family and oftentimes our “office” away from the office. A reflection of our individual tastes and often our largest personal asset.

During the Covid pandemic we found our homes to be our “everything”. They served as schools, offices, restaurants, entertainment centers and so much more. And during that forced quarantine many of us came to “appreciate” our homes more than ever before. Some found new wants and needs and have addressed those, or at least know what they consider to be essential in a future home.

With the stock and bond markets in constant flux recently and home appreciation staying at historically high levels, it’s likely you are finding home “appreciation” on the financial side as well as the emotional one.

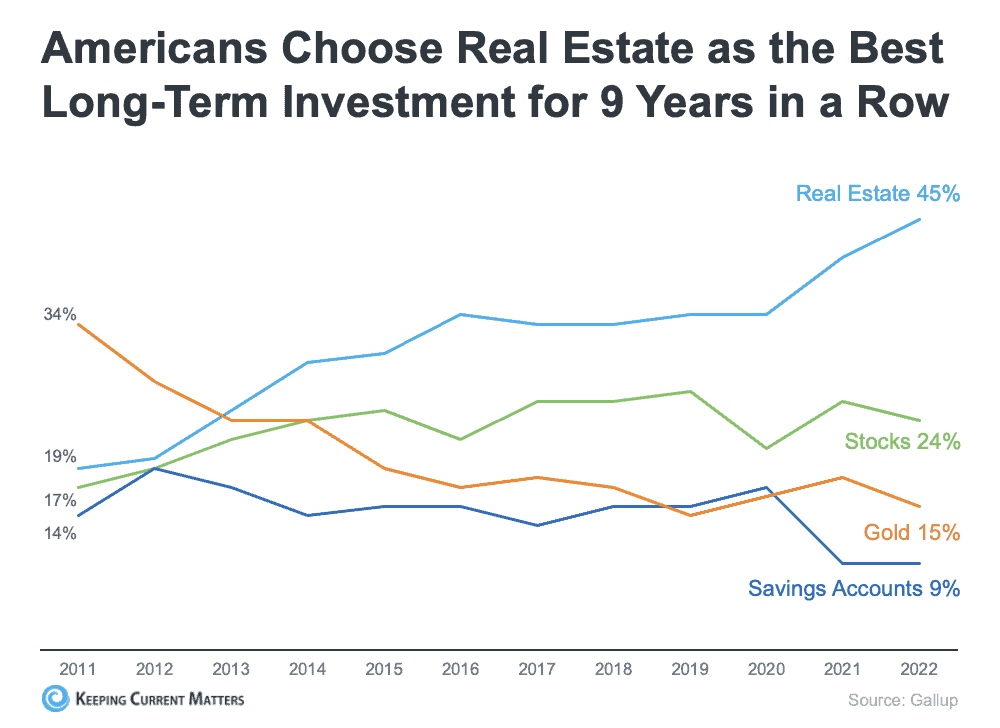

According to an annual survey from Gallup, Americans have chosen real estate as the “Best Long-Term Investment” for 9 years in a row.

This chart below illustrates the survey findings:

Due to inflation reaching its highest level in 40 years, it’s more important than ever to understand the financial benefits of homeownership. To put it in simple terms, rising inflation means prices are increasing in all areas…goods, services, housing costs and more.

When you purchase a home, you lock in your monthly payments, effectively shielding yourself from increases on one of your largest monthly budgetary items. If you are a renter, you don’t have that same benefit and aren’t protected from these increases, especially when rents are rising as quickly as they are today.

According to Danielle Hale, chief economist at realtor.com, “Rising rents, which continue to climb at double-digit pace…and the prospect of locking in a monthly housing cost in a market with widespread inflation are motivating today’s first-time homebuyers.”

One of the advantages of investing in real estate is that it often acts as a good hedge against inflation since there will always be people looking to buy homes, regardless of the economic climate, and because as inflation rises, so do property values.

My background in Investment Banking gives me a head up on many Realtors as I better understand the financial implications involved in purchasing a home, no matter the economic cycle. Yes, today’s interest rates are most certainly higher than a year ago, as I and many others predicted, but that doesn’t mean first-time buyers or others cannot afford to purchase a new home. It simply is a matter of understanding the options and finding a way to make it work for each individual situation.

Not only do I study the money markets each day, but I also look at the prices of commodities such as lumber, concrete, and steel. Those prices affect how homebuilders price the new homes being built. At present, most of these commodities are down, which will translate into better prices for new home construction.

There is so much more than interest rates to consider when looking for a home and that’s why you are fortunate to have me in your corner. I’ve just celebrated 50 years in the local Residential real estate arena and have been around for most every cycle imaginable. I’ve witnessed 30-year fixed mortgage interest rates as high as 20% (1982) and as low as 2.5% (2020). I’ve sold homes for $18,000 and for over a million dollars. I’ve sold homes to first-time buyers, as well as investment properties for those wanting to be landlords. And along the way I have learned the” ins and outs” of getting a deal done right.

But the most important thing I’ve learned is that each client has their own wants, needs and budget requirements. That’s why I look at each client individually and sit down with them to come up with a plan before the home buying or selling process begins, something that’s even more crucial in today’s fast paced buying and selling environment.

It all starts with a call to 719.593.1000 or email to Harry@HarrySalzman.com so we can begin work to make your housing dreams come true.

And now for statistics…

JUNE 2022

Statistics provided by the Pikes Peak REALTORS Service Corp., or it’s PPMLS

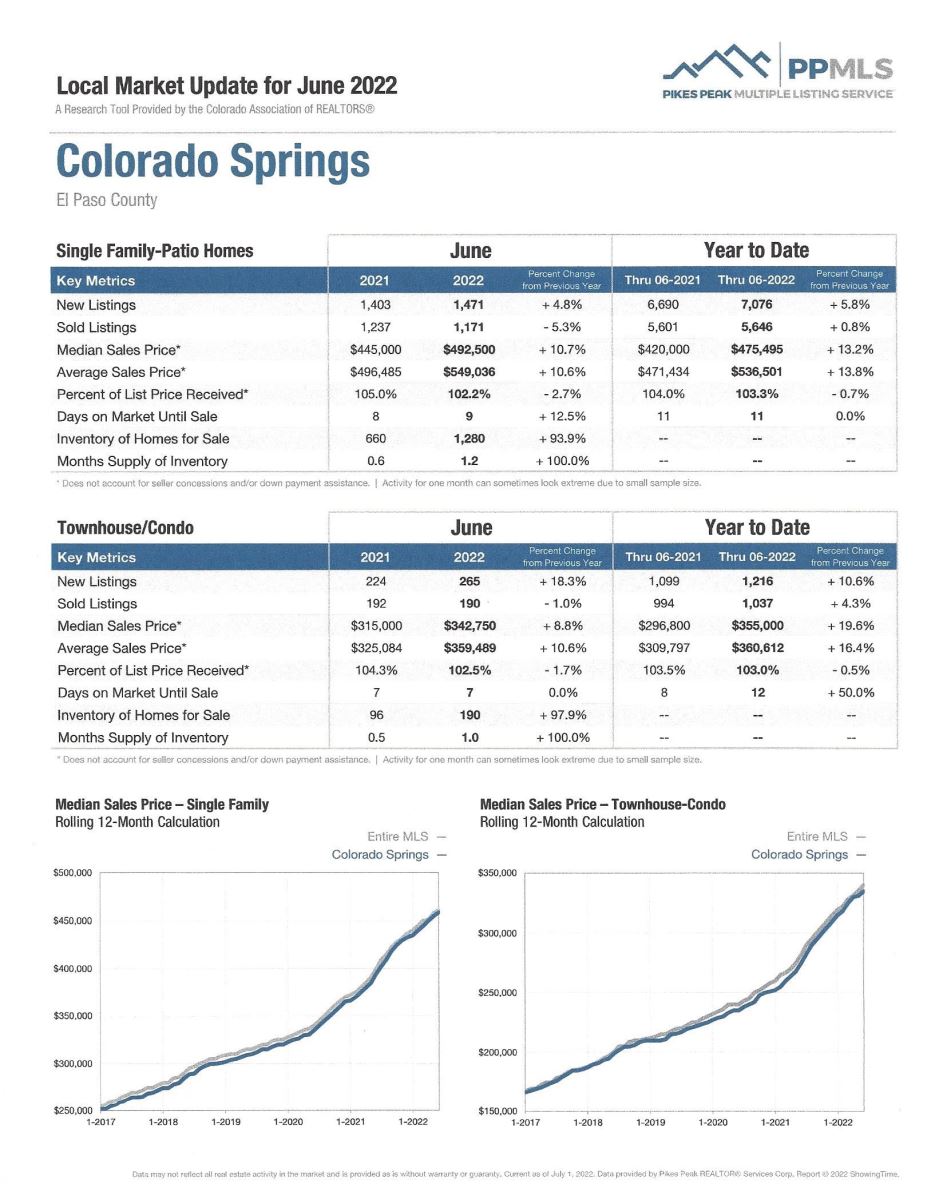

Here are some highlights from the June 2022 PPAR report.

In El Paso County, the average days on the market for single family/patio homes was a very low 9. For condo/townhomes it was 7.

Also in El Paso County, the sales price/list price for single family/patio homes was 102.1% and for condo/townhomes it was 102.5%.

In Teller County, the average days on the market for single family/patio homes was 16 and the sales/list price was 100.6%.

Please click here to view the detailed 10-page report, including charts. If you have any questions about the report or to find out how it relates to your individual situation, just give me a call.

In comparing June 2022 to June 2021 for All Homes in PPAR:

Single Family/Patio Homes:

· New Listings were 2,350, Up 25.3%

· Number of Sales were 1,712, Up 10.4%

· Average Sales Price was $551,304, Up 12.6%

· Median Sales Price was $495,000, Up 14.6%

· Total Active Listings are 2,125 Up 265.1%

· Months Supply is 1.2, Up 25.5%

Condo/Townhomes:

· New Listings were 302, Up 46.6%

· Number of Sales were 218, Down 0.9%

· Average Sales Price was $366,659 Up 15.0%

· Median Sales Price was $348,000, Up 12.1%

· Total Active Listings are 200, Up 181.7%

· Months Supply is 0.9, Down 199.9%

Now a look at more statistics…

JUNE 2022 MONTHLY INDICATORS AND LOCAL MARKET UPDATE ILLUSTRATE OUR LOCAL TRENDS IN DETAIL

Colorado Association of REALTORS® , Pikes Peak REALTORS Service Corp, or it’s PPMLS

Providing greater detail than the above report, this contains information on both El Paso and Teller counties for Residential real estate.

The “Activity Snapshot” for all residential properties in El Paso and Teller counties shows the Year to Date one-year change:

- Sold Listings for All Properties were Down 7.5%

- Median Sales Price for All Properties was Up 10.3%

- Active Listings on All Properties were Up 100.9%

You can click here to read the 16-page Monthly Indicators or click here to get specific information on the geographical are of your choice from the 18-page Local Market Update. It’s a good idea to check out your own area or one that you might be considering to get a good idea of the local pulse. As an example, here is a detailed report on the Colorado Springs area:

BUYERS’ 5 WORST FEARS ABOUT THE 2022 real estate MARKET AND WHY THEY MAY NOT BE VALID

The Close, 6.13.22

- Is There a Housing Bubble? No, there is no bubble at present. And the current conditions are different from what happened during the housing bubble of 2007 and 2008. If you look at the types of mortgages that were issued prior to the bubble bursting, you can see we were headed for a crash. The current market situation is very different. During the recession of 2008, inventory exceeded the demand once the bubble burst, but in this market, the inventory is chasing demand. As long as demand outpaces supply, the market should remain stable.

- Is There a Recession Coming? Yes, a recession is on the horizon but that’s not necessarily a bad thing when it comes to real estate. Typically, when we have a recession that requires the Federal Reserve to increase interest rates to reverse inflation, mortgage rates will drop. In each past recession, mortgage rates came down and they should here as well.

Further down the road there will likely be a time when the higher mortgage interest rates of today will allow homeowners to refinance to a lower rate. Wherever that rate lands, it is sure to be more attractive than today.

Also, contrary to what you might think, housing values typically increase during a recession. Therefore, even if homes are appreciating a bit slower during a recession, they are still appreciating. In our last nine recessions, home values have gone up during eight of them and then went up a lot after each of eight of nine recessions. The only anomaly was when we had the housing bubble in 2007 and 2008.

Overall, the housing market is stable, even as inflation drives prices up.

- Inflation is Too High—I Won’t Be Able to Afford to Buy a House Right Now. As I stated earlier, purchasing a home now means a buyer’s mortgage payment will stay the same year over year, whereas renters might get slapped with rental increases each year as inflation or appreciation increases. Also, your mortgage becomes easier to manage as your income increases.

That doesn’t mean affordability is easy today, but it’s not as bad as you might think. Homes prices have gone up, on average around 18% but mortgage rates have gone up about 2% over the past year.

- Will Mortgages Continue to Rise? In most likelihood, they will probably level off before they reach 7%. But here’s something to remember—you can refinance your mortgage after a year. By that time, the rate will likely have dropped back to around 5%.

- Will My House Be Worth Less in the Next Few Years? This is a great question and one that gets asked the most. The simply answer is no, most homes aren’t likely to lose value. The demand for housing will continue to grow from people who will be looking to buy their first home in the next few years or for those relocating and want to own rather than rent.

The real estate market looks like it will continue to grow and hum for the foreseeable future. As long as demand remains high, and most economists suggest that it will, we will continue to have home appreciation.

I believe the November elections will change the political climate and assuming that happens, steps could be taken to modify what’s happening in today’s economy. If so, we could experience a shorter period of time in the recession.

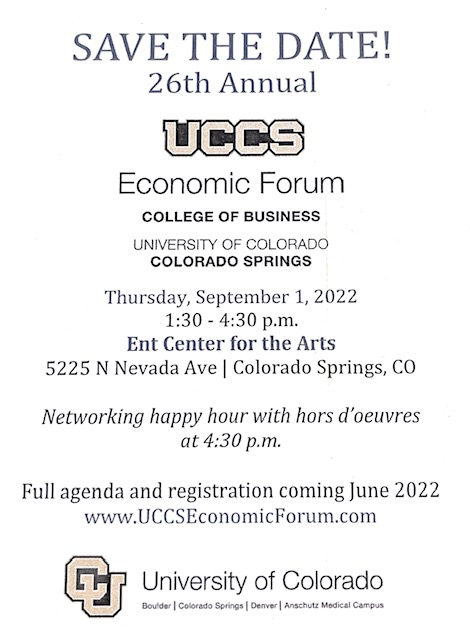

According to Tatiana Bailey, our “local economist” and director of the UCCS Economic Forum, there are approximately 12,000 people who at the moment are looking to buy a home here. Considering at present there are only around 2,000 single family homes for sale, the Colorado Springs area housing market looks to remain strong for the foreseeable future.

Hopefully this answers some of your own questions and if you have others, please don’t hesitate to give me a call.

THE TIGHT housing market IS IGNITING HOT BIDDING WARS FOR RENTALS

The Wall Street Journal, 6.28.22

It’s no longer just houses that are going for over list price. Landlords all around the country are now finding that rental units are being leased for over their asking price as well.

With the low supply of available homes for sale, folks who either sold their home and have yet to find a new one, or those who want to wait out the interest rate hikes, are looking to rental solutions for now. What they are finding out is that there are plenty of others in the same boat and some are willing to make an offer of 10-15% over the ask of the landlord.

As you might imagine, this is hurting those who cannot afford or cannot qualify to buy even harder. This is something I had never heard of until recently and not something I hope to see continue.

What I do know is that the rental market is as hot as the housing market and my clients who look for investment properties are still looking, despite the higher interest rates because what they can get in rent will more than make up for the higher interest they might have to pay.

If rental property is something you want to add to your investment portfolio, give me a call. As a landlord myself, I’ve had a lot of experience in this area and can steer you in the right direction. And, as always, before even considering it, please check with your tax and investment advisors to see if this is a viable option for you.

MORTGAGE RATES DROP AFTER THREE WEEKS OF INCREASES

The Wall Street Journal 6.30.22

While mortgage interest rates have dropped a bit, they remain near multi-year highs. This is fastest acceleration in mortgage rates in decades. At the busiest time of the year for home sales, these rates, along with continued home price appreciation has made it much more difficult for some would-be-buyers to purchase a home.

However, home price growth is staying strong throughout the country and bidding wars and sales over list price are still the norm even while sales are down somewhat. In areas like Colorado Springs where a number of folks are being relocated along with their companies, home demand continues to far outpace the inventory of homes for sale.

As I mentioned earlier, there are still ways of working within the tough new parameters and still be able to find a home that can work for you or a family member. If you find yourself wondering how to make this happen, please give me a call and let’s look at the numbers and see what we can do.

AND JUST A REMINDER:

HARRY’S THOUGHTS OF THE DAY:

Speaking of Appreciation…