HARRY'S BI-WEEKLY UPDATE 7.25.24

July 27, 2024

HARRY’S BI-WEEKLY UPDATE

A Current Look at the Colorado Springs Residential real estate Market

As part of my “Special Brand of Customer Service”, it is my desire to share current Residential real estate issues that will help to make you a more successful and profitable Buyer and Seller.

EVEN WITH HOME PRICES REACHING RECORD HIGHS AND MORTGAGE RATES STILL HOVERING AROUND 7%, THE SECOND HALF OF 2024 MAY STILL PRESENT SOME OPPORTUNITIES FOR YOU

Yes, you read that right. I know that homes keep appreciating and mortgage rates are still higher than we saw just several years ago, but…2024 could still be the year you can put your wants, needs and budget requirements to work and find a new home for you and your family.

I’ve been in the local residential real estate arena for 51 years now and have seen most every cycle imaginable. And as I’ve told you time and again, there are always going to be those who need to buy and those who need to sell at any given time.

There are ways to make your dreams a reality, but it takes some work and preparation. That’s why you’ve got me. With my years of experience, coupled with my investment banking background, I can often find ways to make things happen that many other brokers can’t.

If you have been putting off a search you will see some statistics below that can help you understand why NOW may just be the time to jump back in the market.

But you won’t know unless you ask. If you’ve been waiting, now is a good time to explore the possibilities. Give me a call at 719.593.1000 or email me at Harry@HarrySalzman.com and let’s together see what we can do to make 2024 the year your Residential real estate dreams come true.

UNLOCKING HOMEBUYER OPPORTUNITES THIS YEAR

KeepingCurrentMatters, 7.18.24

There is no mistaking the fact that 2024 has been a difficult year for homebuyers. If you’ve put your search on hold, you are not alone in that. A Bright MLS study found that some of the top reasons buyers have paused their search in late 2023 and early 2024 were:

- They couldn’t find anything in their price range

- They didn’t have any successful offers or had difficulty competing

- They couldn’t find the right home

If any of those sound like why you stopped looking, here’s what you need to know now. The housing market is in a transition in the second half of 2024 and here are four reasons why this may be your chance to jump back in the search.

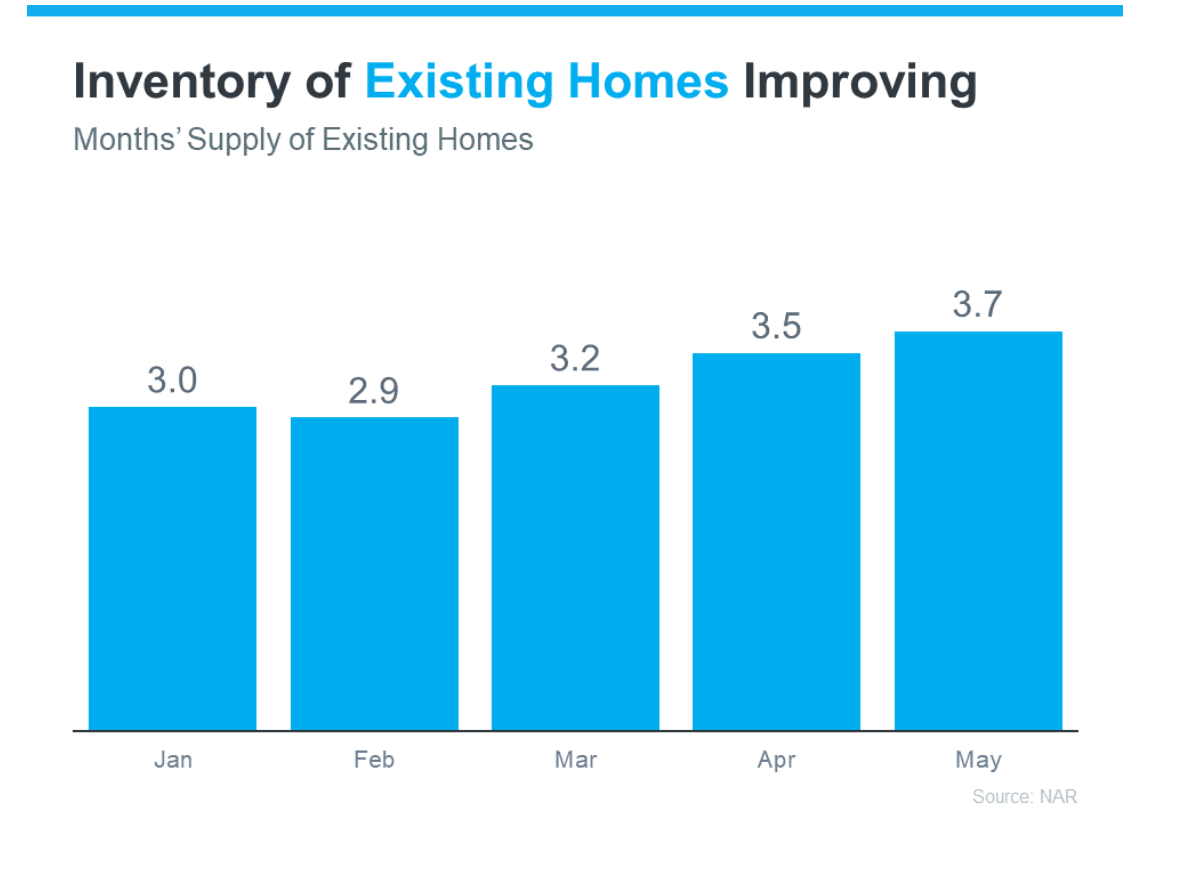

- The Supply of Homes For Sale is Growing. One of the most significant shifts in the market this year is how the months’ supply of home for sale has increased. If you look at data from the National Association of Realtors (NAR) you will see how inventory has grown throughout 2024. See graph below:

The graph shows the months’ supply of existing homes—homes that were previously lived in by another homeowner. The upward trend this year means you have a better chance of finding a home that fits your individual wants, needs and budget.

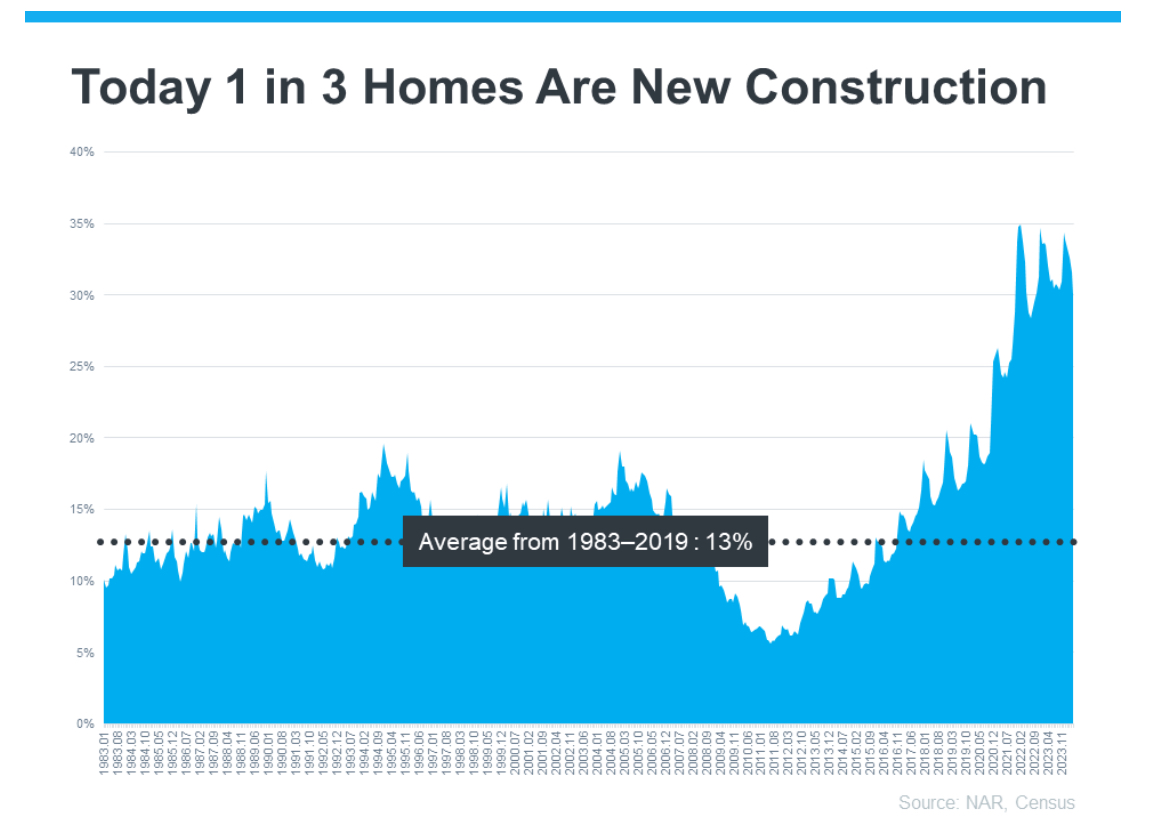

- There’s More New Home Construction. And, if you don’t find an existing home for sale that’s right for you, another opportunity lies in the rise in new home construction. Builders are working to increase the supply of newly built homes his year and are turning to smaller, more affordable homes based on the needs of families today. This could be a viable option and I can help you in this area as well—at no additional cost to you!

According to data from the Census and NAR, one in three homes on the market is a newly built home (see graph below):

This means that if you didn’t previously consider newly built homes as part of your search, you may have been cutting down your pool of options by a third. And some builders are also offering incentives like buying down mortgage rates to make it easier for buyers to get a home they can afford.

- Less Buyer Competition. Mortgage rates are still around 7% so buyer demand is not a fierce as it once was. When you combine that with more housing supply you have a better chance of avoiding an intense bidding war like those we saw several years ago. Danielle Hale, chief economist at Realtor.com highlights the positive trend for the latter half of 2024: “Home shoppers who persist could see better conditions in the second half of the year, which tends to be somewhat less competitive seasonally, and might be even more so since inventory is likely to reach five-year highs”.

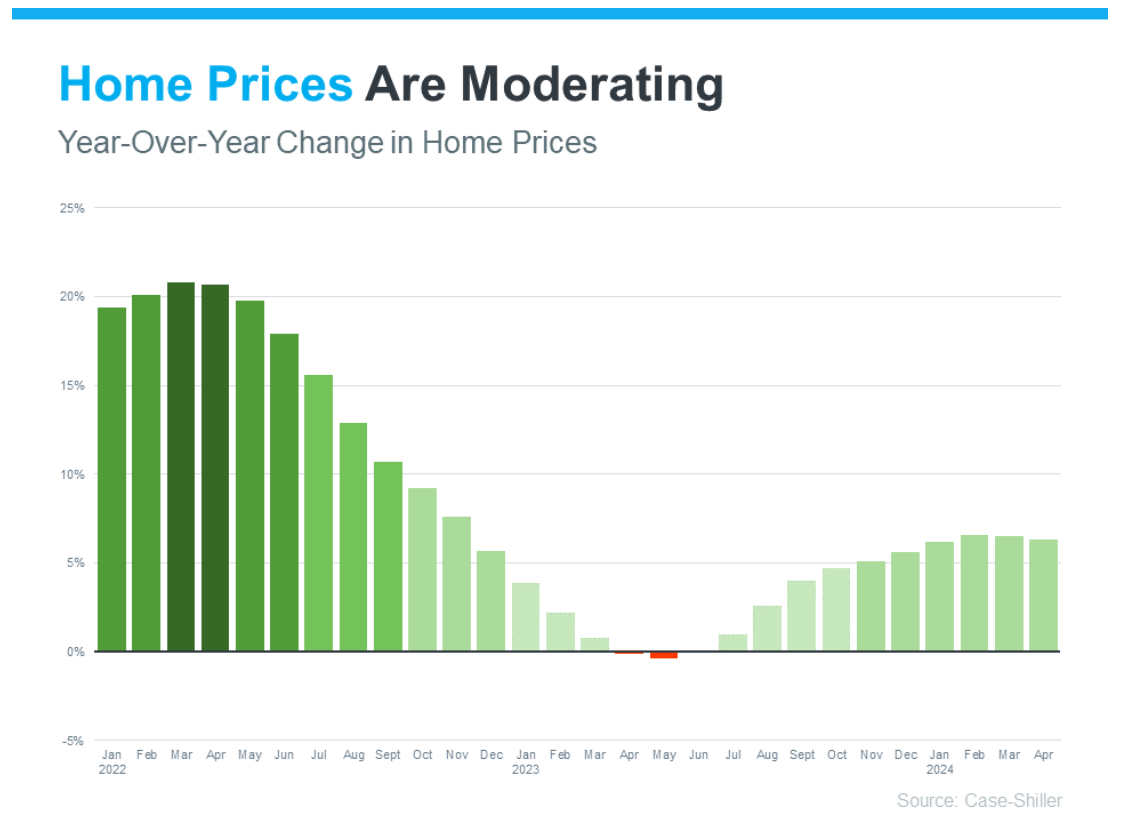

- Home Prices are Moderating. And speaking of prices, home prices are also showing signs of moderation—a welcome relief after the rapid appreciation seen in recent years (see graph below):

This moderation is mostly due to supply and demand. Supply is growing and demand is easing, so prices are not rising as fast. But make no mistake—prices are not falling; they are simply rising at a more normal pace. You can see above that the prices are still increasing, just not as dramatic as it was before.

The average forecast for home price appreciation in 2024 is for positive growth around 3% to 5%, which is more in line with historical norms.

Bottom Line:

If you have put off your dream of homeownership or selling to trade up, the second half of 2024 may be your opportunity to jump back in.

Simply give me a call and together let’s see how we can make your residential real estate dreams come true.

THE BIGGEST MISTAKES HOMEBUYERS ARE MAKING RIGHT NOW..AN INFOGRAPHIC…

KeepingCurrentMatters, 7.18.24

Bottom Line:

Once more with feeling…. NOW is a great time to start your search. You might be pleasantly surprised at what you can afford. And let’s not forget…. home appreciation, while slower than in the past, is not going to stop.

If you are renting you are still paying a mortgage…just someone else’s. Why not put your hard earned money to work for YOU?