HARRY'S BI-WEEKLY UPDATE 6.10.22

June 10, 2022

HARRY’S BI-WEEKLY UPDATE

A Current Look at the Colorado Springs Residential real estate Market

As part of my Personal Service, it is my desire to share current real estate issues that will help to make you a more successful and profitable buyer or seller.

DESPITE RISING MORTAGE LOAN RATES, OR MAYBE BECAUSE OF THEM, HOME DEMAND IS STILL AT A PEAK

As you know, mortgage loan rates are at their highest in at least ten years and are up over 2% from a year ago. The rate increase was not unexpected; however, I don’t think many economists would have thought they would go up this high so quickly.

This is not holding down price appreciation nor buyer demand at present. As you will see below, our home prices are continuing to reach record highs and are likely to keep doing so until there are more available homes for sale.

Higher rates are starting to hurt first-time buyers and those who cannot qualify for the higher monthly payments. Lenders are starting to see more activity in the adjustable-rate market for the first time in a number of years, but these loans bear little resemblance to the ones blamed for the 2008-9 financial crisis.

The type of borrower who qualifies for today’s Adjustable-Rate Mortgages (ARMs) is quite different from those who were qualified back in 2006-2008. Today’s ARM borrowers need higher credit scores and have to meet much tougher qualifications than those back in the early 2000’s.

While rates of 5% and higher do not faze those of us who have been around for the 12-18% rates of old, it still comes as sticker-shock to young people who have seen the historically low rates of recent times.

For those folks who had waited to see if rates would go down further or home prices would drop…well, as I have been warning for some time…the time for waiting is past.

If you have even considered a move or want to purchase a home for investment purposes, wait no longer. It’s likely that the equity in your present home is higher than you might imagine and with a higher down payment you might be able to keep your monthly output close to what it is at present.

We are starting to see a few more listings which is great, but they are still being sold in record time and over list price. Bidding wars and multiple cash offers are the norm, and I would guess will be here until there are more homes for sale.

Rental rates are continuing to rise and with them the demand for homeownership. Let’s face it, when you rent you are paying down someone’s mortgage, just not your own. Millennials are buying up homes much quicker than in the past as they realize how homeownership can help build financial security.

And of course, Colorado Springs and vicinity is seeing a number of new businesses relocating here and their relocated employees are also looking for places to live. This is putting added pressure on our low supply housing market.

Local homebuilders are still seeing an influx of those wanting to buy and I’ve helped a number of my clients in purchasing new construction in recent months. That’s just one of the many services I provide, and at no additional cost to you.

I will emphasize it once more—if you are in the market for anything residential—do not delay. You really won’t know what you can do until you sit down with a professional like me to find out how your wants, needs and budget can work in your favor.

And speaking of me, I just celebrated 50th years in the local residential real estate arena. That, combined with my Investment Banking background, gives me a heads up on understanding all types of scenarios and I am thrilled to put that experience to work for my clients.

It all starts with a call to 719.593.1000 or email to Harry@HarrySalzman.com and we can begin work to make your housing dreams come true.

And now for statistics…

MAY 2022

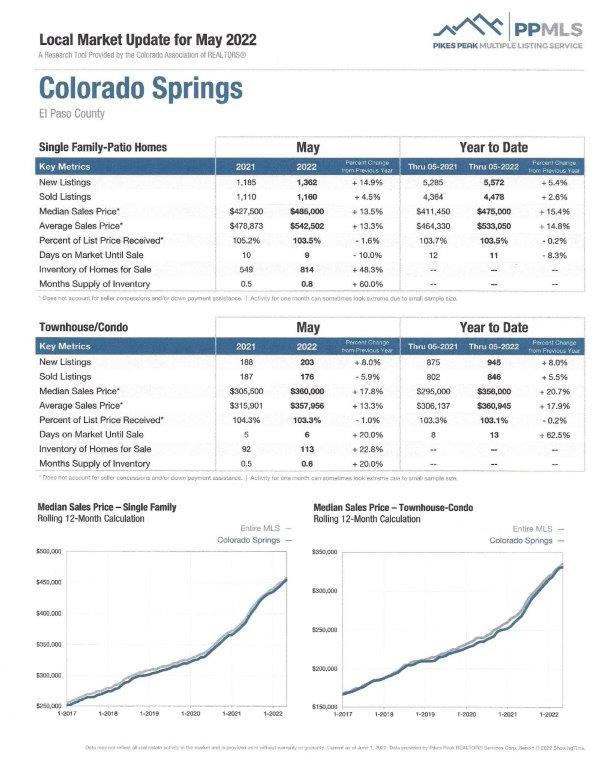

Statistics provided by the Pikes Peak REALTORS Service Corp., or it’s PPMLS

Here are some highlights from the May 2022 PPAR report.

In El Paso County, the average days on the market for single family/patio homes was a very low 9. For condo/townhomes it was 10.

Also in El Paso County, the sales price/list price for single family/patio homes was 103.4% and for condo/townhomes it was 103.2%.

In Teller County, the average days on the market for single family/patio homes was 10 and the sales/list price was 102.1%.

Please click here to view the detailed 10-page report, including charts. If you have any questions about the report or to find out how it relates to your individual situation, just give me a call.

In comparing May 2022 to May 2021 for All Homes in PPAR:

Single Family/Patio Homes:

· New Listings were 2,200, Up 17.3%

· Number of Sales were 1,689, Up 8.9%

· Average Sales Price was $554,013, Up 13.2%

· Median Sales Price was $487,000, Up 12.7%

· Total Active Listings are 1365, Up 69.1%

· Months Supply is 0.8, Up 7.8%

Condo/Townhomes:

· New Listings were 251, Up 21.8%

· Number of Sales were 208, Down 5.5%

· Average Sales Price was $369,783, Up 16.0%

· Median Sales Price was $365,000, Up 17.6%

· Total Active Listings are 113, Up 59.2%

· Months Supply is 0.5, Down 10.8%

Now a look at more statistics…

MAY 2022 MONTHLY INDICATORS AND LOCAL MARKET UPDATE ILLUSTRATE OUR LOCAL TRENDS IN DETAIL

Colorado Association of REALTORS® , Pikes Peak REALTORS Service Corp, or it’s PPMLS

Providing greater detail than the above report, this contains information on both El Paso and Teller counties for Residential real estate.

The “Activity Snapshot” for all residential properties in El Paso and Teller counties shows the Year to Date one-year change:

- Sold Listings for All Properties were Up 3.6%

- Median Sales Price for All Properties was Up 13.8%

- Active Listings on All Properties were Up 52.3%

You can click here to read the 16-page Monthly Indicators or click here to get specific information on the geographical are of your choice from the 18-page Local Market Update. It’s a good idea to check out your own area or one that you might be considering to get a good idea of the local pulse. As an example, here is a detailed report on the Colorado Springs area:

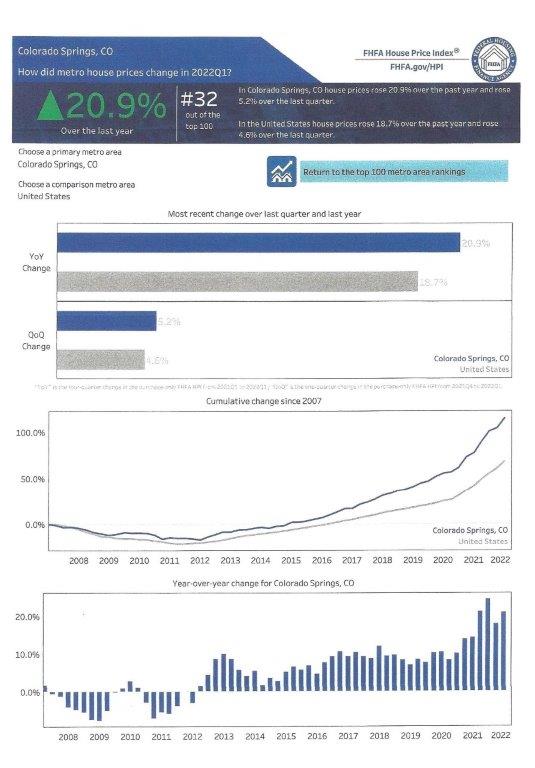

COLORADO SPRINGS RANKS #32 IN THE Q1 FHFA HOUSE PRICE INDEX

FHFA, 5.31.22

The recently published FHFA House Price Index for first quarter 2022 lists Colorado Springs as #32 out of the top 100 in house price changes during that quarter. As you will see in the chart below, we are still trending higher than the country as a whole, with a year-over-year price change of 20.9% and a quarter-over-quarter change of 5.2%.

We would have ranked considerably higher if we had more available homes for sale.

Here is a copy of the Colorado Springs changes:

If you are interested in seeing the entire list of 100 cities in ranking order, please click here. And, if you have any questions, you know who to call.

ERA SHIELDS “STAT PACK” PROVIDES A GOOD RESIDENTIAL real estate OVERVIEW

ERAShields, 5.31.22

As always, I am pleased to provide you with all the most current local information. This easy-to-understand report, along with graphs, gives you a good idea of the state of local Residential real estate.

Below I’ve reprinted the first page of the report and you can click here to read the report in its entirety.

.jpg)

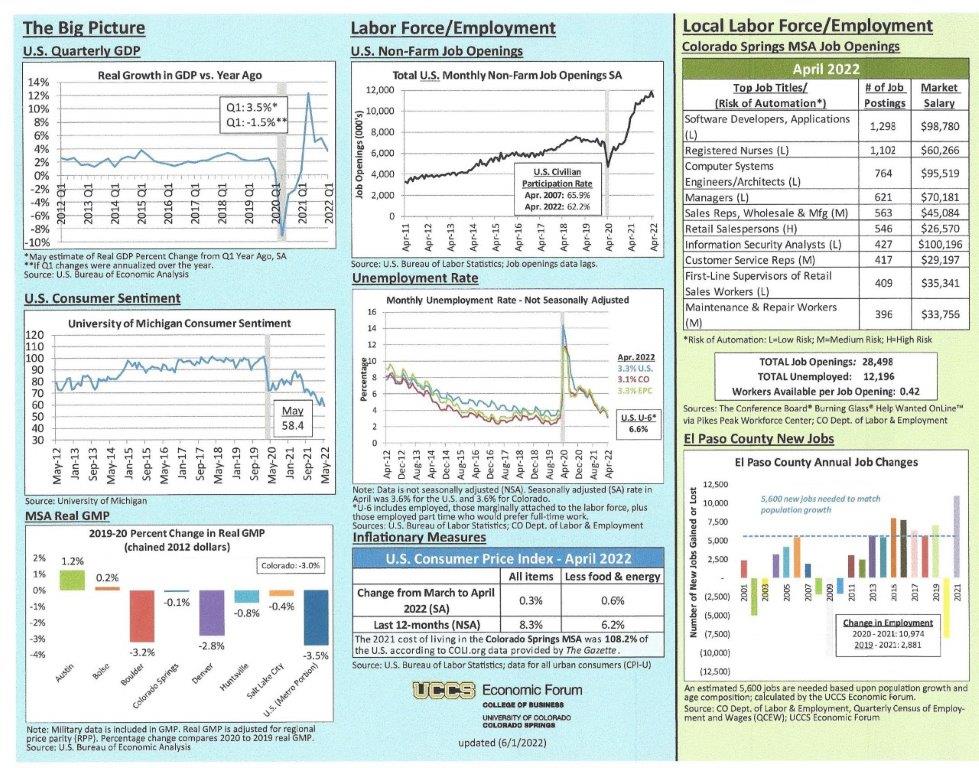

UCCS ECONOMIC FORUM UPDATE

College of Business, UCCS, updated 6.1.22

Here is the most recent economic update from the UCCS Economic Forum. It provides data concerning all aspects of the economy, on both the national and Colorado Springs area levels.

I’ve reproduced the first page of the graphs and you can click here to see the report in its entirety. If you have any questions, please give me a call.

And for those of you who like to plan ahead, the always informative UCCS Economic Forum Event this year will be held at the ENT Center for the Arts on Thursday, September 1, 2022, from 1:30-4:30, with a networking and happy hour to follow. Full agenda and registration will be available soon.