HARRY'S BI-WEEKLY UPDATE 4.6.22

April 6, 2022

HARRY’S BI-WEEKLY UPDATE

A Current Look at the Colorado Springs Residential real estate Market

As part of my Personal Service, it is my desire to share current real estate issues that will help to make you a more successful and profitable buyer or seller.

“IT’S THE SIGN OF THE TIMES” ... AT LEAST FOR THE FORESEEABLE FUTURE

As many of you know, it’s still quite the “Seller’s Market” here in Colorado Springs and around most of the country.

Rising homes prices, bidding wars, offers considerably over list price and all-cash offers with no contingencies are pretty much the norm now.

And, unfortunately, until there are more available homes for sale this is not going to change a lot. However, we are starting to see an uptick in new home construction here and that will help the situation somewhat. Unfortunately, building materials are still scarce and timelines for completion aren’t set in stone, so to speak.

With interest rates on an upward trajectory, folks who have been sitting on the fence, or waiting to see if home prices would fall, are starting to see that there’s no time like the present to see what they might do to make a move that is right for them.

New listings, as you will see below, are up considerably from March, however, that doesn’t equate to more choices. As soon as a home gets listed, there is often a line of potential buyers waiting to grab it, some even sight unseen.

While the chart below shows 705 single-family/patio homes for sale, as of last Sunday there were actually only 458 available in El Paso County and 45 in Teller County! And the City of Colorado Springs makes up 358 of those 458 homes available in El Paso County! Not great numbers for certain.

Two things I’ve been saying for some time now are happening. The mortgage rate increases are now happening. But while they are higher than several months ago, they are still quite reasonable compared to the not-so-distant past and current equity in your present home will likely make little difference in your monthly output for a new home.

And, as I have predicted, average home prices are lower than they have been, but at 14.1% for existing homes in March year-over-year, they are still trending toward my forecast of 10%-12% year-over-year by the end of 2022.

It is actually good to see the average prices trending down a bit as it will make up for the higher mortgage interest rates, as well as make it easier for first-time home buyers to enter the market.

Rents are rising so fast all over the nation, and especially here at home, and that’s another factor driving the rush toward homeownership.

Traditionally, April, May and June make up about 40% of the home sales annually, both nationally and locally. However, as you might imagine, nothing is traditional at the present, and homes are going faster than I have ever seen.

That brings me to a very important consideration for those of you either buying or selling. It is more important than ever to use a seasoned professional real estate broker like me in all your transactions. In this highly competitive market, I’ve seen some agents make promises to potential clients simply to get a listing. Not only is this ethically wrong, but it’s also not fair to the potential seller or buyer.

While homes ARE selling for more than list price in many instances, it’s still wise when listing your home to know it’s true value. That’s what comparables are for. As well as good advice from your listing or selling broker. Yes, if you are selling, it’s likely you will get more than you expect for your home, but first you need to get folks to come look at it. If it’s listed too high, you’ve already eliminated some who might want to buy your home. The bidding wars, etc. can come later, but it’s so important to list your home “right” to begin with.

For those of you who are looking to buy, it’s important to really know your needs, wants and budget and not to get caught up in “winning” a bidding war for the sake of winning.

I’ve been in the local Residential real estate area for 50 years this month and I’ve seen it all. I not only know how to “price” a listing, but how to advice a client when they will “win” by walking away. I’ve seen every cycle imaginable and my expertise in negotiation is especially needed at times like now.

Speaking of negotiation, I just completed another continuing education National Association of Realtors (NAR ) class entitled “real estate Negotiation Expert”, thus reaffirming my title of “Mr. Negotiator”!

If buying or selling is something you’ve even considered, there’s no time to wait. Let’s get together and put your needs, wants and budget requirements together to find the home you desire for you and your family.

Please give me a call at 593.1000 or email me at Harry@HarrySalzman.com and let me help make your residential real estate dreams a reality.

And now for statistics…

MARCH 2022

Statistics provided by the Pikes Peak REALTORS Service Corp., or it’s PPMLS

Here are some highlights from the March 2022 PPAR report:

In El Paso County, the average days on the market for single family/patio homes was a very low 11. For condo/townhomes it was 14.

Also in El Paso County, the sales price/list price for single family/patio homes was 104.1% and for condo/townhomes it was 102.9%.

In Teller County, the average days on the market for single family/patio homes was 22 and the sales/list price was 100.9%. For Teller County condo/townhomes the average days on the market was 14 and the sales to list price was 101.1%.

Please click here to view the detailed 10-page report, including charts. If you have any questions about the report or to find out how it relates to your individual situation, just give me a call.

In comparing March 2022 to March 2021 for All Homes in PPAR:

Single Family/Patio Homes:

· New Listings were 1,834, Up 13.2%

· Number of Sales were 1,361 Up 1.4%

· Average Sales Price was $539,684, Up 14.1%

· Median Sales Price was $475,000, Up 15.9%

· Total Active Listings are 705, Up 52.6%

· Months Supply is 0.5, Up 37.2%

Condo/Townhomes:

· New Listings were 234, Down 7.9%

· Number of Sales were 249, Up 18.6%

· Average Sales Price was $381,852, Up 16.8%

· Median Sales Price was $365,000, Up 20.4%

· Total Active Listings are 74, Down 20.4%

· Months Supply is 0.3, Down 1.1%

Normally I provide you with more neighborhood statistics here but they were not available at press time so I will put them in the mid-month eNewsletter.

WHAT’S UP WITH MORTGAGE RATES AND WHERE ARE THEY GOING?

KeepingCurrentMatters 3.30.22

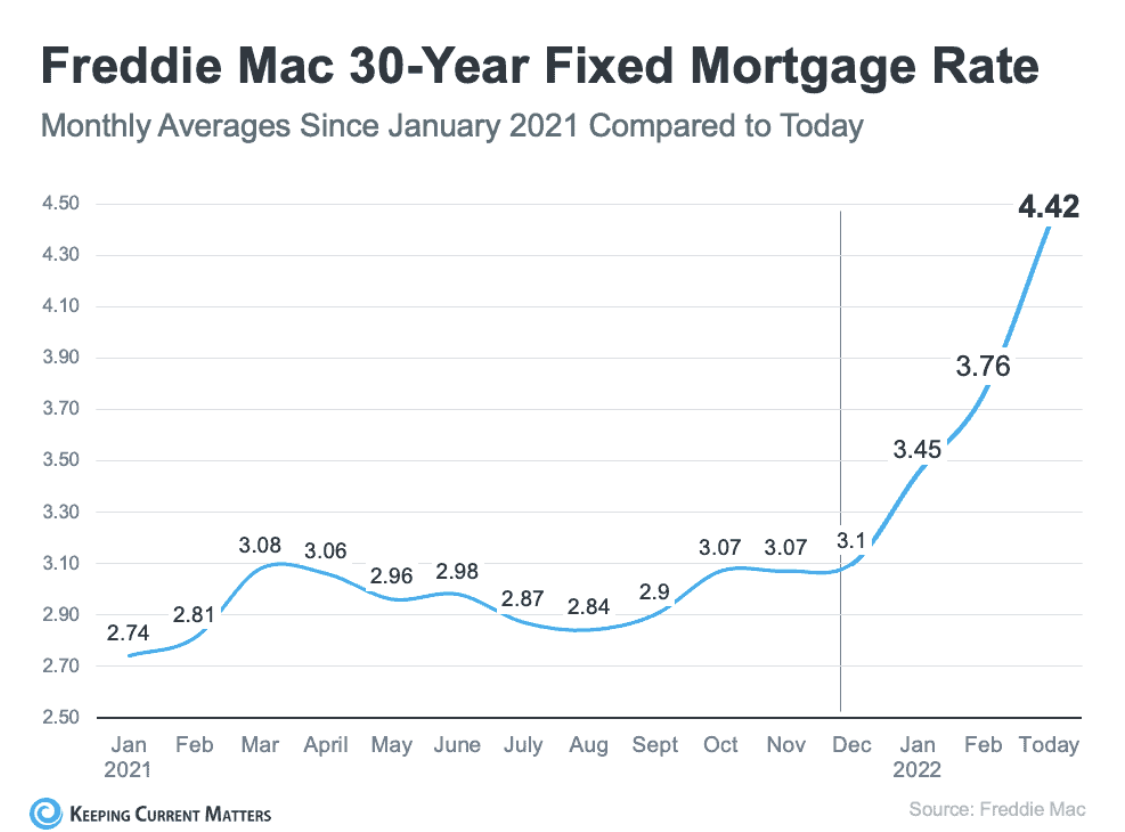

Based on the Primary Mortgage Market Survey from Freddie Mac, the average 30-year fixed-rate mortgage has increased by 1.2% (3.22% to 4.42%) since January of this year and the rate jumped more than a quarter of a point from just a week ago. The graph below shows you how the mortgage rate movement was steady in 2021 compared to the rapid increase in rates this year:

Only a few months ago, Freddie Mac projected that mortgage rates would average 3.6% in 2022 and earlier this year Fannie Mae forecast mortgage rates would average 3.8% in 2022. As you can see above, rates have already surpassed those projections.

Where are the Mortgage Rates Going from Here?

In a recent article by Bankrate, several industry experts weighed in on where rates might be headed going forward:

Greg McBride, Chief Financial Analyst, Bankrate:

“With inflation figures continuing to surprise to the upside, mortgage rates will remain above 4.0% on the 30-year fixed.”

Nadia Evangelou, Sr. Economist and Director of Forecasting, NAR:

“While higher short-term rates will push up mortgage rates, I expect some of this impact to be mitigated eventually through lower inflation. This, I expect the 30-year fixed mortgage to continue to rise, although we aren’t likely to see the big jumps that occurred over the past few weeks.”

Len Kiefer, Deputy Chief Economist, Freddie Mac:

“Mortgage rates are likely to continue to move higher throughout the balance of 2022, although the pace of rate increases is likely to moderate.”

Danielle Hale, Chief Economist, realtor.com:

“…As markets digest the Fed’s updated economic projections, I anticipate a continued increase in mortgage rates over the next several months.”

What does this mean for potential buyers?

With both mortgage rates and home values expected to increase throughout the year, it would be wiser to buy sooner than later if you are able because it will cost you more the longer you wait.

However, as I’ve been saying, there is a possible upside to buying now. While you’ll likely be paying a higher price and a higher mortgage rate than you might have last year, rising prices have a long-term benefit once you buy.

Purchasing a home today at $400,000 with 10% down, you would be taking out a $360,000 mortgage. According to mortgagecalculator.net, at a 4.42% fixed-rate mortgage, your payment would be $1,807 a month (not including insurance, taxes and other fees that vary by location).

Let’s put that mortgage payment into a new perspective based on the substantial growth in equity that comes with the escalation in home prices. Pulsenomics surveys a panel of over 100 economists, investment strategist and housing market analysts every quarter about their expectations for future home prices in the United States. Several weeks ago, Pulsenomics released their latest Home Price Expectation Survey which revealed that the average of the experts’ forecasts call for a 9% increase in home values in 2022. (As I’ve been telling you, for Colorado Springs I predict an average of 10%-12% for 2022).

Based on the 9% projection, a $400,000 house you buy today (optimistic in the Springs!) could be valued at $436,000 by this time next year ($440,000 - $448,000 in the Springs). Broken down, that means the equity in your home would increase by $3000+ a month over that period. That is greater than the estimated monthly payment above.

And while your net worth is tied to the home, it is still one way to put the home price appreciation to use in a way that benefits you and your family.

Bottom Line?

While paying a higher price coupled with a higher mortgage for a home can be hard to swallow, waiting will cost you even more.

If YOU are ready, willing, and able, I’m equally ready, willing, and able to assist you in finding the situation that can work for you.

WHAT TO EXPECT FROM THE SPRING housing market?

KeepingCurrentMatters 3.24.22

While there are multiple factors causing some uncertainty, including the conflict overseas, rising inflation, and the first rate increase from the Federal Reserve in over three years—the housing market appears to be relatively immune.

Here’s what experts are saying:

- Mortgage Rates Will Climb. As I mentioned earlier, Freddie Mac has reported that the 30-year fixed mortgage has increased by more than a full point in the past six months. And despite some mild fluctuation in recent weeks, experts believe rates will continue to edge up over the next 90 days.

- Housing Inventory Will Increase. Realtor.com recently reported that the number of newly listed homes has grown for each of the last two months nationally and NAR announced that the months’ supply of inventory increased for the first time in eight months. Since inventory of existing homes usually grows each spring, and based on recent activity, the next 90 days could bring more listings to the market, but the demand will still be great, and you will need to be prepared to make a decision quickly. And if you are thinking of selling, it would be wise to list your home sooner than later as your leverage in any negotiation will be impacted as additional homes come to the market.

- Home Prices Will Rise. Econ 101 again, folks. Prices are determined by supply and demand and even thought the number of homes entering the market is increasing, buyer demand remains and will continue to remain very strong. In the realtor.com recent Housing Report:

“During the final two weeks of the month, more new sellers entered the market than during the same time last year…however, with 5.8 million new homes missing from the market and millions of millennials at first-time buying ages, housing supply faces a long road to catching up with demand.”

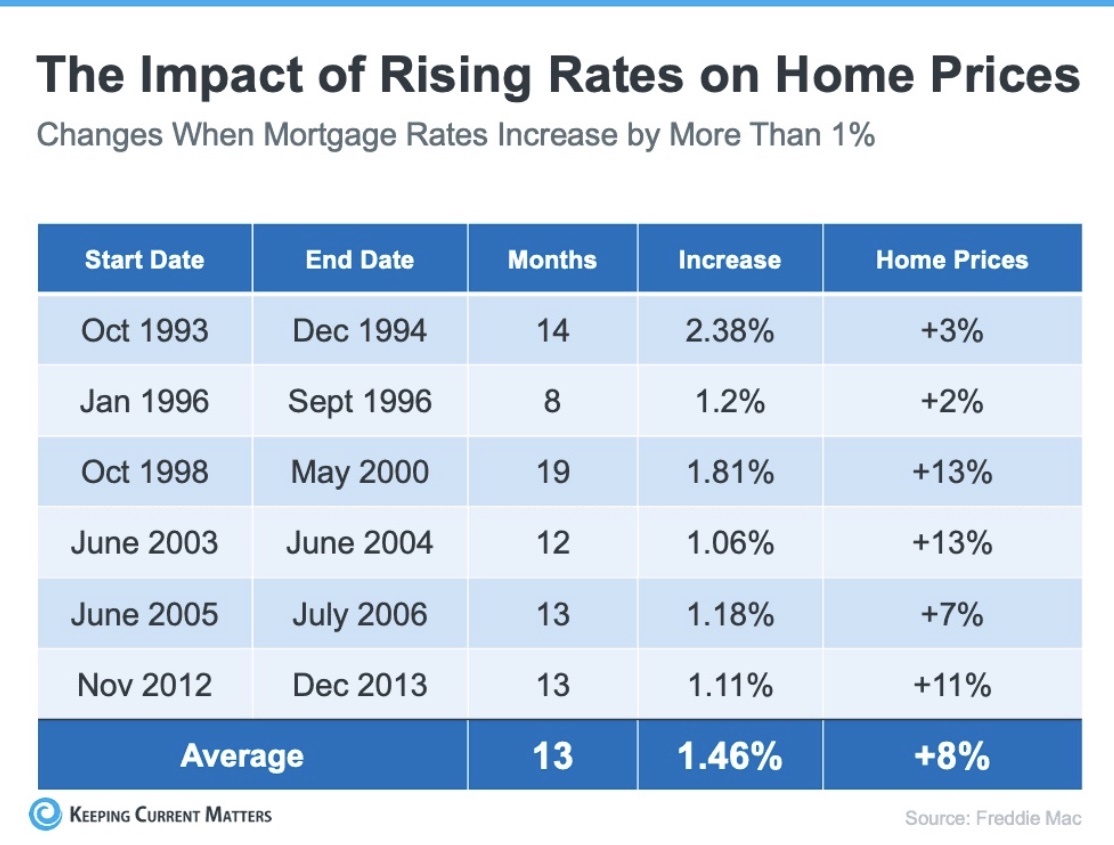

- Won’t Increasing Mortgage Rates Cause Home Prices to Fall? While some may believe a 1% increase in mortgage rates will impact demand so dramatically that homes prices will have to fall, experts say otherwise. According to Doug Duncan, Sr. Vice President and Chief Economist at Fannie Mae, “What I will caution against is making the inference that interest rates have a direct impact on house prices. That is not true.”

Freddie Mac studied the impact that mortgage rates increasing by at least 1% had on home prices in the past and here are the results of that study:

Bottom Line? Once more with feeling, if you’ve even remotely considered a move, NOW is that time. Waiting will hit you in the pocketbook.

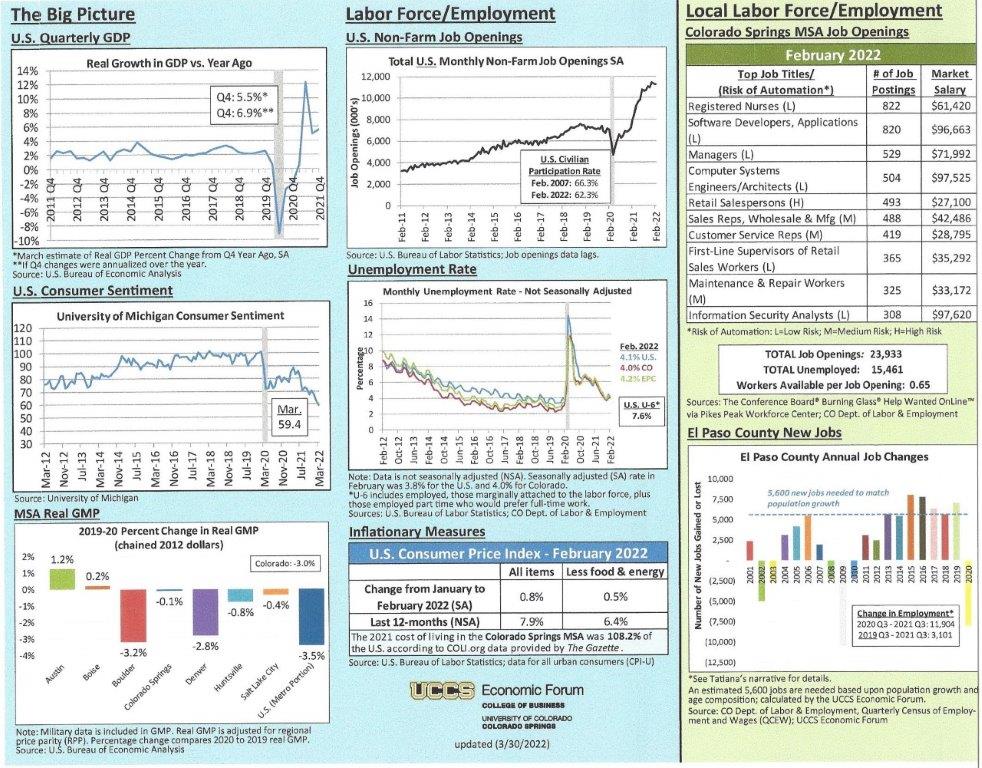

UCCS ECONOMIC FORUM UPDATE

College of Business, UCCS, updated 3.30.22

Here is the most recent economic update from the UCCS Economic Forum. It provides data concerning all aspects of the economy, on both the national and Colorado Springs area levels.

I’ve reproduced the first page of the graphs and you can click here to see the report in its entirety.

If you have any questions, please give me a call.

Also, be sure to mark your calendar for the always informative UCCS Economic Forum Event this year will be held at the ENT Center for the Arts on Thursday, September 1, 2022, from 1:30-4:30, with a networking and happy hour to follow. Full agenda and registration will be available in June.

FEATURED LISTING:

YOURS, HERE? IT MOST CERTAINLY WILL GET A LOT OF ATTENTION—NOT ONLY FROM ME, BUT ALSO FROM MY READERS AND ANYONE LOOKING TO BUY.