HARRY'S BI-WEEKLY UPDATE 2.7.2023

February 7, 2023

HARRY’S BI-WEEKLY UPDATE

A Current Look at the Colorado Springs Residential real estate Market

As part of my “Special Brand of Customer Service”, it is my desire to share current Residential real estate issues that will help to make you a more successful and profitable Buyer and Seller.

.jpg)

WITH SPRING BUYING SEASON ALMOST UPON US, THE LOCAL housing market IS SHOWING SIGNS OF INCREASED ACTIVITY

It’s been a long couple of months in the Residential real estate market, both locally and nationally, but things are starting to look up here just in time for the traditional busy time of year.

To begin with, mortgage interest rates have been falling and should go down a bit more in the coming months. And, as you will see in the statistics below, there are more homes on the market now, and I would suspect that there will be even more in the next month or two.

Traditionally, folks wait to put their homes on the market after the holiday season and while we saw fewer new listings last month compared to a year ago, there are considerably more homes for sale than there were last year at this time. Almost two hundred percent more single-family, townhomes were actively for sale in last month compared to last January!

That is great because there are many folks looking to buy here for so many various reasons. First, rental prices are still going through the roof and many renters are looking for ways to become homeowners. Then we have new companies relocating here and their employees are also looking for to relocate and find housing. Folks who had waited too long to sell and trade up and found themselves in a bind due to the rising interest rates along with the greater home appreciation are now finding ways to make their dreams a reality.

Colorado Springs is as desirable a place to live as it’s ever been, and the city is still getting great press. A recent article in Fortune Magazine entitled “Best Place to Travel in 2023” includes Colorado Springs among many foreign cities, as well as some others in the U.S. And, as you well know, once you visit Colorado Springs, somehow you start thinking about relocation! It’s happened to the best of us and I’ve no doubt it will continue for years to come.

Those who were thinking prices were going to fall are realizing that it’s just not going to happen. Yes, the bidding wars and sales considerably over listing price may be gone now that there are more homes for sale, but don’t think you’re going to see a drop in home values here.

I’ve personally predicted an increase of 3%-5% for 2023. I wouldn’t even be surprised if this is on the low side, but we will have to wait and see. What I do predict is that home values here in general are not going to slide.

If you’ve even considered a move, to sell and trade up, move to a new neighborhood or for investment purposes, you might want to get a jump on the sure to be busy spring buying season.

Knowing what you want, need, and can afford is the first step. The second step is to contact me.

My almost 51 years in the local residential real estate arena, coupled with my investment banking background, give me an edge that my clients have found to be crucial in helping them and their families realize their personal real estate visions.

If Residential real estate is among your hopes and dreams for 2023, please give me a call at 719.593.1000 or email me at Harry@HarrySalzman.com and let me help make them come true.

And now for statistics…

JANUARY 2023

Statistics provided by the Pikes Peak REALTORS Service Corp., or it’s PPMLS

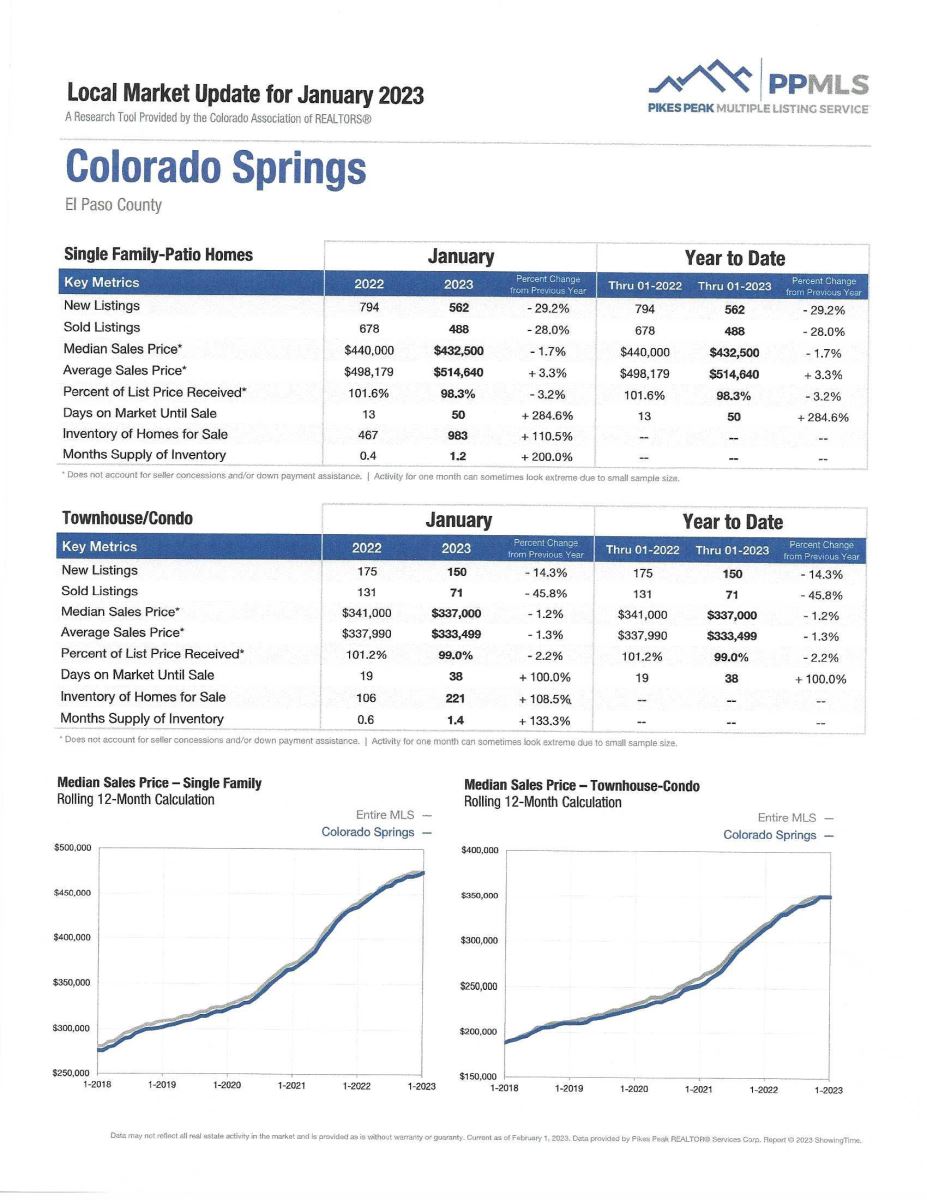

Here are some highlights from the January 2023 PPAR report.

In El Paso County, the average days on the market for single family/patio homes was a 50. For condo/townhomes it was 37.

Also in El Paso County, the sales price/list price for single family/patio homes was 98.4% and for condo/townhomes it was also 99.0%.

In Teller County, the average days on the market for single family/patio homes was 56 and the sales/list price was 97.5%.

Please click here to view the detailed 10-page report, including charts. If you have any questions about the report or to find out how it relates to your individual situation, just give me a call.

In comparing January 2023 to January 2022 for All Homes in PPAR:

Single Family/Patio Homes:

· New Listings were 965, Down 18.2%

· Number of Sales were 739, Down 30.2%

· Average Sales Price was $525,254, Up 6.1%

· Median Sales Price was $445,000, Even

· Total Active Listings are 1,639, Up 198.5%

· Months Supply is 2.2, Down 6.6%

Condo/Townhomes:

· New Listings were 181, Down 11.7%

· Number of Sales were 90, Down 43.0%

· Average Sales Price was $335,963, Down 1.9%

· Median Sales Price was $337,250, Down 2.2%

· Total Active Listings are 256, Up 224.1%

· Months Supply is 2.8, Down 5.2%

JANUARY 2023 MONTHLY INDICATORS AND LOCAL MARKET UPDATE ILLUSTRATE OUR LOCAL TRENDS IN DETAIL

Colorado Association of REALTORS® , Pikes Peak REALTORS Service Corp, or it’s PPMLS

Providing greater detail than the above report, this contains information on both El Paso and Teller counties for Residential real estate.

The “Activity Snapshot” for all residential properties in El Paso and Teller counties shows the Year to Date one-year change:

- Sold Listings for All Properties were Down 33.2%

- Median Sales Price for All Properties was Even

- Active Listings on All Properties were Up 108.4%

You can click here to read the 16-page Monthly Indicators or click here to get specific information on the geographical are of your choice from the 18-page Local Market Update. It’s a good idea to check out your own area or one that you might be considering in order to get a good idea of the local pulse. As an example, here is a detailed report on the Colorado Springs area:

housing market SHOWS SIGNS OF THAWING

The Wall Street Journal, 2.6.23

As I was writing this, I glanced online and saw an article saying pretty much what I had shared above. So, here’s what it said:

“A decline in mortgage rates has more people interested in buying a home”

In response to signs that the Federal Reserve is nearly finished lifting rates, the average 30-year home loan rate has come down by just about a full percentage point from a 20-year high above 7% in November.

Mortgage applications are up by about a quarter since the end of last year and a measure of signed real estate contracts rose in December after six months of declines. In addition, the number of people contacting real estate agents has rebounded from a November low, according to Redfin Corp’s internal data.

While rates are still considerably above the 3% range of a year ago, the fact that they are now a percent lower than November is a good sign and folks are pleasantly happy.

The housing market is a barometer of how the economy is responding to a loosening of financial conditions in recent weeks. Stocks and bonds have both rebounded strongly to start the year on the premise that inflation is coming down without putting the U.S. into a deep recession.

The Fed is still indicating that it is committed to keeping rates high until inflation is lower and it is willing to risk a recession to do so. Only time will tell how this will play out.

However, economists at Goldman Sachs Group have said this past month they expect the worst of the downturn has passed and housing is poised to exert less of a drag on economic growth going forward.

Execs at D.R. Horton, Inc., the largest U.S. homebuilder by volume, told analysts in January that they have seen heightened sales activity in the first few weeks of the year. Nets sales, they said, are expected to increase significantly from the first quarter to the second, when the traditional spring selling season happens.

As I have always said, it appears that folks “are less focused on the specific rate than they are on identifying a window of where they are comfortable with their monthly output”, according to a Redfin agent in Washington, D.C. also.

The Journal cited an example of an assistant superintendent in a Phoenix school district who started looking to buy a house with her boyfriend in the past few weeks. After looking at about a half dozen houses, they made an offer that was accepted last week.

They decided to purchase knowing that rates might fall, and they could refinance their current mortgage later on. According to her, “I’m thinking this isn’t a forever thing.” Exactly what I’ve been telling my clients.

Homebuilders have been offering incentives to sell their finished homes and some buyers are signing up for mortgages with rates that are temporarily lowered for the first few years.

Refinancing has fallen drastically from when homeowners were refinancing at rates that were around 3% or lower. Far fewer can save money at rates above 6%.

Pending home sales—a leading indicator for the housing market—rose 2.5% in December, led by gains in the South and the West, according to the National Association of Realtors (NAR).

So, once again, if you’re even considering a move—the best first move would be to give me a call. I’ve been through most all cycles imaginable over the last 51 years and can help you navigate the still somewhat stormy seas of home buying and selling.

ECONOMIC & WORKFORCE DEVELOPMENT REPORT

Data-Driven Economic Strategies, January 2023

As always, I like to share the wonderful economic data I receive from our “local economist”, Tatiana Bailey. You will see in these charts what’s happening locally in terms of the economy as well as the most recent Workforce Progress Report.

To read the report, please click here and if you have any questions, please give me a holler.