HARRY'S BI-WEEKLY UPDATE 10.7.2022

October 7, 2022

HARRY’S BI-WEEKLY UPDATE

A Current Look at the Colorado Springs Residential real estate Market

As part of my Personal Service, it is my desire to share current real estate issues that will help to make you a more successful and profitable buyer or seller.

Six months ago, when I started advising my clients that the sellers’ market and low interest rates weren’t going to be around forever, even I didn’t know how quickly the cards would turn.

In my 50+ years in the local Residential real estate arena, I’ve never seen interest rates rise this quickly (they are now the highest they have been since 2007) and, while we most definitely needed a more “normal” type of market, I doubt anyone would have projected it to normalize this fast.

What does that mean to you as a potential seller or buyer today? To begin with, as a seller, it means that at present you can no longer dictate all the terms of the sale. And as a buyer, you do get more options than you might have had even 4-5 months ago. Also, oftentimes what you must “give up” as a seller you can make up when you make an offer as a buyer!

An important thing to remember, and something I always remind my clients, is that all Residential real estate facts need to be localized. What is happening around the country is not often what is happening in our neck of the woods.

Colorado Springs has had a much more stable market than we’ve seen elsewhere. The reason? Lots of folks have been moving and are continuing to move here and our economy is doing far better than many other places. Our inventory is still low compared to more “normal” times and that continues to give the seller somewhat of an advantage.

That doesn’t mean that homes are still selling at a record pace and over list price. What it does mean is our home prices are continuing to rise, although at a much more reasonable rate, and while homes are not selling as fast as in the most recent past, they will sell when they find the right buyer.

Things are just getting back to a more manageable pace.

First-time buyers are being hit the hardest as they do not have equity to use for a down payment and the interest rates today are preventing some from qualifying. As rates begin to fall, and they will hopefully do so within the next year, those folks will have more available homes and options from which to choose.

As you will see from the statistics below, home sales here in September are down 25% from a year ago. We can blame some of that on “sticker shock”—a combination of prices and higher interest rates. And there are a lot of “wait and see” folks who want to see where rates and prices are going. Also, as you will read, available homes for sale are up 127.2% over a year ago, which means there are a LOT more homes from which buyers can choose.

Waiting for prices to fall in our area isn’t the best idea since that’s not likely to happen. While homes will not appreciate as fast as they have, I don’t see where the values will decline. And most economists agree.

And waiting for interest rates to fall probably isn’t the best idea either. There are several ways to work around the fixed rates of today, such as getting a 5 or 7 year Adjustable-Rate Mortgage (ARM) and refinancing when rates fall, and several other strategies. The best advice for today’s market is to shop around. You will find that rates vary from lender to lender, and I can help direct you to several that often have very competitive rates and terms.

It’s good to remember that while the price you pay for your home today is permanent, your mortgage rate is not if you choose to refinance later. A wise man once said, “Date the rate, but marry the home”!

As I’ve said, time and again, there are always those who need to buy and those who need to sell. And with an experienced professional like me on your team, where’s there’s a will there will be a way.

Yes, it’s likely going to take considerably longer to sell, but for those who need time to figure out their next move, that’s a good thing. For those who know where they are going, it’s going to take patience to wait for the right buyer. But the good news is…. there is always a “right” buyer.

Another important thing to remember is that this time of year is not the “traditional” buying and selling season. We have tended to forget that since the frenzy of the last several years had created a “year-round” selling season.

I’m not certain which is best, but I do know that having the ability to take time to make what is often your most important financial purchase is a good thing. It’s just not what we have seen in recent times and will take some getting used to for both buyers and sellers. In the long run it will make for happier and certainly more stress-free decisions and that’s as it should be.

If you are wanting to find out how the present market is going to affect any buying or selling thoughts of yours, please give me a call at 719.593.1000 or email to Harry@HarrySalzman.com .

I look forward to speaking with you soon.

And now for September statistics….

SEPTEMBER 2022

Statistics provided by the Pikes Peak REALTORS Service Corp., or it’s PPMLS

Here are some highlights from the September 2022 PPAR report.

In El Paso County, the average days on the market for single family/patio homes was 24. For condo/townhomes it was 17.

Also in El Paso County, the sales price/list price for single family/patio homes was 98.5% and for condo/townhomes it was 99.8%.

In Teller County, the average days on the market for single family/patio homes was 36 and the sales/list price was 98.5%.

Please click here to view the detailed 10-page report, including charts. If you have any questions about the report or to find out how it relates to your individual situation, just give me a call.

In comparing September 2022 to September 2021 for All Homes in PPAR:

Single Family/Patio Homes:

· New Listings were 1498, Down 18.1%

· Number of Sales were 1,294, Down 26.4%

· Average Sales Price was $523,117, Up 5.0%

· Median Sales Price was $460,000, Up 4.5%

· Total Active Listings are 2,690 Up 127.2%

· Months Supply is 2.1, Down 4.8%

Condo/Townhomes:

· New Listings were 205, Down 28.8%

· Number of Sales were 248, Down 17.9%

· Average Sales Price was $363,252, Up 8.1%

· Median Sales Price was $345,000, Up 8.3%

· Total Active Listings are 235, Up 65.5%

· Months Supply is 0.9, Down 3.7%

Now a look at more statistics…

SEPTEMBER 2022 MONTHLY INDICATORS AND LOCAL MARKET UPDATE ILLUSTRATE OUR LOCAL TRENDS IN DETAIL

Colorado Association of REALTORS® , Pikes Peak REALTORS Service Corp, or it’s PPMLS

Providing greater detail than the above report, this contains information on both El Paso and Teller counties for Residential real estate.

The “Activity Snapshot” for all residential properties in El Paso and Teller counties shows the Year to Date one-year change:

- Sold Listings for All Properties were Down 26.8%

- Median Sales Price for All Properties was Up 4.0%

- Active Listings on All Properties were Up 91.9%

You can click here to read the 16-page Monthly Indicators or click here to get specific information on the geographical are of your choice from the 18-page Local Market Update. It’s a good idea to check out your own area or one that you might be considering to get a good idea of the local pulse. As an example, here is a detailed report on the Colorado Springs area:

.jpg)

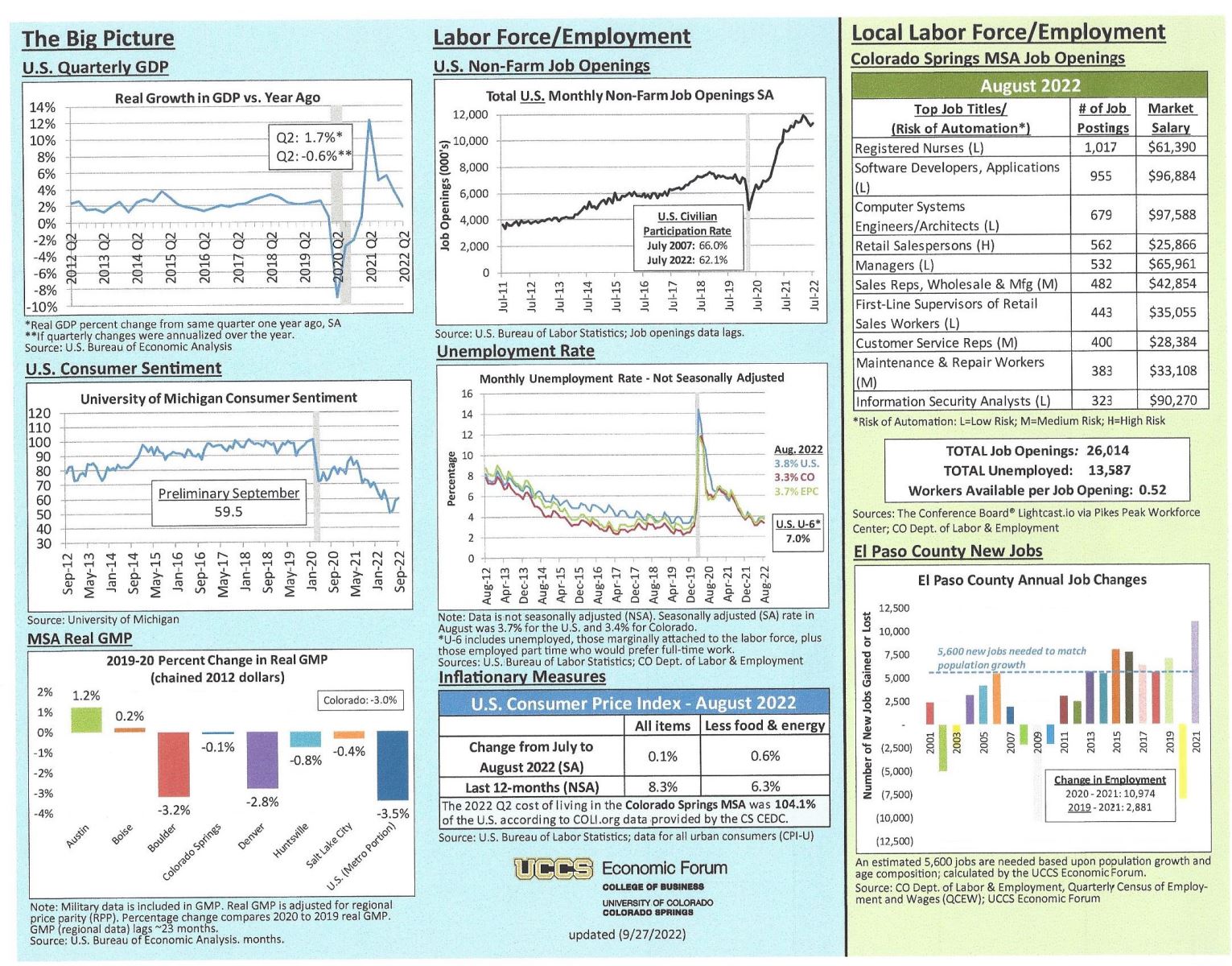

UCCS ECONOMIC FORUM DASHBOARD

UCCS Economic Forum, College of Business, 9.27.22

Here is the most recent economic update from the UCCS Economic Forum. It provides data concerning all aspects of the economy, on both the national and Colorado Springs area levels.

I’ve reproduced the first page of the graphs and you can click here to see the report in its entirety. If you have any questions, please give me a call.

SELLING YOUR HOME? YOUR ASKING PRICE MATTERS MORE NOW THAN EVER

Keeping Current Matters, 8.9.22

As I mentioned earlier, homes are continuing to appreciate and even with more available homes for sale the numbers are still at all-time lows, thus keeping the market competitive despite the rising interest rates.

However, your asking price is more important than ever. During the pandemic sellers could price their homes higher due to high demand and low supply. This year, things have started to shift and that means your approach to pricing your home needs to shift as well. Here is what’s at stake if you don’t.

Why Pricing Your House at Market Value Matters

The price you set for your house sends a message to potential buyers. If you price it too high, you could run the risk of deterring buyers.

When that happens, it is often necessary to lower the price to reignite or stir up interest in your home when it sits on the market for a while. Sometimes lowering the price sends a red flag to buyers who wonder what that means, and they might wonder if the home is still overpriced.

Some sellers are not adjusting their expectations to today’s market, and realtor.com explains the impact that’s having:

“…the share of listings with a price cut was nearly double its year ago level even as it remains well below pre-pandemic levels.”

To avoid the headache of having to lower your price, you’ll want to price it as right as possible from the onset. It isn’t always easy to do with interest rates and other factors changing so fast these days, but we can start by looking at comparables and work from there.

If you are thinking of selling and wondering what your present home might be worth in today’s market, please give me a call so we can discuss it in greater detail.

HARRY’S THOUGHT OF THE DAY:

And this is why all the pet psychologists in Colorado are so busy….

.jpg)