HARRY'S BI-WEEKLY UPDATE 8.6.20

August 6, 2020

HARRY’S BI-WEEKLY UPDATE

A Current Look at the Colorado Springs Residential real estate Market

As part of my Personal Service, it is my desire to share current real estate issues that will help to make you a more successful and profitable buyer or seller.

HERE’S A FIRST…I’M STARTING WITH A STATISTICAL CHART…THE NUMBERS ARE JUST TOO GOOD TO WAIT TO TALK ABOUT LATER

For those who need interpretation, homeowners in the Colorado Springs area should be jumping for joy. Not only has our average home price exceeded $400,000, but home sales in June were the highest in more than a year--up 19% for single family homes and 4.4% for condo/townhomes. And this comes at a time when there is a record low in inventory. Can you even imagine what these numbers would look like if we had more homes for sale?

Folks are obviously thrilled about the historically low mortgage interest rates—under 3% for the first time ever—and are ready to get the home features they found lacking in their present home during this recent quarantine. Upgraded kitchens, home office space, outdoor gathering spots—these are just some of the “wants” of my current potential buyers.

Last week the Commerce Department reported that the homeownership rate rose to 67.9% in the second quarter, up from 64.1% a year earlier and the highest level since mid-2008, which certainly correlates with what’s happening locally.

First time buyers are also looking for starter homes because these interest rates are making homeownership more affordable. However, the lack of affordable housing in the under $350,000 range is making it a bit harder for them.

I’ve been quite busy with relocating folks who are moving here from all across the country. With all the new companies moving to the Springs, no wonder our economy, while obviously not what it was prior to the pandemic, is still faring better than the national average. Like it or not, the world is finding out what those of us who call Colorado Springs home already know. We’ve got it all and now they want it, too!

What does all this mean to you? If you’ve even considered selling to trade up or move to a new neighborhood, NOW is the time. Your present home will likely be in great demand and while it may take longer than usual to find another one, there are still homes available in most price points and in most neighborhoods. It’s important to know exactly what you want, need and can afford prior to the search because bidding wars have become the norm. There’s little time to make buying decisions once you find what you want. If nothing else, it’s certainly time to check it out and see what you can do to realize the home of your dreams.

That’s where I come in. If you have been wanting to begin the process of making your residential dreams come true, all it takes is a phone call to me at 593.1000 or an email to Harry@HarrySalzman.com and I can put my extensive knowledge, experience and special brand of customer service to work for you, your family members and co-workers.

I look forward to talking with you soon.

And now for statistics…kinda “off the chart”…

You will see that home prices are continuing their upward trend due in part to low interest rates, low inventory and a pent-up demand created by the pandemic. With so many folks looking to buy, I would expect to see these numbers, along with the number of sales, to continue to increase over the next few months.

There were a few more listings last month and I would also expect that to continue to rise now that we can visit homes in person.

JULY 2020

Statistics provided by the Pikes Peak REALTORS Service Corp., or it’s PPMLS

Here are some highlights from the July 2020 PPAR report. Remember that the new format of this report no longer provides monthly statistics for each individual neighborhood. However, if you are interested in what’s happening in your neighborhood, I can provide you with this information through other means.

In El Paso County, the average days on the market for single family/patio homes was 17. For condo/townhomes it was 15.

The sales price/list price for single family/patio homes was 100.7% and for condo/townhomes was 100.5%.

Please click here to view the detailed 9-page report, including charts. If you have any questions about the report or to find out how it relates to your individual situation, just give me a call.

In comparing July 2020 to July 2019 for All Homes in PPAR:

Single Family/Patio Homes:

· New Listings were 1,969, Up 6.3%

· Number of Sales were 1,978, Up 19.0%

· Average Sales Price was $427,593, Up 14.8%

· Median Sales Price was $377,000, Up 13.6%

· Total Active Listings are 1,390, Down 36.8%

· Months Supply is .07, Down 1.9%

Condo/Townhomes:

· New Listings were 309, Up 24.1%

· Number of Sales were 263, Up 4.4%

· Average Sales Price was $276,782, Up 14.2%

· Median Sales Price was $251,000, Up 9.8%

· Total Active Listings are 162, Down 18.2%

· Months Supply is 0.6, Down 4.2%

And a look at more statistics…

July 2020 LOCAL MARKET UPDATE AND MONTHLY INDICATORS ILLUSTRATE OUR LOCAL TRENDS IN DETAIL

Colorado Association of REALTORS® , Pikes Peak REALTORS Service Corp, or it’s PPMLS

Providing greater detail than the above report, this contains information on both El Paso and Teller counties for Residential real estate.

It is broken down by geographical areas and you can look to see how your neighborhood is doing in terms of sales, prices, and more.

The “Activity Snapshot” for all residential properties in El Paso and Teller counties shows the Year to Date one-year change:

- Sold Listings for All Properties were Up 14.4%

- Median Sales Price for All Properties was Up 13.7%

- Active Listings on All Properties were Down 37.6%

You can click here to read the 16-page Monthly Indicators or click here to get specific information on the geographical area of your choice from the 18-page Local Market Update. I recommend that you check out your own area or one that you are considering, to get a good idea of the local pulse. As an example, here is a detailed report on the Colorado Springs area:

WELCOME TO THE UNITED STATES OLYMPIC AND PARALYMPIC MUSEUM

All I can say is…it was definitely worth the wait. The recently opened United States Olympic and Paralympic Museum, which is part of the “City for Champions” initiative, is a home run for the city of Colorado Springs, as well as the nation.

Carol and I were there on opening day and were just blown away not only by the exhibits but by all of the mindboggling computerized experiences. Not only is the building visually beautiful, the entire visit is a joy to all the senses.

I’m so very proud to have been a part of the “C4C” initiative from its beginning and it’s so special to be able to see the how all of the hard work of so many is coming to fruition. I highly recommend a visit to one and all.

Harry trying to keep up with the Olympians on the virtual ski slope!

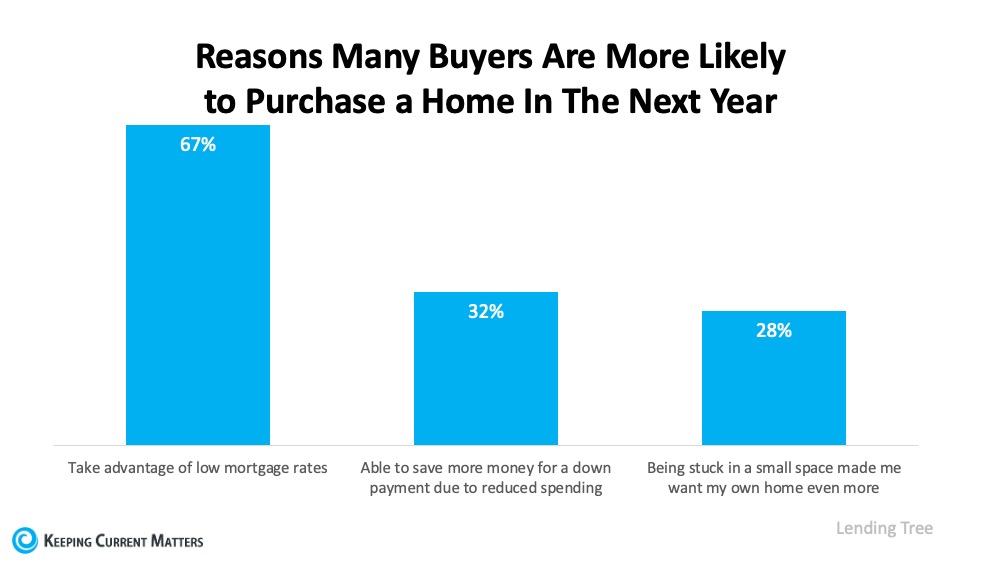

WHERE IS THE housing market GOING IN 2020?

Keeping Current Matters, 7.31.13

Highlights:

- The housing market is forecasted to finish the year with growing strength

- Historically low mortgage rates are creating great potential for homebuyers, and home sales are on the rise

- If you’re thinking of buying or selling a home this year, call me yesterday to maximize your opportunity today

UCCS ECONOMIC FORUM UPDATE

UCCS Economic Forum, College of Business, updated 7.31.20

I just received the updated statistics from the UCCS Economic Forum and wanted to share them with you, as always. Please click here for the look at both the national and local updates on the economy in terms of employment, local demographics, real estate and more.

As always, if you have any questions, please give me a call.

.jpeg)

.jpg)

.jpg)