HARRY'S BI-WEEKLY UPDATE 9.8.20

September 8, 2020

HARRY’S BI-WEEKLY UPDATE

A Current Look at the Colorado Springs Residential real estate Market

As part of my Personal Service, it is my desire to share current real estate issues that will help to make you a more successful and profitable buyer or seller.

MISSING THAT CRUISE OR OTHER TRAVEL IN 2020? CONSIDER ‘TRAVELING’ TO A NEW HOME INSTEAD…

One of the things I’ve missed this year is traveling to new places and returning to places I so enjoy visiting, both for business and pleasure. This is the refrain I also hear from so many of my clients. I’ve always enjoyed hearing about their recent adventures and plans for upcoming trips.

Instead, this year I’ve been hearing about what those same folks realize they either like or dislike about their present living conditions and what they want to do about changing them. Places such as Home Depot and Lowe’s are full of those who have lots of time on their hands and want to make their homes more comfortable and enjoyable. And HGTV and the like have had no shortage of viewers during this pandemic year.

What I’ve heard from clients, and have also learned from my own personal experience this year, is that working from home or home-schooling is creating needs most of us never knew we had.

Now that homes have gone from the place we returned to after work, school, the gym, or travel to the place where families do all of those things, there’s a growing list of “wants and needs” for homeowners.

Personal spaces, larger entertainment areas, home gyms, bigger and more efficient kitchens, outdoor entertaining facilities…these are on the wish lists of many I talk to. Some are looking for new neighborhoods, others for larger homes, and some are preparing to move closer to family or retiring in warmer climates.

The one common denominator is time. And the question I am often asked is…“How soon can I get moved and settled in a new place?”

Well…I wish I had an easy answer for that one. One of the biggest issues in the Colorado Springs area continues to be a lack of available homes for sale. In fact, last month we had a more than 50% decrease in the number of active listings in all local existing properties. As soon as one goes on the market there are often multiple offers over listing price and bidding wars—sometimes within hours of its listing. That makes it tough for everyone. It is most definitely continuing to be a seller’s market in residential real estate and will continue to be so until we have more homes for sale.

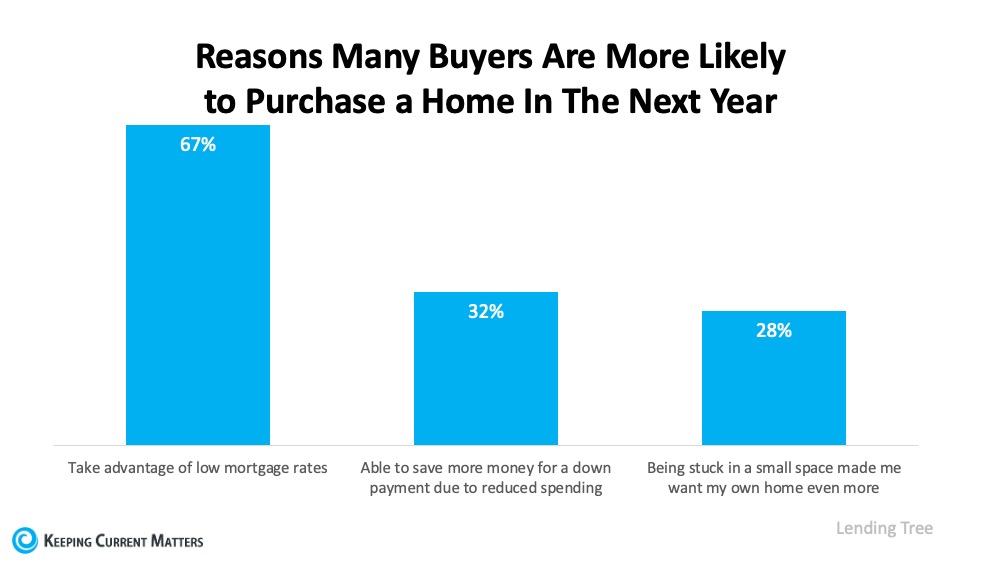

There are a number of companies relocating here and most of those being relocated with them are looking for places to live. With rental rates so high and mortgage interest rates so low, it makes great sense for them to buy. I, unfortunately, have to tell them to “get in line”.

This is one of the many reasons that new home construction is on the upswing, both here and across the country. Folks want to move to get the things they want and need in a new home and with interest rates under 3%—now is the perfect time.

If you are one of those who have been even considering selling to trade up or move to a new neighborhood, either across the city or across the country, simply give me a call and let’s see how together we can make your wants, needs and budget requirements work to make that happen.

After all, if you can’t be cruising or traveling much these days, you might as well take advantage of contacting me—your Colorado Springs “Ambassador” of all things concerning residential real estate. My 47 plus years of “world class service” coupled with my investment banking background, make me your surest bet for finding a home—be it for yourself, a family member or even for investment purposes.

Give me a call today at 593.1000 or email me at Harry@HarrySalzman.com and let’s get started.

And now for statistics…still “off the chart”…

You will see that home prices are continuing their upward trend due in part to low interest rates, low inventory and a pent-up demand created by the pandemic. With so many folks looking to buy, I would expect to see these numbers, along with the number of sales, to continue to increase over the next few months.

A good thing to remember when considering a move is that the equity in your present home is potentially greater than you might think, and with interest rates so low, it’s possible you can get into another home for not much more in monthly payment costs.

AUGUST 2020

Statistics provided by the Pikes Peak REALTORS Service Corp., or it’s PPMLS

Here are some highlights from the August 2020 PPAR report. Remember that the new format of this report no longer provides monthly statistics for each individual neighborhood. However, if you are interested in what’s happening in your neighborhood, I can provide you with this information through other means.

In El Paso County, the average days on the market for single family/patio homes was 19. For condo/townhomes it was 15.

The sales price/list price for single family/patio homes was 100.6% and for condo/townhomes was 100.8%.

Please click here to view the detailed 9-page report, including charts. If you have any questions about the report or to find out how it relates to your individual situation, just give me a call.

In comparing August 2020 to August 2019 for All Homes in PPAR:

Single Family/Patio Homes:

· New Listings were 1,689, Down 8.3%

· Number of Sales were 1,771, Up 14.9%

· Average Sales Price was $435,922, Up 17.3%

· Median Sales Price was $380,000, Up 15.2%

· Total Active Listings are 1,077, Down 50.9%

· Months Supply is .06, Down 57.3%

Condo/Townhomes:

· New Listings were 264, Up 5.6%

· Number of Sales were 246, Up 18.8%

· Average Sales Price was $273,104, Up 3.9%

· Median Sales Price was $265,000, Up 9.5%

· Total Active Listings are 119, Down 36.4%

· Months Supply is 0.5, Down 46.5%

And a look at more statistics…

August 2020 LOCAL MARKET UPDATE AND MONTHLY INDICATORS ILLUSTRATE OUR LOCAL TRENDS IN DETAIL

Colorado Association of REALTORS® , Pikes Peak REALTORS Service Corp, or it’s PPMLS

Providing greater detail than the above report, this contains information on both El Paso and Teller counties for Residential real estate.

It is broken down by geographical areas and you can look to see how your neighborhood is doing in terms of sales, prices, and more.

The “Activity Snapshot” for all residential properties in El Paso and Teller counties shows the Year to Date one-year change:

- Sold Listings for All Properties were Up 14.2%

- Median Sales Price for All Properties was Up 14.1%

- Active Listings on All Properties were Down 53.4%

You can click here to read the 16-page Monthly Indicators or click here to get specific information on the geographical area of your choice from the 18-page Local Market Update. I recommend that you check out your own area or one that you are considering, to get a good idea of the local pulse. As an example, here is a detailed report on the Colorado Springs area:.jpg)

NEW HOME CONSTRUCTION SHOOTS UP 22.6% IN JULY

HousingWire, 8.18.20, NAHB, 8.2020

In a sign that the housing market continues to lead the economy during the pandemic, sales of newly built, single-family homes rose in July to its highest pace since 2006. According to a report from the U.S. Census Bureau and the U.S. Department of Housing and Urban Development, new home construction starts for single-family housing climbed to a seasonally adjusted annual rate nationally of 1.496, a 22.6% jump from the month prior.

These housing starts not only jumped monthly, but also showed a 23.4% growth from the previous July.

“Single-family new home sales in recent months have outpaced their usual relationship to starts,” said Fannie Mae chief economist, Doug Duncan. “Homebuilders have supported sales by drawing down existing inventories in light of continued buyer demand.”

The National Association of Home Builders confirmed that their builder confidence survey has been indicating this for months. “Consumers are being driven by low interest rates, a growing focus on the importance of housing and a shift in buyers seeking homes in lower density areas,” said NAHB Chairman Chuck Fowke.

“New home sales are benefitting from the suburban shift, as prospective buyers seek out affordable markets in order to obtain more residential space. Moreover, sales are increasingly coming from homes that have not started construction, with that count up 34% year-over-year,” said NAHB chief economist Robert Dietz.

If new home construction is in your future, I’m your guy for that, too. I have excellent working relationships with a number of local builders and can help with the ins and outs of new construction purchasing, including site selection and financing. And all of it comes at no additional cost to you, so why not have the “upper hand” in dealing with new construction by giving me a call today?

COLORADO SPRINGS RANKS #16 OUT OF THE TOP 100 METRO AREAS IN HOUSING PRICE INCREASE ACCORDING TO FHFA HOUSE PRICE INDEX 2020 Q2 REPORT

FHFA House Price Index, FHFA.gov/HPI

According to the recent 2020 Q2 Housing Price Index report from the Federal Housing Finance Agency (FHFA), Colorado Springs’ housing market is doing just as well as I’ve been reporting. We are #16 out of the top 100 metro markets surveyed, with a 7.9% increase year-over-year and a 1.2% increase quarter-over-quarter in 2020.

Considering we weren’t even able to show homes for months, and then only on a limited basis, I’d say we are definitely doing great.

In case you’re wondering, “the FHFA is the nation’s only public, freely available index that measures changes in single-family house prices based on data covering all 50 states and over 400 American cities. Extending back to the mid-70’s, the Home Price Indexes are built on tens of millions home sales and other insights about house price fluctuations at national, census division, state, metro area, county, ZIP code and census tract levels.”

And…if you wish to see the report showing all of the top 100 cities as well as the local Colorado Springs area data, please click here.

UCCS ECONOMIC FORUM UPDATE & ECONOMIC FORUM VIRTUAL EVENT INFORMATION

UCCS Economic Forum, College of Business, updated 8.31.20

I just received the updated statistics from the UCCS Economic Forum and wanted to share them with you, as always. Please click here for the look at both the national and local updates on the economy in terms of employment, local demographics, real estate and more.

As a charter member and sponsor of the UCCS Economic Forum, I’m also excited to tell you about the upcoming UCCS Economic Forum Virtual Event on Thursday, October 1 from 1:00-4:00 pm. Due to the pandemic, this year’s meeting will be FREE to all who sign up to watch the presentation. Below are the details and you can go to the website to register and get more information.

The theme of the meeting is “Our Resilient Future” and will feature Dave Nelsen, Futurist and President of Dialog Consulting Group as the keynote speaker.

Aikta Marcoulier, Executive Director, Pikes Peak SBDA will present a Pikes Peak Region Small Business Resiliency and Report to the Community.

Dr. Tatiana Bailey, Director, UCCS Economic Forum will present Economic Conditions and Outlook for the Pikes Peak Region.

Mark your calendars. The information presented will be certain to help you in making future economic decisions and as always, will be quite entertaining and more than worth your time.

You can REGISTER for FREE at:

www.Pikespeaksbdc.org/economicforum

If you have any questions, please give me a call.

HARRY’S THOUGHT OF THE DAY:

.jpeg)

.jpg)